UPDATE 11:30 am EST: ShopAtHome dropped their cash back rate for Staples from 7% to only 3%. Ugh.

Bad blogging

In general, the mechanics of blogging are quite easy. I use a blog editor called Windows Live Writer. I write a post. I add a category and some tags and then set the scheduled post date and time. Then I press “Publish”. Done. Usually. Somehow I messed up twice in two days.

On Sunday, I was working on my improved “Best credit card offers” page and tried to make a backup of the old page. So, I opened a new Live Writer window, pasted in the contents of the old Best Offers page, titled it “Best offers old style” and pressed publish. Here’s the thing: that would have been fine if I had opened a new “Page” window, but I had instead opened a new “Post” window. They look almost identical, but when I publish a Post it gets broadcast to the world through Tweets, Facebook posts, Google+, etc. Oops. I meant to publish a Page (which doesn’t broadcast anywhere) rather than a Post. I edited the post with an apology and that resulted in my shortest blog post ever: “Best offers old style”.

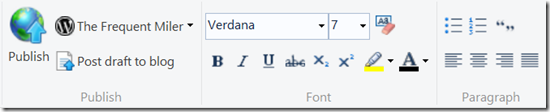

On Monday, I screwed up again. I started writing a post to introduce my new Best Offers page. While the blog editor is roughly WYSIWYG (What you see is what you get), it’s far from perfect. So, as I worked on my post, I occasionally clicked “Post draft to blog.” That way I could see how it looked for real in my browser. Then, when I was nearly done, I accidentally pressed “Publish” instead. Boom. My post was broadcast everywhere before it was done. I quickly made my final edits, so no harm was done. However, I had intended for that post (Better Best Offers) to go out today (Tuesday), not on Monday morning. The problem with posting it on Monday morning was that it may have hidden my originally scheduled post from many readers. If you missed it, you can find it here: #milemadness week 3: the pace slows, and we set our sights on Charlotte.

Better than 5X mortgage or loan payments

Lately I’ve been using ShopDiscover and/or uPromise for 5% cash back when shopping at Staples.com. On Friday, readers let me know that ShopAtHome has been offering 7%. That sounds good to me! One downside of ShopAtHome is that you have to accrue $20 or more to get a check. One alternative is to submit a Highest Cashback Guarantee Claim with TopCashBack. Anyway, a reader named Wes sent me a picture where he was credited with $14.96 cash back from ShopAtHome from the purchase of two $100 Visa gift cards at Staples.com (purchase total was $213.90 due to card fees). I’m thinking that this will be an awesome way to pay my mortgage. I’ll buy Visa gift cards with my wife’s new Ink Plus card which is registered with Visa Savings Edge, and then I’ll use Evolve Money to pay my mortgage. Here’s how the math works out for every $200 of payments:

- Charged to Ink Plus: $213.90

- Points earned: 214 x 5 = 1070

- Visa Savings Edge 1% rebate: ($2.14)

- Portal 7% rebate: ($14.96)

- Total cost: $196.80

If I scale up the above to $2000, then:

- Charged to Ink Plus: $2139

- Points earned: 2140 x 5 = 10,700

- Visa Savings Edge 1% rebate: ($21.40)

- Portal 7% rebate: ($149.60)

- Total cost: $1968

To make a $2000 mortgage payment (this is just an example, not my real payment amount), I would save $32 and earn almost 11,000 Ultimate Rewards points. Plus, it will make a huge dent in the $5K minimum spend required for the Ink Plus 50K signup bonus. Sweet!

UPDATE: ShopAtHome has now dropped their cash back rate for Staples to 3%. So, let’s look at the math based on 5% cash back (from uPromise or ShopDiscover):

- Charged to Ink Plus: $2139

- Points earned: 2140 x 5 = 10,700

- Visa Savings Edge 1% rebate: ($21.40)

- Portal

7%5% rebate:($149.60)($106.95) - Total cost: $2010.65 for $2K worth of loan payments

- Cost per point: $10.65 / 10,700 = about 1/10th of a cent per point

Still a good deal, but not a money maker as before.

![[Live] More easy rewards: Staples fee-free $200 Mastercard gift cards a card with a silver and gold ribbon](https://frequentmiler.com/wp-content/uploads/2019/03/Staples-fee-free-Mastercard-3-19.jpg)

[…] Evolve Money. I’m not sure where I first read about Evolve online, but it was a recent post by the Frequent Miler that nudged me that final inch to try it for …read […]

[…] Evolve Money. I’m not sure where I first read about Evolve online, but it was a recent post by the Frequent Miler that nudged me that final inch to try it for myself. It sounded like an easy way to earn more […]

Yeah I purchased through Shopathome, and now they’re only giving me 3%, though I went through at 7%. Trying to resolve now…

Sent an email via “missing cashback” link or whatever it was called. Next day received a reply that they were sorry for the mistake and the cashback was adjusted. Looked today and they’ve added an additional 4%. Problem solved, (now just have to wait til the 5/31/14 payout date).

This is an update. When I put my order, it was 7%, but I only received 3%.

shopathome drop down to 3% cashback for Staples

Do you have suggestion for how many $100 visa gift card I can buy from staples.com per transaction and per month? I have enough load and Ink credit limit. Just want to make sure it will be fine for Staples and uPromise. Thanks!

Has anyone ever checked if the 5% on ink applies to card fees? I know for a fact that the old Blue Cash Amex only gives 5% on the gift card itself. ie: Buy $500 VR for $503.95, only get $25 back.

BAD BLOGGING! You could fall outa bed, hit your head and outblog all of your peers………..free 5X…….so why not just do ALL your everyday spend on these 5X visa cards………?? BTW nice Rave you’ve created in Charlotte……..

Regarding uPromise cash back, will you get a check for your rebate, or you have to transfer the cash back to an 529 account? I have never used uPromise, I am kind of confused. Thanks!

You can request a check to be sent to you.

Can you use Chase ink plus at shopDiscover to get cashback? It says that Discover card needs to used to get cashback?(for office depot and staples…) Thanks always for good information.

Yes, but Discover won’t help you if the transaction doesn’t track correctly

I placed an order for 2 X $100 GC this mourning when it was 7%. Hope i get it for that. Sucks that it changed already but i appretiate the heads up. Ive been consistently buying GCs using uPromise and getting 5% back without a problem. When i used ShopDiscover i was finding it was 50/50 weather it worked. Thanks again. 5% portals and savingsedge is still the best consistant way ive seen to get UR points from staples.com.

At shopdiscover page:

* Offer not valid on gift certificate purchases

* Must … and use your Discover Card for each transaction

anyone had success here?

Use ShopDiscover to buy VGCs at Staples.com, but use Ink card?

ShopDiscover does not require one to use Discover Card?

Is there any equivalent to Visa Savings Edge with Discover Cards?

Yes, ShopDiscover usually pays cash rewards regardless of how you pay (as long as you click through from the ShopDiscover site when shopping). The problem is if the purchase doesn’t track correctly, Discover won’t help you. No, I’m not aware of a Discover version of visa savings edge, but do keep an eye on “discover extras”

Well, upromise is 5.5% if you deposit the refund to your sallie mae bank account. You get an extra 10% at the end of the year.

True

I ordered this morning after reading your post. It was 7%, now it is 3%. I am wondering what I am going to get.

This is really interesting.

You definitely should get 7%, but it might be a challenge collecting if it doesn’t happen automatically!