By Julian, author of Devil’s Advocate…

I’m generally a pretty upbeat and happy guy. I like traveling and meeting new people. I like gin. And, yes, I like puppies too.

So I apologize in advance if I sound a little annoyed in today’s post. It’s only because the one thing I can’t stand is when someone tries to take advantage of people by overcharging them for something they could easily get much cheaper. Which is exactly what certain banks are doing nowadays with their international ATM’s.

In fact, just the thought of it makes me so angry… quick, show me something funny so I can get through this.

OK, that helped. Thanks. Let’s do this.

First, a little background…

Other blogs have written in the last few years about Dynamic Currency Conversion (also known as DCC) when it comes to using credit cards overseas. To put it simply, DCC is a complete scam. It involves the merchant offering the “convenience” of billing your credit card in U.S. currency instead of in the local foreign currency. So in other words, if you were paying for a hotel room in Europe, they’d offer to charge your card $115 instead of €100.

Sounds handy, right? Except the merchant doesn’t call attention to the fact that this “convenience” results in a horrid foreign exchange rate, usually several percentage points higher than your home bank would charge for just doing the conversion itself. Even if you used a credit card with foreign transaction fees (usually 3%), your bank would still give you a much better conversion rate than the one charged in Dynamic Currency Conversion.

But here’s the really terrible part: if you do use a card with foreign transaction fees and allow the merchant to bill you in U.S. dollars via DCC, your credit card company will still charge you the 3% foreign transaction fee. So you’ll get stuck with a bad exchange rate and have to pay the credit card company fee as well. Ugggghhhh!

Thank you. That calmed me down for the moment.

Now DCC has filtered down to ATM’s too.

Because credit card companies automatically do currency conversions at (relatively) decent exchange rates, it’s usually easiest to use a no foreign transaction fee card for all your purchases when overseas. But often it’s necessary to have a little bit of cash for small purchases or places that don’t take credit cards.

My general M.O. (that’s Method of Operation, not Money Order) has been to withdraw a small amount of cash when I land at the airport or soon thereafter and use that cash as little as possible while focusing most of my spend on a no foreign transaction fee card. But foreign ATM’s — especially the ones at airports and other transit hubs — have gotten extremely persistent at promoting the DCC ripoff.

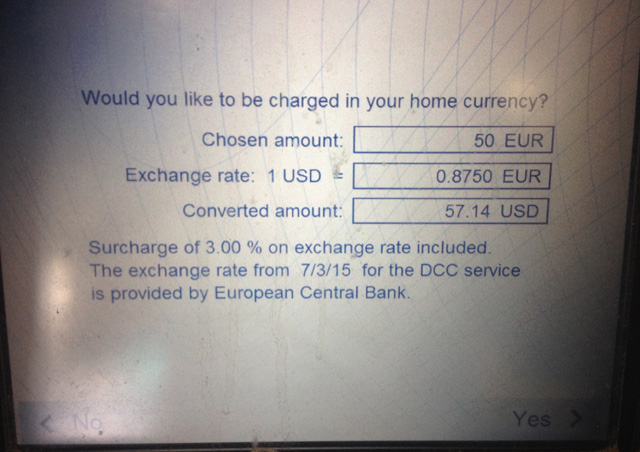

I’ve been to Europe twice in the last 6 months and I’ve noticed the ATM’s there are getting more and more aggressive about trying to trick you out of your money. When I was in Paris, I ran into an ATM at Gare du Nord train station that advertised itself as having “No ATM Withdrawal Fees!” Which was true. Except here’s what it offered me when I tried to withdraw €50 (which would have been about $55 via my bank’s exchange rate in effect at the time)…

Sure, there’s no ATM withdrawal fee… but instead there’s a 3% conversion fee.

Now, you might be thinking to yourself “OK, so if you paid $57 instead of $55, that’d be an extra $2. That’s not such a big deal. It’s about the same as a regular domestic ATM withdrawal fee anyway, right?”

Except that unlike a flat ATM fee, this fee scales upward. The more you take out, the worse it gets.

If I had been taking out €100 instead of €50, the fee would be $4. At €200 it’d be $8. At €300 it’d be a whopping $12 just for the privilege of getting my own cash.

And the DCC at this particular ATM wasn’t even that bad. I ran into one at the Frankfurt Airport that was trying to charge me more than 6% extra for the currency conversion. It was super persistent too. Every time I pressed the button to decline DCC, another screen would pop up asking me if I was sure. And another. And another! Arrrrrghhhh!

Nope, didn’t help this time. I’m too livid. Sorry.

How do you avoid DCC?

Both ATM’s and merchants offer DCC as an option, not a requirement, so the easiest way to avoid DCC is to simply decline it. But you really have to be paying attention to what you’re doing because they’re using every trick in the book to get you to push the wrong button. On that Frankfurt ATM I mentioned above, the button that led to DCC was colored in green while the one that discharged money via the regular conversion process was in red. If you were moving quickly, it would be very easy to push the green button as the obvious choice and get stuck with a stupidly high conversion rate.

Banks and financial institutions have a reputation that is somewhere between cockroaches and Congress, and Dynamic Currency Conversion is a perfect example of why it’s well deserved. So please, avoid Dynamic Currency Conversion at both credit card merchants and ATM’s. Don’t let them take more of your money than absolutely necessary.

Other Recent Posts From The “Bet You Didn’t Know” Series:

Amex Business Card Apps Without a 12 Month Wait

3 ways to automate multiple Twitter accounts for Amex Offers

Automatically Register for Only the Amex Offers You Want

Find all the “Bet You Didn’t Know” posts here.

[…] But since Ryanair knows they’re not going to be able to fee you to death once you buy Business Plus, they do take the opportunity during the checkout process to try and squeeze in one quick unwarranted upcharge. I am speaking of the Dynamic Currency Conversion ripoff, which I’ve written about before. […]

[…] “Avoid Getting Suckered by International ATM’s” (72% of poll respondents learned a new tip) […]

[…] Avoid Getting Suckered by International ATM’s […]

In the UK DCC on credit cards is not too common, but where it is offered it’s designed especially insidiously. For example, if you make a 100 pound purchase, a screen will pop up saying “165 dollars”? The natural inclination is to press “OK”. To pay in pounds you must press “cancel”. This won’t cancel the transaction, but will charge you in pounds.

On the other hand, Switzerland at least implements DCC honestly. You are presented with a choice of “100.00 francs” or “105.53 dollars”, so at least you have all the information needed to make an informed choice.

Julian, like you, DCC brings out the worst in me. I generally treat customer service agents with respect and courtesy, but when an agent lies to me about DCC (or, worse, refuses to accept my explanation about what it really is) I become the devil incarnate. Not a pretty picture….

[…] Bet You Didn’t Know: Avoid Getting Suckered by International ATM’s by Frequent Miler. I haven’t run into an ATM with DCC, but I typically don’t withdraw funds at the airport anyway (I always find they have high surcharges). Very important you avoid DCC, as it’s almost always a complete scam. […]

You are wrong to blame the banks unless it was a bank-owned ATM – it is the ATM owners (and merchants) make the decision to use DCC, not the banks/credit card networks.

The banks and credit card network offers DCC to merchants and ATM owners as an incremental revenue source. However, the merchant need to actively to sign up for it.

This annoys me so much as well! When I first traveled to Europe, I was not aware of DCC and I ended up wasting so much money just to take out some of my money. It’s infuriating because a lot of cashiers won’t even ask you, they just go straight to charging you with DCC. You really have to pay attention and fight your way out of it when you run into those people. I wish there was a way to vote against implementing DCC for travelers.

And ditto on the Charles Schwabb card. They offer the worldwide ATM reimbursement in their fee free, no minimum balance savings account in addition to the checking account. USAA only reimburses ATM fees in the states.

Have experienced many times where they refuse to run the charge in Euros (pesos, whatever). U.S. card, U.S. Dollars. The duty free at the Cancun airport has a nice little racket with this, offsetting that savings on tequila you think you are getting since they refuse to run the charge in pesos.

Just came back from Europe and had experience with cashiers charging DCC rate without asking or even after I said euro. Only realized when I got home since I didn’t double check the receipt. So I guess always specify and double check if you care.

[…] Bet You Didn’t Know: Avoid Getting Suckered by International ATM’s […]

Just got back from Europe (Denmark, Sweden, Croatia, MonteNegro). I noticed DCC most in Sweden. The cashier offered it as a benefit and seemed convinced it would save me money.

Agree with Schwab ATM card. I have a fidelity which works the same way with zero fees. I had to use a BofA ATM card in Monte Negro to convert to euros and on a 300 euro withdrawal was charged 5.00 by BofA plus 10.12 by the foreign bank ATM.

This is a pet peeve over at Loyalty Lobby, too. He’s always complaining about that DCC crap from hotels, restaurants and ATMs. My pet peeve is that my credit union (not even a bank!) will refund ATM fees. But when I withdraw money at foreign ATMs, they don’t split out the fee from the cash withdrawal, so that they don’t have to refund the fee. I went several rounds with them over that and now use Charles Schwab when I travel overseas. They have their issues as well, but at least they refund all the fees.

I have a USAA checking account with a similar ATM fee refund feature and I’ve noticed the same issue as well. And if Loyalty Lobby has been complaining about the same issues with DCC, then at least I know I’m in good company. That guy is a true superstar when it comes to hotels and international travel.

I have been fighting this with European cashiers for years. I’ve found they are instructed to push you to use DCC without knowing why. I’ve also had the problem where they select DCC on my behalf and say USD is the only way to pay since I’m using a U.S. credit card. I always end up holding the line up to argue and I look like the idiot tourist bad guy. I’m glad to hear the annoyance now includes ATM transactions, awesome.