The best way to fly, of course, is to redeem points and miles to travel for free. Often, though, that’s not practical. Maybe award seats are not available. Maybe your travel is work-related and expenses will be reimbursed. Maybe the price of the airfare is low enough to make redeeming miles a bad deal. Maybe you simply don’t have enough points or miles. Maybe you’re inches from the next airline elite tier and need those extra paid flight miles to push you over…

Whatever the reason, it often makes sense to pay for airfare with a credit card rather than with points. When you do, you might as well earn lots of extra points and miles along the way. The key is to use the best online shopping portal option and the best credit card…

Online Shopping Portals

Shopping portals offer a way to earn extra points or miles (or cash back) when buying things online. While most people turn to portals for buying merchandise, they can also be used to buy flights, book hotels, etc.

Currently, the best portal options I’m aware of for buying flights, is through the Chase Ultimate Rewards Mall and Barclaycard’s RewardsBoost portal (logged in with an Arrival card).

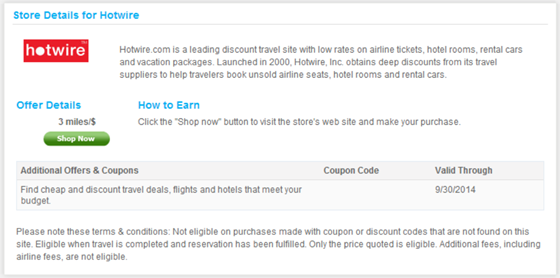

Both portals offer 3 miles per dollar for shopping at Hotwire.

Who knew that Hotwire offered airfare? Well, they do. Here is the Hotwire description that is identical in both portals (bolding is mine):

Description:

Hotwire.com is a leading discount travel site with low rates on airline tickets, hotel rooms, rental cars and vacation packages. Launched in 2000, Hotwire, Inc. obtains deep discounts from its travel suppliers to help travelers book unsold airline seats, hotel rooms and rental cars.

And, note that the terms and conditions do not exclude airfare:

Not eligible on purchases made with coupon or discount codes that are not found on this site. Eligible when travel is completed and reservation has been fulfilled. Only the price quoted is eligible. Additional fees, including airline fees, are not eligible.

To be clear, I haven’t yet tested this option and I’ve never bought airfare from Hotwire so I don’t know if there are any “gotchas” but I would be surprised if there are any major problems.

Tip: When shopping through the Chase portal, log in to your Freedom account if you have both a Chase Freedom card and a Chase checking account. This way you’ll earn an additional 10% bonus on all points earned with that account each year. So, the portal 3X becomes 3.3X. You can still pay with your Sapphire Preferred card, if you have one, to earn 2X on that card as well.

Credit Cards

Credit cards vary in the rewards they offer for travel purchases. Most airline branded credit cards offer 2X when buying flights from them, but you will not get 2X when making a purchase through an online travel agency like Hotwire. Personally, I wouldn’t give up 3X portal miles for an extra 1X from my credit card, so lets agree that airline branded cards are not the best option.

Some non-airline branded credit cards offer rewards when purchasing flights directly from airlines. Examples include the PenFed Premium Travel Rewards card that offers 5X (which is equivalent to a 4.25% rebate), and the Amex Premier Rewards Gold and Business Gold cards that offer 3X. Those are both good options when skirting portals, but you can do better…

The best credit card options when combined with a portal, in my opinion, are:

- Citi Prestige Card: Offers 3 Thank You points per dollar with airlines, hotels, and travel agencies. Thank You points are worth up to 1.6 cents per point when used towards airfare on US Airways or American Airlines. Points can also be transferred to a number of airline programs.

- JCB’s Marukai card: Offers up to 3% cash back on all purchases (1% cash back on your first $1K of purchases, 2% cash back on the next $1K of purchases, and 3% cash back thereafter each year. Earn an addition $50 bonus when you spend $5K or more yearly). Unfortunately, you must be a resident of Hawaii, California, Nevada, Oregon or Washington to get this card.

- Chase Sapphire Preferred Card: Offers 2X on all travel. Plus, if you obtained your card before 8/31/2014 you will earn a 7% dividend on all points earned for the rest of 2014 and 2015. So, this card earns 2.14X for a limited time for those who qualify.

- Barclaycard Arrival: Offers 2X on all travel. Points are worth 1.1 cents each thanks to the 10% rebate on travel rewards, so 2X is worth 2.2%.

- Barclaycard Arrival Plus: Offers 2X on all purchases

- BOA BankAmericard Privileges with Travel Rewards: Offers 2X on all purchases plus 10% bonus if you have a qualifying BOA account.

- Fidelity Investment Rewards Amex: Offers 2% cash back on all purchases.

You’ll find more good options here: Best rewards for everyday spend.

5X or more

By combining 3X portal earnings with at least 2X credit card earnings, you can consistently earn 5 points/miles per dollar, or more, when buying airfare. This is in addition to the miles earned from flying.

[…] You will also, of course, earn miles when paying for the mileage run airfare. At a minimum you will hopefully pay with a card that offers 2 miles per dollar (around 3000 miles), but there are options that are even better than that. […]

[…] The “travel agencies” part of this is intriguing since I recently wrote that the Best option when paying for flights is to go through portals to online travel agencies. As of October 19th, the Prestige card […]

In case anyone was curious, booking through Hotwire goes directly to the airline. For example, just booked a RT on USAir and my Arrival card has a $1 hold by Hotwire and an $XXX charge to USAirways. Should qualify for CC bonus categories for those using an airline branded card.

Thanks!

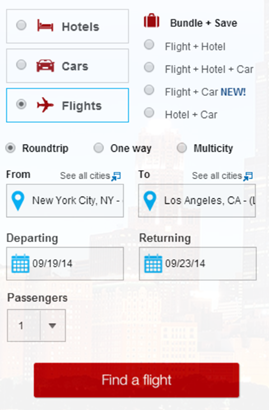

What I find odd is that Hotwire doesn’t seem to allow you to book 1-way tickets!! If I select one-way I get the following popup:

Step two:

For your trip, we’ve partnered with the best:

Orbitz

Priceline, etc

Round-trip itineraries work fine.

Anyone know why this is the case? Never seen an OTA not allow one-way bookings before…

Wow, that’s really weird. I see that too. I think the next best option may be Orbitz, but not for AA flights… sigh

Also — I have been going to the UR mall and then Expedia — Expedia has a rewards “club” as well, which means a few more percentage points for your purchase.

a Couple of things: first, the caveat about not getting miles on tickets booked on Hotwire or Priceline probably means if they were blind bids, not regularly priced tickets. Second, nobody ever mentions the fact that transferring Amex rewards points to an airline costs money, where UR points are transferred for free. This is annoying because I need Delta miles to fly people to Montana. Then of course, you get to pay again for the taxes when you actually find the ff ticket. And more yet if it’s a \last minute\ (within 3 weeks?) ticket, and then there are the baggage fees for the person flying, even though I get free bags via my gold medallion level. \Free\ is long-gone.

[…] Best options when paying for flights […]

There is also the PenFed American Express Premium travel rewards card. 5% of your flight is given to you back as points. Each point is worth 1 cent towards future travel when you book your next flight with them. You will get miles back on the rewards flight.

https://www.penfed.org/PenFed-Premium-Travel-Rewards-American-Express-Card/

I don’t have that card, but my understanding is that they devalued the program a bit such that 5X points is now worth 4.25%. That’s really good, but not as good as the options I presented here.

Upromise offers 5% cash back for hotwire as well as many other hotel and car rental sites. Plus, some companies offer an additional 5% for using the U_P. CC. If one has their Upromise contributions automatically deposited monthly into a Sallie MAe Money market, then they would receive an additional 10% bonus on the contribution.

Unfortunately, the details on the uPromise site say that you’ll earn only “$1.43 on Airfare”. Are you saying that uPromise gives 5% for airfare despite saying that the 5% rate is only for hotels? I’ve seen stranger things happen.

Just a warning: Be aware that a Delta ticket booked through Hotwire will not earn any Skymiles!

Quoted from the website:

“Mileage credit will not be given for the following: Bookings made through some Internet sites as described at those sites, including without limitation tickets purchased through priceline.com and Hotwire.com”

Thanks nomad. I do see that language on Delta’s site (here). I think it is poorly worded. I think that the part that says “as described at those site” means that you won’t earn miles even the site says you won’t earn miles.

.

I just ran a test booking on hotwire for a Delta flight and Hotwire explicitly says “EARN MILES on this flight!”

.

I could be wrong, but my take is that you will earn Delta miles unless Hotwire says otherwise.

FM, thanks for this great tip.

i tried to book flights with hotwire but it directs to expedia. Do you know if hotwire actually sells flights by itself? If not and outsourced to expedia, will I earn 3x points?

When searching for flights, uncheck the box that says “Compare with Expedia”

So, if I get the Marukai card and go through the Chase Freedom portal to Hotwire, I could get 5% cash back plus 3.3X Ultimate Reward points?

No, the Marukai card tops out at 3% cash back. So, 3% + 3.3X UR.

No, the Marukai card tops out at 3% cash back. So, 3% + 3.3X UR.

Miler,

Steve hit the nail on the head and this is usually how I buy. The 3X for Amex gold only works if bought from airline or them at amex travel. It is a solid 4x each time you do this. I do acknowledge you can get another 1X with your scheme above; might have to try that one with my Sapphire.

if you purchase your airfare through AMEX travel with PRG, you get 3x+1x.

Great suggestion. Thanks!