There are several situations in which you may have Citi ThankYou Rewards points that will expire:

- Points earned by a particular credit card account expire 60 days after cancelling that account. See: Cancelling your Prestige or Premier card? Here’s how to keep your ThankYou points alive.

- Points transferred to your account expire after 90 days.

- Points earned from some credit cards expire in a set amount of time after points were earned (e.g. 3 or 5 years after December 31 of the year in which the points were earned).

- Points earned from some credit cards expire if your credit card account has no purchase activity in 18 months.

- Points earned from Citibank checking accounts expire 3 years after December 31 of the year in which the points were earned.

Full details of the above rules (including which credit cards apply to which rules) can be found here. Fortunately, points earned from the most popular current Citibank credit cards (Prestige, Premier, Preferred, AT&T Access More) do not expire unless you cancel the card or transfer the points (one exception: if you product changed to the Preferred or Premier card from another card, your points may be due to expire if your previous account’s points were of the type that expire).

Pooled accounts do not save your points

It’s important to understand that even though Citi ThankYou Rewards points can be pooled together from several separate accounts, every point is still tracked separately. If you cancel one account, the points earned from that account will still expire even if the points are pooled together with another account that is still open.

How to know if or when your ThankYou points expire

1. log into ThankYou.com

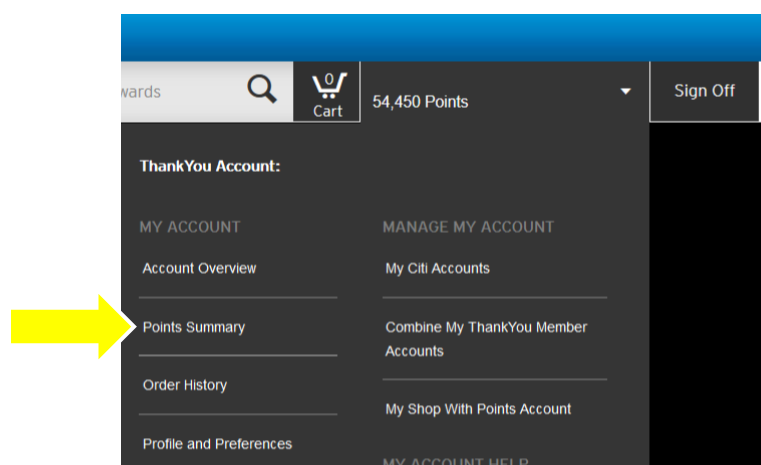

2. Browse to Points Summary

Often, upon logging in you’ll arrive at the Points Summary screen automatically. If not, look for the box near the top right of the screen next to “Sign Off”. Hover your mouse pointer over the downward facing triangle to expose the drop-down menu. Then click Points Summary.

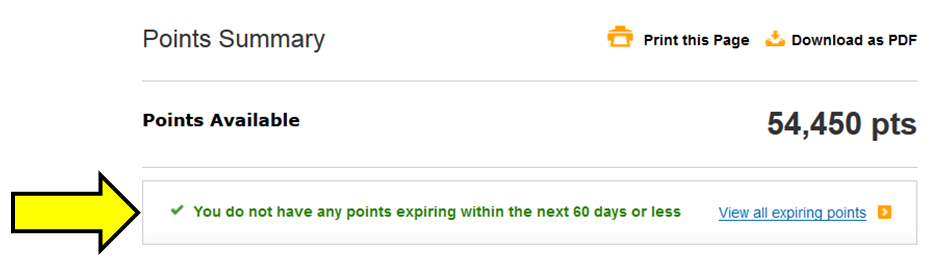

3. Look for link to “View all expiring points”

If you do not have any expiring points, this probably will not appear:

4. Click “View all expiring points”

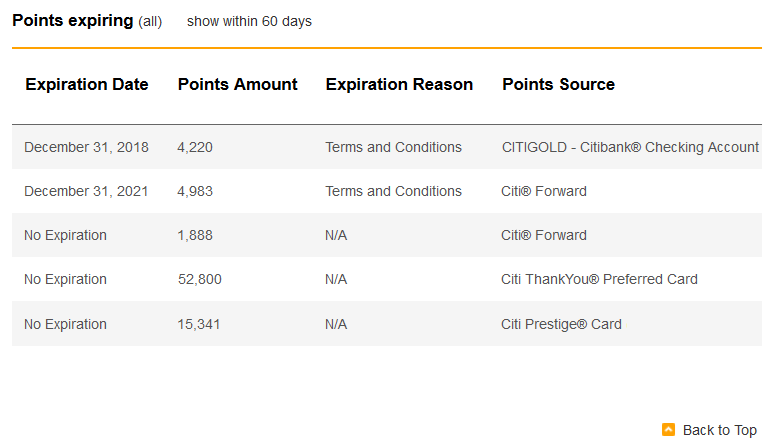

If you find and click the link to view expiring points, then you should see a list of points available from each source along with each expiry date, like this:

UPDATE: According to a couple of readers, If you cancel an account, the earlier expiration might not show up on this screen.

[…] Special Rules for Citi ThankYou Point Expiration […]

I can’t find the expiration anywhere on the new site design. Is it gone?

If you don’t have any expiring points, the site won’t show you.

Oh, thanks!

Sorry to bring up this old thread but I can’t seem to be able to view my expiring points on the TYP website since last week. I use to be able to see it but now nothing listed. And I have a whole bunch of points with expiration. Can you log on to your account and see if you are having the same issue? I feel like I’m going nuts like I’m the only one.

You’re not nuts. I don’t see it either.

Is there anyway I can recover my expired TYP? It’s been 6 months since I closed my account. Thanks.

I expect that it’s too late

Thanks for the info but I am still a bit confused…..I have some TYP under my Citi Forward account expiring 12/2017, and some are still alive till 2021. Since I’ve been using Forward for a long time, now I am considering to change this card to AT&T Access More. I am wondering when will be my TYP expired then. Will all my TYP expire within 90 days after I change my Forward to Access More?

That’s an interesting question. Only older cards had points with expiry dates. I’m not sure what happens if you product change from one of those to a newer card. My guess is that the existing expiry dates will remain as is, but I really don’t know for sure.

[…] regardless of whether or not they have been pooled with other accounts. For more, please see: How to know if or when your ThankYou points expire. As a result of this, pooling has a few serious […]

I had to turn off the popup blocker in Chrome to get the Citi website to work, and it still won’t show me any expiration information. I’ve been a member only since April 2015, so I probably have no upcoming expirations.

Note to Citi: why do you make this so complicated? Your competitors don’t and I’m sure that wins them more customers. Make it simple like AMEX and Chase.

[…] How to know if or when your ThankYou points expire […]

Good point, Mike… keeping the accounts separate would definitely simplify things.

I’ve never been able to discern any benefit whatsoever to account owners of the TY point pooling option. So with no upside, combined with the downside of losing control over points used in redemptions, I don’t know why anyone would ever do it.

some reason I dont see step 3 on 3 accounts. everything else looks like your screenshots. Just dont have the expiration piece.

I don’t see step 3 either.

ditto

🙁

Thank you for the information.

Good post, as this is confusing. In my experience, you can’t rely on what Citi shows as the expiration date for a closed card. After I recently closed my Premier card, it showed an expiration date of June 30, 2019, but the points actually disappeared on June 30, 2016 (60 days after the account was closed).

If you can figure out how Citi decides which points to use when you have a mixture of “taxable” (from checking accounts) and non-taxable (from credit cards), that would be an AWESOME post.

That’s good to know, thanks!

My approach for dealing with taxable points is that I do not combine my checking account rewards with my other rewards (the screenshot was faked to make it look like I did just for illustrative purposes). That way I can choose when to spend those bank points.

Yeah, that would be the best way to manage it, but at least some of the checking account bonus offers seem to be linked to a TYP credit card and post directly to the CC TYP account.

How do you Separate the two?

True, Citi does not update the expiration date of closed cards, but those points will disappear. Also, Citi always uses points in order of expiration date, so I believe the only way to prevent those points from disappearing is to use up all combined points up to the date of the final expiration date of the cancelled card. So if I had points from a Forward card expiring on 12/31/16, 12/31/17, and 12/31/18 and my cancelled card showed points expiring on 11/30/16, 11/30/17, and 11/30/18 then I would redeem all points with an expiration date before 11/30/18. So, in this example, I would redeem everything except the points from the Forward card showing an expiration date of 12/31/18.

By the way, last time I closed a card, I was told by the representative who closed the account hat if I had another Thank You Card account, then I wouldn’t lose my points, but that was not true and those points were lost.

Not sure I follow you. I have multiple typ cards all in the same typ account. I closed the Premier 4/30. My account said points expire 6/30/19 but they vanished 6/30/16. Once the card is canceled, all the points will disappear after 60 days, irrespective of their original expiration dates.

True. But I think if you had redeemed all points (from all accounts) with expiration dates up to and including 6/30/19, then those points would have been redeemed rather than left in the account to disappear.

Maybe someone else can explain it better… it’s definitely complicated…

True. But I think if you had redeemed all points (from all accounts) with expiration dates up to and including 6/30/19, then those points would have been redeemed rather than left in the account to disappear.

And, the points would all need to be redeemed within 60 days of cancelling, so in your case, redemption prior to 6/30.

Maybe someone else can explain it better… it’s definitely complicated…

This is the reason to never combine TY points into one account. If you are ready to make a specific redemption that requires some TY points from a different account, just transfer the number of points needed to the account you want to use for the redemption.

Essentially, there is no way (to my knowledge) to use specific points from a combined account for a redemption. So lets say, you have TY points from a Preferred and a Premier, and you combined them in one TY account. You plan to close the Premier when the first year ends, because its not worth the AF. So during the year you have the Premier, you want to use the points earned with the Premier first, so as to minimize any such points remaining when you close the Premier. I do not believe there is any way to do that in a combined account without cancelling the Premier. I think Citi handles point redemptions pro-rata from the point sources in a combined account when none of the points expire (they do use expiring points first). Since they do use expiring points first, the one way to make sure they use your Premier points is to cancel that card first in order to get the 60 day clock running, and then do the redemption. In that case, Citi will use the Premier points first since they are on the clock. But unless that happens to be near the end of the Premier’s first year, you are forced to give up the rest of the fee-free first year in order to force the use of your premier points first for a redemption. By not combining the TY points initially, you can control which points are used for a redemption.

What is the best way to avoid points from expiring? Assuming one has both Prestige and Citi Checking account, could the checking account points be transferred to a partner airline or used to buy AA tickets?

Checking account points can be used to buy AA tickets at 1.6 cents per point, but cannot be transferred to partners. For details on keeping points from expiring, see: https://frequentmiler.com/2016/07/01/cancelling-your-prestige-or-premier-card-heres-how-to-keep-your-thankyou-points-alive/