Last week I described how I used points from my FlexPerks Travel Rewards card to buy a one-way flight from Las Vegas to Detroit. The retail price of the flight was just over $300 in economy, or $387 in first class. Since FlexPerks charges 20,000 points for any flight up to $400, economy and first class would have cost the same number of points. Obviously, I chose first class.

Selectively choosing first class instead of economy is one way to maximize value from the FlexPerks card, but there are other options. How would you like to get two trips for the price of one, for example? I’ll get to that, but first a bit of background…

FlexPerks Travel Rewards Visa Overview

The FlexPerks card is a strange beast with a mix of good and bad aspects at every turn…

With most bank point programs, points are worth a fixed amount towards travel. Usually point values are capped at 1 cent per point towards travel or 1.25 cents per point with some premium travel cards. There are exceptions, such as the Citi Prestige card with which points are worth up to 1.6 cents each on American Airlines and US Airways flights, but most programs hold points to that 1 cent to 1.25 cent range. With the FlexPerks card, though, it is possible to get up to 2 cents per point value. For example, you can use 20,000 points to buy a $399.99 ticket. Unfortunately, it’s really difficult to reach that theoretical maximum value. A $200 ticket will cost the same 20,000 points (giving you just 1 cent per point value). And, a $401 ticket will cost 30,000 points (giving you 1.3 cent per point value). Another really sucky aspect of the card is that award costs are calculated per-person even when you book two or more people at once. So, for example, if a flight cost $199, you would think that you could get two people on one itinerary and pay a total of 20,000 points since the total cash price for two would be less than $400. Right? Unfortunately, no. FlexPerks will charge points for each person separately: that $199 flight will cost 20,000 points each, for a ridiculous total of 40,000 points.

On the plus side, the FlexPerks card also offers a $25 allowance on award flights towards “baggage fees, in-flight treats, and more.” On the negative side, you have to remember to call after the fact to get those expenses reimbursed. Ugh.

Another good aspect of the card is that it offers category bonuses. I love the fact that the card offers triple points for charity donations. But then they went and made their double point offerings needlessly complicated. In their words:

Double FlexPoints on the category you spend the most on (gas, groceries or airline) and most cell phone expenses during each billing cycle.

So, most cell phone expenses offer double points, but gas, grocery, and airline expenses offer double points only for the type of expense that you spend the most in within a billing cycle. My recommendation: use the card for only one of those three categories (gas, groceries, airlines) and only if you don’t have another card that offers better rewards for that category. I believe this card to be the best option for donations to charity and/or loans made through charitable organizations, such as Kiva (another great option is the US Bank Cash+ card with which it is possible to earn 5% cash back in this category). You can easily do better than the FlexPerks card with the cell phone category, though. For example, the Chase Ink card offers 5X not just for cell phone charges, but also for cable, internet, and even office supply purchases.

I don’t like that the FlexPerks card charges foreign transaction fees. For a travel card that carries an annual fee ($49), I think that’s inexcusable. On the other hand, if you spend $24,000 within a cardmember year they’ll give you 3,500 bonus points which can be used to waive the annual fee. So, for big spenders (or big charitable donors), this can be thought of as a no-fee card.

UPDATE: Beginning September 2014, this card will no longer have foreign transaction fees. Great!

Maximizing value

US Bank makes it easy to use FlexPoints for cash back or to buy items all at a value of 1 cent per point. To do better than 1 cent per point, you can use points to waive the annual fee (1.4 cents per point value), or to buy airfare (up to 2 cents per point value). Let’s look at ways to maximize airfare value…

First, here’s the FlexPoints award chart:

| Ticket Price Range |

FlexPoints Required |

| $0 to $400 | 20,000 |

| >$400 to $600 | 30,000 |

| >$600 to $800 | 40,000 |

| >$800 to $1000 | 50,000 |

| >$1000 to $1400 | 70,000 |

| >$1400 to $2000 | 100,000 |

| >$2000 to $3000 | 150,000 |

| >$3000 to $4500 | 225,000 |

| >$4500 to $7000 | 350,000 |

| >$7000 to $10,000 | 500,000 |

The goal is to use fewer points for greater rewards. This means buying airfare near the top of each price range. For example, ideal flight purchases are those that would otherwise cost you just under $400, just under $600, just under $800, etc.

What do you do if the flight you want to buy costs only $249? You could simply pay the 20,000 points and accept the fact that you received only 1.25 cents per point value. But, if you’ve read this far, you probably know that’s not what I’m going to recommend…

What you can’t do to maximize value is add additional people to the reservation. If four people were traveling together on this $249 flight, the total cash price for all four would be $996. So, you would think that US Bank would charge only 50,000 points for all four tickets, right? Well, no. Point prices are calculated separately. Each person would be charged 20,000 points for a grand total of 80,000 points for the reservation. Boo.

Here are some things that you can do:

Purchase a more expensive ticket for the same price in points. For example, perhaps first class seats are available for $395 each. In that case, you can spend the exact same 20,000 points per ticket, but enjoy the flight a bit more and probably also earn more airline loyalty miles from the flight.

Merge trips to maximize point value. Are you planning another later trip? Suppose the first flight’s cash price was $249 and the second flight’s cash price was $405. Separately, they are each terrible options for FlexPerks redemptions and would cost a total of 50,000 points. Together, though, they would cost 40,000 points. Even better would be with cheap flights. Two separate $195 flights would cost a total of 40,000 FlexPoints, but taken together you can get the same two trips for 20,000 FlexPoints. Use the multi-city search option to put your separate round trip flights into one itinerary. Shown below is an example in which two complete trips cost a total of 20,000 points.

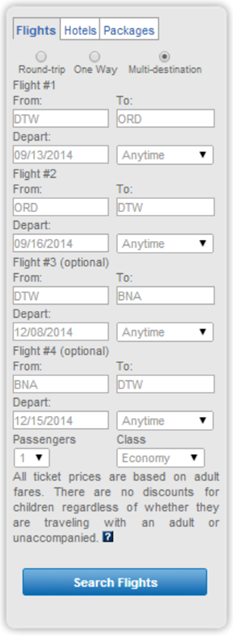

In this example, I found a round trip flight from Detroit to Chicago for $197 in September. And, I found a round trip flight from Detroit to Nashville for $187 in December. I put together all of the pieces of the two trips into the Multi-destination search box as follows:

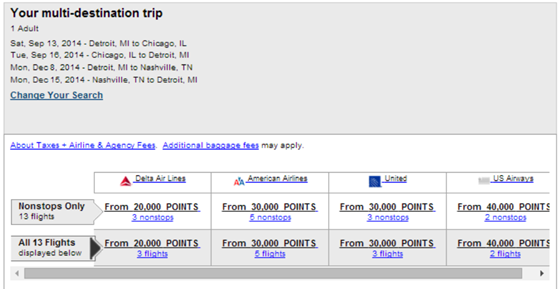

Then the search tool found options that priced out to a total of 20,000 points:

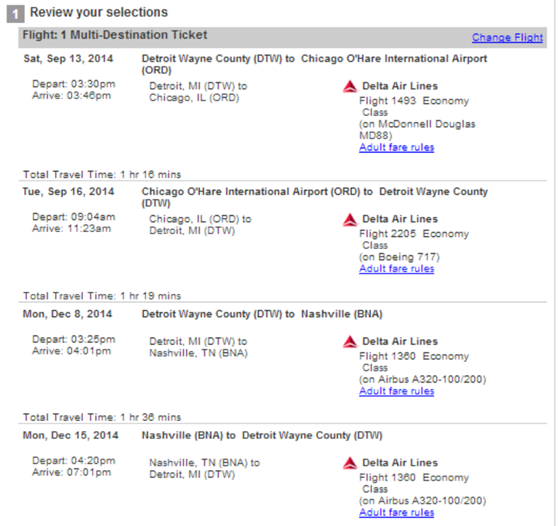

I picked qualifying flights:

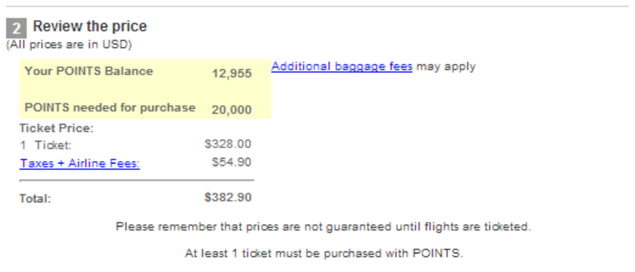

And I could have purchased this entire itinerary for 20,000 points had I had enough points in my account:

Tack on a free one-way (or more). Another option is to think of the unused cash part of an award as a slush fund for future flights. When you price out the trip you want to take, calculate the cash amount left over within the ticket price range from the chart above. For example, with a $249 flight, you would have $150 left over (in the $0 to $400 range). Similarly, a $2200 flight would have $800 left over (in the $2000 to $3000 range).

With only $150 left over in the $249 flight example, you might not be able to find a future round trip flight for $150, but you can probably find a one-way flight you would be interested in. Use a tool like Google Flight Search or Kayak to find flight prices. Then, simply use the multi-city tool to add a future one-way flight that costs less than $150.

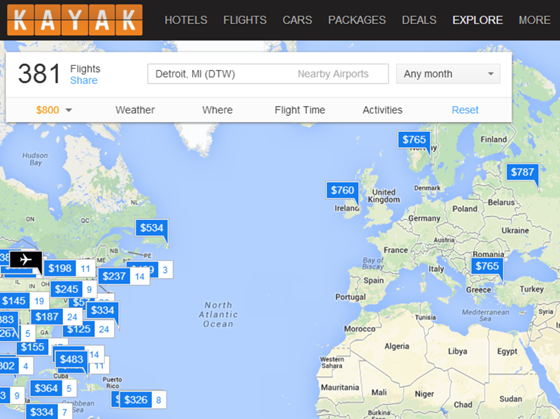

With $800 left over in the $2200 flight example, you would have far more flexibility. You could add on one or more complete round trip flights! If you’re flexible, use a tool like Kayak Explore to find options in your price range:

CAUTION: While it appears possible to book multiple trips with one award as shown above, I have not personally booked such a trip so I don’t know if there are any hidden problems with this technique. It is the case, I believe that if you have to abandon any of the flights other than the last one, your entire itinerary will be forfeit. So, there are risks involved when using this trick to save points.

I purchased tickets with my viza flex points – due to inclemenw weather my reservation were cancelled, Can I uset these points at a later ate.

Jackie

Hi Jackie

I don’t know this for certain because I’ve never had a cancellation. however, once the ticket is booked in your name, I believe you technically own the relationship now with the airline. I would call the airline directly and have then rebook it for you.

On the back end, the only difference is that your ticket is paid for with THEIR corporate credit card. If there were any additional charges, you’d just use your own credit card at that point. Since the airline cancelled, they should comp everything. HTH

It depends whether the airline gave you credit for a future flight or reimbursed the original form of payment. If the former, then you should have the credit in your airline account. If the latter, you’ll have to contact US Bank to get either the points back or the cash value back

Purhaps we all should use a cash back card instead since they do not expire

at least without notice

I SOMEHOW HAVE LOST 138000 POINTS AND FEEL DISSAPOINTED IN THIS PROGRAM

No notice of expiration given me so darn it.

Was it due to an expiration date?

[…] Also, remember that FlexPoints are worth up to 2 cents each when redeemed for travel. Potentially, this sign-up bonus could be worth up to $600 or more. Of course FlexPerks isn’t the simplest program to learn, so I recommend understanding it before making a decision. Frequent Miler has a good post on how to maximize redemptions. […]

[…] when you want to buy flights that are near the top of an award range. More can be found here: Maximizing Value from the U.S Bank FlexPerks Travel Reward Visa Card. Note that if you’re buying tickets for multiple people, they price separately. So, two $200 […]

[…] Frequent Miler has an excellent post on different ways to maximize these points when redeeming for airfare. Travel With Grant also has a walk through that explains booking process. […]

Does anyone have any flexperks points they can transfer to me? I have 9825 points right now. I need 175 points this month (because I have points expiring on 3/31). I will transfer 1250 back to you next month (I have points coming in that won’t hit my account until next month).

can you combine flexperks from 2 diff accounts under my name?

i want to close 1 account but not lose the points. any trickery (like citi’s TY points) when you close an account, its points expire in 90 days?

thanks!

I think you can. You can actually move points freely from one person to another as well but I think that they recently put in a 20K/year limit (or something like that). I’d recommend calling to ask. If they say no, then consider downgrading to a no fee card rather than cancelling.

If I use FP for what should be a refundable business class ticket, if I were paying with cash, do I get the full flexibility to change or cancel the ticket or does US bnk attach some sort of rider onto the ticket to prevent changes or cancelations?

I don’t know. I haven’t tried.

[…] dollar for charitable donations. That’s pretty good since FlexPerks points can then be used for up to 2 cents per point value towards flights. And, now that the FlexPerks Visa Signature card offers free in-flight wifi (details here), I […]

I don’t yet have the US Bank FlexPerks so I can’t search flights. I’m curious: can you use FlexPerk points to book Maldivian flights from Male (MLE) to Kadhdhoo Island (KDO)? If anyone can confirm or deny I’d appreciate it.

With FP, you have to use their interior travel website. It does not offer every airline in the world. Only the major ones.

No, it doesn’t recognize KDO

[…] ahead and do a bit of travel hacking, you can get top value from your points all the time (see: Maximizing value from the U.S. Bank FlexPerks Travel Rewards Visa Card). That’s a lot of work and planning. I prefer to keep FlexPerks around for those […]

[…] Still, if you do it all right, you can get very close to $.02 per point value for your points. Since the cards come with a sign-up bonus of 20,000 points after $3,500 in spending, then the bonus can be worth $400 in theory. (You can find out more about maxiziming FlexPoints here.) […]

[…] card to load Serve, but points are worth up to 2 cents each when used to purchase flights (see: Maximizing value from the U.S. Bank FlexPerks Travel Rewards Card). Plus, cardholders get 3,500 bonus points when they spend $24,000 in a year on the card. Serve […]

[…] Maximizing value from the U.S. Bank FlexPerks Travel Rewards Visa Card – The Frequent Miler […]