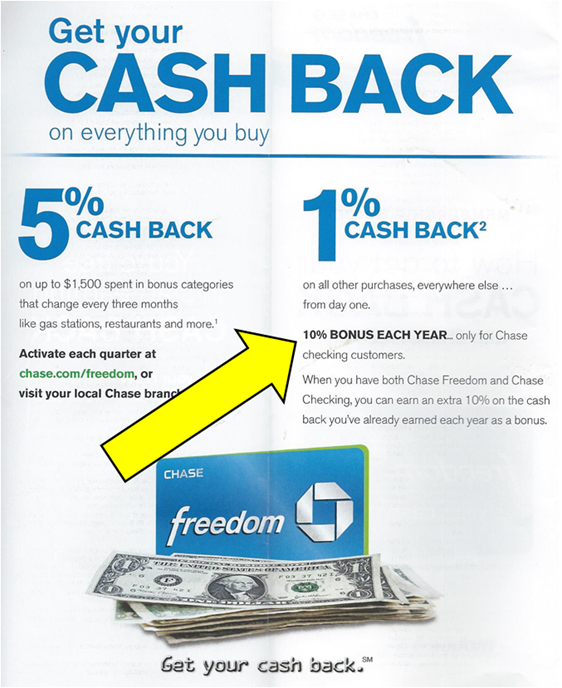

In order to maximize my point earnings this month for Million Mile Madness, I downgraded my Chase Sapphire Preferred card to the Chase Freedom card. This way, I could take advantage of the Freedom card’s 5X drugstore earnings this quarter. Well, last week my new card arrived along with a brochure listing the card’s benefits. And, in the brochure I found something new:

What I found interesting was the text that said “10% bonus each year.. only for Chase checking customers. When you have both Chase Freedom and Chase Checking, you can earn an extra 10% on the cash back you’ve already earned each year as a bonus.” This was interesting and surprising to me because I knew that Chase no longer offered their Chase Exclusives program which used to reward Freedom cardholders & checking account owners with an extra 10 points per transaction and a 10% bonus on base points earned.

When activating my new card, I asked about this 10% bonus. I do have a Chase checking account after all. Is it only on base points earned? I asked. No, it is for all points earned on your Freedom card. What about points earned through the Ultimate Rewards Mall? Yes, any points earned on the Freedom card count. I was so skeptical of this that I asked to speak to someone in the rewards department who then answered the same way. Yes, she said, Ultimate Rewards Mall earnings will count.

Wow. This is great. This is very similar to the Sapphire Preferred card’s annual 7% dividend, but it is 3 percentage points better, as long as you have a Chase checking account. This means that when you earn 10X bonus points through the Ultimate Rewards Mall, you will really earn 11X bonus points (in addition to 1.1X base points). Similarly, when you earn 5X with the Freedom card’s rotating categories, you will now really earn a total of 5.5X when bonus points post at the end of the year.

The Points Guy also recently wrote about this new benefit here: Changes to the Chase Freedom 10% Bonus And What It Means For Your Points Strategy. He didn’t mention the Ultimate Rewards Mall so I thought it was worth expanding coverage of this new benefit.

Selecting an account when shopping

If you have multiple Chase Ultimate Rewards cards tied to the same online account, you will be asked to pick one when you go to the Ultimate Rewards Mall. In the past, there were often different bonus earnings for different cards so it was always best to pick the account with the highest earnings, but recently Chase seems to have kept the point earnings the same across cards. As long as that holds true, the best account to choose when going to the Ultimate Rewards Mall is now your Freedom account (if you have Chase checking). Next best is the Sapphire Preferred.

Sapphire Preferred vs. Freedom

If you already have and use a Sapphire Preferred card, its unlikely that the 3 percentage point difference in the annual bonus between the Freedom card and the Sapphire Preferred will make much difference. For example, suppose you earn 20,000 points in one year. If those points were earned on the Sapphire Preferred card you would get 1400 bonus points at the end of the year. If those points were earned on the Freedom card, you would get 2000 bonus points. The difference isn’t huge. Of course, if you earn hundreds of thousands of Ultimate Rewards points in a year, then that difference will add up fast!

Also keep in mind that the Freedom card does not earn bonus points for travel and dining, nor does it allow you to transfer points to airline & hotel programs. I think that the best strategy for most families is to keep one Sapphire Preferred account and one or more Freedom accounts. Log into the Freedom account for online shopping. Use the Sapphire Preferred for travel and dining. Use the Freedom card for all 5X categories (up to $1500 per quarter) and for all non-category spend (in order to get 1.1 points per dollar). And, of course, if you have a Chase Ink card, use it for all cable, telecom, internet, and office supply purchases (at 5X) and gas (at 2X).

Terms & Conditions

I found the Freedom card’s Ultimate Rewards Rules and Regulations here. I’ve quoted some of the relevant text and bolded parts that I find interesting:

Earning Rewards:

You will earn 1 base point for each $1 of Net Purchases. You will earn an additional 1 point for each $1 of airfare and hotel accommodation Net Purchases when you book at chase.com/ultimaterewards. You will also earn a 10% Bonus on all new points earned with your Chase Freedom card during billing cycles within the previous Year when you, as the primary cardmember, were the sole or joint owner of an open Chase checking account. Your 10% Bonus is calculated after your billing cycle with a December closing date (“Year” means the twelve billing cycle period beginning the day after your billing cycle with a December closing date through your billing cycle with a December closing date of the next year.) Your Chase checking account must be open, and your Chase Freedom card account must be open and not in default, at the end of the Year. Your 10% Bonus points will appear on your January or February billing statement. You will not earn the 10% Bonus on new account bonus points, previous 10% Bonus points awarded, or points transferred into your account. (“Net Purchases” means purchases of goods and services made by you or any authorized user on your Account minus any returns or refunds.) Point accrual will begin upon the Enrollment Date in the Program. (“Enrollment Date” is the day on which we approve you as a Program member.) No retroactive points will be awarded. You do not earn points on balance transfers, cash advances, cash-like charges such as travelers checks, foreign currency, and money orders, any checks that are used to access your Account, overdraft advances, interest, unauthorized or fraudulent charges, or fees of any kind, including fees for products that protect or insure the balances of your Account. Points will be deducted for any returns or credits made on your Account. Points will appear on your monthly statement.

Notice above that all new points earned on the Freedom card count except those earned from a sign-up bonus or transferred from other accounts.

Pete: Thanks for the update. That’s good info to have: Wait at least a year before trying to downgrade Sapphire Preferred to Freedom. Noted.

I know this is late, but I’ll post it anyway.

On the issue of downgrading to a Freedom – my wife called to downgrade since we both have Sapphires and was able to downgrade to a no fee Sapphire only. But she was told that once she passed a full year of having the CS preferred she could then change it to a Freedom.

[…] per dollar thanks to the annual 10% bonus I get for having a Chase checking account (see “The new king of the Ultimate Rewards Mall“). And, my Citi ThankYou Preferred card earns 5X at drug stores for the first year […]

[…] checking account, I qualify for a 10% annual bonus on all Freedom card points earned (see “The new king of the Ultimate Rewards Mall“). So, I’ll earn a total of 5.5 points per dollar within the bonus […]

Thanks for the vote of confidence, and for the MasterCard suggestion. I’ll keep that in mind. Thanks again!

RayB: That sounds reasonable. Personally, I prefer to keep my points as Ultimate Rewards until I need them so that they can be used for whatever I need at that time: UA miles, SWA, BA, Hyatt, etc. Don’t forget that there is a MasterCard version of the Sapphire Preferred, so you may be able to get that and keep the ability to move points for another year.

FM…Let me know what you think of my plan.

I also have a Chase checking account and just applied (and was approved) for the Freedom card. I also have the Chase Sapphire (no-fee) card, the Sapphire Preferred card, as well as the Southwest card (on my second year and paid the $69/fee, but received 6K miles instead of the usual 3K) and a UAL MilePlus Visa.

Once I activate the Freedom card and spend the $500 to earn the 10K UR points I plan to move those points to my Sapphire card. Then, I’ll transfer all my UR points between United Airlines and Southwest (I primarily travel to Hawaii once/year and Colorado twice/year). Then, close out my Sapphire Preferred card (thereby avoiding the yearly fee) and possibly my SW Visa. Then, use my Chase Sapphire (no-fee) card for restaurant purchases (2x points), and the Freedom card for everything else (1.1 points). I’ll the UAL MilagePlus Visa, for free baggage to Hawaii and primary car rental insurance.

Over the span of 18-24 months, I’ll earn the points on the Freedom and Sapphire card. Then, eventually, apply for a new Sapphire Preferred or Ink card, get approved, and transfer all my accumulated points to the new card.

points on the dollar: The positive spin for me comes from the fact that I wasn’t grandfathered into the old Exclusives program. Plus, the old program didn’t help with UR Mall earnings.

^^^^ yep, that and the fact that the 10% Freedom card’s bonus was deposited monthly. Now, just like the CSP’s 7% dividend, we have to wait until year’s end to get the bonus. Yuck, I want all my rightfully earned points, now! 🙂

I don’t understand the positive spin that this uniquely negative change is generating! We’re losing a huge benefit — 10 points per transaction, which is incredible for all of those small daily purchases — and gaining a measly tenth of a percent (or point, if transferred to UR points) on each dollar spent.

I tried to do the same thing (downgrade Sapphire Preferred to Freedom) but the agent said:

“At this time, I’m unable to change your account to the Freedom product. The only product change option available

is to the Sapphire no annual fee card. I apologize for

any inconvenience this may cause you.

As an alternative, you may apply for a new Freedom

product”.

@Chimney: you’re not earning 10x on your $70 phone bill, you earn 10% of your $70 bill.

(7 bonus points + 10 bonus ‘swipe’ points + 70 base points = 87 points)

@Jayson, yes I most certainly am getting 10X, when I’m paying my phone bill $1 at a time.

Lahaina the 5X quarterly categories and 10% bonus make Freedom a darn good card, especially if you have Sapphire Preferred or Ink Bold/Plus. My Sapphire Preferred Visa annual fee is coming up. I have Bold, and Freedom Visa, so I wonder what I should do. Get a Sapphire Preferred Mastercard? Will I get the bonus? Should I get a no-fee Sapphire (I do eat at restaurants often)? Should I get a Freedom Mastercard?

Hi, Greg. Can you please discuss (again) why it would be more benefecial to downgrade from Chase Sapphire PREFERRED to the no fee Freedom card vs. downgrading to (also no fee) Chase Sapphire? My annual fee has come up for my Chase SP, and I already have the Ink Bold card. Thank you!

Lahaina: The Freedom card has the 10% annual bonus as well as quarterly 5X promotions. The Sapphire (non-preferred) has 2X for dining. If you eat out a lot, the Sapphire might be a better bet. But if you use the Ultimate Rewards mall alot and/or max out the quarterly 5X promotions on the Freedom card, then you’ll do much better with that card.

Mark: That’s interesting. They must custom tailor people’s downgrade options.

Rachel: I’m not sure

Steven Lu: It took about a week to get the new card from when I called.