In my recent post, “Best Category Bonuses,” I listed credit cards that earn the best bonuses in different popular categories such as grocery stores, gas stations, department stores, restaurants, etc. If you browse through that ever growing list, you’ll see that there seem to be no end to ways to earn high rewards multipliers almost everywhere.

It’s great that credit card companies offer such generous bonus categories, but sometimes it can be difficult to figure out whether the places you shop qualify. For example, when I buy food from a take-out place, does that purchase qualify for a restaurant bonus? Fortunately, in the comments of a different post, a few readers shared a very helpful website (Thanks Rob and Nick!). Visa, provides this website to their corporate customers for finding suppliers. Luckily, they made this site open to everyone:

https://www.visa.com/supplierlocator/search/index.jsp

Generally, credit card companies use the same merchant codes found in this website to decide how to categorize transactions. So, while what you find in the Visa website won’t be perfect, it should be a good indicator of how transactions are likely to be classified.

An Example

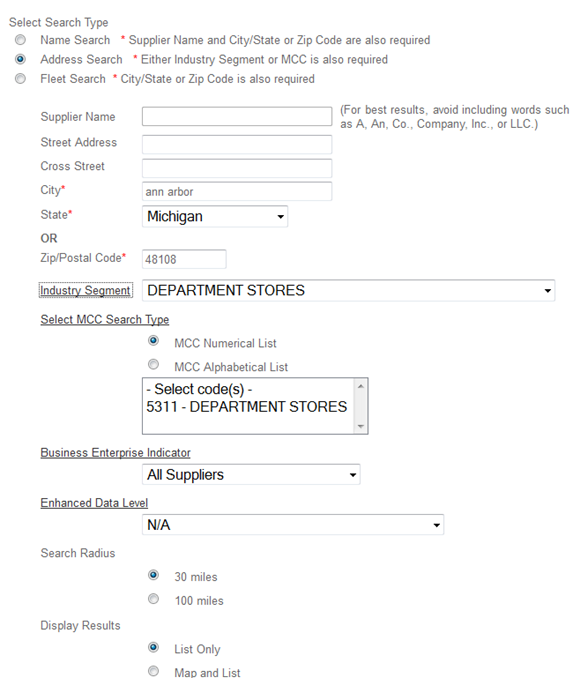

Since I have my US Bank Cash+ card setup to pay 5X this quarter at department stores, I wanted to see which local stores count. I ran an Address Search and entered my City and State. Then, for “Industry Segment,” I selected “DEPARTMENT STORES”.

After pressing “Submit”, I was shown a list of qualifying local merchants. The results included obvious departments stores such as Kohl’s, JC Penney, Macy’s, and Sears. Less obvious were stores such as Kmart and Fourth Ave Birkenstock. Kmart is a nice find since they tend to have a better selection of gift cards than does Sears.

Despite Kmart showing up in the list of Department Stores, neither Walmart nor Target were there. So, out of curiosity, I ran a name search for Walmart. The results came back showing that Walmart has several merchant codes including discount store, drug store, and grocery store. Do any readers know how to get your purchases to ring up as drug store or grocery purchases? I wonder if it has to do with the location in the store in which you make your purchases? For example, I wonder if you buy items at the pharmacy check-out would the entire purchase ring up as a drug store purchase? That would be handy! It looks like I’ll have to run my Amex HHonors card over to Walmart to try this out.

I ran a name search for Target as well, but my local Target showed up only as a discount store. That’s too bad since I tend to visit Target much more often than Walmart.

Late to the party here, but thought I’d contribute one of the policies behind multiple MCCs for a given merchant. From the Visa Merchant Data Standards Manual ( http://usa.visa.com/download/merchants/Visa-Merchant-Data-Standards-Manual-Oct-2013.pdf ):

Merchants with multiple business operations on their premises must use more than one MCC. If there are different businesses operating on the same merchant premises, each business must be assigned its own MCC if (1) they operate under different merchant names, (2) they operate in distinct areas and (3) have separate points of sale. For example, lodging merchants often operate other types of businesses on the premises (i.e., restaurant, flower shop, gift shop, etc.) with separate business names and payment terminals from the hotel. Visa requires the merchant classify these other businesses as a separate business under a unique and separate MCC that describes the specific business operation. For example, a flower shop in a hotel should be classified under the Florist MCC, whether or not it is affiliated with the hotel property

Thanks JD. Great info

Do you live in or around Louisville. Ky.?

Can you call me? I’m trying to figure out this rewards thing.

502-235-0920

kami, sorry about that! I updated the link in this post to one that works. However, my examples are now out of date since they’ve overhauled the look and feel of the site.

Do you know if this link has been updated? I know I am a couple of years behind but is there any links for this?

Hehe.. You can appreciate this – the Model A Restorers Club is showing up in the Gym Category. So it looks like 5% back for us on membership with the Citi Preferred since it’s one of the categories this quarter.

Oh wait. Nevermind.

Correction: Pre-Authorized charge shows up as ‘Jack In The Box’ but actual charges shows up as ‘Chevron’.

FYI, I noticed my local Chevron gas station is showing up in the credit card statement as ‘Jack In The Box’, it’s attached to a Jack In The Box. Which is coded as ‘Restaurant/Bar’.

I am switching to credit card with restaurant bonus for this gas station.

[…] will probably love this post. Last November, Frequent Miler posted an interesting article titled How to find bonus merchants where he showed how to search for merchant codes (the codes credit card companies use to classify […]

@Grant. Apple Stores are mcc-code 5732.

@Chris. Yes, foreign purchases are also coded. Any supplier/shop accepting Visa needs to have an mcc-code. A US credit card with cashback on, say, groceries will give casbach in any shop in the world that is coded with 5411 for groceries.

Thanks, Svein!

Just one quick note about the Visa categories. There are two targets near me. One listed as discount/wholesale and one as grocery store. I checked a purchase made with Amex Hilton at the “wholesale” location last week, and it was coded as “discount/wholesale.” I made a purchase last night at the “grocery” location with the same card, and it is still showing as “discount/wholesale.”

[…] How to find bonus merchants […]

Are foreign purchases also coded, and do category bonuses work for them? I spend half the year in China, and Discover is the only cc that regularly is accepted in my area. Trying to decide which card works best for my situation.

Will be making $1 purchase at 20+ stores in next two weeks.

@matt I’m talking about vanilla prepaid cards not reloads. I’ve been doing vanilla reloads long before bluebird. Vanilla prepaid gets 5x and you can liquidate by buying beans at cvs or use amazon payments.