UPDATE: Serve is no longer safe with some cards. Please see this post for more details: Some online Serve credit loads now posting as cash advances.

One big advantage of Amex Serve cards over Bluebird cards is that Serve allows online loads via credit card, up to $1000 per month (or $1500 per month if you signup for Serve via SoftCard).

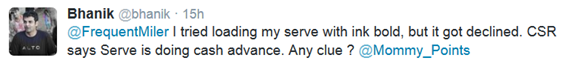

Since yesterday, a bit of a panic has set in since it appears that some cards are suddenly treating Serve online loads as cash advances. The first I knew about this was from this tweet:

The author of the tweet then found this new thread on FlyerTalk where many people have reported that pending charges for loading Serve are showing up as cash advances. Strangely, others with the same cards are reporting the opposite. Travel with Grant summarized the situation here.

What it means

We do not yet know if cash advance fees are really being charged. Sometimes a bank will code a pending charge as a cash advance, but will change it to a purchase once it moves from pending to actual. One common example of this is with US Bank credit cards and Amex gift cards. When US Bank credit cards are used to buy Amex Gift Cards online, the pending amount is treated as a cash advance, but it later changes to a purchase. Until these Serve online load charges move from pending to actual, we simply won’t know. It typically takes a few days for pending charges to move to actual.

What to do

- Do not call your credit card company about the cash advance fee while the purchase is pending. There’s simply no point to it.

- If, and only if, you see an actual cash advance fee on your credit card, then call the bank to see if they’ll waive it.

- Do consider calling your credit card company to ask to have your cash advance limit dropped to zero. Not all banks allow this, but some do. One downside to this: with a zero cash advance limit, you might not be able to buy Amex gift cards online or reload Serve online if your bank treats the pending charge as a cash advance but later changes it to a purchase.

- Consider delaying online Serve credit card loads this month until more is known.

My experience

I always use my Barclay Arrival Plus card for Serve credit card loads. Here’s why:

- The Arrival Plus earns a fantastic 2.2% return for all purchases as long as points are redeemed for travel.

- Switching credit cards often may look suspicious to Amex’s fraud department. I prefer to keep one card going without changing it.

- I like the “set and forget” method that I outlined last week: Earn miles automatically, with Serve.

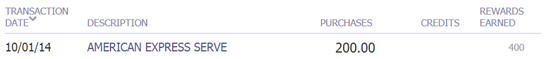

So far this month, I have one Serve transaction that has moved from pending to actual, and that was not treated as a cash advance. The purchase already shows points earned. This charge is from October 1, though, so I’m not sure its relevant since reports of the cash advance thing started appearing on October 2nd.

That said, pending charges on my Arrival card from yesterday and today do not appear to be cash advances either.

![[EXPIRED] Serve One VIP to be discontinued Switch REDbird to Serve](https://frequentmiler.com/wp-content/uploads/2015/09/SwithRedbirdToServe.png)

Citi changed Serve to a Cash Advance.

I got charged cash advance fees PLUS did not meet minimum spend due to the charges changing from purchase to cash advance within the statement period.

That’s rough. A lot of people have been caught with this since October 9th. See this post: https://frequentmiler.com/2014/10/11/some-online-serve-credit-loads-now-posting-as-cash-advances/

I used my Bank of America Travel Rewards credit card and got charged a cash advance fee. Hope this helps.

Thanks.

Has anybody tried the DiscoverIt to load to serve? Does anybody know if they charge cash advance?

I tried arrival+ and Saphire, both show up as purchases.

J

So I just called. The woman ( who knew exactly what Serve was ) told me it must have been a glitch in the system that my Serve loads were coming up as purchases and that I got lucky up until my last one. Held firm they were advances and not purchases. Looks like i’ll be staying away from that card for a while when it comes to loading serve.

I just got the same $10 fee on my club carlson card. Will call to ask about it.

Just an FYI – I am new to all this so I might be missing something, but I used my and my boyfriend’s Club Carlson cards (USBank) to load $1000 each in the last 2 weeks on our individual Serve accounts. Showed up as normal purchase both in pending and when actually posted, but when statement came out on each card there was a $10 “cash equivalent fee”. This equates to a 1% fee on money transferred to serve.

That’s frightening. Can you call US Bank to ask them why there’s a $10 fee on your account? If you ask nicely they might waive it for you. Please report back how it goes.

I have used my Delta Reserve Amex card, to transfer to my Serve card, it does not code as a cash advance and I also received my miles for the transfer.

Craig, are you 100% sure that you received miles? If so, that would be great!

UPDATE: We now have evidence that Serve loads are being handled as purchases, not cash advances.

.

Please see the update here: https://frequentmiler.com/2014/10/04/serve-is-safe/

United – daily autoload. Transactions # 1 & 2 cleared: # 3 & 4 pending.

CA availability decreased when #’s 1 & 4 went pending but not 2 & 3.

the cleared ones (# 1&2) show “type” as sale and were awarded miles.

Please correct me if I’m wrong, but:

A) Aren’t mile not awarded for CAs?

B) wouldn’t we have to wait for the statement to close in order to find out for sure since the CA fee is a % and would be calculated then?

A) Correct

B) If you see that you were awarded miles then it should be safe

Loads from chase united explorer both oct. 1 and 2 posted as sales for me.

I did a Serve load on Oct 1, and another on Oct 2, using a Chase Marriott Business card. My Cash Advance availability has not changed, though neither load has yet to post in a way that clarifies whether they’re classed as Purchases or CA’s.

My Serve load on Oct 1 has now posted, as a Sale. Still waiting for my Oct 2 Serve load to post, but since my Cash Advance availability still shows no reduction, I’m expecting it to also post as a Sale.

I have absolutely NOT been able to ever buy Amex GC’s online using my US Bank cards which have the cash advance limit set to zero.

Exactly my point

Chase Sapphire Preffered loaded on 10/1 was not treated as cash advance. I wonder if there is a difference for people who loaded on or after 10/2.

I have a Chase Sapphire Preferred, have been doing this for a 6 months now, no problems. I am now getting an error that Chase declined the purchase. My cash advance limit has always been set to zero since I got this card. Certainly seems like they are trying to charge it as a cash advance now.

Chase Sapphire Preferred online loads are not treated as cash advance.

To be clear, it appears my CSP CA limit is being reduced by $200 when the charge is pending, but the charge posts as a purchase. This is probably why Aaron’s CSP loads are being rejected.