In April I published a scary warning: Why Chase cancels accounts (and how to protect yourself). In that post, I reported that Chase had been shutting down accounts due to “perk abuse” and/or bad credit risk. A few weeks later, a thread titled “Nervous about high Ultimate Rewards balance?” appeared on FlyerTalk. Within that thread, quite a few people reported that they were transferring points out of the Ultimate Rewards program to try to protect themselves in case Chase decided to shut them down. The issue was that most people who were shut down lost all of their Chase points. Calls, letters, and emails to Chase had no effect.

Yes, it is scary, but…

In my opinion, a large part of the value of Ultimate Rewards points is their flexibility (if you have either the Sapphire Preferred or the Ink Bold). When I want to fly on a Star Alliance airline I simply transfer my points to United. When I want to stay in a hotel I transfer my points to Hyatt (other hotel options aren’t as good of deal, in my opinion). And, when I want to ride the train, I transfer my points to Amtrak.

To me, the risk of getting shut down is smaller than the benefit of keeping Ultimate Rewards points. In the post cited above, “Why Chase cancels accounts (and how to protect yourself),” I gave a list of Dos and Don’ts. If you follow that advice, I believe the risk of getting shut down will be very low.

Chase pays back

A few days ago, a reader sent me a link to this Fatwallet thread in which a guy reported that Chase redeemed themselves by sending him a check for the points that had been accrued in his forcibly closed accounts. This led me to the AARP thread in which many people reported the same thing.

To me, this turn of events is a big relief. It would still be a terrible thing to be shut down by Chase, but at least I would be likely to receive a penny for each point I had saved up. It helps me feel secure in my decision to keep my Ultimate Rewards points until I need them.

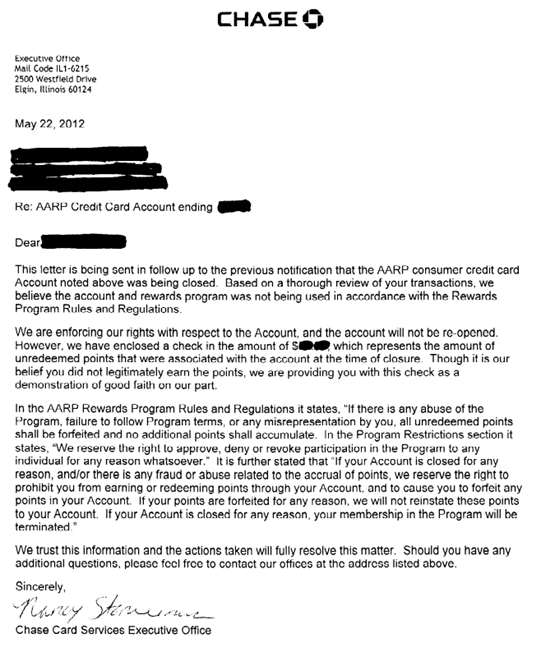

One FatWallet contributor posted a copy of his letter from Chase:

A word to Chase

Chase, if you’re reading this, I’m giving you a big thumbs up for the decision to pay back your customers for the points earned. I’d ask, though, that you make one more change: don’t close accounts without warning. I understand the need to tackle fraud head-on, but you should give customers a chance to challenge your findings. Give them a chance to prove their innocence before you lose them as customers forever. Sure, if you need to, freeze accounts until the matter is cleared up, but don’t walk out on your customers without a conversation. You may be surprised at what you find.

Reader experiences

Have you had any run-ins with Chase freezing or closing accounts? Care to share your experiences? Are you keeping your Ultimate Rewards points or transferring them out? Comment below.

The only run-ins I keep having with Chase is their completely useless customer support via phone. I spent countless HOURS in the last few months calling them to get something done/fixed with my accounts (both business and personal) just to be transferred around, put on endless holds, told that I have to call back the next day just to finally be told that I need to go to the branch and resolve things in person.

@Gregorygrady, notice is the award is from 3 different customers, NOT ONE! It has nothing to do with whether or not I’m a profitable customer or not. It has something to do with concern of customer credit. I don’t keep tracking of how much my parents are spending, but they have a business and put majority of their spending on their Chase card, yet my mother’s account was shut down as well.

I also have been used Chase Freedom as my primary card since 2006, and charge majority of my large expenditures on there.

Lol, I’m not jealous in the least. Glad u were able to get 450k chase pts. Just please don’t kid yourself that you are a profitable customer for chase when u earned 400k in bonuses and only 50k from spending. And spending on the Ink Bold and sapphire preferred nonetheless, so likely only $25k in actual spend, with the rest being 2x and 5x category bonuses. There IS a reason they shut u down, probably cuz u were taking advantage of them too much and they realized u were NOT a profitable customer.

@Greg The Frequent Miler , I have about 6 years of credit history while my mother has about 7-8, I think that could be an factor. I actually did received the job offer from Chase but I got an slightly less competitive but closer commute from a different bank.

With the 2007 financial crisis, alot of banks are closing/denying accounts for non-prime customers, because they have to hold more funding for risky customers, increasing the cost of capital because they can not lend as much. Banks are implementing systems that will closely monitor customer credit/ratings, and they’re proactively managing the risk.(This is what I do at my new job, analyst 🙂

@pdxjosh , I actually know someone who charged up or balance transfer amount of 100k+ and ran off to a foreign country.

@Gregorygrady,

Sapphire Preferred (me, my parents) 150k points +2 matching of 100k

Chase Ink Bold(me, my parents) 150k Points

That is 400k total for 3 people + 50k from spending. You do not understand and you are jealous I was able to obtain this much points.

Meant to add those 450k UR pts come from $1k per month of spending. Something doesn’t add up and I can understand chase shutting u down.

@Rick: u have 450k sapphire pts in one year of sapphire acct ownership and u are saying you are profitable for them? I think not! Seems like u must be using the signup bonuses and 5% bonus categories very well.

I have not had this experience with Chase, but I had a remarkably similar experience with Amex. And I’ve got about 25 years of near-perfect credit history. I got a very nice man from Amex on the phone who explained tht it was because I opened too many – way too many – Amex cards in a very short time period, along with too many other cards. He said that makes it looks like I’m getting ready to charge up $100,000 or so and go to Mexico. In the end, they did a full financial review and allowed me to open up a card again. The big problem for me was that I had taken a points advance of about 50,000 points, and now I had no way to earn them back, so they charged me for them. And they weren’t cheap.

Moral for me: take it easy! Reallocate credit limit instead of increasing total credit limit when applying for your 4th or 5th or 6th or 9th amex or Chase card. Don’t apply for more than 1 or 2 cards at a time, and wait several months in between. Close accounts after 8 months or so if you’re not using them.

Chase closed my 6 accounts including Chase WaMu card(2007)$1000 limit, Chase Freedom(2007) $5000, Chase Sapphie Card (2011) $5000, Chase United(2012) $5000 , Chase Southwest(2011) $1000, and Chase Ink Bold(2011) $10000. Approximately $27000 credit( I have $15k with Citi, 8k with Discover, 11$k with Amex). On personal income of 60k or household income of 120k but I dont think that matters. So my best advice is when opening future cards with Chase, do not request for more credit, request to allocate your existing credit instead. My father’s cards were not impacted, he has as many Chase accounts as I have but with less then 10K credit limit. All my mother’s chase cards were closed because her limiti was 20k+.

I lost over 450k worth of Sapphire points, they did not allow me to transfer to other accounts nor redeem miles, however after letter to Executive Corresponding Team, they did allow me to redeem for cash only. I’m very disappointed that I could not transfer those to Continental, despite I have 450K miles in continental.

Their reasons for account closure include

~ Too many recent inquiries

~ Too many recently open accounts

~ Too many accounts with Chase or too much revolving credit with Chase

I tried to negoite to keep 1 or 2 accounts open since Chase is my main card, I charge approximately $1000/month on Chase, but they would not budge. Chase is my main card that I have been using for years, so I’m profitable to them.

I have never had a single late payment on any of my cards, my utilization ratio is 5% or less on each card and however I applied for approximately 8-10 cars in 2010.

On the good note, I have a job interviw with Chase card services in their finaical analysis group, working closely with marketing & risk management on budget/ marketing developements etc. It’s only for one Chase card product, not sure how much I’d be expose all the marketing campaigns.

rick: Thanks for sharing! It does highlight another aspect of the danger of Chase perceiving people as a bad credit risk. When people have many cards open, many recent inquiries, and a lot of revolving credit those factors a red flags to Chase. Correct me if I’m wrong, but I expect that in your case you also have a fairly short credit history? I bet that someone with 20 years of history but otherwise the same numbers would have been OK by Chase. BTW, good luck with your job interview!

My AARP was shut down at about the 13 month mark. I used it hard for the 6 months of cash back (over $3000 in cash back), for a few travel purchases in the next 6 month period. I carried a balance in the last 6 months To take advantage of 0 interest. I had only a minor point balance. I did not complain or even call Chase bc they did not do anything with my other accounts though I did change plan on planned closures and applications. One day the account was back. It has no fee and 3 percent on travel so I use it occassionally so I wont get shut down again.

Susan: you should be able to find the info from Dan’s deals or, I believe that “Deals We Like” has detailed this a few times.

smitty06: Agreed. If you do things in moderation and use the card for other stuff you should be fine.

traveller: 1 cent per point

Soriso: Thanks for sharing!

What value did they put on the points?

I perused the fatwallet thread. It seems like these were not subtle abuses. Those that got shut down were making thousands of dollars worth of questionable charges each month. This was not throwing a gift card in with your groceries spending. I would guess that Chase looks for spending patterns that are way out of the norm.

@Susan – It’s called the “Chase Trifecta”. You can google plenty about this.

I read from DAN that any dining purchase of less than $5 to $10 is better paid with freedom than with chase SP becos of 10% bonus and 10 bonus points for chase freedom and checking linked.

I don’t know how this chase freedom 10 bonus and 10% bonus points in addition regular 1x to 5x bonus cash back you earn works.

Please write a detail post on how we can best take advantage of chase freedom points. please

thanks

Agree Mikes!

I think terror tactics are an appropriate response from Chase, assuming we’re talking about people who are abusing the accounts by running mint/fake transactions and such. If you really spend 100s of thousands, then it should be somewhat apparent in the spending patterns.

I do agree that it should be freeze and talk, but perhaps there are potential legal issues with a human making that decision. I do NOT think Chase should write a check in cases of massive abuse. Why would they case about losing a “customer” such as that? Blacklist them… save the points for the rest of us! 🙂