As of January 1, 2015, Delta has been awarding miles based on the ticket price rather than the distance flown. Under the new program, long distance heavily discounted flights result in far fewer earned miles than before. For example, as shown in the image below, a $320 flight between Detroit and Los Angeles used to result in 7,916 earned SkyMiles for those with Platinum elite status. Today, the same flight will earn only 2,880 miles. And a person with no status at all will earn only 1,600 miles.

Of course, there are many counter examples in which you can earn more miles in 2015 than you would have before. High priced, short distance flights are good examples. Still, I expect that most people will earn fewer miles from flying in 2015 than they would have in 2014.

If you live in an area served by many other airlines, you may have already jumped ship away from Delta to a competitor. If you live near a Delta hub, though, or you simply prefer flying Delta, jumping ship may not be an option. If that’s you, here’s how to make the most of Delta 2015…

Get more from your miles

One ameliorating (I had to look up the spelling of that word!) factor of Delta 2015 is that Delta SkyMiles are arguably worth considerably more now than they were before. There are a few reasons for this:

- Delta now allows one-way awards. As a result, it’s easier to find saver level awards. If you find saver level awards in one direction, but not the other, you can now book one-way with miles and pay cash for the other direction (or use another mile currency for the other direction).

- Delta has made more saver level awards available. Delta used to be extremely stingy with making the cheapest level awards available. Today, however, they seem to have made more seats available at saver level than ever before.

- Fewer miles will be in circulation. Thanks to the change in how miles are earned, we can expect fewer miles to be handed out. As a result, there should be less competition for awards.

- Delta has drastically improved their online award calendar. While the new calendar is far from perfect, it is still unquestionably far superior to what we had before. Today, finding reasonably priced awards is many times easier than before.

On the flip side of these improvements, Delta has eliminated free stopovers and open-jaws that used to be available with their round-trip awards. It used to be possible to use these features to visit multiple cities on one award, or even book one and a half trips for the price of one award. So, for those who took advantage of these features, Delta SkyMiles may have reduced a bit in value.

Personally, I’ve taken advantage of the free stop-over and open-jaw many times, but I’ll still gladly trade them for the ability to book one-way awards. Just yesterday I booked an award flight using Delta miles for the outbound and AA miles for the return. That wouldn’t have been possible in the past without paying Delta the full miles required for a round trip ticket.

Earn more miles from flights, but pay less

American Express offers 3 Delta branded cards:

Gold Delta SkyMiles® Credit Card ($0 intro annual fee for the first year, then $95 per year). Read my review here. (Update: This offer has temporarily expired.)Platinum Delta SkyMiles® Credit Card ($195 annual fee). Read my review here. Update: This offer has expired.Delta Reserve Credit Card from American Express ($450 annual fee). Read my review here. Update: This offer has expired and/or is not currently available at Frequent Miler.

An interesting perk of the Platinum card is that you are given a domestic companion certificate each year upon renewal. This makes it possible to buy two round trip economy tickets for the price of one (plus taxes and fees for the companion). The Delta Reserve card has a similar companion certificate but it’s even better: this one allows buy one, get one free first class tickets. With either type of companion ticket, the primary ticket holder earns redeemable miles and Medallion Qualifying Miles (towards elite status) whereas the companion earns none.

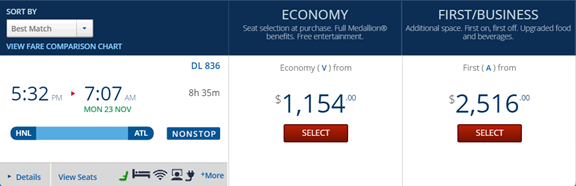

While the companion certificates are limited to certain fare classes, it’s been rare in my experience to have trouble finding availability (your experience may vary, of course). Where I use these tickets regularly is for overpriced holiday travel. Flights that usually cost less than $400 often soar to $700 or more during the holidays. And, reasonably priced award flights tend to be nonexistent during those times as well. The companion ticket then makes it possible to save a lot of money. Often, during the holidays, first class fares cost only a bit more than economy fares. In those cases, the Delta Reserve companion tickets offer a fantastic value.

One new unintended perk to these companion tickets is that the primary ticket holder can now earn far more miles in 2015 than they would have before. As long as the companion ticket is used to offset unusually high ticket prices, you should find that mileage earning will be higher as well. Update: These offers have expired and/or are not currently available at Frequent Miler.

Hawaii residents do especially well!

While Delta’s companion tickets can’t be used to fly to Hawaii, Hawaii residents can use them to fly to the mainland. In that case, there are huge savings to be had and miles to be earned!

Earn from credit cards rather than from flying

Unless you fly a tremendous amount, there are many more opportunities to earn miles from credit cards than from travel:

Signup bonuses

An easy way to earn miles quickly is by signing up for the best credit card offers. Delta miles can be earned from the following credit cards:

All Delta branded credit cards.- All Membership Rewards cards. Membership Rewards points can be transferred to many different airline programs, including Delta. Note that there is a small fee to transfer Membership Rewards points to US based programs, such as Delta.

- All Starwood Preferred Guest (SPG) cards. SPG points can be transferred one to one to many different airline programs, including Delta. When points are transferred in buckets of 20,000 at a time, you’ll earn a 5,000 mile bonus. In other words, 20,000 SPG points equals 25,000 airline miles.

Daily Spend

Another way to earn miles with credit cards is to use those cards for all daily spend. If you use the right card, it is possible to average much more than 1 mile per dollar spent. Here are some examples:

- Amex EveryDay Preferred Card: Earn 3x points at US supermarkets on up to $6,000 per year in purchases (then 1x); 2x points at US gas stations; and 1x points on other purchases. Even better: Make 30 or more purchases with your card in a billing period and earn 50% more points on those purchases less returns and credits! That means it is possible to earn 4.5 points per dollar at supermarkets, 3 points per dollar at US gas stations, and 1.5 points per dollar everywhere else. For most people I expect that this card will result in far more earned points for daily spend than pretty much any other card available.

Delta Reserve Card: This card offers 15,000 bonus miles (and 15,000 bonus MQMs) when you achieve $30,000 spend in a calendar year. Then, you can get the same bonuses again at $60,000 spend. So, if you spend exactly $30,000 or $60,000 in a calendar year, you will average 1.5 miles per dollar across the board. Plus, of course, you’ll also earn valuable Medallion Qualifying Miles (MQMs) to move you closer to the next level of elite status.Update: This offer has expired and/or is not currently available at Frequent Miler.- Starwood Preferred Guest Card: This card earns 1 point per dollar for all spend (except at SPG properties where it earns 2 points per dollar). That doesn’t sound like much, but if you transfer 20,000 points at a time to airline miles, you’ll earn a 5,000 mile bonus. With that bonus, this card has an earning rate of 1.25 miles per dollar for all spend.

Manufactured Spend

“Manufactured Spend” is a collection of techniques for increasing credit card spend in ways that results in getting most or all of your money back. The reasons for doing so include: meeting credit card minimum spend requirements, earning credit card big spend bonuses, or simply earning credit card rewards.

By taking advantage of some of the easier manufactured spend techniques, its possible to earn far more miles and even obtain elite status via the Delta Platinum or Reserve cards.

Here are a few posts that can help get you started:

A prime example of credit card affiliate links driving “content”…

incorrect

Hey Paul,

If you don’t like the content go start your own blog and offer up some thoughtful analysis. Oh, you don’t have a blog? Trolling is a tough sport…

Delta.com eliminated the availability of CZ/MU now on their website, which is searchable several days ago! That means, technically many partner awards are searchable on our own and they have already set up the database, but Delta is not happy to let you do so. So now you need to call them for CZ/MU redemption again.

Those partners keep disappearing and reappearing on Delta.com. I would check back in a few weeks and see if they’ve come back.

Crediting Delta flights to Alaska earns anywhere from 25%-200% of actual flight miles, depending on fare class, with 500 mile minimums, as follows:

25% in E

50% in L, U, T, X, V

75% in H, Q, K

100% in B, M, S

125% in Y, Z, G

150% in D, I

175% in J, C, A

200% in F, P

Those miles can be used to book saver tickets on DL (although you can’t book one-ways through Alaska yet, but you can book a roundtrip with DL one way and another AS partner on the other). Alaska also allows stopovers and open jaws on award tickets.

I will be sure to have a printed copy of my return itinerary for inbound Customs and Immigrations officials to prove I have an outgoing ticket, but are there any potential problems using awards in one direction, and paying cash for the other direction for international travel?

Yes, for international flights there are a couple of “gotchas”:

1. International flights are more likely than domestic flights to charge more for one-way than for round trip

2. Delta charges fuel surcharges on award flights originating from Europe. So, if you want to use the one-way trick with Delta, make sure to use Delta miles for the outbound flight to Europe, but consider using United miles (which never charge fuel surcharges) for the return.

On the front of “redeeming miles is now easier than ever”, you missed some recent developments on FT where it is reported Delta is now using married segment logic to price awards. In short, the problem is that if AAA-BBB is available in low, BBB-CCC is available in low, AAA-BBB-CCC may not be available in low. I think this is far worse that stopovers being taken away and other bullet points mentioned in this post.

That’s interesting. I didn’t know about that. If this is true, wouldn’t there be a plus side to that too, though? Wouldn’t there be cases where AAA-BBB-CCC is available in low, but the segments are not?

That is correct, but image the likelihood of this working to our advantage compared to Delta’s.

On a similar note to Kai, I am curious as to whether there are any Skyteam partners (e.g., Korean?) to which one could credit “cheap” Delta flights and receive a distance-based amount of redeemable miles.

I might be wrong, but I don’t think there are any partners left where a discount economy Delta flight would award 100% miles.

I wonder if it’s worthwhile to credit Skyteam flights to Delta? In those cases, won’t you be getting butt-in-seat miles vs. spending?

When flying other airlines but crediting the flight to Delta, yes you’ll be awarded miles based on distance flown. In many cases, though, you’ll get less than 100% of the miles (it depends on the fare class and the airline). You can find details here: http://www.delta.com/content/www/en_US/skymiles/earn-miles/earn-miles-with-partners/airlines.html

Right, I looked into it right after I posted the question. It seems that most are offering 25~75% range depending on the group partner. In terms of long-haul, some may still be worth it, if Delta is your main account, and you are just flying one-off flight w/ the SkyTeam airline that earns at least 50% w/ Delta.

Ah, I guess crediting to Alaska is a better bet.

Just changing my thinking this year as a result of SkyMiles 2015… BIS miles are MQMs only, whatever I earn in RDMs is gravy. Real RDMs will come from credit card spending spread across several AmEx cards (but hitting the necessary thresholds obviously).

Jumping ship to American Airlines since GM benefits have changed to SM benefits.

Just earned 4200 miles from a Delta Shuttle r/t. I’m shifting more travel to Delta, not away, as a result of their re-calculation. I just wish they would calculate elite status using the same system rather than dollars for redeemable miles and actual miles for status.

Yep, it sounds like you’re one of the winners in the new scheme. You could potentially do very well earning MQMs through their credit cards in order to reach a higher level of elite status.

I was really tempted to purchase a $1000 LGA-DCA ticket the other day because I would have netted 9,000 miles (as a PM) versus the 2,000 I would have earned last year. I couldn’t bring myself to do it though because Amtrak was only $400, even though the company was paying. Companies are definitely going to have to keep an eye on their employees who have discretion to book their own travel even more now.