Last year, I signed up for the Amex Gift Card Premium Shipping Plan which offers free Express Next Day shipping on all Amex gift card orders. Usually, the plan costs $99 per year, but thanks to a tip from a friend, I signed up for free. Since then, I’ve been able to get free money, in a way, by clicking through cash back portals to buy Amex gift cards. Cash back rates have hovered at 1.5% for quite a while now, but they regularly spike up to 2% or even 2.25% during one-day specials on sites such as TopCashBack, BeFrugal, and Simply Best Coupons. Each Amex gift card has a $3.95 fee, but when buying large denomination cards (e.g. $2000), the fee (0.2%) is trivial as a percentage of the card’s total value.

Yesterday, my free enrollment expired:

How to check your plan status

It isn’t obvious how to check the status of your free shipping plan, but its easy once you know how:

- Log into your online Amex account

- Scroll to the bottom of the page, and click on “Gift Cards”

- Click “My Orders”

- Look a the section titled “Shipping Addresses”. To the right, you’ll see your shipping plan status along with a link to View details.

![]()

Problems with Amex Gift Cards

Amex gift cards are not all sunshine and roses…

- Portals don’t always track purchases correctly. In fact, for my last four orders through TopCashBack I’ve had to submit missing cash back claims. Fortunately, each was resolved quickly in my favor.

- Amex declines orders for no apparent reason. They’ll send an email with the subject heading “Your order has been declined”. The usual reason: “We could not verify the information you provided.” That’s a particularly strange reason when the person ordering had logged into their Amex account and used their free shipping plan to place the order. For me, that problem has gone away ever since I started using a real EIN as the Tax ID when placing Business Gift Card orders. You can easily get your own EIN here.

- Amex occasionally withdraws Amex gift cards from portals. Often, around the September or October, Amex Gift Cards disappear from portals then appear again a few weeks later, sometimes at a lower cash back rate.

- Amex sometimes screws up.

- Sometimes people receive gift cards that haven’t been properly activated. Then, when calling Amex, the reps claim that the cards have to be swiped in-person to be activated. That’s completely wrong. If this happens to you, keep calling and asking for supervisors until you get someone who knows how to fix the issue.

- I received an error recently on the website when placing an order, so I tried again. The second order went through successfully. The first order didn’t track through the portal, but it did result in cards showing up at my door and my credit card being charged. It took three separate time consuming calls to get the duplicate order cancelled and my money refunded.

- Some credit cards charge cash advance fees: This used to commonly happen with Citibank cards, but Citi seems to have fixed the issue. To be safe, it’s a good idea to decrease your cash advance limit to zero, or at least to less than the amount of your Amex gift card orders. Unfortunately, with some banks (Discover and US Bank, for example) this could result in your order getting declined even if the purchase wouldn’t ultimately result in a cash advance fee.

- Registering cards for online orders can be a pain. Some online merchants will try to verify your billing address by comparing to the info registered to your credit card. This can cause orders placed with Amex gift cards to fail. A fix is to call Amex to register your address to the gift card first. This can be extremely time consuming. I really wish they would add an online option for registering!

- Some merchants won’t accept Amex gift cards. Simon Mall employees have been told not to accept Amex gift cards for purchasing Visa gift cards. At local stores that sell Visa gift cards, success can be hit or miss. Online, neither GiftCardMall (which has become irrelevant recently since they dropped their max Visa gift card values to $250) nor GiftCards.com accept Amex gift cards. And, of course, there are places that don’t take American Express at all.

- $1 holds can make the cards difficult to drain completely. This is usually just an online purchase problem, but it is a hassle. One example is with Kiva loans which can be paid for with Amex gift cards. If you try to make exactly $2000 worth of loans, for example, and pay with a $2000 Amex gift card, the transaction will be declined. The reason is that PayPal will first verify the card by placing a $1 hold. This reduces the available balance on the card to $1999 for quite a while (its been a while since I’ve done this, but my admittedly shaky memory tells me that I’ve had to wait up to a week for the hold to clear). Read more about Kiva here: Kiva: loans, points, and miles.

- REDbird no longer likes Amex gift cards. For about 7 months, it was possible to reload REDbird (the Target Prepaid REDcard) with a credit card at Target. As of May 6th 2015, though, only debit cards or cash can be used. And, Amex gift cards are not debit cards.

Despite the issues, I’m a fan

In the post “REDbird grounded. Now what?” I described how I would deal with Amex gift cards I had on hand:

While writing this, the UPS guy showed up at my door with a big pile of Amex gift cards that I had ordered on Tuesday when TopCashBack offered 2.25% cash back. The original plan was to use these to load REDbird at Target. That plan is now out the window. Fortunately, I have an easy alternative. I’m aware of a few stores in my area that will let me buy $500 Visa gift cards and pay with Amex gift cards. Sure, I’ll incur a fee for each gift card of around 1%, but its well worth it – it simply eats into my 2.25% portal earnings. It’s a bit more work, but I’ll still be well ahead.

Note that this solution is extremely location sensitive. There are stores in my town within the same chain that do not allow Amex gift cards as payment. And, I’ve heard from some readers that wherever they live they’ve been unable to find stores that accept credit card payments at all for gift cards, let alone Amex gift card payments.

So, the cards on hand weren’t a problem for me, but I also declared my intention to stop buying Amex gift cards:

Going forward, rather than buying Amex gift cards, I’ll buy $500 Visa gift cards. Unlike Amex gift cards, Visa gift cards can be used as debit cards to load REDbird. Done.

Since then, I’ve changed my mind. I’ve been fortunate in that almost all Target stores in my area have continued to allow Visa gift card debit loads to REDbird. So, draining Amex gift cards has been fairly easy: 1) I use Amex gift cards to buy Visa gift cards at local stores; and 2) I use those Visa gift cards to reload REDbird at Target. Then, of course, I use REDbird’s free bill pay feature to pay bills that can’t usually be paid by credit card.

There are two killer features of Amex gift cards that make it worth it, to me, to add the extra step:

- I can meet minimum spend requirements instantly and from home. This is huge to me. When I sign up for a new credit card that has a spend requirement for its signup bonus, I can simply click through a portal to Amex gift cards and buy as many Amex gift cards as are needed to meet the spend requirement. Done! Sure, I then have a longer term issue of dealing with the Amex cards, but there is no longer any fear of missing out on the signup bonus.

- Portal rewards wipe out fees associated with manufacturing spend. Buying Visa gift cards involves fees. Liquidating Visa gift cards sometimes involves fees. Cash back earned from purchasing Amex gift cards via a portal is usually more than enough to cover those fees and probably the cost of gas too (for driving around from store to store).

Maybe not for you?

My ability to liquidate Amex gift cards is extremely location sensitive. There are stores in my town within the same chain that do not allow Amex gift cards as payment. And, I’ve heard from some readers that wherever they live they’ve been unable to find stores that accept credit card payments at all for gift cards, let alone Amex gift card payments. And, even if you can turn Amex gift cards into debit gift cards, you may live in an area where those are hard to use too.

As a general rule, I’d recommend that you make sure that you have at least two different ways to drain gift cards before investing too heavily in them. Options disappear all the time. If you can’t afford to be stuck holding the cards long term then don’t buy them.

Should I renew premium shipping?

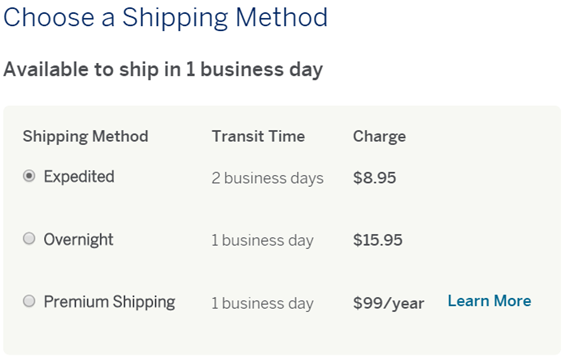

Now that my premium shipping plan has ended, I need to make a decision. Should I pay $99 to renew the premium shipping plan?

Without the plan, I’d have to pay $8.95 per order for shipping. If I place 11 or fewer orders in the next 12 months, I’d be better off paying separately each time. If I place 12 or more orders, then I’m better off with the shipping plan. My guess is that I will place 12 or more orders, so I should go with premium shipping. However, there are a few risks:

- Amex gift cards may disappear from portals as they’ve done in the past. And, there would be no guarantee that they would return.

- Portal rates on Amex gift cards may drop to rates that are too low to be worth the effort.

- Options for liquidating Amex gift cards may dry up.

- A free shipping code might surface again.

All of the above are reasons to pay for shipping per order, for now, rather than paying all at once. On the other hand, I think that the risks are low and savings would add up if I buy gift cards often enough. So, my plan is to wait until the next time I want to buy gift cards. I’ll sign up then for premium shipping as part of my next order.

Questions about Amex gift cards?

Please see: The complete guide to Amex gift cards.

![[Pulled early] 10% back on all gift cards via Pepper app](https://frequentmiler.com/wp-content/uploads/2024/04/Pepper-app-10-back-everywhere-targeted-offer-218x150.jpg)

DoC posted a link to a new Amex offer for gift cards. Have not purchased these before but it seems quite good, and timely given all of the new platinum card owners out there these days:

https://www.doctorofcredit.com/amex-offers-american-express-gift-cards-spend-1000-get-50-statement-credit/

Are the pitfalls you describe still a reality? Particularly interested if there are limitations to online liquidation (paying taxes, paying tuition bills, etc.)

Thanks!

I recently applied for the AMEX Business Card. I was thinking of purchasing the AMEX gift cards to meet the minimum spending. However, the terms and condition states: “Eligible purchases do NOT include fees or interest charges, balance transfers, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents.” Are AMEX gift cards consider prepaid cards and cash equivalents?

Well, yes, Amex gift cards are considered prepaid cards, but in my experience Amex doesn’t enforce those terms. I’ve often bought gift cards in order to meet minimum spend requirements with Amex credit and charge cards and I’ve never had any problems.

[…] My Amex gift card strategy […]

[…] My Amex gift card strategy – Frequent Miler – Miler shares his AMEX Gift Card Strategy, now that he’s had a year of free shipping. I used to do this myself, but, locally, more and […] […]

Hello – Very informative article. I was redirecting my attention to “working” my Amex rewards. I was curious to know if you have strategized the ‘points for gift card purchase’ offers. I have verified which monthly purchases I can make with Amex, and seems that it would be pretty lucrative regarding points earned. Earning 20,000 points for a $100 gift cards seems questionable to me. But I am a reward newbie.

Unfortunately, since this was written, Amex stopped paying out through portals for Amex gift cards with denominations above $200. This made the cards too difficult to deal with, in my opinion. So, I don’t recommend this approach anymore.

Hi FrequentMiler

Awesome information here thanks. I recently took out the Amex business card but need to spend $10,000 in the first 3 months (for the 75,000 reward points), but obviously can’t spend that much. My question is, as I am an amex customer looking to hit $10,000 spend, would I be best buying the highest denomiation amex gift card ($3,000) or 6x $500. They are currently running a fee free special I believe until end of month. Plus I have the free shipping.

Since Amex has stopped paying out through portals for denominations above $200, Amex gift cards are no longer a good way to earn cash back. However, if you simply need to “time shift” your spend, it can still be worthwhile. I would recommend buying the highest denominations you can afford to float. That way, you can earn the signup bonus and take your time spending down those gift cards.

Hi, I’m new to all this. I think I read on another post that cashback is only offered on AGC that are $200 or less. This now negates the above strategy, right?

Right

Ok I just saw that I cannot get a red bird in San Diego. Can someone mail me one?

Try contacting noonradar@gmail.com. He sells them and helps people get started.

Quick update on getting the temporary activated Redbird…you can now purchase it directly from my online store at NoonRadar.com

Thanks I got one from you last time. I’ll get one for my wife through your website

Can I still sign up for red bird? I thought somewhere I heard it was discontinued ?!

What do you do with the cards after you buy them…Just use them for shopping around town??

I use the Amex gift cards to buy Visa gift cards, then I use the Visa gift cards as debit cards to load Redbird at Target. Then, I use Redbird to pay bills that can’t usually be paid by credit card.

Hi, I am completely new to this, What if i don’t have any bills to pay?can i pay the amount back to my credit card using Red Bird. Also can you tell me if i can buy the gift cards with Citi AAdvantage Platinum Select MasterCard? If not what are my options to Make minimum spend to get Rewards with out getting a cash advance mark on my card

Yes you can pay your credit card bill.

Yes you can buy gift cards with your Citi card.

I decided NOT to do it. It was a forced delivery fee of 8.95 and a $3+ processing charge. There was someplace I think I saw a code to have the processing fee waived so either I would lose $2+ on the whole thing or make $1.00. Again, the stupidest thing I’ve ever seen! If I’m wrong please let me know.

Thanks

The trick is to buy large denomination cards ($2,000) so that the fees become a very small % of the total. That way, you make money on the portal rewards.

[…] My Amex Gift Card Strategy (written prior to the Plastiq promotion) […]

I am totally new to this whole entire gift card deal so this would be my FIRST Time. I am currently being offered a $10 rebate for a $200 purchase on two of my different AMEX cards.(green and a Starwood). It says offer only valid through americanexpress.com/gift. When I go to this portal it says a $200 card will cost be $3.95. So if I buy a card for 203.95-10=193.95 and I would be able to use a $200 card for a net profit to me of $6.05 and earn miles of the one AMEX card I use. Am I reading all of this right? Am I instead suppose to get though one of these rebate portals instead? HELP!!

Is it like the other reply question below?

FrequentMiler says:

June 18, 2015 at 10:16 am

Michelle: The Amex Offers deal is a credit you get on top of the credit card rewards.

1. Enroll your Amex credit card to the offer

2. Use that Amex card to pay for Amex gift cards

3. You’ll get both the $10 credit and whatever credit card rewards your Amex card offers.

Reply

You can do both: sign up for the $10 rebate offer AND go through a portal for additional cash back.

So if im looking at this right. 2000 amex giftcard @ 1.5% is 30-3.95, giving me 26.05 cash back. Then I go to my local 7-11 (Assuming i can use them) and buy 4 x 500 visa vanillas to load redbird @ 4×4.95. So in total I will make 6.25 to liquidate the Amex? This of course doesnt include the shipping as I would have a 3 month free trial @ amex.

No. You are leaving out the cash back portal bonus (tcb frequently at 2.25%) and shorting yourself on the rewards %. There are multiple cash back and rewards cards giving 2% or more. So $2000 Amex gc x 4.25% is $85 minus $4 shipping and $20 to liquidate at 7-11 and you’re clearing more than $60 per Amex card. And most of us buy more than one:)

How do you liquidate at 7-11?

I was just using Jason’s example. I don’t have any 7-11’s near me. I use cvs or Walgreens (buy vanilla gift cards and they load to redbird)

So then to liquidate amex, Walgreens has been sucessful? I’d assume you buy 4 vnc per 2000 amex 3x 500 and 1×480?

Buy 4 $500. Register will auto drain $2K Amex gift card. Then pay the rest with another credit card.

Or I just put $495 on each card. It makes the total for four cards $1999.80. Then you don’t need a second form of payment or have to remember which of your cards are $500 vs. $480

would the codes i see for waived amex gc fees negate the cashback from befrugal or whatever?

nvm

Wow I feel bad for the people who think they made money off this. I bet it ran that smooth every time and max points were everyday right??? Not just once or twice a month?

Amex cut it to $200 bc all of these people were going broke.

[…] My Amex gift card strategy […]