We’ve all been there. We get excited about a credit card signup offer… or two… or three… Next thing we know, we have card(s) in hand, but have to figure out how to spend an outrageous amount of money in a short amount of time in order to get those signup bonuses. Specifically, I’m often asked how best to meet the Ink Bold’s requirement of spending $10K in three months to get the full 50K bonus (half of the bonus is given after first spend, but the rest requires the full $10K spend). Just a few days ago, for example, I heard from a reader who’s thinking of getting the Ink Bold, but his monthly spend is only $1600 so he doesn’t think he can get the full bonus. The truth is, though, if you’re willing to put in some effort, you can…

Below is a step by step approach to spending $10K in three months assuming $1600 per month of usual spend. The steps below assume you would be using an Ink Bold card, and will produce the most extra points with an Ink Bold card, but should work with any card.

Preparation: Sign up for an American Express Prepaid card

American Express offers a free prepaid card that works a lot like a credit card, but requires that money be loaded into it before it can be used. I’ll explain in the following steps how this card is useful, but for step 1 just order one without loading any money onto it yet. Signing up for the card doesn’t result in a hard credit pull so it will not affect your credit score in any way. Because of limits to how much can be loaded to each card, many people find it helpful to order two or three.

Sign up here: American Express® Prepaid Card (I do get a very small kickback for each signup through this link). It should take about a week to get your card in the mail.

Monthly Process

The following steps are intended to be done monthly until the $10K spend is met. To spend $10K in three months, you should target just over $3300 in spend per month.

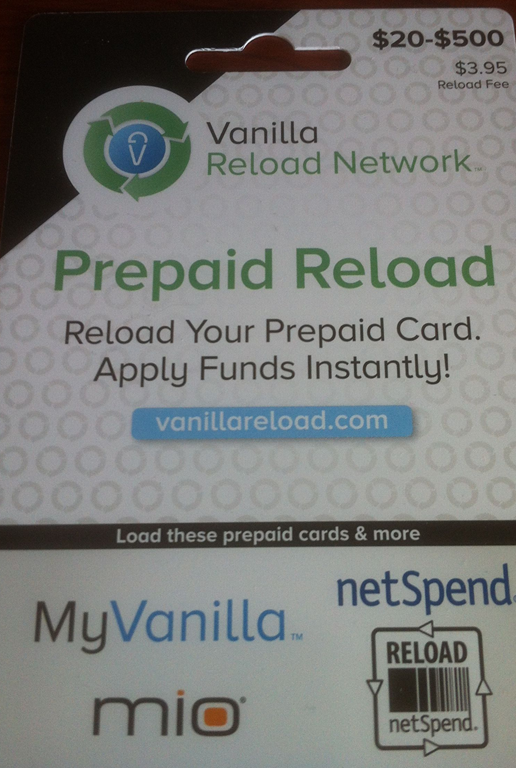

Buy $2500 in Vanilla Reload cards at Office Depot

Unfortunately, not all Office Depot stores sell these cards, and not all allow you to use credit cards to purchase them, but most stores do. Take a look at “Where to buy Vanilla Reload Cards” to see if others have had success in your area.

At Office Depot, look for cards that look like this:

Take five of these cards to the register and ask for $500 to be loaded to each one. Each card has a $3.95 fee, so the total should come to $2519.75. Some people like to throw in a pack of gum or other items to ensure that the total varies from month to month. The fear is that if Chase sees recurring identical orders they may become suspicious that something is amiss. So, even though you’re not doing anything wrong here, it can’t hurt to mix things up a bit. You can also spread out these purchases throughout the month rather than buying them all at once.

Once you have the Vanilla Reload cards at home, go to vanillareload.com to move the money from the reload cards to the Prepaid Amex that you ordered (see “Preparation” above). You can move at most $1000 per 24 hour period, and at most $2500 per month onto the card.

Spend $1600 using a mix of the Ink Bold and the Amex Prepaid

The scenario here is that the cardholder normally spends about $1600 per month with a credit card. The idea is to spread the spend across the Ink Bold and the Amex Prepaid. Ideally, spend $700 using the Amex Prepaid and $900 with the Ink Bold. Since the Ink Bold gets 5X for office supplies, phone, and cable, use the Ink for those expenses. Also use the Ink for gas and hotels where it gets 2X. Mix in some 1X spend as well. One reason for putting spend on the Ink Bold instead of exclusively on the Amex Prepaid is to reduce the chance of Chase deciding you are a bad customer (see “Why Chase cancels accounts and how to protect yourself”).

Make two $400 ATM withdrawals

The Amex Prepaid card allows one free ATM withdrawal each month and thereafter charges $2 per withdrawal. ATM owners usually charge a fee as well. Assuming the ATM you go to charges $3 per withdrawal, two $400 withdrawals will cost you a total of $8. Spread out the withdrawals across the month. If you don’t need that much cash on hand, you can proceed directly to your bank to deposit the cash.

Caution: I don’t recommend doing more than two $400 withdrawals a month. Such activity would likely be noticed by American Express, and you would likely face a financial review.

Make one $1000 Amazon Payment

Amazon has a feature that allows you to make payments to friends and family of up to $1000 per month (total across all recipients). The service is free and they allow you to use your credit card to make these payments. So, the trick here is to get a family member or friend to help:

- Send your friend/relative $1000 through Amazon payments. Use the Amex Prepaid card to pay. Make sure you mark the payment as “good/services”. Your friend/relative can immediately withdraw the money to their bank account.

- Have your friend/relative return $1000 to you via check or some other means.

Please see this post by Million Mile Secrets for a full description of how to use Amazon Payments.

Add it up

If you follow the above steps, you will spend over $10,000 in three months. Your total out of pocket cost (from reload card fees and ATM fees) comes to $27.75 per month or $83.25 total. This trick should work with any credit card, but if you use the Ink Bold in particular, you will benefit greatly from the Ink Bold’s 5X category bonuses. From the purchases of the Vanilla Reload cards alone, you will earn over 37000 Ultimate Rewards points! With the additional spend put on the Ink Bold directly, you will easily top 40K Ultimate Rewards points in addition to the sign-up bonus! When you combine this with the Ink Bold’s 50K signup bonus, this means that you will have earned a total of over 90,000 Ultimate Rewards points in 3 months!

Related Posts and Links

- How to sign up for the Ink Bold

- One card to rule them all

- Where to buy Vanilla Reload Cards

- Fast-Track Your Credit Card Sign-Up Bonus With Amazon Payments

- Get your free American Express® Prepaid Card

[…] · https://frequentmiler.com/2012/07/25/how-to-spend-10000-in-three-months-and-earn-90k-ult… […]

Patti: I’ve used Amex cards to buy Vanilla Reloads before and it showed up as a regular purchase. Maybe try buying one to see how it appears on your account and then buy more if it looks like a regular Office Depot purchase?

I just ordered the American Express business card, where you nave to spend $10000 in 4 months and you get 75000 miles. Their fine print said that it does not include purchase or cash advances on prepaid cards. Have you run into this? How do I get around it?

Is still any significant advantage in getting the AMEX prepaid card despite the advent of AMEX/Wal-Mart Bluebird?

WishyAnand: For most people I think the Bluebird will be a better option than the Amex Prepaid (but we need to wait and see if it works as well as advertised). Big spenders may see an advantage in having both the Prepaid cards and the Bluebird.

[…] If you’re a regular Frequent Miler reader you probably already know that I love the Ink Bold business card. Like the Sapphire Preferred, the Ink Bold rewards you with Ultimate Rewards points which can be incredibly valuable when transferred (instantly and for free) to airline miles or hotel points. Where the Ink Bold beats the Sapphire Preferred is in the ability to earn points quickly. The Ink Bold offers 5 points per dollar when used for office supplies, phone, and cable bills (for up to $50K in purchases per year). For a few examples of how to maximize this benefit, take a look at “How to spend $10,000 in three months, and earn 90K Ultimate Rewards along the way.” […]

Thanks for the answers, although your last answer makes my eyes rain…

http://www.youtube.com/watch?v=qIxHb7cA6tg

I guess I’ll have to scout around my area to see if there are any ODs that sell the reloads.

Jon Lee: Correct. Your only hope, I think, would be to find a prepaid card that can be loaded via credit card and use the temporary cards as credit cards to do so.

So since I don’t have access to the reloads, I’m assuming that I don’t have any options to add to the balance of any permanent cards that I have other than the first three temp cards that I convert into permanent cards?

Hi FrequentMiler, I just came upon your site and I had a question regarding what you said in comment 61:

“the temporary Amex cards that you can buy in-store can’t be used at ATMs. You can convert up to three of them to permanent cards though (the money moves over automatically).”

Can you elaborate on the “convert up to three of them to permanent cards”? Does this mean that if I order a permanent card, I can only add three temp cards to the permanent card? My Office Depot doesn’t sell reloads, only temp cards, so I was wondering if I could perpetually add the temp cards to my permanent card. Thanks.

Jon Lee: What I meant was that you can order up to 3 permanent cards. When you order a permanent card, it asks if you have a temporary card. If so, you can put in its number and the cash will move over to the permanent card once you get it. You can’t (to my knowledge) add balances from temporary cards to existing cards.

@Greg The Frequent Miler: What about the new Chase Liquid card? any chance that the Vanilla Reload cards will work with it ?

NJ: I don’t think the Liquid card is reloadable via Vanilla. I’m not sure you’d want Chase seeing that anyway…

Miles Momma: Actually, I’ve looked a bit more and see that they expect only 1 credit card load per year (which you can’t do until 3 months of using the card). That plus the fact that it is backed by MetaBank (same as NetSpend) makes me wary.

Miles Momma: I just got around to looking at that upside card. Looks interesting! I’ll try it out. Thanks for the tip!

Hi

Thanks for your wonderful article on getting 90000 points, its impressive and tempting. But I just saw on chase page that there is similar offer of 50000 points for chase ink plus card with 5x points for office supplies. Do you think that the same steps for ink bold can be applied to ink plus to get 90000 points. The only benefit for which I want the ink plus is, right now they have 0% APR for 6 months, and I think I may need that 0% APR offer. Can you please help me with this question? Do you have any affiliate link for ink plus? Thank you very much and appreciate all you do here!

newbie008: Yes, the ideas presented here would work with the Ink Plus. The Ink Plus link on my Best Credit Card Offers page is an affiliate link. Thanks for considering using it!

Mike H: It’s fine to use a joint account for your wife’s amazon account as long as it’s not the same account you use to link to your Amazon account.

Good sir, If I do an Amazon Payment to my wife’s amazon account would she be able to transfer that into her checking account without an issue if that checking account is a JOINT checking account with my name on it? Thanks!

@Mike H – I have done what you are suggesting several times but would not advise it long term. Have not experience any problems using our joint checking account but no that it could get flagged at some point. I have recently open a ING Direct checking account for the hubby. I make Amazon Payment to him and then transfer funds to his ING Direct account and then one more transfer to our main credit union checking account. You can also get a $50 sign up bonus with ING Direct. This is the regular sign up bonus.