For the past 6 months I’ve been happily earning two extra points per dollar on all purchases with my Citi Forward card. Those two points per dollar were in addition to the 1 to 5 points per dollar the card normally earns (sadly the card is no longer available to new applicants). So, I’ve been earning 7X at restaurants, bookstores (including Amazon.com), and movie theaters, and 3X everywhere else!

The reason I was earning so many points was that I had simply called Citibank to ask about retention offers. You can read the details in this post: How one call led to a points bonanza and rethought plans.

Then, mid August came, and my miraculously awesome Forward card lost its superpowers. It’s still awesome for its 5X categories, but its no longer my go to card for all purchases.

Calling Citi

I called Citibank to see if they would give me another retention offer. We started with my AA Executive card (which I really did need to get rid of before the annual fee became irrevocable). I was offered a lower interest rate. No thanks.

Next card: Prestige. Lower interest rate? No thanks.

Next, Citi Forward. Lower interest rate? Nope.

Then, ThankYou Preferred. Lower interest rate? I’ll pass.

You get the picture. We cycled through all of my cards and the nice phone agent was as surprised as I was that she couldn’t offer me anything useful. But… my wife was nearby… So, I asked the agent if she could check my wife’s cards. With my wife’s permission, she did so…

My wife’s offers

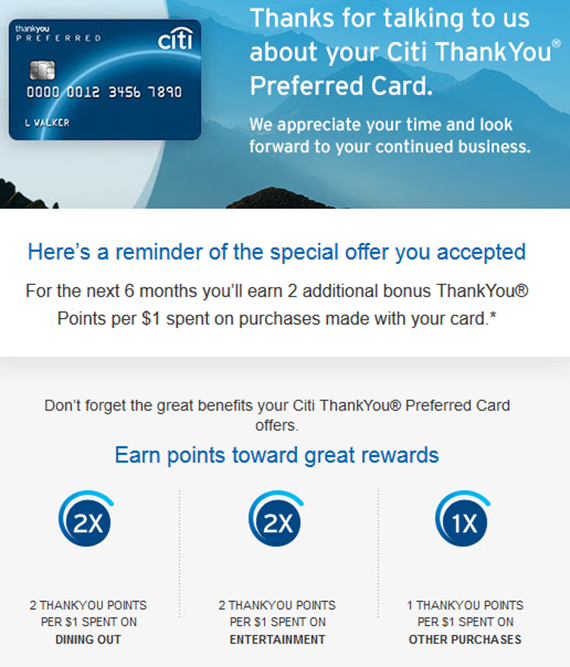

My wife has two ThankYou Preferred cards. For each card she was offered 2 additional points per dollar for six months. Unfortunately, the offers were limited to a 35,000 bonus points each. Still, that’s pretty good! With these two cards, we can easily earn a total of 70,000 points in addition to the points earned by default. Citi even sent helpful reminders via email:

And the fine print states:

*For the next 6 months, starting from the date you’ve accepted this offer, you can earn two additional ThankYou Points per dollar spent on purchases made with this card account. Purchases exclude balance transfers, convenience checks, cash advances, items returned for credit, fees and interest charges. All purchases must be posted during the promotional period. You may earn a maximum of 35,000 additional points with this offer. Points earned under this offer may take up to 2 billing cycles to post to your card account. The account must be open and current to earn and redeem ThankYou Points.

Citi retention dept offered bonus of 15K TY points for $4500/6 months on my TY Preferred card and 15K TY points for $4500/6 months on my Forward card. All this in addition to regular earnings on these cards. Sweet!

So both of these offers yield less than the Forward Card’s base earning. What’s the point? I guess for others who don’t have the forward card that is one thing, but you do, and presumably your wife is an AU on your card.

The Forward card earns 5X only for dining, bookstores, and a few other things. We will continue to use that card for those purchases. For everything else, we can use my wife’s two cards to get 3X instead of 1X that would be offered usually.

I just got zero offers while closing my Citi AA Plat MC. Tried several times – same result. The last agent told me that my acct was not even eligible to be reviewed by the Retention guys. Closed the acct after that news.

I have had no usage on my preferred card. Called cs to inquire and said no bonus offers. Me tinned I’d like to cancel it and was promptly transferred to retention. They offered me 15,000 ty points with 4000 in spend the next 6 months. Also said I was going to close my premier card I just got and was offered 5000 bonus points with 1k in spend. Took both offers.

Great!

So, this begs the question if CC companies refuse a retention bonus do I cancel my cards AND do I do this before or after a planned churn? I’ve acquired over 200K points/miles on my 1st awards acquisition and want to do this on a regular basis (avoiding all possible negative consequences) So far my first churn landed me the Chase Sapphire, Freedom and BA rewards; AMEX SPG, Citi TYP and AAvantage, Hawaiian’s Barclay card and Alaskan’s card. Just looking for experienced churner’s advice. Thanks.

FYI, my credit score had never been higher.

There is some evidence with Barclays that cancelling or lowering your credit limit ahead of time may help. With other banks I prefer to downgrade to no fee cards.

I just called to cancel the Citi Exec AA card. They offered a $50 statement each month, for seven months, as long as we spend $1500 each month. I kept it, and it should essentially make my annual fee $100 instead of $450.

I had 2 extra TY points without any cap for 6 months. I end up racking up 300k TY points in 6 months. Now, I have to figure out how to use TY points.

The Citi rep said that they may get more offers at end of Sep to induce holiday shopping on Citi Card.I will call them again at end of Sep/Oct to check retention offer for me.

Thanks, great suggestion

I’ve gotten a few retention bonuses with Citi since January, and never got an email with details of the offer. Is this new? My most recent bonus was in June. I SM’d Citi to confirm the offer, and they confirmed it. Is the email thing new? Or have others gotten it in the past as well?

Yes, its new

Greg, can you add some data points to my theory on getting retention bonuses?

Does your wife use her Citi Premier card for regular purchases before she called? And are the 3 cards that you called for just used for bonuses?

I think having regular use of the card affects the retention offer. So if you just get the card for the bonus after the minimum spend and not use the card the rest of the year, then I think you would not get as lucrative retention bonus compared to someone who uses the card all the time. I have had much better retention bonuses on the cards that I use regularly but didn’t want to pay the AF than the cards I used for just the sign up bonus and nothing else.

She hasn’t used either of her Preferred cards at all other than to earn the signup bonuses a while ago

So, do you ever have any luck using your TYP at gas stations for OVG cards at 3pts/$ or now 5pt/$ ?? All the gas station clerks I have tried to buy from do not know how to ring up those cards.

Sometimes you just have to teach them how to ring them up… Scan the barcode, swipe the card, enter the amount… LOL. But even then, it’s hit or miss — most gas station cash registers in my area are hard-coded to deny credit cards for the entire transaction if a VGC is being purchased. It’s like they know…!

I called Citi yesterday for my TY Preferred. Offered no retention bonus at all. Same on my Hilton Reserve.