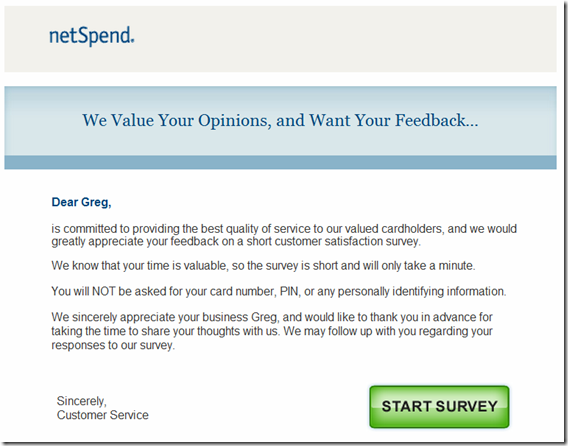

After netSpend shut down my account the other day and refused to tell me why, I haven’t been a big fan (see “We’re sorry, there is a problem with your account”). So, I found it funny when this email appeared Friday morning:

It was great to hear that I’m still a valued cardholder! Too bad they won’t let me use the card anymore.

Too bad, too, that they forgot to say who “is committed to providing the best quality of service” (see first sentence of their email under “Dear Greg”). Maybe that omission was intentional when they realized that no-one they know is really committed to that.

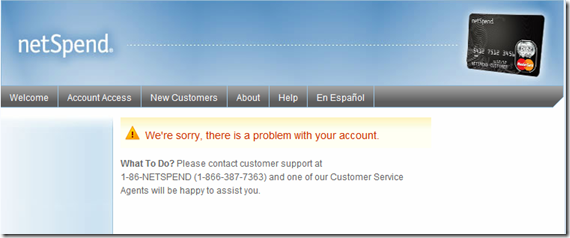

I filled out the survey, but then was taken to this familiar screen:

Do they really value my opinions? Were my survey results even recorded? Do you think I gave them positive ratings?

@Preacher: $3500 in IB spend is going to be 17.5k UR, right? Unless there is a way to get 10x on IB spend in OD..

Your experience is truly inspiring for me to get the netSpend card. So, looks like you are going with their basic plan that charges 2 bucks per PIN transaction. How many of these “revenue” transactions did you do before starting the MOs?

Preacher: don’t know why you get charged, but the way it works is you set up a routing and acct number from your card the same way you’d pay a bill from a regular checking account. Somewhere inside your online profile for this debit card there’s a page that shows these #s. Then you start the payment from inside your mortgage or CC account page. It may not work for every financial institution but try it out.

Is the ACH bill pay feature free only if you opt for the $10/month fee-free plan? I don’t have that plan and I was charged a 1$ fee to pay $500 of my son’s University tuition today. How do I get in on this “bill-pay, fee-free” extravaganza?

Men in dark suits are watching you 🙂 expect some black Suburbans with dark tint to pull up to your house soon.

that’s pretty sweet deal going on, I’ve been spreading it around to more grocery / OD mix of stores and using bill pay, which is free and less suspicious looking.

Same day as yesterday. In the past 4 days, I’ve run 7 Vanilla reloads through my Netspend, with about $3500 of MOs. So 35K+ UR points through my IB cost me $3.95 X 7 plus $8 Netspend fees and $2.40 WalMart fees. And they still haven’t shut me down…SWEEEET!

Ho hum. Another day, another 5000+ UR points/2 Vanilla reloads/1K MO. How many more days will this gravy train last? I’ll keep ridin’ it till it does!

The post office only sells MOs up to $1K and charge $1.55 each.

Bought a $490 MO yesterday and a 1K one today at Wal-Mart. 60 cent fee for each, plus the $2 each from NetSpend. Almost free money and haven’t been shut down yet! 7500+ more easy UR points…

Where can I purchase MOs larger than 1K? Anyone out there in FM-Land know? That’s the max at Wally World!

Preacher: Great! You can try the post office too.

Funny story…I got the email too, asking for my valued opinion. At first I thought maybe my acct got closed but turns out all is good.

Just the other day, I had yet another ACH bill payment go through, this time it was around $400 for one of my credit card payments.

So far I’ve cleared almost $1500 in 2 weeks at the cost of $9.90, which includes two reload fees and two filler store purchases I made to create spending variety. I think the key to using this card is to start of slow, with small purchases and bill payments, and to ramp it up over several weeks. I don’t know where the limit is before you get shut down but so far this scheme has worked for me.

The ACH bill payment feature is a free transaction and has great potential to generate a lot of extra spending every month. I can just keep buying reload packs and using them to pay back the resulting credit card tab.

Mio card takes vanilla reloads and is from Bancorp. Might be worth a try.

Btw, you should try some of the Reloadit card partners who are issued by Bancorp.

https://reloadit.com/card_partners.aspx

The upcoming Vanilla reloadable card looks to be from the same bank, so might have similar features to Netspend but you won’t have to deal with Metabank.

atxtravel: I haven’t found a grocery store that sells reloadit cards yet

Mortgage payment was a success, I got a $950 reload pack at a grocery store last weekend and made an $800+ mortgage payment using ach edebit, free. I still have a few hundred left in the account and will try to pay another credit card bill with it. Not sure when or if my account will get shut down, but looks like several smaller transactions in the beginning mixed with a few big ones might keep them happy.

atxtravel: That’s great news! Thanks for sharing! Please continue to keep us informed as things progress.

I loaded money today and the $20 referral credit loaded instantly.

After loading the $40+ onto the card, how long will it take till I get the $20 bonus credit?

Stay tuned, later this week I’ll report my results of how to make all these payments free.