In my May 31 post titled “Citibank Stork delivers news,” I described a letter from Citibank with news about changes to the Citi ThankYou Preferred card. Its terrifying to get a letter from a bank saying that “exciting account changes are coming soon”. Usually language like that means that your card benefits have just been greatly devalued. In the case of the ThankYou Preferred card, though, the news was OK. I even found it humorous that it was a Stork that delivered the news. The letter was signed like this:

Anyway, I recently received another letter from Mr. Stork. This one referred to my ThankYou Premier card and also promised “exciting changes.” This time, though, the changes were “exciting” in the scary way I expected. Luckily for me, I wasn’t surprised by any of these changes because Gary had already published the details a while ago. Anyway, the gist of the changes are as follows…

Expiring Premier card benefits

- Earn Flight Points on airline tickets purchased with your card

- Points were worth 33% more toward airfare

- Earn 1.2X at gas stations, supermarkets, drugstores, parking, and commuter transportation

- Anniversary bonus on points earned from purchases

- Annual companion ticket & 15% savings on airfare.

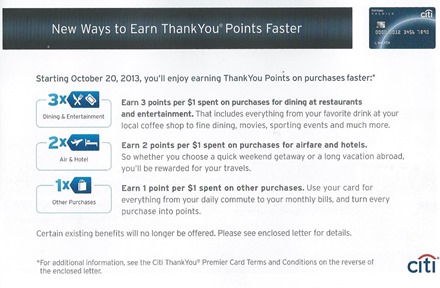

New Premier card benefits (as of Oct 20)

- Earn 3X on dining and entertainment

- Earn 2X on airfare and hotels

- Points will be worth 25% more toward airfare

For some people, the removal of Flight Points will be a huge letdown. If you could wrap your mind around Citi’s complicated Flight Point program you could essentially earn 2X everywhere with the Premier card, and even a little bit more than that thanks to the soon to be gone anniversary bonus. With points (previously) worth 1.33 cents towards airfare, this was like getting 2.66% back, or more, on all purchases. That’s excellent, but it will soon be gone.

I imagine that some people will also be bummed about the loss of the annual companion ticket. I’ve never used mine, so I don’t really know if I’m missing anything there.

The fact that the airfare benefit is dropping from 33% to 25% is certainly a devaluation, but it’s a very small one. For example, suppose you use points to buy a $400 flight. Before October 20th, that flight would cost you 30,000 points. On or after October 20th, it will cost 32,000 points. Not a big deal.

The new 3X and 2X benefits are nice, I guess, but I’d rather get 5X for dining with my Forward card, and 2X Ultimate Rewards points for travel with my Sapphire Preferred. So, overall, I’d say that the changes to this card are mostly negative.

My take on ThankYou Points

I believe that Chase’s Ultimate Rewards program is the single best all around flexible points program. Points are easy to earn through signup bonuses, category spend bonuses, and the Ultimate Rewards Mall. And points are easy to use: simply redeem for cash or merchandise at a value of 1 cent per point. Better yet, with a premium card (Ink Plus, Ink Bold, or Sapphire Preferred), you can redeem for travel at a value of 1.25 cents per point or transfer to airline, hotel, or Amtrak programs and sometimes get much more value.

After Ultimate Rewards, I look to American Express. They have both the Membership Rewards program and Starwood Preferred Guest (SPG) credit cards. Both offer flexible options for converting points to airline programs. And, SPG, of course, has the added bonus of being able to use points at SPG properties for free stays.

Then there’s Citi’s ThankYou Rewards program. Like Ultimate Rewards, Citi ThankYou points can be earned easily through signup bonuses, category spend bonuses, and the ThankYou shopping portal. ThankYou points also seem to be similar to Ultimate Rewards in that you can redeem them for cash or merchandise, use them to book travel, or transfer points to other loyalty programs. Where the ThankYou program suffers is in the details…

Convert points to cash: Sure, you can do so, but Citi will give you only half a cent per point. You can get a full penny per point by using points to pay your mortgage or student loan, but be careful when doing so. In May, Citi shut down many people’s accounts, and a common factor among most of them was that they had recently requested mortgage or student loan checks. Many people have reverted, instead, to cashing out by redeeming for gift cards at a value of 1 cent per point.

Book travel: With a premium card, such as the Citi ThankYou Premier, you can book airfare for 1.25 cents value per point (previously, 1.33 cents per point). Unlike the Ultimate Rewards program, though, the extra value only applies to airfare, not other travel booked through the ThankYou program. Still, it’s a pretty solid offering, and probably the best part of the ThankYou rewards program.

Convert points to loyalty programs: Let’s look at the vast array of transfer partners available to ThankYou point participants:

Yep, Hilton is the one and only current transfer partner. For each ThankYou point you exchange, you get 1.5 Hilton points. I value Hilton points at about .4 cents each, so this is like getting .6 cents value from each ThankYou point. No thank you.

In 2012 there was wide speculation that Citi was going to allow transfers to Singapore airlines and British Airways. Both would have been great additions to the ThankYou program, but neither materialized.

One great feature

One great feature of the Citi ThankYou program is that they allow free transfers of points to other people. Unlike Chase, Citi does not require that you transfer only to a spouse or significant other. This is great because it means that almost anyone can get 1.25 cents per point value towards airfare. The Citi ThankYou Premier card (which gives you access to the 1.25 cents per point airfare redemptions) costs a hefty $125 per year, but you may not have to pay it. Simply transfer points to a friend with a ThankYou Premier card and ask them to book flights for you. The downside of this (besides owing your friend lots of favors) is that transferred points expire in 90 days. So, don’t transfer points until you are 100% sure they’ll be used right away.

A program worth pursuing

Sure, I’d rather have Ultimate Rewards, Membership Rewards, or SPG points, but if I can acquire ThankYou points cheaply (or freely), I’ll happily take them. I often use my ThankYou points to book domestic flights (and, unlike using airline miles to book flights, I earn airline miles when flying this way). Sure, it’s a bummer that Citi has reduced the value of points redeemed for flights from 1.33 cents to 1.25 cents per point, but that isn’t really a huge difference.

Related posts

- Citibank Stork delivers news

- Converting ThankYou points to airline miles

- Eating your way to Kauai. Which card is best?

- What to do with your ThankYou card

- ThankYou!

Phil: the 15% discount is for paid flights not for flights where you redeem points. So, you can get one or the other: 1.33 cents per point or 15% off a paid fare

@Nic

when you talk about the 15% discount, are you talking about the 1.33x redemption rate of TYP for airline tickets? or, is this ON TOP of the 1.33x redemption rate, as long as you found the cheapest fare?

if so, WOW.. i missed out on this card big time. also, could you use the companion pass on tickets you paid for with TYP? for example, stack the 15% discount on top of the 1.33x redemption then get the companion ticket? and with multiple AU, am i right in assuming you could do this in pairs of tickets?

sorry bout all the questions, but you piqued my interest!

It would be nice and appropriate if Citi-TY signed with AA as a transfer partner on a 1:1 basis.

@D

Right, I’m saying I want to use the TYPs to pay off real loans, I’m just interested in buying TYP at a discount and am surprised there isn’t a more active market for paying off mortgages and student loans at a discount since TYPs aren’t that great otherwise.

Is there a business card version of this card?

MSPDeltaDude: There is a business ThankYou card, but it is not similar to this Premier card (other than earning ThankYou points).

.

Max: Agreed!

if you have bank relationship with Citi, you will earn some thank you points. got average 1,500 thank you points every month,18K per year, with routine bank activities. how much $$$ do you need to make monthly $15 interest in today’s CD/saving account? these points and credit card points can be combined.

[…] Citi ThankYou Premier Card Removes Flight Points, Changes Other Benefits […]

@Nick Reyes

Yes, the companion ticket was good. Well, you can still use it go to thankyoucompanion.com. You pay for the first ticket and the taxes on the second. There a few instances were it price slightly above anywhere else, probably unperceived to the naked eye. In those cases a call will get you a refund.

I have this card and never realized that it had a companion ticket benefit. Was it any good, or was it one of those deals where there’s an inflated price for the ticket you have to pay for?

@Ford – The mortgage checks are made out to the financial institution. If, perhaps, one had a checking account at that bank, deposits have been know to happen.

Still using the preferred card that earns 5X at drugstores to purchase Vanilla Reload, 3.95 fee gives me 25 dollars of airfare. The 6X leverage is still attractive especially when it comes to Mileage Run.

I know point resellers hawk UR/MR/big airline points/miles, anyone have a lead on how to *buy* from these guys, just send a msg? We all know TYPs are kind of ok for flight redemptions and only “decent” when redeemed for student loans/mortgage where you get 1:1 on redemptions. IF I’m looking to pay off my student loans, I wonder what kind of discount I could get. 10%? 20%? I know I’d probably sell mine for 80-90% cash value.

@superflyboy

The 15% discount was on any ticket provided that was the cheapest fare on that route. So when you found an MR worthy flight, it was just sweeter to get a 15% discount on top. The discount could be use as many times as you wanted.

Then you also had the companion ticket (annual benefit) but each authorized user could also get a companion ticket. For a big family very very useful.

Wow – awesome benefit!

Miler,

Does Citi allow you to use TY points to pay your annual fee like Chase will? I know would only be 1 cpm, but considering how many I have, I would not mind paying 12,500 to keep my Premier card.

THEsocalledfan: Yes, Citi will happily let you pay your fee (or any statement balance) with points, but you’ll get only half a cent per point.

@Miles – Thanks for the clarification.

Was the 15% on the ticket for a companion only or was it for each and every flight you booked with the CC?