By Julian, author of Devil’s Advocate…

Update: This post includes offers that were valid at the time of publication, but have since expired. Please click here to see the best offers currently available.

Amex business cards are still a bountiful source for signup bonus points. Unlike the Amex personal cards which are now limited to just one signup bonus per lifetime, the business cards normally only require that you have not held the same card in the last 12 months. This effectively means you can alternate between a new Amex Business Gold and Enhanced Business Platinum (offer expired) card every year and pick up a signup bonus each time.

However, recently there’s been a couple of ways to get those business signup bonuses without any wait between cards at all.

The first option is somewhat recent and I can report about it directly from my own successful personal experience with both Amex Enhanced Business Platinum (offer expired) and Gold card offers. The second option has been discussed a bit on the comments of this blog and elsewhere in the past, but I’m including it here as well for those who might not already know about it.

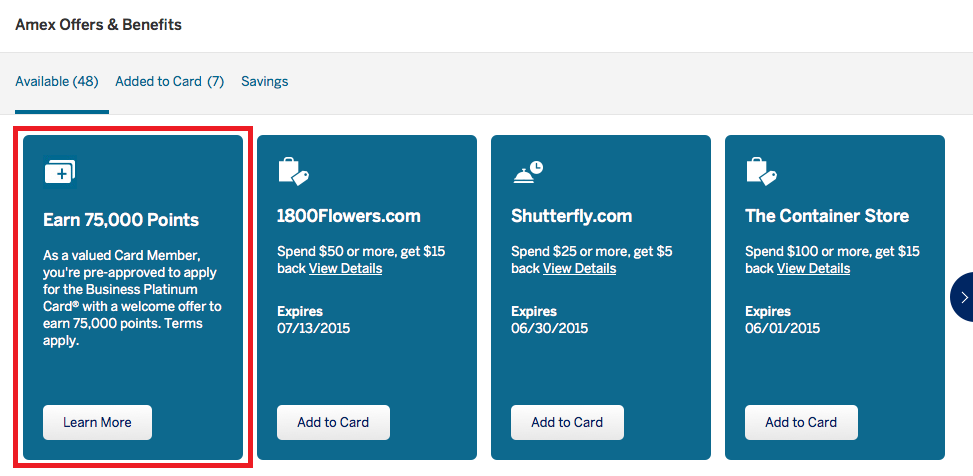

Amex Offers on your online account.

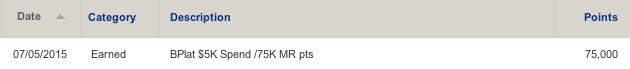

A few months ago Will at Doctor of Credit wrote about a signup offer for the Enhanced Business Platinum card that I had personally found in my Amex Offers. The bonus was 75,000 Membership Rewards points for $5,000 in spend, which was pretty good since the standard offer on that card is 40,000 points. But it was also the first time either of us had seen a targeted offer directly in an existing Amex online account.

The really intriguing part of this particular offer was that even though I had literally just canceled an Amex Enhanced Business Platinum card about 10 days beforehand, this particular targeted offer didn’t include any 12 month language restriction.

I like having an Amex Platinum and I had been considering signing up for the Ameriprise version of the Platinum personal card with 25,000 bonus points (now expired) to get a Platinum back in my wallet. But since I was presented with this particular opportunity and I knew it would be useful to test it out, I went ahead and applied for this Business offer without the 12 month rule, and was instantly approved. Note that I used a different business than my previous Enhanced Business Platinum card (offer expired)(I have several legitimate businesses) but the identical personal information which was already pre-filled in the application from my Amex login.

Some folks felt I wouldn’t get the bonus points regardless of the lack of 12 month language since I had held the identical card just a few weeks before. But I’m pleased to report that, after completing the required spend, the 75,000 bonus points appeared in my account within a day.

So, all’s well that ends well, right?

Except here’s the really interesting part…

A few days after I applied, when I went back into my Amex Offers again, I found another targeted offer. This time it was for an Enhanced Business Gold Rewards card with 75,000 additional Membership Rewards points for another $5,000 spend.

The 75,000 bonus points is the standard offer on the Enhanced Business Gold Rewards card, though it usually requires a $10,000 spend instead of just $5,000. But again, this offer did not have any 12 month restriction for previously holding the same card. In my case it wouldn’t have mattered since I’ve never had this card, but I’m quite certain based on my experience with the Platinum that I would have gotten the bonus regardless.

There’s also the targeted mail offer.

Greg the Frequent Miler has previously written about a way to get yourself targeted for Amex business cards. This is helpful in general because often the best signup offers are the targeted ones. In the last year we’ve seen targeted offers on the Amex Enhanced Business Platinum reach as high as 150,000 points (offer expired) (albeit with a high spend requirement).

Now, if you already have an Amex business card or have had one in the not too distant past, you may have been ignoring these mailed offers even if you received them under the assumption that you wouldn’t qualify for the bonus so soon after previously having the same card. Like many other credit card companies, Amex is not known for being terribly judicious about who is “targeted” by these targeted offers, and it’s entirely possible they might send a targeted offer to someone who isn’t even eligible for the card they’re being targeted for.

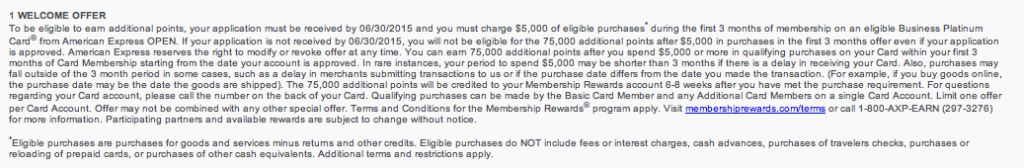

But if you’re fortunate enough to receive one of these targeted offers, it’s extremely important to open it and read the terms and conditions carefully. This is because it’s been reported that targeted Amex business offers in the mail do not always have the 12 month restriction in them.

So if you look carefully through the T&C’s and don’t see the 12 month language or something similar, then guess what — you just hit the jackpot. You should be able to apply for that offer and receive the signup bonus even if you just had the card. Of course, make sure you save all the paperwork so if Amex doesn’t come through with the bonus, you have the terms and conditions in writing to argue with them.

Oh, and one last very important note: when I was speaking at the Ann Arbor Art Fair DO last weekend, I got a report from a fellow attendee who had received a targeted mail offer without a bonus restriction on a personal Amex card. While I believe this is much less common than the business offers, it still demonstrates that it pays to open every one of those mailings from Amex.

Other Recent Posts From The “Bet You Didn’t Know” Series:

3 ways to automate multiple Twitter accounts for Amex Offers

Automatically Register for Only the Amex Offers You Want

How to NOT Break the Walmart MoneyCenter Express

Find all the “Bet You Didn’t Know” posts here.

[…] Amex Platinum Business card and a new 75,000 point bonus without having to wait 12 months (see my “Bet You Didn’t Know” post over at Frequent Miler if you’re wondering how I pulled that […]

[…] your Amex account and scroll down to look at your available Amex Offers. For an example, see: Bet You Didn’t Know: Amex Business Card Apps Without a 12 Month Wait. Personally, I have yet to see one of these offers, but it can’t hurt to […]

[…] In either case (business or personal cards), you may receive a targeted offer by mail or email that does not have the above restrictions. If there is no such language in the fine print terms of your offer, you should be able to receive the signup bonus even if you had the card before (personal cards) or within the past 12 months (business cards). See, for example: Bet You Didn’t Know: Amex Business Card Apps Without a 12 Month Wait. […]

[…] Amex Business Card Apps Without a 12 Month Wait […]

[…] our chat in Ann Arbor, he went on to write over at Frequent Miler about his experience. Julian not only received an offer without the 12 month language, but applied and […]

[…] Amex Business Card Apps Without a 12 Month Wait […]

[…] as known as Devil’s Advocate writing at Frequent Miler, wrote a post about Amex Business card apps & how the 12-month does not have to apply. Very interesting, you bet I didn’t know […]

[…] Update: Julian was able to get the 75,000 points successfully, you can read more about that here. […]

[…] Bet You Didn’t Know: Amex Business Card Apps Without a 12 Month Wait by Frequent Miler. This is really good news, I know I’ll be checking my mail from AmEx more carefully looking for offers without the 12 month language, would be great if I could find a personal offer or two. […]

I definitely concur that you always need to keep copies of the offers without any restricting language. I once applied for a Delta Amex card, did the spend, and then didn’t get the bonus. In my correspondence with Amex, the agent said things like, “We never offer cards like that…” So I sent off the screenshots and got the bonus. But if I hadn’t had them, I would have been out of luck.

Hey Julian, maybe a little off topic, but do you know if the Ameriprise plat is considered a different product from the regular plat, and from the Morgan Stanley plat?

The Ameriprise version is definitely considered different than the regular Plat, but I’m not sure where things stand on the Morgan Stanley version. Originally there was talk that it would be considered the same as a regular Plat, but I don’t know if that’s still the case.

I would hope that the Morgan Stanley version is not the same as the regular platinum since I used to have a Morgan Stanley account and the Platinum card but after canceling the MS account, Amex closed my Plat account per a request from MS (mid year) – since I no longer had an account with MS. The agent I spoke to said I could apply for a personal card with a 40k bonus – but that’s not enough to entice me right now!

I have a similar offer having just cancelled my card a few weeks ago. It popped up on my payment page after I made a payment at the bottom of the page. I accidentally navigated away from the page, and it disappeared; however, it came up again after I tested it by making an additional payment of a few cents.

That’s very interesting — thanks for the data point. I’ll look for that when I make payments!

Jeez, what’s with the haters this morning? Anyways, thanks for posting this Julian. I’ll be on the lookout.

Amex still limits you to 4 cards per account right? business and personal correct? or is it 4 credit cards and 1 charge card?

Yes, it’s an overall 4 card limit for credit cards and includes both personal and business cards. But that does not include charge cards such as the Platinum, and I’ve heard of folks having both 1 personal charge card and 1 business charge card at the same time.

Do you have to close the card before opening the next one or can you have 2 simultaneously?

do the businesses have to be different or can it be the same business? For example, apply with biz 1, open or close the card (depends on your answer to the above question), and then apply with biz 1 again? Or does it have to be biz 2?

For the regular 12 month limit, does it matter if the business uses a Fein? Assuming it has to be 2 separate businesses, can you apply for biz 1 with a Fein/SSN combo and then business 2 with just a SSN (assuming same SSN)?

I personally used two different businesses, but I don’t know that it’s necessarily required. As far as the FEIN’s go, the bonuses are usually tied to the SSN for the person who is personally guaranteeing the card, so I don’t think it particularly matters which EIN you use for the actual business itself.

and do you have to close the 1st card?

The T&C’s don’t technically require it if it’s a non-12 month offer, but I suspect it might be difficult getting approved for a second card while still holding the first. But I haven’t tried it myself yet.