I’ll be on vacation until January 6th. Until then, I’ll publish a series of “mini posts” with an occasional regular post if something interesting comes up. I may or may not answer blog comments or emails during this time. Thanks for understanding!

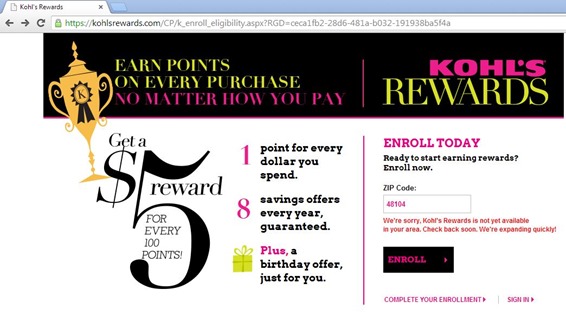

Kohl’s is rolling out a new rewards program called Kohl’s Rewards. So far, it’s available only in limited areas. A few readers have told me that they have access to Kohl’s Rewards in the California Bay Area. In Ann Arbor, Michigan, I get nothing:

The basic structure of this program is that you earn 1 point per dollar and each point is worth 5 cents towards an award certificate. So, this is like getting 5% back in the form of these certificates. My guess is that these certificates will work like Kohl’s Cash. If so, they’re actually worth less than their face value (since you can’t apply coupon discounts to the part of an order where these are applied). So, let’s call this a 2.5% rebate rather than a 5% rebate. That’s still pretty good considering the many ways to save money and earn points when shopping at Kohls.

Click here to see other recent Frequent Miler posts about Kohl’s.

Wrote small details on how I use kohls reward http://theflyermilerpost.blogspot.com/2014/01/kohls-reward-and-how-to-maximize-kohls.html?m=1

FM thanks for getting back to me so quick.

This article had a good summation of my concerns about the subject: http://money.usnews.com/money/blogs/my-money/2013/02/04/are-credit-card-cashback-rewards-and-airline-miles-taxable

Excerpt from the article:

However, there may be situations where the IRS could see cashback rewards as income, says Kehoe. For example, if an employee was using their personal credit card to make business-related purchases and then was reimbursed by their employer —while earning rewards points or cash on their purchases—the IRS could see this as an abuse of the system if the individual was “earning” cash for tax avoidance purposes.

Kehoe says the IRS looks for abusive patterns when it comes to reporting income and business-related expenses. If you’re a small business owner or are self-employed and are using a cashback credit rewards card to pay for inventory or business-related expenses, you will need to make sure you are reporting the reduction in your purchase price because of any cashback received. Not doing so may be a potential abuse of the system.

Thanks Nick

Hi there,

I have been manufacturing spend by buying and selling products I purchased through online vendors. However I have a few tax related questions I am perplexed with.

1) If you buy a product from lets say gap for $100 for reselling and receive gap cash of $10, and you then in turn use that $10 to buy more products. You now have $110 worth of products that you purchased for $100, is that $10 rebate taxable? or would you have to factor that $10 rebate as a reduction of your overal costs? If I in turn sold the $110 worth of items for $150, would that be considered a $40 profit? or a $50 profit?

2) If I made 100,000 UR points from buying items for resell, are those points considered a reduction of the cost to acquire the inventory for sale?

Assuming 1 UR point is 1 cent, and 100,000 UR points would be worth $1000. If I bought $10000 (my costs) worth of items and received 100,000 UR points in the process, then in turn sold the items for $15000 (net revenue) netting me a gross profit of $5000.

Would my profit be $5000 or $6000? Would the IRS consider those 100,000 points a reduction of my cost to acquire the items?

3) how would the IRS quantify the value of the points if I used them for travel instead of cashing the points out for cash?

Great questions! First let me say that I’m not qualified to answer tax questions so take anything I say in that context:

1. Technically, your out of pocket costs were $100, so you have $50 profit.

2. Just as you wouldn’t include credit card rewards in your tax calculations, I believe that you wouldn’t have to include portal rewards either

3. See answer 2

I’m in NY and have had it for months. On your receipt the reward dollars actually show up as Kohl’s Cash when redeemed.

Payment Type(s):

kohls Cash

8386

Amount Charged: $25.00

Is there anything preventing anyone from signing up for this with a fake address? If you only shop kohls.com and get the rewards by email, who cares what your location is. Right?

Just to follow up, I was able to register for a rewards account using zip code 90210. After I was registered, I went into my account and changed my information back to my real address and it updated successfully. I got a 100 point bonus for signing up. Obviously I won’t be able to earn/ redeem rewards in my local store, but should be able to online which is my main way of shopping at kohls anyway.

You can earn points in store if you were sent a card even if your store is not participating. I had a card a year before my store started and got plenty of points. I had heard about program online and called customer service and they added me even though it had not reached our region yet. The programs great and is worth asking customer service especially if you are a Kohls card holder.

Great tip. Thanks!

Can I ask the people who’ve had this for awhile – what happens if you return some of the original merchandise that generated the Kohl’s Rewards, after you already spent the reward? Do they take money out of your return, the way they’d I with Kohl’s Cash?

They do not reduce the price like Kohls Cash. It will deduct points of a return from kohls rewards program so you may be in negative points until you buy next item.

Cool… looking forward to the nationwide rollout

Has been around in TX since june, well thats when I signed up for it, I did mention on one of your post once, its amazing, you can double dip, u can get kohls cash and reward at the same time, it works best when u use the 2nd 30% of the month promotion to generate miles. Because the reward point works on monthly basis, ie whatever reward u earn in a month dont come in as a kohls cash until 2nd of next mo, and they dont expire till end of the month. U can use kohls cash and reward to buy item for free. The reward point dont get awarded until the item ships the weare house, so dont buy item after 25th, in case they ship the item on the 1st, then u end up waiting 30 extra days to use that.

I’ve had it for a year in AZ…and they do work exactly like Kohl’s Cash.

This has been around since May in CA……..