American Express is introducing two new credit cards to their lineup: Amex EveryDay, Amex EveryDay Preferred. The EveryDay card has no annual fee. The EveryDay Preferred will cost $95 per year. My understanding is that these cards will be available starting April 2, 2014

Membership Rewards

Both cards earn Membership Rewards points that can be transferred to airline miles…

AeroMexico, Aeroplan, Air France KLM, Alitalia, All Nippon Airways, Asia Miles, British Airways, Delta Air Lines, EL AL Israel Airlines, Emirates, Frontier Airlines, Hawaiian Airlines, Iberia, JetBlue Airways®, Singapore Airlines, Virgin America, Virgin Atlantic Airways

Or to hotel programs (but, in my opinion, the hotel transfers tend not to be a good value)…

Best Western International, Inc., Choice Privileges®, Hilton HHonors®, Starwood Preferred Guest

EveryDay Category Bonuses

Both of the new cards offer category bonuses as follows:

Amex EveryDay: 2X at U.S. Supermarkets, up to $6K spend per year (then the rate drops to 1X); and 1X everywhere else.

Amex EveryDay Preferred: 3X at U.S. grocery stores, up to $6K spend per year (then the rate drops to 1X); 2X at US standalone gas stations; and 1X everywhere else.

EveryDay Spending Bonuses

The most unique aspect to these new cards is that cardholders can earn bonuses by using their cards frequently. The two cards offer the following spend bonuses:

Amex EveryDay: Earn a 20% bonus on points earned when you use the card to make 20 or more purchases each billing period.

Amex EveryDay Preferred: Earn a 50% bonus on points earned when you use the card to make 30 or more purchases each billing period.

Combined Bonuses

For those who successfully earn spending bonuses each billing cycle, the category bonuses and spending bonuses will add up to the following maximum earning potential:

Amex EveryDay: 2.4X at U.S. Supermarkets, up to $6K spend per year (then the rate drops to 1.2X); and 1.2X everywhere else.

Amex EveryDay Preferred: 4.5X at U.S. grocery stores, up to $6K spend per year (then the rate drops to 1.5X); 3X at US standalone gas stations; and 1.5X everywhere else.

Analysis 1: Rewards for merchandise or cash back

In my opinion, if you want to use rewards to buy stuff or to get cash back, you can do better with other cards. In fact, let’s look no further than Amex’s own very similar Blue Cash cards:

Blue Cash EveryDay: No annual fee; 3% cash back at US supermarkets (up to $6k spend per year, then 1%); 2% cash back at US gas stations and select department stores; 1% everywhere else.

Blue Cash Preferred: $75 $95 annual fee; 6% cash back at US supermarkets (up to $6k spend per year, then 1%); 3% cash back at US gas stations and select department stores; 1% everywhere else.

With Membership Rewards points, it is possible to get up to 1 cent in value per point when redeeming for stuff (and sometimes more during promotions), but in general you’re better off with cash, in my opinion. However, let’s assume that each Membership Reward point is worth 1 cent each when redeemed for stuff (not airline miles) so that we can compare the cards…

No fee cards:

|

Amex EveryDay |

Blue Cash EveryDay |

|

| Annual Fee | $0 | $0 |

| Max Grocery store earnings | 2.4X (2.4%) | 3% |

| Max gas station earnings | 1.2X (1.2%) | 2% |

| Max department store earnings | 1.2X (1.2%) | 2% |

| Max everywhere else | 1.2X (1.2%) | 1% |

As you can see above, the no fee Blue Cash EveryDay beats the new Amex EveryDay card in all categories except “everywhere else”. And, there are many good options to earn more than 1.2% cash back on all purchases with no annual fee if you’re willing to add a second card to your wallet. Winner: Blue Cash EveryDay.

Fee cards:

|

Amex EveryDay Preferred |

Blue Cash Preferred |

|

| Annual Fee | $95 | |

| Max Grocery store earnings | 4.5X (4.5%) | 6% |

| Max gas station earnings | 3X (3%) | 3% |

| Max department store earnings | 1.5X (1.5%) | 3% |

| Max everywhere else | 1.5X (1.5%) | 1% |

Again, the Blue Cash Preferred card beats or equals the new Amex EveryDay Preferred card in all categories except “everywhere else”. And, there are good options to earn 1.5% cash back or more on all purchases (with or without an annual fee) if you’re willing to add a second card to your wallet. For examples, please see “Best rewards for everyday spend”. Winner: Blue Cash Preferred.

In my opinion, if you want to use rewards for stuff, look elsewhere. However, if you want to earn airline miles, I think you’ll find these cards appealing…

Analysis 2: Rewards for Airline Miles

Many miles and points enthusiasts prefer earning miles over cash back because it is then sometimes possible to get outsized value from your rewards. For an extreme example, consider that last year I flew Singapore Airlines Suites class in exchange for about 71,000 miles (transferred from Membership Rewards points) and less than $300 in fees. That same flight would have cost about $11,000 had I paid cash. If it were possible for me to redeem 71,000 Membership Rewards points for 71,000 pennies instead, I would have received only $710. Similarly, at the other extreme, it’s sometimes possible to get outsized value with economy flights. For example, several times I’ve transferred Membership Rewards points to British Airways and used those points to fly between Detroit and New York City on American Airlines for only 4500 points each way. Those same flights would have cost over $300 each way had I paid cash, so I arguably got about 7 cents per point value from those trips.

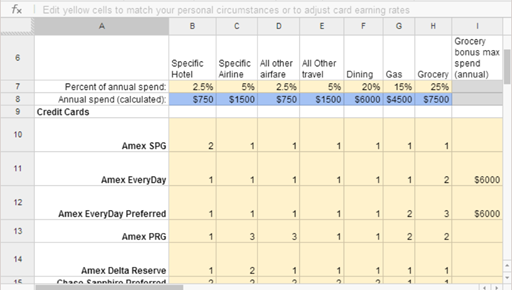

So, if you’re committed to earning airline miles, let’s look at how these new cards compare to popular alternatives. Note, though, that bonus categories with alternative cards do not line up as nicely as in my cash analysis above. So, let’s make some wild assumptions so that we can compare mile earnings across credit cards:

Assumption 1) The credit card holder will spend exactly $30K annually on the card in question.

Assumption 2) The credit card holder’s spend will be in the following categories:

- 15% Travel (2.5% with favorite hotel brand; 5% with favorite airline; 2.5% with other airlines; and 5% all other travel)

- 20% Dining

- 15% Gas

- 25% Grocery

- 5% other targeted categories (e.g. 5% cable/internet/phone/office-supply when analyzing Chase Ink cards)

- 20% non-bonus spend

Given those assumptions, here are the expected miles per dollar earnings from various credit cards:

|

Card |

Annual Fee |

Estimated Miles Per Dollar |

Notes |

| Amex EveryDay Preferred | $95 | 2.33 | 30 or more purchases per billing cycle |

| Amex Premier Rewards Gold* | $175* | 1.55 | Assumes all airline spend is directly with airlines, not through online travel agencies. No credit given for very specific computer supplies category. |

| Chase United MileagePlus Club Card | $395 | 1.58 | |

| Deta Reserve | $450 | 1.55 | Contingent upon earning 15,000 bonus points with exactly $30K spend. |

| Amex EveryDay | $0 | 1.44 | 20 or more purchases per billing cycle |

| Chase Sapphire Preferred | $95 | 1.44 | Includes 7% annual dividend |

| Chase Ink Plus | $95 | 1.4 | Assumes half of “all other travel” is with hotels |

| Chase United MileagePlus Visa | $95 |

1.38 | Earn 10,000 bonus points at the $25K spend mark |

| Chase Freedom | $0 |

1.32 | Assumes 5% of annual spend is in rotating 5X categories. Assumes 10% annual bonus with Chase checking account. |

| Starwood Preferred Guest (SPG) | $65 | 1.28 | Assumes points are transferred to miles 20K at a time (which results in 5K bonus) |

* The annual fee and category bonuses for the Premier Rewards Gold card have changed since this analysis was written. The card now has a $195 annual fee and they’ve added the following: 2X points at US restaurants; $100 Airline Fee Credit. Up to $100 a year for incidental fees with your selected airline. Terms and limitations apply.

As you can see above, given our credit card spend assumptions, the new Amex EveryDay Preferred card with up to 2.33 miles per dollar earnings beats the pants off almost all other cards in the roundup (when the goal is to earn airline miles).

Of the no fee cards, the new Amex EveryDay slightly edges out the Chase Freedom card with 1.44 vs. 1.32 miles per dollar earnings, respectively. Note that with the Freedom card, you or your significant other must have a premium card (Ink Plus, Ink Bold, Sapphire Preferred) to transfer points to airline miles. Of course, there’s no harm in having both no-fee cards. That way, you can concentrate spend within category bonuses in order to average quite a bit more.

I find it interesting to see the SPG card at the bottom of the list. It has long been celebrated as one of the best cards for earning airline miles: it offers a huge array of airline transfer partners and it offers a 5K bonus when transferring 20,000 points. However, unlike Amex Membership Rewards and Chase Ultimate Rewards, transfers can take up to a week to process. And, as you can see above, the earning power of the SPG card pales in comparison to many other cards. Even for spend outside of category bonuses, the SPG card earns less than the Amex EveryDay Preferred (1.25 vs. 1.5) and barely more than the no fee Amex EveryDay card (1.25 vs. 1.2).

If you would like to check my work, try different spend percentages, or model other credit cards, feel free to make a copy of this Google Docs Spreadsheet (you must make a copy if you want to edit cells):

Conclusion

If the requirement to use your card 20 or 30 times per billing cycle doesn’t disturb you, and if you’re primarily interested in earning airline miles rather than cash back, I think you’ll find these new EveryDay cards to be fantastic additions to your wallet. In particular, the EveryDay Preferred card has fantastic earning potential even with the $6K per year spend cap on the grocery category bonus.

I’ll have a lot more to say about these interesting new cards in the coming days and weeks, so please stay tuned.

[…] cards included. The Amex EveryDay cards that were introduced in 2014 offer really good points per dollar earning potential. The addition […]

[…] all daily spend. And, as I showed recently, their new cards do a pretty good job of that (see “Amex’s powerful new EveryDay cards”). However, if you’re willing to juggle a few cards, you can do better, even with no-annual […]

[…] Full details can be found here: Amex’s powerful new EveryDay cards. […]

[…] points per dollar on all spend by making sure to use their card 30 times each billing cycle. And, they’ll earn even more points with purchases at gas stations and grocery stores. And, of course, Chase Freedom Unlimited cardholders can earn 1.5 Ultimate Rewards points […]

[…] offer any more value. And, even if you don’t have the option to get those Chase cards, the Amex EveryDay Preferred card offers equally good point earnings, by itself, as long as you use the card 30 or more times per […]

[…] for example, earns just 1 Membership Rewards point per dollar in any category. Meanwhile, their $95 Everyday Preferred card earns up to 3 points per dollar for gas and up to 4.5 points per dollar …. In other words, Amex rewards Everyday Preferred customers for using the card whereas Amex […]

[…] points card that offers 1.5X points per dollar. That is the Amex EveryDay Preferred card (see: Amex’s powerful new EveryDay cards). The EveryDay Preferred card offers 3X points at US supermarkets on up to $6,000 per year in […]

I know I’m way late to this conversation, but assuming you hit 30 transactions/mo, the EDP gets more SPG points at grocery stores than the SPG card. You earn 4.5 MR per $1 at grocery stores which transfers to 1.5 SPG points vs 1 SPG point with SPG Amex.

Something to consider based on your spend if you are currently using SPG Amex…

Good point! Keep in mind the $6500 grocery spend cap though

[…] This card offers 2 miles per dollar for Delta purchases and 1 mile per dollar everywhere else. Unlike the Platinum and Reserve Delta cards, there is no bonus for high spend. Overall, in my opinion, you would do much better putting your daily spend on cards that offer better returns. For example, please see “Amex’s powerful new EveryDay cards.” […]

[…] requirement for EveryDay cards: I’m a fan of the Amex EveryDay and EveryDay Preferred cards (see why here). The EveryDay card offers a 20% bonus on all points earned when you make at least 20 purchases […]

[…] If you like the idea of cash back, don’t even think about this card. If you like the idea of racking up airline miles so that you can fly around the world in business or first class, then this may be your best bet. First the negatives: foreign transaction fees, $95 annual fee, and to maximize rewards you need to make sure to use the card 30 times each billing cycle. On the plus side, the card offers decent category bonuses (3X grocery, up to $6K per year; and 2X gas) plus it offers a 50% bonus in every billing cycle in which you make 30 or more purchases. This means that the card’s maximum points per dollar earnings are: 4.5X grocery, 3X gas, and 1.5X everywhere else. When I estimated (in this spreadsheet) how a regular person might use their card, I calculated an average earning rate of 2.33 points per dollar. For a card that offers a large selection of airline transfer partners, 2.33 points per dollar is ridiculously good. I recommend making a copy of this spreadsheet and entering your own assumptions about how much you spend overall and in each category to see how many points per dollar you’ll likely earn. See also: Amex’s powerful new EveryDay cards. […]

So if I’m reading this right (and can’t find the answer on the AMEX website) – the $6k cap is for grocery stores only. But if I intend to use this card for MS purposes (and get to 30 transactions per month) – then I can get 1.5 unlimited points? That makes it better than my United Club card for MS!

That’s correct

Wondering if this is better card compared to Capital One Venture card or Chase BA VISA card…

Also as several others indicated, whats best for singles? Where their monthly expenses don’t really cross 1000$.

With low monthly expenses, the card you choose won’t matter too much. I’d recommend going for a no fee card. The no fee Everyday card is a good choice. Other good options include:

1. Chase Freedom (5X rotating categories)

2. Discover It (5X rotating categories)

3. Fidelity Amex (2% cash back everywhere)

Which one is best depends upon what type of rewards you like best. The EveryDay card is the only no-fee card that has points that transfer to airline miles. If you prefer cash, go with one of the others.

FM-I’m still looking for bonus opportunities but I’m dusting off my Fidelity Investment Rewards AMEX that returns 2% cash everywhere. A cent is worth more than a cent/point.

Hi FrequentMiler,

This is some what related but do you know the credit card with pretty good benefits but you had to be a California resident? I remember it had some 3% back from a credit union. The reason I am asking is because I just moved to California.

Thanks in advance.

Yep, I believe you’re thinking of JCB’s Marukai card