Last week, Home Improvement gift cards turned into gold but then lost their luster soon after. Here’s the story, and what to do…

For me, the story began on July 29th, when I received the following tweet:

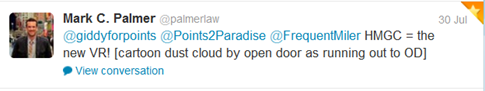

Points to Paradise had published this post about using the Home Improvement gift card to load Bluebird at Walmart. This was big news because the Home Improvement card was the last reloadable card that Office Depot was allowing to be purchased with a credit card. And, there was (and still is) no fee for buying these cards. And, you could pay with a card that gets 5 points per dollar at office supply stores. It was a perfect storm of free points! My favorite reaction was this tweet:

While I did Tweet the deal, I didn’t write a post about it because I was sure it wouldn’t last long and I didn’t want to hasten its demise. More importantly, I thought it was risky to buy Home Improvement cards if you didn’t plan to use them on, you know, home improvement. What if it stopped working? You see, Home Improvement gift cards are supposed to work only at Home Improvement stores: Sears, Home Depot, Ace Hardware, etc. I was sure that the ability to use the card at Walmart was a bug that would soon be corrected.

Travel Summary initially wrote about the deal without spelling it out. He wrote: “Hypothetical: If You Could Buy Points For Free, Would You Go All Out?” In that post, Travel Summary suggested that the rational thing to do was to go all out – buy and liquidate as many Home Improvement cards as you could. I disagreed. In the comments of that post, I wrote:

Going big in this case is risky because you never know when you’ll be stuck with many thousands of dollars worth of gift cards that have lost their magic…

Points Summary apparently shared my concern and tried to warn people. He wrote: “The Pitfalls and Dangers of the Home Improvement Gift Card (HIGC).”

Regardless of concerns about it, word about great deals tends to travel fast. It wasn’t long before the deal received widespread exposure through blogs and forums such as Flyertalk. And then it seemed that everyone in this game was running out to buy thousands of dollars worth of Home Improvement gift cards.

Then, the deal died

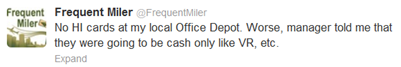

On Thursday, I stopped at my local Office Depot after lunch. There were no Home Improvement gift cards to be found. The store manager recognized me as a frequent gift card buyer and proactively told me about their recent policy of not allowing reload cards to be purchased with a credit card (see: “$500 Vanilla window slams shut at Office Depot“). Surprisingly, though, she also explicitly mentioned that they were out of stock of Home Improvement cards and that when they returned they too would be cash only.

I tweeted my experience and quickly heard from several others that their local Office Depot stores had also gone “cash only” for these cards.

Not only did we lose the ability to get a 5X office supply bonus when buying these cards, but we also lost the ability to easily turn them into cash. At around the same time that I learned about Office Depot’s new policy, reports began appearing on Flyertalk that the cards no longer worked at Walmart. And, apparently it had lost its ability to work at other non Home Improvement stores as well (the next day, Million Mile Secrets posted: Home Improvement Card No Longer Working at Other Stores).

So, now what?

What if you’re now stuck with thousands of dollars worth of Home Improvement gift cards? What can you do? Sadly, one of the best options that used to exist no longer works. I’ve been told by many readers that it is no longer possible to use the Home Improvement card online to buy Sears gift cards (this was previously useful because Sears often offers large rebates via cash back or points earning portals). Instead, consider these options:

- Buy stuff you need from Lowes. Here’s how to maximize savings: Go through uPromise or ShopDiscover to Lowes to buy Lowes’ gift cards $500 at a time (use the HI card as a Discover credit card). Both uPromise and ShopDiscover currently offer 5% cash back at Lowes. Once you get the Lowes gift cards, go through the online portal again to buy what you need. Make sure to use coupon codes to lower your total purchase price even more. I’ve been told that you can alternatively charge things to a Lowes AR card for 5% off any purchase, and then pay off that card with Home Improvement gift cards. I haven’t tried that though.

- Buy merchant gift cards from Lowes. Lowes carries a wide assortment of gift cards in-store (department store cards, gas station cards, travel cards, Amazon.com, etc.). You should be able to find some merchant gift cards that you would actually use. You can buy those gift cards and pay with the Home Improvement gift card (since it works like a Discover credit card). You cannot buy gift cards with Lowes gift cards. If you just want to get most of your money back, use giftcardgranny.com to find the gift cards that resell for the highest rates (hint: look at the gas station cards). Then, you can buy the gift cards at Lowes with the HI card and re-sell those cards. I don’t particularly recommend this path since you will likely lose 7% or more of the price you paid for the HI cards, but if you really need the cash its better than nothing.

- Buy merchant gift cards from Sears. If you can find the mysterious gift card rack at Sears, then you should be able to use the HI card in-store to buy those gift cards. Note, however, that Sears tends to have a much smaller selection than Lowes. The best Visa gift cards available are $100 gift cards each with a $5.95 fee. You would be losing more than 5% of your Home Improvement card’s value by buying these, but at least they can be used virtually anywhere. And, yes, you can use the last four digits on those cards as the PIN number at Walmart for loading Bluebird.

- Buy and sell. This is the toughest option, by far. If you know how to hunt deals, and you know how to resell products, it is possible to earn back your money or better by buying and reselling items from Sears, Lowes, Home Depot, etc. Unless you’re already used to doing this, I wouldn’t recommend this risky and stressful approach. If you are considering this, I highly recommend that you re-read my Million Mile Madness adventures to see what worked, what didn’t, and how issues with Home Improvement cards were eventually resolved.

- Other options. In the post, “The Aftermath of the Home Improvement Gift Card Deal,” Travel Summary suggests several ideas for liquidating Home Improvement gift cards. Please follow the link and check it out.

Do you have any other suggestions for what to do with Home Improvement gift cards? Comment below!

[…] it was PIN-enabled and could be loaded to Bluebird. It was a bonanza! People bought tons. And then the deal died, the PINs were shutoff and people were left floating a ton of […]

[…] If you want to be really cautious, you can slow down or stop buying reloads and gift cards altogether. At least temporarily, until the situation is more stable. Focus more on just getting your money out. All these developments–like with CVS–are making me think it’s better to lighten up on manufactured spending and concentrate on exit strategy. Sure, you might miss out on some potential points, but it’s better than losing real cash by getting stuck with cards you can’t use. For a good case study (more like a good scare), read about what happened with Home Improvement gift cards. […]

[…] Home Improvement gift cards lose their luster. Now what? […]

All of these discussions I see about giving out strategies ….then having them stop working…. Well imagine that happening in your business, I mean in your livelihood….where someone giving out your business strategy results in too many people engaging in it and the edge being whittled away to nothing. That’s similar to a card issuer stopping one of these fun points accumulation strategies, except that it affects your living, not just your hobby.

Well,as a securities trader I was on the receiving end of that for 10 years and had to keep coming up with new strategies. How others found out about the strategies is anyone’s guess—from a clearing firm looking at your trades to someone just discovering it, to me actually telling people about it.

My point is you can’t get too worked up about these deals going away. It’s not your livelihood, hopefully. Sure, it’s a great hobby, but you don’t have to feed the kids and make the mortgage payment with it.

I mention this because I’m my own worst enemy when it comes to giving out a winning strategy. I think it’s a function of wanting to help your friends….and then it gets out of control or one of them carries it to the extreme and takes the entire edge out of an advantaged trade.

I was lucky to keep thinking up new ideas until I didn’t have to worry about it anymore….but I think what is going to happen with points strategies is exactly what happened with trading strategies: Eventually the winning ones are going to be much more expensive to play.

[…] Miler gives us the play by play of yet another deal dying a premature death. “Home Improvement gift cards lose their luster. Now what?“ FM stated and I quote: “I didn’t write a post about it because I was sure it […]

You can have a perpetual point machine, in small numbers. Anyone with two brain cells can generate $1,000 in spending with Amazon… I’ve done it for years now. The Chase thing has been going on for at least six months without being stopped. And AP and Chase have been discussed, numerous times, in many forums.

For the ones in the secret club who knew about HIGC since May that’s great, but you have to realize there are always people who aren’t in the secret club, that have no problem blowing your cover away, and may not even realize it. Unfortunately it’s impossible by definition from someone outside the secret club to join without an invitation, but the only way to get invited is to come up with something novel, because how else would you know that they weren’t a leech? (Or, I suppose build a relationship in real life, but that ends up being hard for a lot of travelers.) So these large scale PPMs will continue to be crashed, and those who use them need to always stay on guard to liquidate ASAP if it breaks.

Greed, greed, greed…. that is what killed that deal. And tons of people stuck with these cards. But they are mad !

@BryanPort – Even if the limit is increased to $5k a day, do they require a scan of the DL ?

FM,

Could you elaborate on buying Lowe’s gift cards with the HI card? I couldn’t figure out how to do it even when trying it as a Discover credit card. Do you think I need to wait a while after registering the zip code?

FM – I appreciate that you clearly understand the influence you have in the miles/points world and chose to “cause no harm” by not writing about this. I went in on this deal a little more than I should have (lesson learned, I hope) and will use your tips (and those of others you mentioned) to minimize the costs.

Jose A: thanks

An anecdotal story that may be useful to some readers… I tried to unload a HICG by buying Visa gift cards at Sears store location in SoCal last week. The manager would not allow HIGC as tender and confirmed this would be the case even if I was buying something other than gift cards. His assertion was that the HIGC are not embossed and that on the back they say “valid for electronic use only” or something similar. I called a CSR for HIGC and they spoke to the Sears store manager and he maintained his position and would not accept the card. The CSR for HIGC told me that in fact the only section of Sears the HIGC was valid in was the home improvement section. I pointed him to the website, which simply stated Sears as a listed participant… but the point was moot because the manager would not accept them anywhere in that particular store.

girlmeetsworld: That’s quite a story. I’m curious what would happen if you simply went to a different cashier when that manager isn’t around.. ?

I actually tried one cashier and my boyfriend tried another, they both called the manager over to complete the transaction. In the end we were promised a refund on the HIGC’s because of this issue, which may be the best outcome considering… though if FT is indicative a lot of people are trying for a refund, so I’m not sure how easy it will be to obtain.

girlmeetsworld: I agree, that was the best outcome you could have hoped for!

Greg, are you sure you didn’t know about this deal a couple months ago? Something tells me you might have… 😉

Unfortunately, I learned of this deal too late (OD had sold out 2 days before I learned of it) but it has inspired me. I am on a quest to find the perpetual point machine on my own. Ironically, I’ve come to realize I will never read about the perpetual point machine on Frequent Miler, because its painstakingly clear that perpetuity is incompatible with wide publicity. Thus I must find it on my own. But tell me, Greg, does it exist? I am convinced that it does, and I’m on a mission to find it. Thanks for the teaching me the ropes via your blog. I now have the skills to find it on my own.

Game on!

Jonathan: you give me too much credit! Yes, I knew that the HI card had a settable PIN a few months ago, but I didn’t know that it could be used at Walmart. You’re comment about perpetual point machines is insightful. I generally avoid blogging about the point machines where I know that exposure will kill it. Do they exist? Absolutely. Have I found one that will remain “perpetual” after it has been blogged about? Probably not.

@HikerT – Are you saying people should not publicize deals that they find or that it be done discreetly? If discreetly, how do you propose that it be done? That is the eternal question.

I don’t blame bloggers. I blame those stupid enough to broadcast it. People who find these deals on their own should be rewarded.

I think banks act quickly on deals like this when they amount they are paying out in rewards exceeds when they’re making in merchant fees. With most people paying with Ink at OD for these cards, Chase moved quickly because 5 UR per dollar exceeds what they’re making in fees. VR at CVS doesn’t warrant this kind of prompt action.