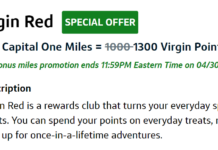

In my crazy quest to get 1.2 million Virgin Atlantic miles for a trip to Richard Branson’s private Necker Island, I previously signed up for four Virgin Atlantic credit cards at once. Thanks mostly to REDbird, I quickly met the spend requirements and earned about 90,000 miles per card. I then signed up for a 150K Amex Business Platinum card offer in May. Since Amex often has 30% to 35% transfer bonuses to Virgin Atlantic, this potentially added over 220,000 Virgin Atlantic miles to the pot. Awesome… I was already about half way there!

In my crazy quest to get 1.2 million Virgin Atlantic miles for a trip to Richard Branson’s private Necker Island, I previously signed up for four Virgin Atlantic credit cards at once. Thanks mostly to REDbird, I quickly met the spend requirements and earned about 90,000 miles per card. I then signed up for a 150K Amex Business Platinum card offer in May. Since Amex often has 30% to 35% transfer bonuses to Virgin Atlantic, this potentially added over 220,000 Virgin Atlantic miles to the pot. Awesome… I was already about half way there!

Then, a month went by with no new influx of Virgin Atlantic miles. I was starting to get itchy for more. I had planned to wait 91+ days before applying for more credit cards. With many banks, that seems to be the magic amount of time that lessens the impact of prior applications. But, I was impatient. In late June, I decided to give it a try early. On the day I went to apply, though, I discovered that the application link was no longer working, so I put it off.

Then, on July 1, MileCards reported a working link to the 75K Virgin Atlantic offer (the offer is advertised as 90K, but I describe it as 75K since the additional 15K is dependent upon an annual big spend bonus). If I had bothered to look at the calendar, I would have waited a few weeks. July 16th would have marked 91 days since my prior applications. Instead, I was reckless and jumped the gun.

Application plan

My plan was as follows:

- Sign up for one card and ensure approval (e.g. call to get approved if not instantly approved)

- If step 1 goes well, then sign up for two cards and call for approval

- If step 2 goes well, then sign up for two more cards and call for approval

Honestly, I probably would have kept going until failure, but as it happened, failure came early….

New BOA approval process

According to the plan, above, I applied for one card. I didn’t receive instant approval, so I called. After a few minutes on the phone I was told that I was approved with a $20K credit line. Score!

Next, I submitted two applications for the same card. I didn’t receive instant approval, so I called. Both applications were denied. I was told that I had opened too many cards in the past 90 days. I waited a while and called a couple more times (sometimes you can get a different answer from a different analyst). I heard the same story from each.

The last person I talked with gave me a bit more information. She said that there has recently been a change to their approval process. She said that they can’t approve a person who has submitted too many applications within the past 90 days. I asked her whether the number of applications were the issue or the number of new accounts, but she said that she couldn’t divulge that much information.

Applications vs. New Accounts

Obviously I should have waited 91 days and I probably then would have been more successful. Now, I’m in a bit of a quandary. I don’t know whether they look primarily at applications or new accounts. If they look primarily at applications, then I’ll have to wait 91 days from my July 1 applications, since they’ll see that I submitted three new applications at that time. If they look primarily at new accounts, I could apply for more as early as July 16th since I then would only have one new account in the past 90 days.

Unfortunately, I’m pretty sure that the rule is based on applications not new accounts. The Bank of America Application Status Center shows all recent applications that have been approved or denied. My bet is that the analysts see the same information… and more. That means that I’ll have to wait until September 30th to apply for more Bank of America cards. That’s quite a setback.

Next steps

After meeting the $12K spend requirement for my new Virgin Atlantic card, I’ll have about 450,000 miles banked. That would leave me 750,000 miles short of Necker Island.

Of course, I could transfer points from Starwood, Chase Ultimate Rewards, Amex Membership Rewards, or Citi ThankYou Rewards. But, should I?

Starwood: Ha. No way. SPG points are far too valuable.

Chase Ultimate Rewards: Again, no way. As with SPG, I value these points too highly.

Amex Membership Rewards: Only with a 30% or higher transfer bonus. I don’t use my Membership Rewards points often, but I like having the option of using them for high value transfers to airline programs. And, I don’t see Virgin Atlantic as a high value transfer. So, I’ll wait and see if/when Amex introduces a new transfer bonus. When that happens, I’ll have a tough decision to make.

Citi ThankYou Rewards: Here’s where I’m having the most trouble deciding what to do. On the one hand, I highly value ThankYou Rewards (especially for the ability to use points for 1.6 cents per point value towards AA flights, thanks to my Prestige card). On the other hand, I’ve found that ThankYou points are incredibly easy to earn thanks to big signup bonuses, great category bonuses, big retention offers, etc.

I need to answer the ThankYou question by August 23rd. As I reported via Quick Deals, Citi is currently offering a 25% transfer bonus to Virgin Atlantic, but the deal ends August 23rd. How many points should I transfer? 600,000 ThankYou points would be enough to complete my mission. But, that’s a huge amount of missed opportunity! 600,000 ThankYou points could be used for $9,600 worth of AA flights. Ouch.

Calculating miles per dollar

With the Virgin Atlantic 90K-ish offer, $12K of spend and the addition of two authorized users results in a total of 93,000 miles. That amounts to an overall earning rate of 7.75 miles per dollar (93K / $12K). In an earlier post, I demonstrated why the Amex Business Platinum offer I signed up for was a better use of my spend. Even without a transfer bonus, the spend required for that card resulted in 8.5 points per dollar. With a 30% transfer bonus, it would be about 11 miles per dollar.

Let’s look at a few Citi ThankYou offers the same way:

Retention bonus: Until mid August, I have an active retention bonus on my Citi Forward card. I’m earning an extra 2 points per dollar for all spend. So, for non-bonus spend, I’m earning 3 points per dollar. If I transfer those points to Virgin Atlantic while the 25% transfer bonus is in place, that will increase my effective earning rate to 3.75 Virgin Atlantic miles per dollar. That’s clearly not as good as the Virgin Atlantic signup offers.

Citi ThankYou Premier / Prestige signup offers: For each of these cards, Citi is currently offering 50,000 points after $3K spend. If that $3K spend doesn’t involve category bonuses, then the cardholder would end up with 53,000 points. If the points were then transferred to Virgin Atlantic while the 25% transfer bonus is in place, the cardholder would end up with 66,250 miles. 66,250 / $3000 = 22 miles per dollar. That’s a pretty fantastic earning rate.

I could sign up for the Citi Premier card myself and the Premier or the Prestige card for my wife. But, I would have to hurry. The transfer bonus ends on August 23rd. I’m not at all sure that I would get the points in time even if I met the spend requirement on day 1. Still, it can never hurt to earn additional ThankYou points!

My plan

At this point, I think I will simply wait until September 30th to apply for additional cards. I have until August 23rd to decide whether to transfer ThankYou points. My leaning right now is not to. Maybe I’ll change my mind by then, though. We’ll see.

[…] REDbird is useless, and portal profits from buying Amex gift cards are a thing of the past. And, signing up for multiple Virgin Atlantic cards has become more difficult too. Today, if one were to find a way to sign up for the same number of cards and the same offers […]

[…] New BOA approval process and a stumble on my way to Necker Island […]

[…] their approval process. I experienced the new process myself when I tried again in July (see: New BOA approval process and a stumble on my way to Necker Island). My wife, though, hasn’t applied for any cards in a while so I knew she could easily get at […]

[…] and ran into their new stricter policy of not approving more than 1 application. Frequent Miler mentioned this the other day as […]

[…] has been shutting down some accounts for this practice and Bank of America is seemingly making it more difficult to get applications approved. It’s possible to sign up for both the business and personal cards on the same day. While […]

[…] Frequent Miler and Doctor of Credit recently wrote about approval issues from Bank of America. I recently converted my Bank of America Alaska Airlines Credit Card to a Bank of America Better Balance Rewards Credit Card and I still have a Bank of America Virgin Atlantic Credit Card open. I will try for another Bank of America Alaska Airlines Credit Card and hopefully I will get automatically approved for the Visa Signature version offering 25,000 Alaska Airlines miles on approval, with a $75 annual fee. The public offer does not have any spending requirements. […]

[…] have been known to merge credit inquiries done in the same day. With that said, they have recently tightened up their policies when it comes to multiple apps, so keep that in […]

[…] New BOA approval process and a stumble on my way to Necker Island by Frequent Miler. Interesting information and read as always. […]

[…] http://frequentmiler.boardingarea.co…necker-island/ […]

As to transferring citi points versus redeeming for AA flights, it seems a little late to be thinking about missed opportunities now – the whole Necker Island idea has a lot of opportunity cost but it is entertaining!

That’s a good way to think about it, but I find it harder to give up the bird in the hand (ThankYou Points I already have).

Or just fly 600,000 miles on Virgin, duh.

LOL

[…] Frequent Miler reports that Bank of America has started limiting the number of applications they’ll approve within 90 days. […]

Just finished my churn, applied for Alaska for the first time:

Alaska Business – under review

Alaska Personal – approved instantly

Virgin Atlantic – declined

Looks like the policy of one personal card is applicable for all BoA cards now and not just one type of card. I churned after Feb since I was refinancing in between so no reason for too many cards / applications.

Did you try calling to get the decline reversed? If so, what did they say?

I think no discussion of this is complete without mentioning the damage that Million Mile Secrets did with his post. But then again, you made a similar post.

There was someone in that blog’s comments who applied for 16 of them in one day and got approved for 14 or so. As long as people use miles for themselves, it’s ok, but when too many start reselling and use it as a means of supplemental income it becomes a problem.

I received a letter from Amex today, saying effective Oct 1 2015, when transferring points from Amex Membership rewards to British Airways and Iberia, the number of Avios you receive will change: for every 250 Membership Rewards you transfer to British Airways Executive Club and Iberia Plus programs, you will receive 200 Avios. This means if you want to transfer to Avios do it before Oct 1.

Yep. I updated the Transfer Partner Master List a while ago with the new info as a note: https://docs.google.com/spreadsheets/d/1M8qx5Y2OTr44R8T0smSEgy3Zsy6E7MMQdtg0hxTzoWU/edit#gid=0

It makes MR a bit less generally valuable for sure.