Recently I’ve fallen in love with two old friends. No, I’m not talking about my true love, Ink Bold, or her equally fantastic twin, Ink Plus. I’m actually talking about two cards that I hold, but almost never use…

Priority Club Visa

I was attracted to this card over a year ago by a generous 80K sign-up offer which I spent for cash & point nights at the InterContinental London Park Lane hotel. One of the cool features of the Priority Club visa is that it gives you a 10% rebate on all points used, so I eventually got some of those points back for later use.

Since then, I haven’t thought much about the card. I certainly don’t use it for regular spend since I value other point programs more highly, and I value earning 5 Ultimate Rewards points per dollar much more highly. Recently, though, I paid the card’s $49 annual fee and then received my annual free night voucher. I needed a one night stay in Manhattan anyway, so I applied the voucher for a free night at the InterContinental Times Square (which was wonderful, by the way).

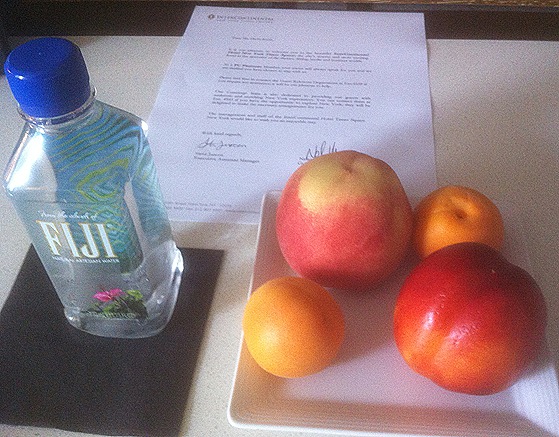

Suddenly, I was once again loving this card that I had long neglected. Thanks to paying its small annual fee, my family stayed in a $400+ per night hotel. And, since I have Priority Club Platinum status (which is given automatically to cardholders), the InterContinental upgraded us to a higher floor, and gave us water and a fruit plate as a Platinum welcome gift (which was, indeed, very welcome).

Think about this, by simply holding onto this card and paying the $49 annual fee, you get a free night at any Priority Club hotel worldwide, free Platinum status, and a 10% rebate on all points used. This card is definitely a keeper!

Marriott Premier Visa

I picked up this card last November when I was lured in by a 70K sign-up bonus. Until recently, those points (and others that I earned from actual stays) sat in my account unused. This past week, though, I found I nice use for those points. After dropping off our son at a camp in Northern Michigan, my wife and I spent a night at the Inn at Bay Harbor, which happens to be a category 5 Marriott Renaissance resort. Instead of paying over $350 per night plus taxes and resort fees, we redeemed 25,000 points. In return, we were upgraded to a beautiful lake view room and given free hot breakfast. I’m not sure what criteria they use to decide who gets free breakfast, but I did notice some Trip Advisor reviews in which people with Marriott Silver status got this benefit. Since the Marriott card gives you Silver status automatically, free breakfast at this resort might be automatic for cardholders.

We enjoyed our stay so much that when we headed north again at the end of the week to pick up our son, we stayed 3 more nights.

I haven’t received my annual free night from my Marriott Visa yet, but I’m now excited about it. It gives me a free night at any category 5 Marriott hotel. This means that I can stay a night at this resort every year for just $85 (the card’s annual fee). While this card isn’t as valuable as the Priority Club card, it is close.

Like a sign-up bonus without the credit pull

I regularly sign up for credit cards just to get the awesome sign-up bonuses so many cards offer. What I love about these hotel cards is that in addition to great signup bonuses, you get benefits every year without having to do anything but pay the annual fee. The Priority Club free night can be optimally used at a hotel that would otherwise cost 50,000 points per night. If you use it this way, it’s almost like getting 50,000 points every year for simply paying the annual fee. Similarly, the Marriott free night can be used at a hotel that would go for 25,000 points per night. So it’s like getting 25,000 Marriott points per year for paying the annual fee. The Hyatt Visa Signature card also offers a free night each year up to category 4 (equal to 15,000 points), so this one is high on my list for a future churn.

My goal is to get all three of these cards for myself and for my wife. That way, in addition to the sign-up bonuses, we will get a combined 6 nights per year towards fantastic vacations every year going forward. The combined annual fees across all 6 cards will come to $418. When you consider that one night at some of these hotels would otherwise cost this much or more, it’s a great value.

All three of these cards are Chase cards. Chase is known to shut down cards over time for lack of use so it’s a good idea to use these cards occasionally. I plan to use these cards only for spend within the corresponding hotel chain so as to maximize points earned. While that won’t amount to much, I’m hoping it will be enough to keep Chase happy with me as a customer.

Free nights, but with spend required

The Priority Club, Marriott, and Hyatt cards each give a free night each year (after the first year) regardless of whether you’ve actually used the card for spend. Two other cards worth mentioning are the Fairmont Visa Signature card and the Hilton HHonors Reserve. The Fairmont card requires $12K annual spend to receive a free night that can be used at any Fairmont hotel in the world. The Hilton card requires $10K annual spend to receive a free weekend night that can be used at almost any Hilton hotel in the world. Both of these cards have great signup bonuses and perks that may make them worth keeping past the first year, but they’re not “no brainers” the way the others are. I’m sure I’ll signup for each of these cards eventually, but I’m not sure whether I’ll keep them beyond the first year.

Summary of annual costs and benefits

The following benefits ignore signup bonuses. The point here is to look at hotel cards that offer sign-up-like bonuses every year after the first year simply by paying the annual fee.

- Priority Club Select Visa: $49 per year. Free night at any Priority Club hotel. Automatic Priority Club Platinum Status. 10% rebate on point redemptions.

- Marriott Rewards Premier Visa: $85 per year. Free night at any category 1 through 5 Marriott. 15 nights elite status credit (enough for Silver status which isn’t worth much).

- Hyatt Visa Signature: $75 per year. Free night at any category 1 through 4 Hyatt. Automatic Platinum status (free internet!).

- Fairmont Visa Signature: $95 per year. Free night at any Fairmont after $12K annual spend. Two free lounge visits per year.

- Hilton HHonors Reserve: $95 per year. Free weekend night at almost any Hilton property after $10K annual spend. Automatic Hilton Gold status (free internet, and free breakfast and room upgrades at many properties). This card is notable as the only one on the list that is not a Chase card (this one is from Citibank).

From this day forward

There’s something really fun about using points and free nights for fantastic redemptions. I love the idea of getting these free nights every year with no effort whatsoever. So, yes, I love my Priority Club and Marriott cards, and will likely love my Hyatt card too once I get one. That being said, you won’t see me using these cards day to day. These are cards to have and to hold, and to keep in a drawer until they’re needed.

[…] my post, “To have and to hold,” I described a few hotel credit cards that I like to keep around, not to use for spend, but […]

@dave: tvm; I did coach many friends to get 55 K invitation pop up by faking a booking. DId not know it could work on Hyatt card..

Happily I just paid $75 On Hyatt card for one 1-4 category free night and $99 on Southwest for 6K points.

PJ: Sometimes you get a better from the provider than what chase releases to the wild. For example, for United, previously BA, and Hyatt – if you start to make a reservation before you have to pay for it, you may get an ad to display that has a better offer. Click and apply via that link and you’ll get the perk. Then don’t bother completing the reservation.

For Hyatt the improvement was a $75 statement credit which basically cancels the first year.

For United, if you have some miles in your account, and in some cases if they are not stale (add a couple via some manner, UR transfer, etc if you can’t get it to display) you may find the 50K/55K/65K offer, vs the 40K offer.

In the spring, via British Air, you could get a 100K offer that gave 50K with low spend, than a second 50K upon renewal versus the 100K offer that had high spend (10k?).

Worth testing/reading around if you are looking for a new card. Your daughter could send a message to chase, but I doubt it will pan out, as she has already applied.

FM: Thanks for the response, I’ll go ahead and sub to your newsletter in case you do a feature on married couple points gathering strategies 🙂

She had a targeted offer for a Chase United MileagePlus card, and I applied under her name/info because Chase wouldn’t extend me the offer…I listed our household income as I added myself to the account also. We’ll see if we get accepted, haven’t heard back yet.

@david

What is dummy booking? My daughter got the new Hyatt card and was billed for $75 ( 1st year not waived) Maybe there is a way to get back this $75 .

Lane L: yes, the best strategy is absolutely to have your wife sign up separately so as to get two bonuses per household. You do not get extra benefits (with most cards) by simply adding additional cardholders to your account. Getting approved for many cards can be a bit tricky though if your wife doesn’t have any income. If you have investment income in her name (or in both names), she could list that as her income.

Good idea bout writing up this strategy. Thanks for the suggestion. I would probably put it in my newsletter rather than the daily blog

Chris: call Chase’s business reconsideration line (800-453-9719) and ask about the status of your app. Be prepared to answer lots of questions. If all goes well they’ll approve you on the spot.

Regarding your strategy of having cards held by both you and your wife…do these cards give free nights for each authorized user on the account, or do you need to apply separately?

I am new to the churn game and so far I have just added my wife as an additional card holder on the cards I’ve applied for (Sapphire Pref, Hilton AMEX, SPG AMEX, United MileagePlus).

Can you get multiple bonuses per household if you apply to the cards separately? If I’ve been missing out on this I don’t want to any longer! Do you have any posts on how married couples should strategize differently than single people? If not, would you consider doing one? 🙂

(P.S. I am the sole income earner for my family, so I’m not sure how that plays into separately applying for cards (she does have great credit though). We also would likely have to stagger our applications in order to meet some of the mid-high spend requirements.)

I applied for ink bold since 08/09. Until now, I havent heard anything back. Check daily on the automated phone number to check the status and the message is still thank you for the apps, we will get back to you in appox. 2 weeks…its been more than 2 weeks now. What to do?

Nevermind, I just got the PC card in the mail today and the benefits state platinum elite as long as you hold the card. That is pretty awesome.

FYI, with respect to the Priority Club Visa I don’t think you retain platinum for as long as you hold the card. Instead you receive Platinum when you earn 60k points in a year. You then get to retain Platinum for the following year. So at best you get Platinum for two years, assuming you don’t earn another 60k to qualify for Platinum again.

I find the PC platinum benefit very inconsistent from hotel to hotel. Some hotels I get upgraded automatically without asking. Others, I get no benefit at all, not even an acknowledgment. I did tell them I got plat status, and their reaction were “so what”.

Dave Op: That’s true, but to me it’s a great and welcome surprise when platinum status pays off — especially since I didn’t have to do anything but get a credit card to get the status. I’ve been pretty lucky so far: two InterContinental’s both resulted in modest room upgrades and a few other perks; one Holiday Inn resulted in club floor / club access (which meant free cookies and drinks). One Holiday Inn — nothing. 3 out of 4 ain’t bad!

I just want to second the amazing benefit this is for the Intercontinental in general and the Times Square location specifically. Even though they have their own frequent stay program–they treated my Priority status very well and I benefited from all the extras that came with the status (including a good night sleep). The hotel desk also acknowledged the status many times and I received great service across the board. I have found this same service and attention at other Intercontinental’s as well (though not the nice fruit plate). 😉

Great post, as usual FM. Thanks 🙂