UPDATE 3/18/2015: As of April 16 2015, American Express will no longer allow online loads with any credit cards other than American Express credit cards. While Amex’ own cards do not earn rewards when loading Serve online, you may be able to earn rewards by using an Amex card issued by another bank (e.g. Fidelity Investment Rewards Amex)

Note: On January 8, 2016 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend

I often write about complicated techniques for earning points and miles. This one is easy. With Amex Serve you can earn miles easily and automatically. I’m on track to earn 72,000 miles per year this way. Here’s how…

Unlike the very similar product named Bluebird, Serve allows cardholders to reload their card with a credit card online, for free. Each cardholder is limited to $200 in credit card loads per day up to a maximum of $1000 per month. Those with SoftCard (previously named Isis) can do even better and load up to $1500 per month. For the sake of this post, though, let’s assume you have the regular Serve product without SoftCard.

At a high level, the approach is dead simple:

- Setup Serve to be auto-loaded each month with a rewards-earning credit card.

- Use the Serve balance, as needed, to pay bills (including credit card bills), to withdraw cash for free at MoneyPass ATMs, or to transfer directly to a bank account.

Getting Serve

If you don’t already have a Serve card, you can order one for free here, unless you have a Bluebird card. You can only have one: Bluebird or Serve. If you want to switch from Bluebird to Serve you’ll have to empty the funds from Bluebird, call to cancel your account, and then wait about a month to order Serve. Alternatively, you can speed things along as follows: 1) Cancel your Bluebird card; 2) Get a temporary Serve card (at CVS, for example), 3) Try to register for a permanent card (it will fail), and 4) Call support. If you go this route, be prepared to be on the phone for a long time.

Choose a credit card

To load Serve online, you can use any credit card registered to the same name and address as your Serve card. Even though the Serve website warns of the possibility of being charged a cash advance fee, that has never happened to me. I believe that even Citibank cards (which often charge cash advance fees for other financial-like expenditures) are fine to use. The only cards you shouldn’t use are those from American Express as they will not earn rewards.

Starting in mid-October 2014, Serve changed the coding of credit card loads such that many credit cards now do charge cash advance fees. You should avoid these at all costs. For an up to date list of which cards are safe and which are not, please see:

Some online Serve credit loads now posting as cash advances.

Setting up auto-loads

Thanks to the $200 daily limit, reloading Serve is not as simple as logging in once a month to add the money manually. You could log in 5 times a month and load $200 each time instead, but there are better, automatic, solutions.

One extremely simple solution (suggested to me by a friend) is to setup your Serve account to load $200 per week from your credit card. This way, in some months you’ll load $800 and in other months you’ll load $1000. Done!

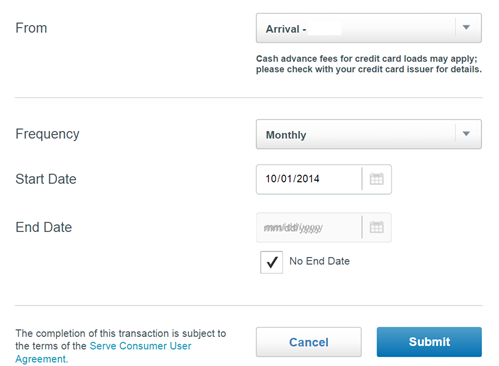

The only problem with the once-per-week approach is that you will miss the opportunity to load the maximum allowed $1000 on some months. If you don’t mind doing a bit more setup work, you can load the full $1000 automatically. The trick is to setup five separate automatic loads (Serve calls them “Scheduled Adds”). Setup the first one to load $200 monthly on the first of each month. Setup the second one to load $200 monthly on the second of each month. And, so on.

One caution: Rapid Travel Chai tells me that some banks block these automated charges because they appear to be fraudulent (since they happen repeatedly in the middle of the night). This has happened to him more than once with US Bank credit cards. I’ve had no such problem with my Barclaycard Arrival Plus card, but it is something to watch out for.

Earning more miles

With the approach described here, you can use a credit card that earns 2X everywhere (such as the Arrival Plus card) and earn 24,000 miles per year free and easy. If you have friends or family members willing to let you manage Serve cards in their names, you can do even better. For each Serve card you manage that is not in your name, order an Arrival Plus authorized user card with the same name and address that is tied to the Serve card. Then, use that authorized user Arrival Plus card to automatically reload the matching Serve card. I currently have three Serve cards setup this way (my card, plus two others), for a total of 72,000 miles per year. And, of course, with more Serve cards, one can do even better.

Warning: some people have had their accounts frozen when trying to use authorized user credit cards with Serve. I have not had this problem with the Arrival Plus card, but it may be an issue with other cards or other accounts.

You can do even better by doing online debit card loads in addition to online credit card loads. The trick is to have debit cards that earn rewards, or debit cards that are reloadable with credit cards. That’s a story for another time.

How to setup automatic loads

Here’s a quick tutorial. After logging into Serve, do the following:

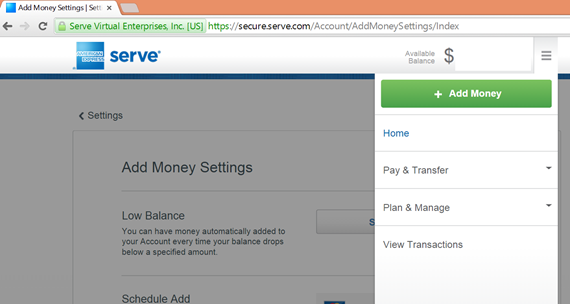

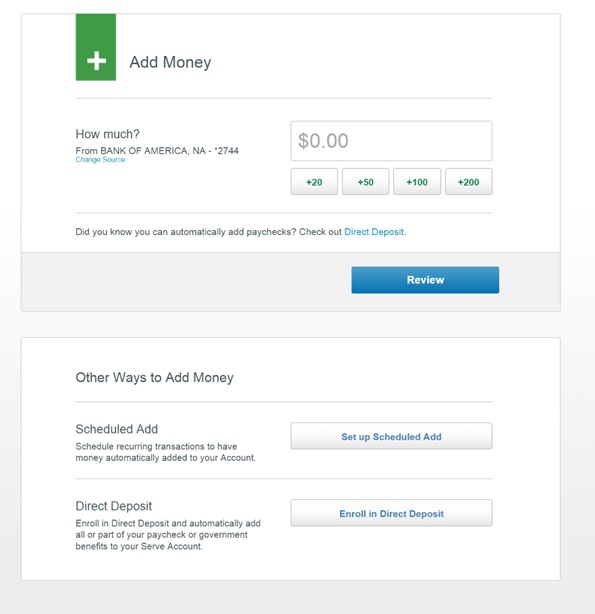

1) Select “Add Money”

2) Scroll past the “Add Money” section, to the “Other Ways to Add Money” and click on “Setup Scheduled Add”

3) Configure the Scheduled Add with the appropriate credit card, start date, and frequency

![[EXPIRED] Serve One VIP to be discontinued Switch REDbird to Serve](https://frequentmiler.com/wp-content/uploads/2015/09/SwithRedbirdToServe.png)

a

New to MS here. I’ve been reading a lot last few days. I used to buy GC from a casino $499 every 24 hours where you can cash it right away. By far the easiest and simplest way to rack up some serious mileage. I no longer live in that area. I was looking for a way to pay my mortgages via CC. They all add up a little over $5k. Looks like the BB will be better for me in case I could write a check to pay for the mortgage. Thanks.

Phil

I have a Barclaycard Arrival Plus card. Just wanted to check:

1) Does this still work for you using your Arrival Plus

2) Does Barclaycard allow you to then turn around and pay your bill with the Serve card?

Thanks!

1) Yes, but only until April 16th when Amex will stop accepting any cards other than Amex for online loads

2) Yes

I noticed you said you can direct deposit into your bank account from serve but, I can’t find that option. Can you please explain how that is possible? I realize I can just go to an ATM but, I am moving to Brazil and need ways to manufature spend etc. all online. Let’s say I was really sad when Amazon Payments stopped allowing us to send money back and forth through emails. That was how I started getting into earning miles and then they changed policies. Thank you for your great website and help! It’s wonderful paying $5.60 for direct flights using miles considering I spend my time in Brazil helping the children in the slums. It allows me to put my money where it’s needed and not in an over $2,000 ticket. You’re Awesome!

It seems like you can only do one scheduled add now. I was changing cards for an automatic upload, and there isn’t a way to do a second scheduled add any more.

I have to decide whether to do a weekly add, and do a manual add on some months, or do all manual adds. I don’t want to do daily adds, as I’m concerned that will trigger a fraud alert.

Seems to me that a weekly add is a good compromise

I think you’re right, although I liked having 5 monthly adds on the 1st, 3rd, 5th, 7th & 11th.

For me, I think that Serve is still better than RedCard, since I can do the loads online.

Hi, thanks for all the useful info. Just got my Serve card and I’m starting slowly with the $1K CC load a month to my BA Chase Visa. So far, I’ve set up a weekly charge of $200 but when it comes to the last part of your post:

5) To setup additional “Scheduled Adds”, simply repeat the whole process from step 1: Add Money

I’m not finding the option to add an extra “Scheduled Add” – it just shows me the details of the existing “Add” – has the site maybe changed since you posted this or am I missing something?

I don’t know. I’ve since switched all of my cards to REDbird so I can’t test it. Anyone else?

I’m having the same experience (see my post below).

I think I’m just going to do manual adds every other day.

@John,

Yes, UFBDirect Debit Card loads to Serve and earns miles, I have my UFB card linked to my Serve and do the $1,000/month to earn 500 miles.

How often do they post the miles? I loaded some money on 11/24/2014 to serve using UFB debit card. I have not seen any mile posted to my account.

Hi John,

It actually takes a while, looks like 2 months~ is the time frame. I checked my UFB activity and I had spent $410 in debit charges on my card in October ($400 was from Serve and $10 was something else) and I was awarded 205 AA miles on December 22, 2014.

So since you loaded money on yours in the month of November, I’d say you’ll be receiving miles sometime towards the end of January (Jan 22? just a random guess!), so it should be soon 🙂

I am still waiting for the 500 AA miles they owe me for the $1,000 in activity for November and December. Those will probably post for me around Jan 22nd, and February 22nd – respectively.

Brandon, thanks for the information. I guess I should wait until the end of January.

Anytime!

I have learned from experience to be patient with UFB, they tend to be a bit on the slow side.

On a side note, if you have $50,000 laying around you should get a BankDirect account. You’d earn 5,000 AA miles a month just for having the money in the account, although you do pay $12/month to have the account but I think it’s worth it.

Hi John,

Did your UFB miles post yet? Mine posted today for the activity from November.

I just checked. It was posted yesterday too!!!

Great!!

No one can confirm it?

Can anybody confirm that UFBDirect Debit Card loads to Serve will earn miles?

Thanks!

FM,

How do you get the Arrival authorized user card registered at the user’s address? It didn’t give me that option (online.) Just call customer service?

…..Or do you just register all the serve accounts at the same address?

I haven’t actually done so (my authorized user cards are registered to my home address). I had assumed you could have them mailed to whoever you want. Does it not give you that option?

How do you reload $1500 (instead of only $1000) through your credit card. When I tried through the SoftCard app, it wouldn’t let me. It told me I reached my max. Help.

SoftCard sends me to my Serve account to add money.

Did you order Serve initially from the SoftCard app? If not, you will be stuck with the $1K limit.

The $999 limit on payments would not work in high property value areas. 🙁 Otherwise evolve looks promising.

I wonder if you could use this to pay property taxes. Seems like a great way to get around the usual 2-3% fee to pay those.

Yes, but when using bill pay, the checks are sent from a central location so if you need to send a paper stub with your check that would be difficult.

Evolve or one of the Evolve esk services has a long long laundry list of county tax offices that if you have a match might work very very well……

Just switched from BB to serve. Trying to link the Chase issued IHG mastercard. Getting this error message – CARD ISSUER DECLINE TRANSACTION CODE. Is this Chase specific? What do I do? Help appreciated.

As of 3 Nov both Freedom and Sapphire Preferred work and earn miles without CB fees……

You probably have too small of a cash advance limit. If you call to raise your limit, the charges should go through.

Hi

I already signed up for the Serve but have not activate the card and just now getting the Softcard app on my phone. Can I still get the Softserve by using the app to active the card?

Can I use my phone to register for my husband’s softserve and manage it if in case I’m not allow to use Softserve due to the issue above?

I don’t think so. I think you would have to somehow cancel your unactivated Serve and sign up again through the app.