U.S. Bank’s Cash+ card was too good. Changes are coming.

I’ve written before about U.S. Bank’s excellent new Cash+ card. For example:

In those posts, I wrote that the Cash+ card was probably the best cash back card available. The reason I was excited about this card was for its stackable cash back benefits:

- Every quarter, US Bank lets the cardholder choose one 2% cash back category and two 5% cash back categories. All non-category purchases earn 1%.

- Cardholders who sign up for the Platinum Checking package earn an extra half percent on all purchases.

- When a cardholder requests $100 or more of their earned cash back, they are awarded with a bonus $25 Visa gift card. By redeeming rewards $100 at a time, the cardholder effectively earns 25% more.

By stacking all of the above, cardholders earn cash back as follows:

- 6.875% cash back within the two 5% chosen categories

- 3.125% cash back within the one 2% chosen category

- 1.875% cash back for all other purchases

With the minimum earnings at almost 2%, and the maximum at almost 7%, this no-annual fee cash back card beats the pants off almost every other cash back card out there. For now.

Confirming Rumors

Last week, a reader told me that he had gone to a US Bank to apply for the card (since it is no longer available for online signups) and he was told about some changes coming to the card. For one, he said, US Bank would be changing some of the categories available for 5%. Secondly, he said, they would stop giving $25 gift cards for every $100 redemption and would limit that benefit to just once per year.

The idea that US Bank would change its 5% categories was not surprising. Their marketing material always seemed to suggest that the available categories would change. The bigger blow was the loss of the 25% bonus on cash back awards. That would change the earning rate of this card substantially!

I called US Bank to try to get confirmation of these changes, but the rep I spoke with said that no changes were coming.

Meanwhile, contributors to threads on FatWallet and SlickDeals began to post similar rumors, with one big addition: they said that US Bank would cap the 5% category at $2000 spend per quarter. That would not be surprising at all, but it would be a big blow to the card’s benefits.

So, I called US Bank again. Again, I was told that no changes were coming. I asked to speak to a supervisor. The rep put me on hold to speak with a few supervisors. She eventually came back on the line and told me that, yes, changes were coming in July. Yes, 5% categories were changing. Yes, there will be a limit of one $25 bonus per year. Yes, there will be a $2000 cap per quarter on 5% cash back categories. However, she told me that the $2000 cap would be the cap in awards, not in spend. In other words, she implied that one could spend up to $40K per quarter within 5% cash back categories to max out the $2000 per quarter cap.

The information I received from the last rep about the $2000 cap didn’t seem right to me, so I called again. Again, I was told that no changes were coming. I told this rep that I was told about changes by US Bank in a previous call. She went to speak with a supervisor. When she came back to the phone, she admitted that changes were coming. This time, she had an internal web site opened with the information about the changes. She confirmed my suspicion about the $2000 cap and gave other details as well. For now, I’ll assume that I finally got the real information…

Changes coming in July

Here is what I believe to be the final word on the changes planned for July:

Changes to 5% categories:

Bill Pay, Home Improvement, and Airline categories will be removed. They will be replaced with Sporting Goods, Book Stores, and Cell Phone.

$2000 cap on 5% categories:

Beginning in July, only the first $2K of spend per quarter within 5% cash back categories will earn 5%. Any additional spend will earn only 1% cash back.

$25 bonus gift card:

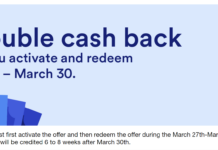

Beginning in July, cardholders will be able to get a $25 bonus gift card only once per year when redeeming $100 or more in awards.

Analysis of changes

None of the changes are surprising, but they’re all bad. Details:

- By limiting to one $25 gift card per year, it’s no longer correct to think of this benefit as adding 25% to the awards. So, the top earning rate for this card drops from 1.875%/3.125%/6.875% to 1.5%/2.5%/5.5%.

- The loss of Bill Pay, Home Improvement, and Airline 5% categories will be big blows to some people. Bill Pay included insurance, telecom, cable, etc. so the new Cell Phone category is just a small subset. Of the new categories, Book Stores is the most interesting since it may apply to Amazon.com purchases, but I would still prefer the Citi Forward card in that case since it gives unlimited 5X rewards for bookstores (and restaurants, and movies).

- The $2000 per quarter cap on 5% categories is probably the biggest disappointment for heavy hitters. 5% of $2000 is $100. No one is going to get rich with this card (anymore).

Bottom line

The Cash+ card is still a very good cash back card. It has no annual fee, so if you use it just within the 2% and 5% categories, and if you do not exceed the $2000 per quarter cap, you’ll earn a very respectable amount of cash back. When paired with the Platinum Checking package, the card becomes a 1.5%+ cash back card (meaning 1.5% is the least you can earn) which is pretty good for a no annual fee card. That said, as of July, this card will no longer be the amazing cash back card that it is today.

I just want a refund I cant use the card

[…] available in branch and had a pretty lucrative cash back bonus structure. But U.S. Bank has since devalued that card multiple times while at the same time opening up online applications, so there’s no huge advantage in […]

[…] up: US Bank Cash + I wrote about this a bit on Twitter—and Frequent Miler had a great, concise piece about it here. What categories you’ll use it for, and how much spending you do in those categories will […]

Just confirmed with USB rep over the phone, now CC balance (along with other loan/investment balance) counts towards the $25K requirement for free Platinum checking, CC limit does not count.

TonyL: I don’t know

The Platinum Checking package is no longer free, the monthly fee is now $17.95, that requires of bonus spending of $3590 per month to break even.

With the limit of $2K per quarter on 5%, I’ll drop the platinum checking on July.

@FM, is the $2K limit only on 5%? no limit on 2% spending?

[…] Cash+: This was once my favorite cash back card, but it has since fallen quite a bit (see “Cash+ comes down to earth“) […]

This is really a bait-and-switch. Part of their big marketing ploy was to get you to switch all of your automatic bills for insurance/phone/cable/internet/cell phone/water bill/electricity/gas, etc. over to the Cash + card, and now they’re ripping out the rug from under you. Not surprising though. Back to the Fidelity Investment Rewards for 2% cash back on everything, Citi Forward for 5% on Amazon and Dining and Fast Food, and PenFed Cash Rewards for 5% on gas with no rotating categories to mess with.

Went into the web site today to see if I could sign up yet for quarter 2 categories. Bill pay, airlines, and home improvement are already gone. Sporting goods, book stores, and cell phone are there. I’m especially going to miss paying the bill pay category; it was the easiest way to get 5% back on my insurance premiums.

Tso: the last person I talked to was able to bring up information about the changes on her computer. The others just went by what they knew or were told.

So you basically got 3 different answers. No change. 2000 in rewards. 2000 in spend. What makes you think the 2000 in spend was the correct one. How did you determine which to believe? Love your blog, but don’t see any advantage to calling and asking for supervisors who obviously dont even know what the changes will be themselves.

@FM (@DutchBag): Believe he was stating that the information you purvey is ill-informed (no common theme, no authority), rather than the questioning itself.

Can’t see the forest for the trees, Corporate America will bring you to your knees! Beggars can’t be choosers while indiscretion is the greater part of valor…

Hi HNY,

what is the matter with you? FrequentMiler is such a decent guy and did quite some useful researches. Show some appreciation rather than being bitter for no reason.

Laughing My Ass Off. Looking forward to more bad news coming(well not really, just pissed off sorry). Hopefully some of you will realize one day …

I don’t blame you personally though. I understand you have had a job loss last year, so have to look for cash flow. But some of the deal aggregators(bloggers) are just turning into arrogant pieces of …. and no this wasn’t a blog phenomena (Cash+) ….

Man I just got the card and would probably spend at least $3k/quarter on 5% bonus categories. All I can do now is some huge prepays to utilities to get the 6.25% before the changes. But I will stick with it for the $2k/quarter I guess.