US Bank has apparently ditched their old FlexPerks Travel Rewards Amex card in favor of a new one. The new card is called “U.S. Bank FlexPerks Gold American Express Card” (hat tip: Doctor of Credit).

The old Amex card

For $49 per year, the old card offered double points for restaurants and cell phone charges; triple points for charitable donations; and double points for gas, grocery, or airline purchases (whichever was most each month).

The new Amex card

Let’s get the bad part out of the way first. This new card comes with a much higher annual fee: $85 not waived first year.

Signup Bonus

Earn 30,000 FlexPoints after $2,000 spend in four months. By today’s standards, $2,000 spend is quite reasonable (the old card required $3,500 spend for 20,000 bonus points). And those 30,000 points are worth up to $600 in airline tickets.

Bonus Categories

The FlexPerks Gold Amex earns at the following rates:

- 3X Restaurants

- 2X Gas Stations

- 2X Airlines

- 1X All Other

Perks

The FlexPerks Gold Amex has the following noteworthy perks:

- One time rebate for TSA PreCheck or Global Entry

- $25 airline allowance with each award travel ticket:

…”Qualified Purchases” are any purchases made with your FlexPerks Gold Card that post to your account under the airline carrier providing your award travel flight between the dates of your award travel flight…

FlexPoints Value

FlexPoints are worth different amounts depending upon how they are used:

- 1 cent per point when redeemed for cash

- 1 cent per point when redeemed for gift cards or merchandise

- 1.7 cents per point when redeemed to pay the card’s annual fee

(exchange 5000 points for $85 annual fee) - Up to 2 cents per point for airfare

- Up to 1.5 cents per point for hotels

- Up to 1.25 cents per point for car rentals

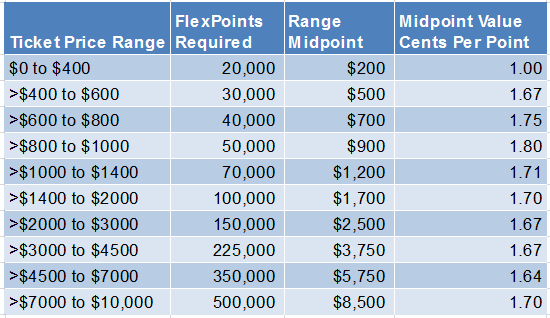

The best value of FlexPoints is to use them to purchase airfare, but not always. FlexPoints flight award rates are based on the ticket price range. For example, any ticket priced at $400 or less can be purchased with 20,000 FlexPoints. At the top of the range, FlexPoints are worth 2 cents each (if you magically find a ticket that prices at exactly $400). Even better, if you use 20,000 points for a $400 ticket and you use your $25 flight allowance, you can get to the theoretical top point value of 2.125 cents per point. At the low end, the values are atrocious. Imagine for example, a super cheap one-way fare for $89. US Bank will still charge 20,000 FlexPoints for that ticket, so the point value will be less than half a cent per point.

The best way to use FlexPoints for flights is to pick and choose the best opportunities. Use FlexPoints when you want to buy flights that are near the top of an award range. More can be found here: Maximizing Value from the U.S Bank FlexPerks Travel Reward Visa Card. Note that if you’re buying tickets for multiple people, they price separately. So, two $200 tickets will price at 40,000 points (20K per person). Just something to keep in mind.

Worst case, let’s say that you use FlexPoints for all of your airfare and that, on average, flights fall in the middle of the FlexPoints award ranges. In that case, we can calculate FlexPoints value:

As you can see from the above chart, with mid-range redemptions, it is usually possible to get 1.67 cents per point value, or better. This doesn’t even include the added value of the $25 airline credit per trip.

Since flight awards usually offer 1.67 cents per point or more value, and other travel rewards offer 1.5 cents per point value, let’s conservatively value FlexPoints at just 1.5 cents each.

Given this conservative value of 1.5 cents per point, let’s look again at the Gold card’s bonus categories:

- 3X Restaurants = 3 x 1.5 = 4.5% rebate towards travel

- 2X Gas Stations = 2 x 1.5 = 3% rebate towards travel

- 2X Airlines= 2 x 1.5 = 3% rebate towards travel

- 1X All Other= 1 x 1.5 = 1.5% rebate towards travel

Many other cards offer better value for gas station purchases (found here). And, many offer equal or better value for airline purchases (found here). However, the FlexPerks Gold Amex is the only card that consistently offers better than 3% value for restaurant purchases (found here) unless you count the US Bank Cash+ card which offers 5% cash back at fast food restaurants only.

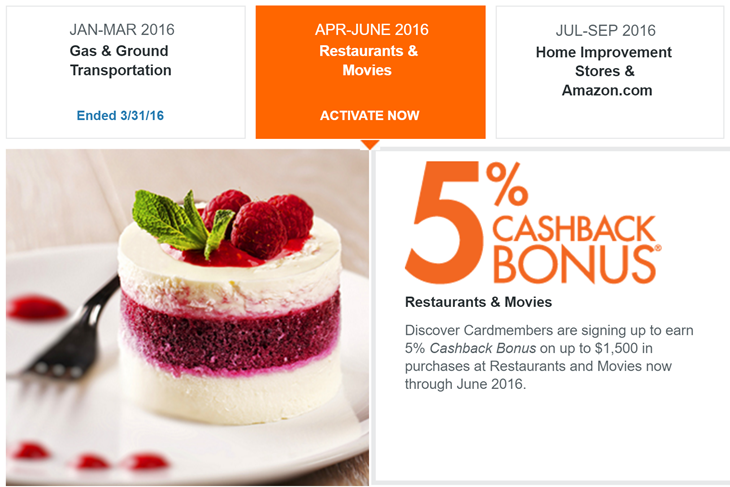

There are, though, some cards that sometimes offer better value at restaurants. For example, the Discover It card offered 5% cash back at restaurants April through June this year:

And, the Chase Freedom card will offer 5X points between July and September:

It is also the case that credit card companies often have targeted offers for cardmembers in which they give bonus points for certain categories of purchases. Restaurants tend to be a popular option.

Compared to the US Bank FlexPerks Travel Rewards Visa

US Bank continues to offer the Visa version of their FlexPerks Travel Rewards card. I happen to really like the Visa version. Let’s compare the two cards:

| FlexPerks Gold Amex | FlexPerks Travel Rewards Visa | |

| Annual Fee | $85 | $49 (waived first year) |

| Signup Bonus | 30K after $2K spend | 20K after $3.5K spend |

| Bonus Categories | 3X Restaurants; 2X Gas Stations and Airlines | 2X cell phone; 3X charity. 2X gas, grocery, or airline purchases (whichever is most each month) |

| Big Spend Bonus | None | 3,500 bonus points with $24K spend per cardmember year |

| Other perks | One time Global Entry rebate | 12 Gogo in-flight wifi passes per year |

The Amex Gold card has a better signup bonus, a better restaurant category bonus, and the one-time Global Entry (or TSA PreCheck) rebate. The Visa card includes a lower annual fee, a 3X charity category bonus, a big spend bonus, and free in-flight wifi passes. Overall, in my opinion, the Visa card is way better than the new Amex card. The only exception would be for those who spend heavily at restaurants.

Summary

The new FlexPerks Gold Amex is a good card to have and hold for anyone who spends heavily on restaurant purchases, but the old Visa FlexPerks card is a better bet for most others. If you’re simply looking for a one time signup bonus (and plan to cancel or downgrade to a fee card after a year), then the Amex card is a very good choice.

Personally, even though I do spend a lot at restaurants, I don’t think the incremental value from this card (vs. others in my wallet) warrants adding another card to the mix.

Both cards can now be found on my Best Offers page.

[…] of the list with an estimated 5.46% rebate on dining. Somewhat surprising, though, is that the US Bank FlexPerks Gold Amex offers an almost identical 5.4% estimated rebate. I had forgotten about that card until […]

[…] cards come in several varieties, including an Amex card. My favorite variety is the FlexPerks Travel Rewards Visa Signature because it is the only one […]

I just received my first statement for this card, and I was quite shocked to discover that a paltry 13% of my dining purchases are in the restaurant category. Oddly, places like Panera qualified, yet more formal places registered as fast food, catering, entertainment, and other variations. One place whose merchant name includes Restaurant even fell under lodging. USB insists they have no control over these categories, and their policy is that they make no exceptions.

Needless to say, I won’t be keeping this card past the first year nor using it very much. The introductory bonus is well worth paying the annual fee IMHO, but that seems to be the best value of the product.

Wow, 13% is a terrible hit rate! I agree with your conclusion: this card is best for its signup bonus, but not to keep. Especially so now that the Chase Sapphire Reserve has come out since it offers 3X dining and travel (and I believe they handle the restaurant bonuses better)

Oh, I’d totally get CSR is I could. It’s gonna be a couple of years. 🙂

[…] fee for FlexPerks Gold American Express card (Redeem 5000 points to offset $85): 1.7 cents per […]

Using Flexperks for hotels is not always/usually a true 1.5. There are thresholds there, as well. It is similar to airfare; possibly because they only allow you to redeem in increments of 10,000. To get top value, it is the same game as with airfare.

Good to know! Thanks!

Can someone who has the card explain how the 1.5 Flexpoints redemption for travel expenses works? Can you credit it directly to your bill for past travel expenses coded as travel, or do have to go through some portal?

You have to log into your account and book travel through their rewards center. Points are deducted at the time that you book the travel.

BTW, my experience with their rewards center has been very good. My wife and I have booked free trips to Scandinavia as well as Australia using these points and the reservations agents have gone far beyond what I had expected to get a price that would “fit” the number of points that I had. Though I am pretty much out of flexpoints right now, I am staying with the card for reasons of their customer service.

Do you think USB will have an Olympics FlexPerk promo like they did 2 years ago? Fingers crossed here.

According to a note I got from USB on Twitter — yes, they will be offering the Olympics promotion this year. There was some language, however, about the offer being for folks who have not had the promotion in the past. We’ll see…..

I have an Avianca card up for renewal and am wondering the best way to transition?

The USB Avianca LifeMiles goes away this month, so it may be converted before there is an AF for you. Is your Avianca card a SIgnature Visa? If so, you should get the bonus I mention above. You should have received a letter (via snail mail).

I paid my AF a few months ago, but I felt it was worth it for the 20K mile anniversary bonus I had.

you had a 20k anniversary bonus???

i don’t remember what mine was but it was way lower sadly. i didn’t renew.

Greg I read somewhere there will be a new Visa and the 3x on charity will be gone – any news on that? And if true any guess how long before they would push the new Visa to existing card holders?

No, I don’t know about that. I hope that doesn’t happen!

I have a USB FlexPerks Amex, but it has no annual fee.

FYI. USB is discontinuing the LifeMiles card. They are automatically issuing a FlexPerks Visa card this month in its place with a 20K bonus for a $500 spend (if you had LifeMiles Visa Signature).

I’ve had the Flex Visa for a while now- and with a big CL and account age I don’t want to cancel- but it’s also not adding much value compared to other options I have. Is there a specific USBank card that you recommend downgrading to? Does USBank even allow downgrading?

If you still have flexpoints, then downgrade to the no-fee version of the card so that you don’t lose the points. Otherwise, a good option is the Cash+ card which has 5% cash back categories and no annual fee. I don’t know if they’ll allow a product change to that though