When signing up for a new Chase card, should you add your spouse or other household member as an authorized user? The combination of Chase’s 5/24 rule, Chase’s point transfer rules, and Chase’s signup bonus offers make the answer to this question surprisingly difficult. The point transfer rules and the signup bonuses encourage adding authorized users, but the 5/24 rule discourages it. I’ll explain…

When signing up for a new Chase card, should you add your spouse or other household member as an authorized user? The combination of Chase’s 5/24 rule, Chase’s point transfer rules, and Chase’s signup bonus offers make the answer to this question surprisingly difficult. The point transfer rules and the signup bonuses encourage adding authorized users, but the 5/24 rule discourages it. I’ll explain…

Chase’s 5/24 rule

In the past year or so, Chase has frequently denied applications for certain cards (such as the Sapphire Preferred and Freedom) due to having opened 5 or more credit cards (with any bank) in the past 24 months. That means that anyone who regularly signs up for credit cards in order to earn points & miles is likely to be denied when they try to sign up for these cards. Currently, the 5/24 rule does not apply to co-branded cards (e.g. it does not apply to hotel or airline cards). According to Doctor of Credit, though, the 5/24 rule will be applied to co-branded cards sometime in April 2016.

Regarding authorized users and the 5/24 rule: Chase’s 5/24 rule reportedly includes accounts in which you are an authorized user. For example, if you haven’t signed up for any cards in years, but five people recently added you as an authorized user to their accounts, you might not get approved for a new Chase card due to having 5 or more new accounts in the past 24 months. In other words, the 5/24 rule discourages people from adding authorized users who are likely to apply for new Chase cards in the next 2 years.

Note that the 5/24 rule doesn’t seem to be set in stone. There are plenty of reports of people getting approved for new cards despite having opened 5 or more accounts in the past 24 months. In fact, it happened recently for me: Chase Private Client and Sapphire Preferred 65K.

Chase signup bonuses

Many of Chase’s signup bonus offers include an extra bonus for adding an authorized user. For example, if you sign up for the Marriott 80K offer, you’ll get an extra 7,500 points for adding an authorized user. Similarly, if you signup for the Sapphire Preferred 50K offer, you’ll get an extra 5,000 points for adding an authorized user.

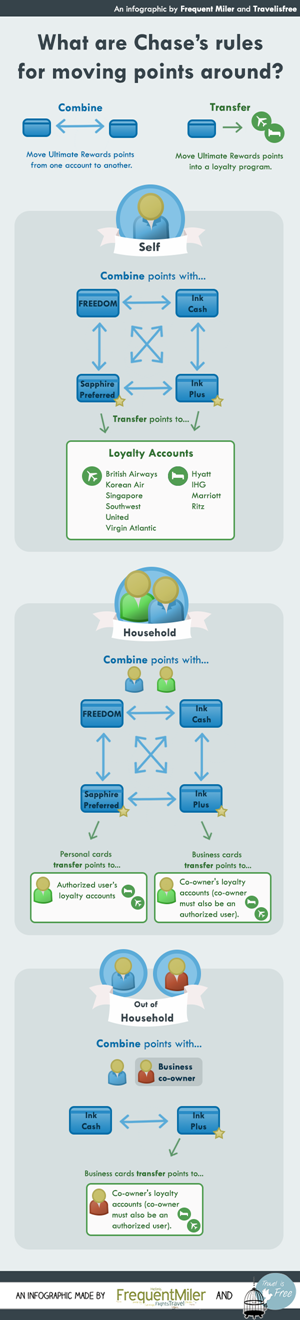

Chase’s point transfer rules

Within a household, you can freely move points from one Chase Ultimate Rewards card to another. However, if you want to transfer points from one person’s Chase account to another person’s loyalty account, then the second person must be an authorized user on the first person’s account. See: Chase point transfer rules made simple [Infographic]

Note that these rules apply only to cards that earn Ultimate Rewards points. Whether or not you can move points from person to person with loyalty accounts (Marriott, Hyatt, United, etc.), depends upon the rules of each specific loyalty program.

What to do when signing up for new Chase cards?

As a general rule, when signing up for new Chase cards, I recommend adding authorized users who are unlikely to sign up for new Chase cards in the next two years. Children are good candidates (I don’t believe that Chase has any minimum age requirements for authorized users), or pick a friend or relative who has no interest in adding new Chase cards to their portfolio (get their permission first, of course). You don’t have to give the authorized user card to this person, you only need it to get extra points with your signup bonus.

What if you’re signing up for an Ultimate Rewards card and you want the ability to move points freely to your spouse’s loyalty accounts? In that case, keep in mind that authorized user cards aren’t the only option. Another option is for each of you to have a premium Ultimate Rewards card (Sapphire Preferred or Ink Plus, for example). This way, since you can freely move points from one person’s account to another within a household, and each person can transfer points to their own loyalty account as needed.

Reasons to add household members as authorized users

In a multi-person household, there are a several reasons why you might want to add each other as authorized users despite the 5/24 rule:

- Share category bonuses: Chase Ink cards offer fixed 5X categories. Chase Freedom offers rotating 5X categories. And, Chase Sapphire Preferred offers 2X travel and dining. If you only have one of each card in the family, it makes sense to add others in the household as authorized users so that they can benefit from those category bonuses.

- Share benefits: The Sapphire Preferred card offers primary rental collision coverage as well as many excellent trip protection benefits. It makes sense, then, for everyone in a household to use the Sapphire Preferred account when booking travel. Sure, each person could have their own Sapphire Preferred card, but then you would be paying more in annual fees than is really needed.

- Point transfers: As described above, there are certain situations where authorized user accounts enable transfers to loyalty programs.

- Help in meeting spend requirements: When trying to put enough spend on a card to earn a signup bonus or to earn a big spend bonus, it makes sense to share the burden across two or more people. This can be easily done by requesting authorized user cards.

For many, I suspect that the advantages of adding authorized users outweigh the disadvantages.

Summary

Chase has rules that both encourage and discourage adding authorized users. If the only reason you want to add an authorized user is to get a bigger signup bonus, then I recommend making sure to add someone who doesn’t plan on applying for Chase cards in the near future. If you need the other person to be an authorized user for other reasons (as shown above), then it’s probably worth doing. Just keep in mind that they might have a harder time applying for new Chase cards in the next two years if this authorized user card pushes them over the “5 accounts in 24 months” barrier.

No, he doesn’t need to add her as an AU. Two people in the same household can combine points. See our guide here:

https://frequentmiler.com/2016/03/08/chase-point-transfer-rules-made-simple-infographic/

In the Ultimate Rewards portal, there is a link under “use points” that says “Combine Points”. If they click there, the process of linking up is pretty straightforward

Thanks for clearing that up, Nick.

A friend of mine only has Freedom and her dad is gonna get the Sapphire Preferred soon. They all have the same address and she doesn’t plan on getting a premium UR earning card anytime soon.

The goal is to combine her points with her dad’s, so he can book. How do you think this can be done? Does he need to add her as an AU at the time he applies?

Thanks!

[…] For more about authorized user cards, please see: The Chase authorized user dilemma for 2 adult households. […]

I just added myself as an authorized user with my nickname and it worked

[…] is probably good for their business and probably has less chance of infuriating customers the way Chase’s 5/24 rule and Amex’s once per lifetime rule […]

[…] Chase has recently tightened their approvals for many of their cards. For some cards they will not approve you if you have opened up 5 or more accounts across all banks during the past 24 months. As far as I know that rule isn’t in place for this card, however it is rumored to be implemented soon. You may also want to consider if it is a good idea to add a spouse or household member as an AU to your account for the extra bonus. You can find more info on that at Frequent Miler. […]

You can always (well, at least for most banks I know) request an AU account be removed from your credit report, after you cancel the AU card.

[…] The Chase authorized user dilemma for 2 adult households – Navigating Chase’s many rules and policies to determine whether it makes sense to add authorized users to your accounts. […]

[…] Chase 5/24 Rule Update – The Authorized User Dilemma […]

[…] FrequentMiler When signing up for a new Chase card, should you add your spouse or other household member as an […]

My mom just applied for the BA Chase card with me as an authorized user. She has applied for 1 credit card in more than 5 years, but she got declined because I have too many credit request on my record. WTF??

Wow, that’s a new one. I’ve never heard that twist before. That really makes no sense.

Ok…I get the point about not wanting to add them as an authorized user for accounts younger than 2 years old…but what about adding them to A) accounts OLDER than 2 years old, or B) to an INK account. This should get around the problem since if you add them to accounts older than 2 years old, it will not show up as a newly added account on the AU credit report. In addition, I’ve NEVER seen an INK BUSINESS card show up on my credit report…especially as an AU. Thus that’s a great option to have if you want to transfer points back and forth…

Good ideas. I don’t know whether newly issued authorized user cards get back dated to the start of the primary cardholders account or if they show up as new. I also don’t have any experience with whether or not Ink business card AUs show up. I’ll take your word for it that they don’t. In that case, yes, it seems like a good solution.

Total newbie here. Got stung by this one. I recently got the Sapphire, UA Exp and RR personal cards and added my wife as an AU on all three. She has two Citi AA in the last two years. I was able to get her the Sapphire, but got shut down on UA Exp and Chase IP because she had “too many cards.” I got her off of my three cards and have been working with TU and Experian to get those off of her reports, but a couple still show up as “Terminated.” Does anyone know if these still count against the 5/24 once their responsibility has removed? This looks like a way for Chase to end doubling up by two cardholder households. And I was just getting started. Bummer.

Freedom’s 5x rotating categories have a limit of $1500 ( Ink’s 5x categories also have a limit though much higher). If there is an authorized user on your account, then your account gets twice the limit? Or the user is ‘sharing’ into the limit?

No, unfortunately the authorized users share the same limit.

I was curious about how many authorized user accounts are really showing up on my credit report. Using credit karma, it’s only showing a couple accounts, when its really more like 5. If people are concerned, just double check these au accounts are showing up.