In October, I sent out a Quick Deal warning Amex gift card buyers that Chase was coding online Amex gift card purchases as cash advances. Apparently American Express had changed how they coded these purchases and that led Chase (and possibly other banks too) to start seeing these purchases as cash advances. This meant that buyers were charged fees for these purchases, and those fees more than wiped out the benefit of buying gift cards through cash back portals.

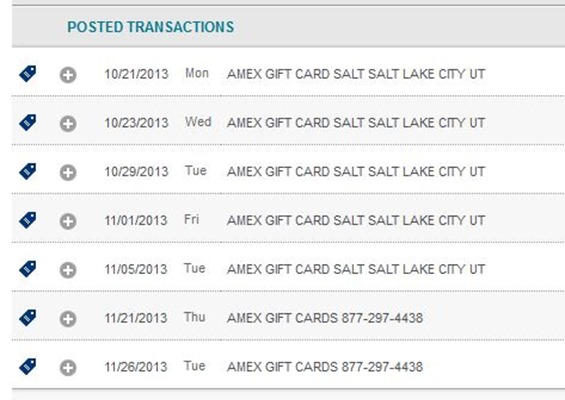

Recently, a few things happened that made me question whether Amex may have solved the problem. First, several readers recently told me that they were not charged cash advance fees when using Chase cards. Second, I noticed that when I bought Amex gift cards with my Amex cards, the coding changed a bit. Here is a screen capture showing recent gift card purchases:

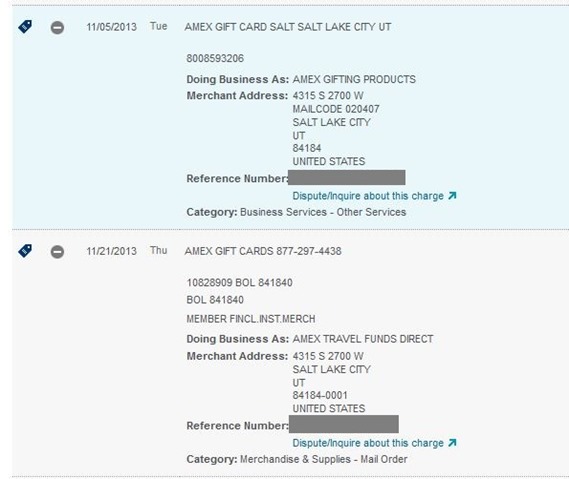

Notice, above, that earlier transactions read “AMEX GIFT CARD SALT LAKE CITY UT,” but beginning November 21 they read “AMEX GIFT CARDS 877-297-4438”. And, looking at the details, you can see that they changed “Doing Business As” from “AMEX GIFTING PRODUCTS” to “AMEX TRAVEL FUNDS DIRECT”:

Experiment

I ordered a $50 Amex gift card using my Chase Sapphire Preferred Card. My hope was that 1) It would not code a cash advance; and 2) It would code as a travel expense for double points. I had to wait until the transaction moved from pending to actual to get the full story. The results came in yesterday:

Yes, the order was coded as a regular transaction that earned points. No, it was not coded as a travel expense.

Other cards?

As of right now, I know that Chase and American Express cards seem to be safe to use to buy Amex gift cards online. What about other banks? Citi, in particular, has long been known as a bank that charges cash advance fees for these, but now I wonder if Citi cards would be safe? How about Barclays, US Bank, and others? If you have bought an Amex gift card online (via Amex’s gift card website) on or after November 21 2013, please report below which type of card you used and whether or not it was coded as a cash advance.

Warning

It’s always possible that cash advance fees will return even if they aren’t incurred right now. To protect yourself, call your bank and ask for your cash advance limit to be lowered to the minimum allowed. Then, make sure that your gift card purchases exceed that limit. That way, your purchase should be declined rather than you being charged a cash advance fee.

Amex gift card purchasing options

The reason that buying Amex gift cards online is interesting right now is that it’s possible to stack the following promotions so as to earn money on gift card purchases:

- BigCrumbs and TopCashBack are offering cash back when you start your shopping in their portals. BigCrumbs is currently offering 2% cash back, and TopCashBack is currently offering 2.25% cash back through Monday. BigCrumbs also pays the person who referred you and the person who referred that person .17% when you buy Amex gift cards. If you are new to either portal, you can find signup links for them here. Note that it can take several months for cash back earned this way to become payable back to you.

- You can use the code HOLIDAYCC4 to get the cards fee-free until 1/31/2014. Even though the cash back portals say that using codes from elsewhere will invalidate the cash back, I have not found that to be true in practice.

- When selecting a shipping option, you can choose to sign up for a free trial of their Premium Shipping Plan to get unlimited free next day shipping. You must be logged into your Amex account to sign up for this. If you make enough purchases of Amex gift cards it may even be worth paying the $99 annual fee for this option.

Things you can’t do with Amex gift cards

Please don’t try the following. They won’t work:

- You cannot use Amex gift cards to withdraw money from an ATM.

- You cannot use Amex gift cards (or any Amex cards) as debit cards.

- You cannot use Amex gift cards to load Bluebird or Serve.

Related posts

- How to spend down Amex gift cards

- Amex gift cards 2.25% cash back via TopCashBack

- Chase coding Amex gift card purchases as cash advances

- Learning Amex gift card rules the hard way

![[Back] Costco offering 10% off Southwest gift cards again Southwest-Gift-Card](https://frequentmiler.com/wp-content/uploads/2023/12/Southwest-Gift-Card-218x150.jpg)

[…] A: There was a brief period in 2013 when Chase charged cash advance fees for Amex gift cards, but that has been fixed. Please see this post for more: It’s once again safe to buy Amex gift cards with your Chase card. […]

I mistakenly used my Citi AAdvantage Amex card to buy Amex gift cards online. It went through as a purchase but the statement hasn’t closed so I made a payment in full anyway. I may try this again next month too….

Ooh, excellent! I’ll have to test that out. Thanks!

citi always charges cash advance fee….however, i can confirm chase has fixed the problem….i bought $2000 on 12-27-13, and it was a purchase

and thanks for frequentmiler for writing this blog, his informative post convinced me AMEX/chase has changed the coding and i went ahead with my purchase

oh one more thing, i was charged $22 interest because i paid a bit late (past the due date but before closing date)….called up talked to a nice lady who had no problem reversing it, great bank to deal with !!

I just used my citi card and was charged an ‘advance’ fee for purchasing AMEX cards directly from there site – UGH!

i need to spend about $1200 on my citi AAdvantage card to accumulate enough points….is buying vanilla cards at CVS ok ? generally speaking is buying visa/MC/AMEX GCs at retail locations always considered purchase and not cash advance ?

Yes, when you buy gift cards at a store, you are generally safe from getting charged cash advance fees.

Barclays coding my $500 purchase as FINANCIAL INSTITUTIONS-MERCHANDISE SALES

@MichaelP, I had the same experience, first rep told me that he couldn’t lower my cash advance limit, it’s 20% thing. I called the second time and second rep told me that she could lower the limit access to my CA to $500 instead of $1000.

I did purchase the $1000 Amex GC yesterday using my Chase Ink Plus. I called Chase to make sure it’s not cash advance. The first CS told me it would be CA and advised me to cancel the order if I didn’t want to pay for finance charges. I called back Chase few minutes later and another CS told me as of now it shows as normal charges but the merchant shows as Financial Institution, so she didn’t know for sure. She said it’s too early to tell. I checked my cash advance limit and it’s $1000. So I placed the second order Amex GX for $25 and it went thru. So I think it will be approved as charge, not cash advance?

FYI,

I called Chase to lower the cash advance limit on my Hyatt card, rep said it’s tied to the credit limit, 20% of the credit limit is the cash advance limit.

i have chase sapphhire preferred, i called to cancel my cash advance, first person said it’s 20% of my credit limit, but transferred me to a specialist (guess somebody who has higher authority) who cancelled my cash advance altogether effectively to zero

Quick question about the $500 limit for Topcashback: is that really enforced and is it $500 per day or $500 per gift card (i.e., buying 10 $500 cards will be eligible for cash back on the full $5,000).

I would like to know the answer to the question @luchex asked as well? What are the limits for amex gift card purchases?

The limits are unclear to me. See this post: https://frequentmiler.com/2013/04/16/learning-amex-gift-card-rules-the-hard-way/

Is there a daily limit as to how much you can buy?

FM , do you have a better way than Target AMEX to unload these GC?

I ordered 2 2500 Biz GC. Even though I deleted the discount code I still didn’t get charged, only the 5k of the GC.

They seem to be waiving fees this weekend even without the code. Another way to unload these is with Google Wallet. Costs 2.95 fee, but much of that is recovered with 2% (or more) cash back

I’m not familiar with google wallet I’ll read about it. The little I kno is that I can send money just like Amazon Payments. Do they have any billpay feature? I’ll read about it. If you know a feature other than sending money please let me know.

You mean 2.9% charge, right? $2.95 would be amazing for a several thousand dollar transaction.

Oops, yes 2.9% not 2.95 fee. darn percent sign is on the 5 key. Must not have pressed the shift key just right

GW has proven difficult due to fraud prevention issues and lingering (sometimes multiple) temp auth charges and also limits on the sizes of transactions. For the meager upside, hardly worthwhile.

No one has said anything about USAirways mastercard. I bought Amex gift card worth 3k through Bigcrumbs and ironically my cash advance limit is 3k. This transaction has been pending as AMEX GIFTING PRODUCTS for the last 3 days. Today i called to set my limit to 0 but CSR said NO. That will not be possible. Then I requested him to check my pending charge and see if that will be approved as cash advance or charge and he confirmed as CHARGE. So for the time being I am relieved but I will have to wait until it is approved.

Did you try lowering your CA limit rather than setting it to zero?

Just tried to purchase Amex GC using US Bank Club Carlson Business card – purchase was declined due to exceeding cash advance limit, so US Bank is still treating these as cash advances.

Mike, thanks for that data point. I’m surprised by that finding.

I’ve continue to attempt buying Amex GCs with my Club Carlson Business card both today and last Monday but these purchases are still being declined by US Bank. I called them today and they confirmed that the purchases are still coming to them as cash advances, and thus being declined as there is a 0 cash advance limit on my account. Apparently, Amex’s fix to this issue was not universal. Any suggestions as to how to move Amex to fix this for US Bank, as I am very disappointed being unable to generate Club Carlson points this way.

Thanks for digging into this and sharing.

I assume if it went as a purchase you also received points?

I saw someone cleverly used Bold which has no cash advance capability, so no fee but also no points.

A month dip after CGC ended left a hole. This game is actually better because all the banks can play, higher limit and it is a MM, or that can go towards absorbing more MS fees elsewhere (5X).

Yes, I received points. You can see in the image in my post that 50 points were awarded for the $50 purchase