In my recent post, “Best options when paying for flights,” I listed a number of credit cards that offer better than usual rewards for either travel purchases or all purchases. In the comments of that post, a few readers alerted me to a new, terrific option (for some): Bank of America’s Travel Rewards card combined with Preferred Rewards. Taken together, it is possible to earn up to 2.625% on all purchases. Let’s look at the card and then the Preferred Rewards program, before looking at them together…

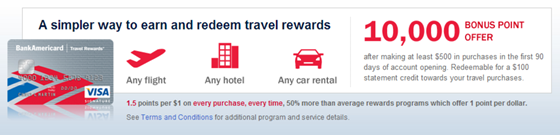

BankAmericard Travel Rewards card

For a no-annual fee card, this is actually a pretty strong option. It offers 1.5 points per dollar on all purchases. Points can be redeemed for 1 cent each towards any travel purchases (more on that later), so this can be compared to a 1.5% cash back card for those who travel frequently. That may not sound like much when comparing to a card like the Fidelity Investment Rewards card that earns 2% cash back everywhere and also has no annual fee, but the BankAmericard has the benefit of having no foreign transaction fees and chip & signature technology.

10K signup bonus

10,000 points ($100 worth of travel) is not a big signup bonus by any means, but is not bad for a no annual fee card.

10% bonus for Bank of America customers

If you are already a Bank of America customer, you’ll get an additional 10% on all points earned. That quickly makes this a 1.65% back card. Note these details: “The qualifying account must be open at the time of review, which will occur on or around December 31st of each year and the bonus will appear on your February or March monthly billing statements.” I believe this means that as long as you open a bank account before the end of the year, you’ll get the 10% bonus on all base points earned.

Double points via Bank of America Travel Center:

I’ll mention this 2X travel center benefit for completeness, but keep in mind that other portals are often more generous. Also, just FYI, only the first $6K in airline purchases per year will receive double points. All other travel center purchases are uncapped, however.

Redeem rewards for almost any travel expenses

Bank of America gives you up to 12 months after making a purchase to redeem points to pay off that purchase. The main restriction here is that rewards start at $25, so you will not be able to reimburse smaller purchases. What amazes me is the long list of purchase types that qualify. All of the usual stuff is here (airlines, lodging, car rentals, cruises, tours, etc.). Here are a few surprising ones:

- Real Estate Agents and Managers-Rentals (MCC 6513)

- Timeshares (MCC 7012)

- Tourist Attractions and Exhibits (MCC 7991, 5971)

- Amusement Parks, Carnivals, Circuses, Fortune Tellers (MCC 7996)

- Boat Leases and Boat Rentals (MCC 4457)

Here is the full list:

A travel credit will be available to redeem for purchases from the Travel Center or for qualifying travel purchases made as defined by the following merchant category codes (“MCC”): (a) Airlines, Air Carriers (MCC 3000-3299, 4511); (b) Lodging-Hotels, Motels, Resorts (MCC 3501-3999, 7011); (c) Car Rental Agencies (MCC 3351-3441, 7512, 4121); (d) Cruise Lines (MCC 4411); Travel Agencies and Tour Operators (MCC 4722, 4416, 4417); (e) Passenger Railways (MCC 4112); (f) Transportation-Suburban and Local Commuter Passenger, including Ferries (MCC 4111); (g) Bus Lines (MCC 4131, 4722); (h) Transportation Services-not elsewhere classified (MCC 4789); (i) Real Estate Agents and Managers-Rentals (MCC 6513); (j) Timeshares (MCC 7012); (k) Campgrounds and Trailer Parks (MCC 7033); (l) Motor Home and Recreational Vehicle Rental (MCC 7519); (m) Tourist Attractions and Exhibits (MCC 7991, 5971); (n) Amusement Parks, Carnivals, Circuses, Fortune Tellers (MCC 7996); (o) Aquariums, Dolphinariums, Zoos, and Seaquariums (MCC 7998); (p) Boat Leases and Boat Rentals (MCC 4457); or (q) Recreation Services-not elsewhere classified (MCC 7999). Eligible purchases will be available for redemption for a travel credit for a period of 12 months. Points can also be redeemed for cash rewards and gift cards.

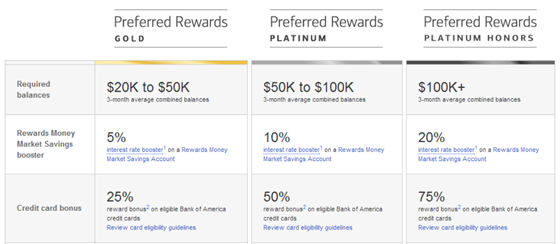

Preferred Rewards: Up to 75% bonus

Separate from any particular credit card, Bank of America recently announced their “Preferred Rewards” program (see June 23 press release here) which rewards customers for keeping large balances with Bank of America and Merrill Edge.

You can find information about the Preferred Rewards program here: bankofamerica.com/preferred-rewards. Note though that it will ask you which state you are in, and the answer may cause the page to route to the old Platinum Privileges information. I had to change my state from Michigan to California to see the updated Preferred Rewards information. I don’t yet know if that means that this program is unavailable in Michigan, not yet available, or if this is just a website fluke.

The Preferred Rewards program has three tiers with qualification as follows:

- Gold: Requires at least $20K in combined balances (averaged over 3 months)

- Platinum: Requires at least $50K in combined balances (averaged over 3 months)

- Platinum Honors: Requires at least $100K in combined balances (averaged over 3 months)

While the program offers quite a few benefits, the one of interest in this post is the credit card bonus:

- Gold: 25% reward bonus

- Platinum: 50% reward bonus

- Platinum Honors: 75% reward bonus

The reward bonuses apply to multiple (but not all) Bank of America credit cards. These bonuses are not stackable with the 10% bonus given to Bank of America customers. So, with the Travel Rewards card, the 1.5 points per dollar earnings become:

- Gold: 1.875 points per dollar (1.875%)

- Platinum: 2.25 points per dollar (2.25%)

- Platinum Honors: 2.625 points per dollar (2.625%)

Qualify once per year

You will qualify for the program or move up a tier once your 3 month average combined balances meet the tier’s requirements. You will then maintain that level for the next 12 months even if your balances no longer qualify. After 12 months, you will have a 3 month grace period to re-qualify. What this means: If you have the money, but you don’t like the idea of keeping it permanently parked with Bank of America, you could move the money in for 3 months, withdraw it, then move it back 12 months later to maintain your status.

The rich get richer

When taken together, the BankAmericard Travel Rewards card with Platinum Honors Preferred Rewards becomes an almost unbeatable combination:

- Rewards worth 2.625 percent on all spend.

- No annual fee (for the credit card, anyway — there may be fees for other banking products).

- No foreign transaction fees.

The downside, of course, is that you would need $100K invested, at least temporarily, with Bank of America and Merrill Edge.

I’ve finally completed the 3 month period to become Preferred Rewards Platinum.

Choosing travel as my 3% category on our Cash Rewards card means that my timeshare maintenance fees now earn 5.25% cash back.

I got one of the MLB cards so that I can also get 3%/5.25% for all online purchases.

This is assuming that my MF payments will code as Travel. I will report back after I’ve tested this.

Great idea to add the MLB card in order to expand your 5.25% options beyond what one Cash Rewards card offers!

[…] BOA Preferred Rewards […]

[…] rewards program for business customers that is similar to their consumer Preferred Rewards program (the program that makes it possible to earn up to 2.625% in rewards for all spend). I wrote about this program earlier today based on some inside info I had learned and a bunch of […]

[…] Via an inside source, I’ve just learned that Bank of America is planning to launch a rewards program for business customers that is similar to their consumer Preferred Rewards program (the program that makes it possible to earn up to 2.625% in rewards for all spend). […]

[…] BOA Travel Rewards: Earns 1.5% towards travel with as much as a 75% bonus for Preferred Rewards banking customers (which requires $100K in investments). If you qualify for the 75% bonus, then this card earns 2.625% back in rewards for all spend. […]

[…] card. Instead, the best comparison is to BankAmericard’s existing Travel Rewards card (which I wrote about previously, here). Let’s look at the cards side by side based on what we know […]

[…] option on the other card. Instead, the other card was changed to the no-fee Travel Rewards card, which can be a great card in its own right, but our intention is to later product change the Travel Rewards card to a second Better Balance […]

[…] When earning points or travel credits, travel means “airlines, hotels, car rental companies, taxis, limousines, passenger trains and cruise lines.” This definition of travel is broad, but not nearly as broad as defined by other cards, such as the Sapphire Reserve. For example, given this definition, you would not get 3X or travel credits for online travel agency charges, Uber/Lyft, Plastiq rent, etc. And you certainly won’t get 3X for timeshares or fortune tellers. […]

[…] upon the size of the relationship. At the high end, the card can earn 2.625% back for all spend. More details can be found here. Pair with the Fidelity Investment Rewards card and a Fidelity account in order to redeem points […]

[…] See also: Up to 2.625% back for timeshares, fortune tellers, and more. […]

[…] Overall, this card is very similar to the Bank of America Travel Rewards card. Both cards earn 1.5 “miles” per dollar. Both have no annual fee. And, both have no foreign transaction fees. Where they differ greatly is in the way consumers can do better than 1.5 miles (AKA 1.5% cash back) per dollar. For details about maximizing the BOA Travel Rewards card, please see this post. […]

[…] Under the right circumstances, this card earns up to 2.625% on all purchases when points are redeemed for travel. Please find details here. […]

You mention “For a no-annual fee card, this is actually a pretty strong option.”

Are there any other cards out there (with a fee or not) that can beat 2.625% cash back on every purchase?!

I haven’t found any yet, but I would love to be wrong :).

Yep, you could try this: https://frequentmiler.com/2014/10/10/how-to-earn-4-cash-back-on-all-spend/

So the 10k or 20k bonus whatever you get the 75% or 50% goes ontop of that when you cash the points out. So 20k signup = 350 dollars if spent towards travel.

No, the preferred rewards bonus is on top of rewards from spend, not from signup bonus points

Ah called customer service yesterday and that is what he said. But he probably had it wrong.

I got a offer for 20k bonus points for the same card. Went through BOA portal. Must be customized per person?

I expect so, yes