Plastiq is a card-based payment service that allows consumers to use credit cards to pay bills where credit cards are not normally accepted. Common examples include rent, mortgage, tuition, etc.

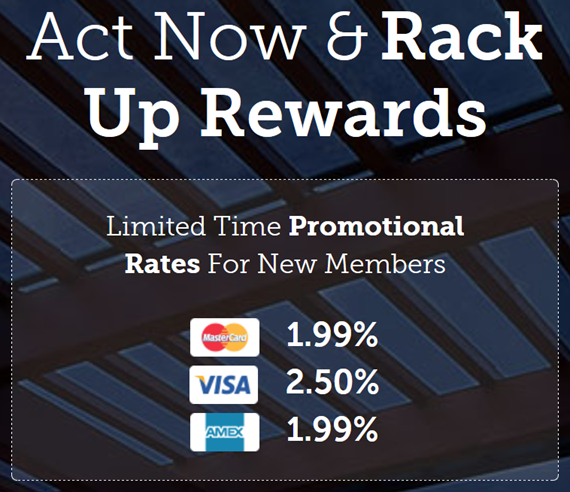

Plastiq usually charges a flat 2.5% fee for this service. That’s already cheaper than most competitors, but for a limited time, Plastiq is offering reduced rates (1.99%) when you pay with American Express or MasterCard.

The only way to get this reduced rate is to sign up for Plastiq via a promotional signup link like this one: plastiq.com/promos/r/FM-1. Once you have signed up for the service using this link, you can browse directly to Plastiq.com to pay bills and you will receive these special rates for as long as the promotion is active.

Important Notes

- To secure these promotional rates, sign up for a new account using this link: plastiq.com/promos/r/FM-1 (or, use a similar link found on another publication)

- If you signed up for Plastiq before this promotion started, you can re-register with a different email address in order to get the promotional rates.

- Once you have signed up for the service using the above link, you can browse directly to Plastiq.com to pay bills and you will receive these special rates for as long as the promotion is active.

- The end date for this promotion has not yet been set. One way to lock in lower rates is to setup recurring payments.

- Plastiq does accept Visa, MasterCard, and Amex gift cards for payment. As with regular credit cards, Visa gift card payments will incur the standard 2.5% fee whereas MasterCard and Amex payments will be charged 1.99%.

- Disclosure: I will earn a $5 referral fee for each person who signs up via the link shown above.

Questions?

Please see: The Complete guide to Plastiq credit card payments.

Never miss a Quick Deal, Subscribe here.

![[Back] Costco offering 10% off Southwest gift cards again Southwest-Gift-Card](https://frequentmiler.com/wp-content/uploads/2023/12/Southwest-Gift-Card-218x150.jpg)

Any promos still going on or is it all at 2.5% again?

No, the promos are over. Everything is 2.5%

Hello FM – Does the promotional rate for new members still apply? What is the link to use ala the Aug. post? Thanks.

No, sorry, the promos are over

I am using Plastiq to pay my mortgage and currently have the 1.99% promotion for paying with MC. The amount of my monthly payment just increased. When I try to change it in Plastiq it tells me the rate will go up to 2.5%. I tried editing just one payment and all future payments. It made no difference. Do I need to make an extra payment every month to compensate or am I doing something wrong?

Thank you for your help.

That’s right. You can’t make changes without the fee being recalculated at current rates. I’d recommend just making a second payment each month.

Ok, thank you for confirming and the quick reply. Great info!

[…] Pay mortgage, rent, and more by credit card. Plastiq offers 1.99% Amex and MasterCard promo rate! […]

[…] Pay mortgage, rent, and more by credit card. Plastiq offers 1.99% Amex and MasterCard promo rate! […]

If you send a check for a payment, does Plastiq update the status from Processed? My card was charged 8/23 and there’s been no record of payment yet at the vendor. Or does it just go from Processed to Paid?

It just shows that the check was sent

Hi,

Is the link no longer available? I get a page that says: “Forbidden

You don’t have permission to access /content/built/landingpages/promo1 on this server.”

Thanks!

Yikes. Thanks for letting me know about this. Plastiq is working on fixing this.

Fixed! Thanks again for the heads-up

[…] Plastiq usually charges a flat 2.5% fee for this service, but thanks to an ongoing promotion (details here) Plastiq has been offering reduced rates (1.99%) when you pay with American Express or […]

Is there anyway I can create a referral url too? I didn’t see anything on plastiq.com (I’ve already signed up through FM)

Sorry, but no. Plastiq setup special links only for a few blogs.

im not getting the 1.99%!!

Please email support@plastiq.com. You should get the 1.99% rate for Amex or MasterCard payments if you signed up with my link.

Plastiq 😀

Question: Am I able to pay my student loan via Plastique? Thanks.

Yes, I believe so

So just to clarify, to really maximize this promotion, you need to have bills that are 2k or higher, otherwise you’re hit with the 1.99% fee for each bill? Any ideas on monthly bills that can be combined to reach 2k? E.g. Some cable/telephone companies let you pre-pay your bills, could it be done with a mortgage? I’ve never tried.

Shannon, you actually cannot send a payment over $2000. You have to pay a fee no matter how much you send. whether it’s $100 or $1000. The promotion is that the fee is reduced to 1.99% rather than the usual 2.5% for AmEx and MC.. (not visa)

The trick is that if you can purchase AmEx Gift cards with your points earning Credit Cards and get 2% rebate from rebate websites like TopCashBack then you can use those AmEx gift cards on Plastiq. Now you are paying your bills (earning credit card points) for practically free.

Oops.. I didn’t write that correctly. You can pay any amount you want with Plastiq but in the conversations above, the are talking about paying with AmEx Gift Cards. It’s just that when you try to pay with a AmEx gift card of $2000, you have to account for the fee for 1.99% charged. So in the case mentioned above you can’t pay $2000 bill because there will be almost $40 in fee and you’ll need a gift card worth $2040.

You can overpay your mortgage, but the bank may apply the overpayment either to your next bill or to the principal. Depending on your situation, one or the other my be preferable. You could ask the bank how they handle overpayments if you need to know ahead of time.

.

Also, if you’re a good record-keeper, you could make smaller payments that don’t use up the entire Amex gift card. You would just have to check with each bill that you’re not going over the total remaining.

I set up a recurring payment but I need to change the dates. The website will not let me. I can only change the dates individually. Anyone else have this problem?

[…] Hat tip to Frequent Miler’s Quick Deals […]