I mentioned recently the rumors that Capital One will bring back it’s mega signup promotion from last year. Some people are now dashing to cancel last year’s cards in the hopes they can qualify again this year. Others are simply looking to cancel because the $59 annual fee is on its way.

If you’re in a similar situation, you may also be trying to figure out how to effectively spend down the last of the points in your account. Points can always be used to reimburse travel expenses or exchanged for gift cards. If neither of those options sit well with you, here are a few other suggestions:

#1: Convert to a no fee card

Instead of cancelling your card, consider simply downgrading to a no fee rewards card. This way you will preserve your credit and your points. With the free VentureOne Rewards credit card you can even convert the points directly to cash.

#2: Buy points or miles using your Venture card

Do you know the trick that lets you buy Priority Club points for only .6 cents each? I bet those transactions will look like travel to Capital One! You could use this trick to effectively convert, for example, 100K Capital One points to over 166K Priority Club points.

#3: Buy hotel gift cards using your Venture card

Is there a hotel chain you use a lot? You could buy their gift cards (from them, not from a 3rd party) and the transaction would most likely appear as travel. Even better, go through a points earning or cash back portal to get the most of your purchase.

Personally I think option 1 is by far the best, but let me know what you think. Do you have other approaches?

Stay informed:

Follow me on Twitter / Like me on Facebook

If you’re new to Frequent Miler, please start here

Where is the thread on MP where people are reporting their downgrade success? I’d like to find out if people had to downgrade before their annual fee posted, or were they able to do it after statement with fee came out and then called for reversal and downgrade.

Ted F: Here’s the Milepoint thread: http://milepoint.com/forums/threads/capital-one-venture-chase-ba-and-other-retention-offers.29793/#post-1246818

I’ve bought AA gift cards, Southwest gift cards, and a Royal Caribbean gift card. The airline gift cards work for reimbursement on Capital One but the cruiseline gift card did not. The AA gift cards must be a minimum of $50 but Southwest let me enter a specific amount down to the cent! This allowed me to buy only the amount I need to use up my Capital One points. Don’t forget to make your purchase a little larger than the # of points you have left * 100 if you are trying to zero out your account, b/c you will earn more points with the actual purchase that you can then use to reimburse it!

Stephanie: Great tips, thanks!

Frequent Miler – https://www.getmymiles.com/

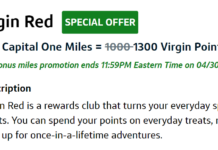

the preview for a promo is up. There’s lots of discussion about it on various forums (especially, “what does this mean?” and “does anyone have a credit card that sends them an annual summary?” and “do cards like Chase Sapphire Preferred count?”

No answers yet. Just a lot of questions.

Steve: Thanks! I see now they seem to be looking at dollars actually spent on one credit card. This deal might not be as big of a bonanza as last year for most people since you would need proof that you spent $50K on a card in order to get 100K points.

I did option 1 no problem. Even was able to do it using the online chat tool that Cap1 has.

I did option 1 but am wondering whether keeping a non-fee card will prevent me for qualifying for future promotions?

Brittain is saying you can redeem for e.g. $30 by indicating an airfare purchase of $300 = 10 tickets of $30 each. You can also redeem multiple times against the same purchase within 90 days. My favorite for redeeming against small amounts is cab or subway fare. I will not be churning this card. $1000 is not worth 3 inquiries to me. I’d rather use those inquiries to churn a barclays, chase and citi or amex card.

When you use points to reimburse air fare it asks how many tickets you purchased and how many you want to pay with points. You can use this to divide up the air fare and and bring your point balance down even further.

For #1, I’m not sure Capital one will do that. I have had a Cap one no-hassle card with annual fee once and tried to talk them into converting the card into a no-hassle card with no annual fee. They refused and but gave me a statement credit instead. Cap one is a ultra conservative financial institution and used to only lend to people with poor credit.

On #2 – Unfortunately buying points with my Sapphire didn’t look like travel to Chase – coded as “PRIORITY CLUB POINTS AND”. No 2x travel bonus or 10x points through the UR Mall.

Ken: It’s worth contacting Chase. Since you simply booked a points and cash room, it definitely should count as a travel expense for 2X. I can see them reasonably denying the UR Mall 10X (since that is supposed to be awarded after an actual stay) but it can’t hurt to ask for that too.

Qing: People on MilePoint have reported successfully downgrading their cards. It’s definitely worth a shot. Sorry to hear that it didn’t work for you with the no-hassle card.

Brittain: I don’t understand your example. Can you explain?