Avid points & Miles collectors are always on the lookout for opportunities to increase credit card spend without fees. Taxes, mortgage payments, rent payments, car payments, etc. are great examples of large expenses that many would like to pay with credit cards, but high fees for paying by credit card are often a barrier.

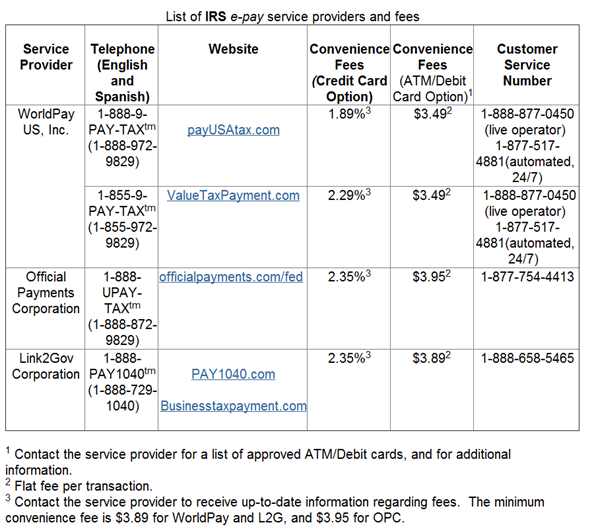

For Federal Taxes, the IRS maintains a web page that links to service providers who make it possible to pay taxes via credit or debit card. See “Pay Taxes by Credit or Debit Card.” This is great if you have a mile-earning debit card since debit fees are very low. However, most of us have credit cards (or charge cards which work the same as credit cards), and the credit card fees are quite steep. Here is the fee chart:

The lowest fee for paying with a MasterCard or Visa is 1.89%, and the lowest fee for paying with an American Express card is 2.29%. Debit cards, though, have only a single fixed fee per payment of $3.49 to $3.95. The larger the payment you make, the lower this fee is as a percentage. With a $1000 payment, for example, the fee is less than half of one percent.

Pay Taxes for Very Low Fees

One easy way to lower your fees is to buy American Express gift cards for cash back and then use those cards to pay your taxes. Currently, for example, BigCrumbs is offering 2.25% (or, temporarily, 2.5%) cash back if you go through their portal to American Express Gift Cards and buy the cards there. For details, please see my post “Big News at BigCrumbs.” Note that depending on which cards you choose, which shipment method you go with, and which discount codes you input, you will have fees that lower your effective rebate.

If you then use those American Express gift cards to pay taxes via ValueTaxPayment.com you will be charged 2.29% in fees. The exact cost of paying taxes will then depend on your effective rebate from BigCrumbs, but overall it should be very low.

Pay Taxes for No Fee (or make a profit!)

If you add another step to this process, you can reduce your fees even more. You might even make a nice profit! Here’s the trick:

- Buy Visa gift cards: After buying Amex gift cards as described above, go to GiftCardMall.com and buy one or more $1000 Visa gift cards. Pay with your Amex gift card. I did this recently with a $1000 Amex gift card. I chose to buy a Visa gift card for $992 so that the fees and shipping costs would come as close to $1000 as possible ($999.94) in order to clear out my Amex gift card.

- Pay Taxes via Debit card: Use the resulting Visa gift cards to pay Federal Taxes. These cards can be used as debit cards so that your fee will be less than $4 per payment. For step by step instructions for paying with a Visa gift card online, see “How to pay Federal taxes with a Vanilla Visa.” Even though that post describes how to pay with $500 Visa cards, the basic steps are the same. Make sure to scale up the payment amounts though! See the next step:

- Clear out your gift card: Pay exactly the amount that will clear out your Visa gift card. For example, if you have a $992 Visa gift card and the fee for paying by debit card is $3.49, then pay $992 – $3.49 = $988.51. This way, the one payment will leave a zero balance on your Visa card and you can then toss it in the trash (once you receive confirmation of the payment).

- Take it bigger: The online services only allow two payments at a time, but I found that by calling Official Payments Corporation (1-888-872-9829), the phone agents will happily accept as many debit payments as you care to make. So, if you need to make more than $2000 in payments, try that method.

By going through the method described above, your fee for paying taxes is reduced considerably. Let’s add up the fees:

- GiftCardMall: Approximately $8 per card

- Tax payment: $3.95 (or less) per payment

- Total: $11.49 per payment. If we assume a payment of $988.51 (as described above), this amount to a fee of = 1.16% fee

Remember that you would have bought these gift cards with Amex gift cards in which you gained over 2%. In total, you can not only pay taxes for free, but earn a profit!

Related posts and links

- BigCrumbs referral link

- Big News at BigCrumbs

- How to earn 5 points per dollar paying taxes

- How to pay Federal taxes with a Vanilla Visa

- Pay Taxes by Credit or Debit Card

![[Back] Costco offering 10% off Southwest gift cards again Southwest-Gift-Card](https://frequentmiler.com/wp-content/uploads/2023/12/Southwest-Gift-Card-218x150.jpg)

[…] of some different ways to maximize paying taxes going forward head to Frequent Miler’s posts here and […]

Spacetime17: Great!

Happy to report that I just put through $6,000 in estimated tax payments using exactly the method outlined above. Even with only 1.4% BC cash back I came out slightly ahead!

Using the free shipping trial and ordering in bigger size will make the process even more cost effective going forward.

Thank you Frequent Miler!!!

[…] Pay Federal Taxes via Credit Card for Free […]

LaDonna: probably the easiest option is to get a card that offers great big-spend bonuses (see https://frequentmiler.com/2012/12/10/best-big-spend-bonuses/) and use that to pay taxes. Just make sure the points earned outweigh the credit card fee. Alternatively, sign up for the SunTrust debit card and pay with that. You will be charged about $4 altogether and will get 20,000 Delta miles.

I have close to 20K in taxes I owe this year and I’m trying to figure out the best way to pay. We can no longer purchase $500 VR at OD and BigCrumbs is down to 1.4% for American Express GC. Any ideas? Please help!

Just found out the hard way that paying tax with bluebird is not a debit but a credit transaction, so looks like I may have to get MyVanilla Debit after all. Going to have to make sure to swipe once every 90 days (Good for estimated payments) so I don’t get hit with the inactivity fee.

leslie: The tax payment services don’t require a pin for debit purchases.

the visa gift card doesn’t have a pin, how can we use it as debit to pay for the tax

[…] anticipate having some chunky tax bills this year. I was planning to give FrequentMiler's method a try (Amex GCs through BigCrumbs, then using those to purchase Visa cards on GiftCardMall, then […]

Nick: Pay1040 will treat the Amex Bluebird as a credit card. You need a card like MyVanilla that can be used as a true debit card.

I probably have to make a large tax payment this year. Loading up the max amount on one bluebird and the rest on my partners should cover it. Vanilla reloads seem to be scarce but still available in my area. Or would you recommend a different card, like the MyVanilla visa.

Does anyone have any confirmed tax payment site that take the bluebird? This one seems to, I assume it doesn’t treat it like a credit card and charge a percentage fee?

wwww.Pay1040.com

FYI, DealsSeeker reported separately that she was finally able to get through to Official Payments phone agents after pressing 0 repeatedly.

There are no phone agents at 1-888-872-9829 for official payments, it is an automated system.

Linktogov’s fee for debit cards is $2.99