The usual offer for the Ritz Carlton Rewards credit card is 70,000 bonus points after spending $2,000 in three months. The annual $395 fee is not waived the first year. That fee sounds awfully steep, but it includes some really nice perks such as 3 club level upgrades; Gold status, first year (and each year thereafter when you spend $10K or more); $100 hotel credit for each 2 night or longer stay; complimentary Lounge Club membership; and $200 annual credit for airline incidentals.

A reader has alerted me to two even better targeted offers. Via the MyFico forums, this thread details two offers: One for 70K bonus points with the first year fee waived, and the other for 140K bonus points, but the first year fee is not waived.

I called the number listed in the MyFico thread (1-888-846-7004) to see if the codes listed there could be used by people who were not targeted. The phone agent I talked with wasn’t aware of the 140K offer, but she was able to find it when I gave her the promotion code (F5BP). I was completely honest in explaining that I didn’t receive the code personally, so she did some digging to see if I could use it anyway. Finally, she apologized and told me that no, since I had admitted that I wasn’t targeted to receive the offer, I wasn’t qualified for it. I didn’t ask her to check the other promo code (F53K), but I’m pretty sure I would have gotten the same answer.

Now, this is just a guess, but I’m betting that if you get targeted for either offer, you could successfully call and ask to be switched to the other one. So, which is better?

The difference between the two offers is simple: with one offer you save $395 and with the other offer you get an additional 70,000 points. Choosing the 140K offer is equivalent to buying 70,000 points for $395. If those additional 70,000 points are worth more than $395, then the 140K offer is the better one. If the points are worth less than $395, then the 70K, first year free offer is better.

How much are those 70,000 Ritz Carlton points worth?

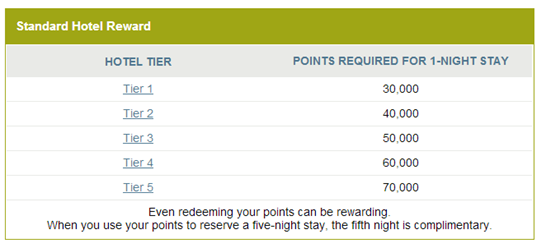

In this context, when I ask how much Ritz Carlton points are worth, I mean “how much would you / should you pay for them?” That is very different from asking how much value can you get from the points. Let’s say, for example, that you use those 70,000 points to stay a night in a top tier Ritz property (see award chart below). And, let’s say that the property would have cost $500 per night if you had paid cash. In that case, you could argue that you got $500 in value from those 70,000 points. That does not mean, though, that 70,000 points are worth buying for $500. Not at all. Why buy points for the chance of redeeming for the same amount? The only reason to buy points is to get more value from the points than you could have gotten with cash. It only makes sense to buy 70,000 points for $395 if you know for sure that you’ll get significantly more than $395 value from those points.

Marriott Connection

Ritz Carlton points are essentially the same as Marriott Rewards points. Ritz Carlton points can be used to book not just Ritz Carlton properties, but Marriott properties as well. Gary, at View from the Wing, covered the topic in detail here. So, if we can estimate how much Marriott points are worth, we can estimate Ritz points’ worth as well…

Fair Trading Price

My Fair Trading Price page estimates the opportunity cost per point of various loyalty programs when people choose to use certain credit cards or stay in certain hotels instead of choosing other options. The current estimated Fair Trading Price of Marriott points is shown as .5 cents per point. Since Marriott and Ritz points are essentially the same, we can say that Ritz points also have a Fair Trading Price of a half cent each. So, we can further say that the Fair Trading Price of 70,000 points is $350. In other words, based on the Fair Trading Price, 70,000 Ritz Carlton points are not worth $395 (but it’s close!).

Conclusion

If you have the opportunity to pick one of the special Ritz Carlton credit card offers, think carefully about how much you would be willing to pay for points. If the 140K offer will get you closer to a valuable award, then it may be worth paying $395 (.56 cents per point) for those extra points. If you’re simply collecting points for someday, I’d say that the first year free offer is probably the better option.

What do you think? If given the option, which offer would you choose?

I applied for the Marriott card in March and was approved & got the 70k.

I just applied for the Ritz card last week and after moving some credit around, got the 140k Ritz card without having to close the Marriott card (although I probably will when AF is due).

Got approved for this deal and this card is amazing if used right, I am saved thousands. This is a no brainer for 4 reasons 1) You get GOLD status on Marriott ( free Lounge and breakfast)and the Marriott Card gives you only Silver status 2) Airline incidentals are 300$, I am aiming to use them when I select premium seats on Jetblue on my Caribbean flights, as well as on any change or cancellation fees. Best benefit is to pay Airlines like US Airways who charge 50$ per passenger as booking fee for reward bookings 3) Transferred the 140k points to my Marriott Account. Will book the The Marriott in Paris champ Elysees for 45k/pernight ( actual cost 650 Euros or 900 USD on average ) so planning to use it on that. Plus I get Upgraded to the Suite cause of the GOLD status 4.) Lastly, going to ask Carlson to Status Match myself to GOLD status as my wife is GOLD already on Carlson, we can now get 2 nights free on the Radisson in Europe by paying just for 2. Phew….

Thanks for the comment. I think there are a couple of pieces of confusion here, though…

3) Marriott Gold status does not guarantee an upgrade to a suite. In fact I’ve had Platinum status for the past couple of years and have only been upgraded to a suite once that I can remember. Yes, there are great benefits to having Marriott Gold status, but room upgrades are not Marriott’s strong suit.

4) To get 2 nights free with Club Carlson for paying just for 2, I think you have in mind the Bonus Award Nights that come with the Club Carlson Credit card. This is a feature of the credit card, not a feature of Gold status.

hay, can i apply ritz carton if i applied to marriott in couple month ago?

I think so, but I’m not sure

[…] 140,000 point signup offer, which surprises me since he gives the same promotion code that Chase told Frequent Miler that he was ineligible for a year […]

@Darlene I would love to see your experience put in writing in the terms and conditions……..until then I will remain distrustful of Ritz Carlton Tahoe and fit Carlton Half Moon Bay and will go elsewhere until they change their policy………..really sad bait and switch that you have to go to that extreme to get your benefit………I love their hard product but the marketing team leaves hella lot to desire………

[…] The card does have some nice perks, but costs a whopping $395 per year. See “The Ritz 140K offer. Should you take it?” for details about a couple of good signup offers. Please read the comments of that […]

Darlene: The T&Cs came with your card or you can read the terms of the Club upgrade on the Chase app page. Like I said, it is only specifically limited by the statement of “no promotional or corporate rates” but it also states that the club upgrade is based on availability. I made my booking on the RC website at their lowest standard rate and called in. They tried to tell me that their was no club upgrade availability at the lower rate, but I said that as long as I didn’t book a promo or corporate rate they would have to give me the upgrade at the rate I booked if there was “availability” at higher rates.

And as for kama’aina rates, I just haven’t seen any good ones since the economy picked back up. I’m glad for that, but it’s certainly limited my weekend inter-island travel this year.

Hi Isaac,

I wanted to get back to you and thank you. I did call back the RC & asked for a supervisor. He actually gave me the best internet rate for the Club upgrade without a problem. I was amazed.

I also thought I remembered your saying something about using the $200 airline incidental credit for airline gift card purchases. Were you ever successful with that? What denomination did you buy? It also looks like you get $200 per calendar year even if your credit card year goes across two years. Is that true?

Thanks for all your help in advance.

Mele Kalikimaka

Darlene

[…] story does not end there. After catching up on my daily point reading I came across a Frequent Miler post that highlighted the little known offers available with this card. I was so frustrated with myself […]

Isaac: thanks so much for your info on getting an Internet rate with the club voucher. I will be staying in October & already had the agent change my rate to the higher rate. How did you get a copy of the T &Cs? What rate did you pay? Also do you remember the name of the agent who helped you as he/ she is already aware of this issue. I was going to stay there for a bday celebration but the club voucher rate was outside my comfort zone. Usually I can get great kamaaina rates ( for Hawaii residents) so I’m not used to even the regular rates. Any help you can give me would be deeply appreciated. Mahalo nui loa!!!!!

allen: I don’t know

Does AA Gift Card qualify for the $200 airline credit? Thanks.

You guys are going to be very bummed when you go to try and use the $100 credit and club level upgrades and find out they are only good with “juiced” rates…..

This offer is still valid; I am on the phone with Chase right now opening an account using the F53K 70K bonus offer.

In addition Ritz is very dishonest with this offer as only “elevated rates” qualify for the $100 credit and Club level upgrade……..it is amazing to me that a premium brand would use this bait and switch tactic………..lost me as a life long customer as a result of the insult………..

Fairmont has a much better offer and is just as nice a hotel chain without the Marriott baggage……..