Somebody at Amex must have been really pissed that a 100K offer for the Amex Platinum card was erroneously let loose on Reddit back in May. With similar situations in the past Amex has taken down the offer, but fully honored the deal for those who got in on it. This time it was different…

The first indication that something was wrong was from those who earned the bonus right away and then tried to redeem points for airline miles. Many found that their Membership Rewards accounts were frozen while Amex investigated those accounts.

100K Clawback

Later, reports of clawbacks began trickling in. Amex was actively taking back those 100,000 points. They sent letters that stated the following:

We are writing to let you know that, after careful review of your Membership Rewards account activity, we have removed points from your Membership Rewards program account. Please ensure that any Additional Card members who are authorized to redeem points from your account are notified of this change in your Membership Rewards balance.

Why We Are Removing Your Points

We recently noticed point accrual and redemption activity on your Membership Rewards program account that indicates an effort to obtain and use points in a manner that is not appropriate. Please recall that the Membership Rewards program terms and conditions state that “if you attempt to use or obtain points in a fraudulent way, we may:

- Take away all points in your program account,

- Cancel your program account, or

- Cancel any of your American Express Cards”

Your Options

If you have any questions about this letter, or if you believe that the points have been removed in error, please contact us at 1-800-AXP-EARN (1-800-297-3276).

Fact Check: Do the Membership Rewards terms & conditions really say that?

I found the Membership Rewards terms & conditions online here: membershiprewards.com/terms. On that page, I clicked on the tab titled “ADDITIONAL TERMS” and did indeed find the above quoted language. If you attempt to screw with them in a fraudulent way, the terms do indeed say that they have every right to screw you back.

Why the clawbacks?

While I have no inside knowledge of this, it seems to me that someone high-up at Amex has decided to go after the Reddit Churning crowd with a vengeance. People have reported to me the following reasons given by Amex for the clawbacks:

- Manufacturing spend

- Improper returns

- Once per lifetime rule

- Closing the account too early

Each of the above requires a brief explanation:

Manufacturing Spend

Amex doesn’t actually have any explicit rules against manufacturing spend per se, but their new card bonus terms routinely state the following (underlining is mine):

The following charges do NOT count towards the Threshold Amount: fees or interest charges; balance transfers; cash advances; purchases of travelers checks; purchases or reloading of prepaid cards; or purchases of other cash equivalents.

Many manufactured spend techniques involve buying and liquidating Visa or MasterCard gift cards, which are prepaid cards. So, those who met the offer’s $3000 spend requirement by buying gift cards are out of luck. Even though Amex has never enforced these terms before to my knowledge, they have every right to do so now.

Improper Returns

Some people have been known to meet spend requirements by making large refundable purchases and then returning those items after receiving their points. If that is done deliberately, then I’d agree that it was an attempt to obtain points in a fraudulent way.

The problem here, of course, is that returns are often legitimate.

Once per lifetime rule

Some people were told that their points were reclaimed because they had a Platinum card before. The signup bonus terms do indeed state: “Welcome bonus offer not available to applicants who have or have had this product.”

While Amex does usually enforce that rule, they don’t enforce it when you’ve had a different Amex Platinum product before. In several cases, I’ve heard from readers who previously had the Platinum Mercedes card or the Platinum Ameriprise card and were told that their 100K clawbacks were due to having had a “Platinum” card before.

This is a tough one. Amex has never before treated the different Platinum products as the same product, but I can’t think of any rule that would prevent them from doing so if they wanted to.

Closing the account too early

Some credit card churners like to cancel their new cards as soon as they’ve received the signup bonus. If done fast enough, its possible to avoid annual fees this way. Some who did so had their points clawed back.

Personally I’ve never done this. When a card issuer offers a big signup bonus I’ll only take it one if I feel that the signup bonus outweighs the first year annual fee. Then I’ll keep the card for a year before deciding if I want to keep it longer, downgrade it to a no fee card, or cancel it altogether.

My wife got the 100K Clawback despite never qualifying for the 100K offer in the first place

In the post “My 100,000 point Membership Rewards mistake,” I wrote about how my wife signed up for the 100K Platinum offer, but never received the 100,000 points. The reason was that she actually had the personal Platinum card in the past. My records saying otherwise were wrong.

We were surprised when she received a letter identical to the one copied above. “…we have removed points from your Membership Rewards program account.” Uh, what?

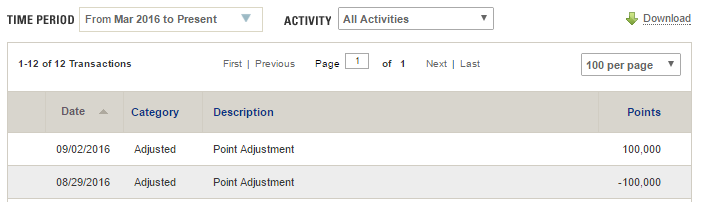

We quickly logged into her account to see what had happened. Apparently they were so hell bent on withdrawing 100,000 points that they did so before checking first to see whether she had ever received them. Luckily, someone or something realized the mistake and quickly put the points back:

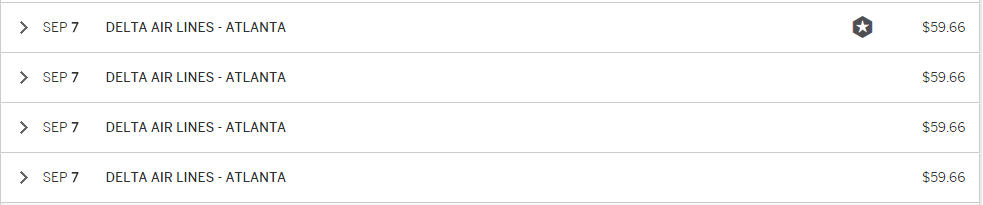

What had my wife done to deserve this clawback? She had not bought any prepaid products with the card. But, we had used her card to pay fees on a number of award tickets:

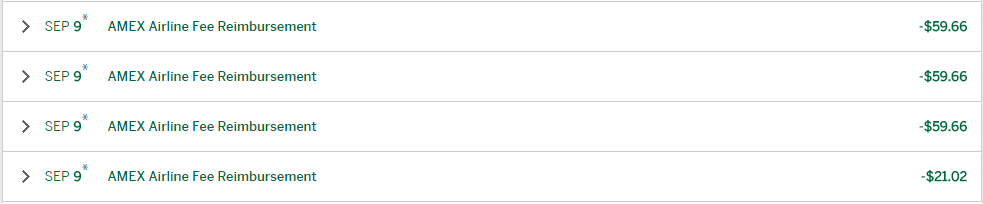

And, since she had picked Delta as her airline of choice, she received her $200 in airline fee credits:

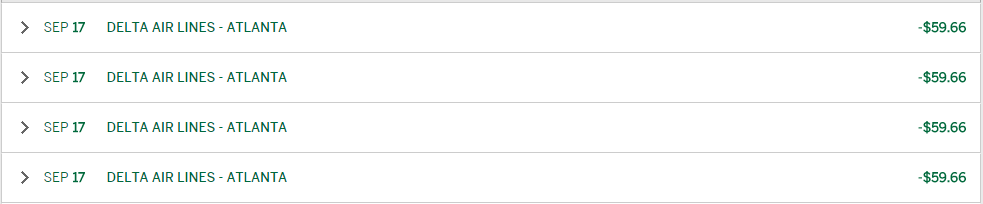

But then we realized that the award flights didn’t work for us after all, so we cancelled them and got a refund from Delta:

I can certainly see why this pattern would appear to be fraudulent. Since they quickly replaced the 100K points, we don’t have any reason to question Amex about this.

What can you do?

If you fulfilled the offer’s spend requirement through means other than purchasing prepaid products or cash equivalents, and if you didn’t do anything fraudulent in obtaining points, then you have every right to those 100,000 points, in my opinion.

I’d recommend the following steps:

- The letter states “if you believe that the points have been removed in error, please contact us at 1-800-AXP-EARN (1-800-297-3276)”. Do that. If necessary, demand to speak to a supervisor. Most likely they’ll open a case for investigation. I think it is worth doing that and giving Amex some time to resolve this on their own.

- If that doesn’t work, submit a claim notice to Amex (found here).

- If that doesn’t work, consider filing a complaint with the Consumer Financial Protection Bureau (CFPB). Their website for filing complaints can be found here: www.consumerfinance.gov/complaint/

- If that doesn’t work, try mediation. Details can be found on the Arbitration tab of the Membership Rewards Terms & Conditions web site.

- If that doesn’t work, try arbitration. Details can be found on the Arbitration tab of the Membership Rewards Terms & Conditions web site.

Reader Experiences

Were your points clawed back? If so, have you had any luck getting them reinstated? Please comment below!

I’m using plastiq to pay my rent, is that consider MS?

No, that’s fine

Thanks! Another question if u don’t mind, I just got spg bus and PRG personal 50k offer, on both I made purchase, met spending requirement 5k & 2k, and before statement closed some purchases were refunded yet Amex deposited the 50k MR & 25k star points? I’m planing on meeting the requirements still but was wondering how come they didn’t account for returns especially it was within the same statement?

I don’t know why, but sometimes they award signup bonus points as soon as you meet the spend without waiting for the statement to close. As long as you do meet the requirements (as you said), you should be fine.

What about purchases from Raise or the other GC reseller sites? Those should be fine right?

I would guess so, but there is risk there since it may be clear that you are purchasing gift cards.

Even if I’m using the GCs to buy inventory to resell for my business?

Yeah, the reason you buy them doesn’t matter. The fact is that Amex’s offer terms always prohibit meeting min spend through prepaid products (i.e. gift cards). They rarely enforce that rule, but its there.

In other words, I don’t think you’ll get clawed back, but Amex would have the right to.

If I’m using my Biz Platinum card to buy stuff on Ebay, what’s the best way to maximize cashback or points bonuses? This card doesn’t bonus any spend really, so the usual office store ebay GC won’t work. And I’m afraid to buy GCs from any of the resellers and face Amex’s wrath.

Within those constraints, I think your best bet is to shop through portals to eBay. You can also watch out for Amex offers for stores that may sell eBay gift cards. I understand your worry, but the gift card restriction only applies to meeting minimum spend for the signup bonus, not for earnings after that.

That’s what I’ve been doing, and it looks like electronics and computer parts isn’t included in the portal CB so looks like I’m not going to get anything. Ebay did do an 8% bucks offer so I got $80 back from purchases yesterday. Hopefully they’ll let me redeem those bucks on an ebay GC like they did a few weeks ago.

[…] did claw back some 100k bonuses recently, but as long as you not doing manufactured spend or trying to cheat in some other way, you […]

Hi Greg,

Is Plastiq safe to meet min spending? Thanks

Yes

Well in my case I got the 100k clawback because I closed my account on Aug 30. BUT the only reason I closed was because my points were frozen and I did about $500 of MS to meet the spend req. I would not take the risk of waiting to see whether Amex would unfroze my points (unlikely given all the FT data points) or not. I’M 100k MR poorer but $375 richer. Fair trade for the crappy way they handled this whole situation.

What happens if you transfer out your MR points to an airline etc to avoid a clawback.

Can they clawback points if they’ve been transferred out already?

I believe that would be safe

Actually in this case you would get -100K points on your account and get charged about 2 cents/point

So you’re saying Amex is going to subtract 100K MR from your account in addition to charging you $2,000? Please explain.

Not additionally, I have read some people reported they got -100K on their account even though they spent the points already, and then Amex would later ask you to pay off the points.

[…] week I told the story of an Amex Platinum 100K offer that has led to many clawbacks. Amex never intended for the offer to go public and so they found every excuse they could to claw […]

My husband and I both had all our points were frozen (but never clawed back). This included the points earned through platinum bonus and points from previous cards and spend. About two-thirds of minimum spend was reached through true spending, and 1/3 from gift cards purchased online. The points were frozen for several months and then unfrozen recently. I’ve transferred all of them to airlines just in case! Scared me to almost lose 500K worth of membership rewards points. From now one will no longer use gift cards to meet minimum spend and will be more judicious about Amex sign-ups.

Mine and my wife’s were clawed back due to purchasing of gift cards. It was done just 3 days before the prorated annual fee change and well after the time where I could complete the min spend in other ways. Really disappointed in how Amex handled this. I won’t be using them anymore as it put a very sour taste in my mouth.

People who say they won’t use Amex again because of the clawbacks just don’t get it. YOU didn’t fire THEM.

Some people also got points clawed back for closing the card “too early” or downgrading it. I’m not sure what “too early” means.

Good point. I’ll throw that into the list

How early is “too early”? I like to keep my cards for awhile, at least for the whole year. I usually keep (and use them) for two or three years, unless they are real expensive.

I could be wrong (it has happened before!) but my guess is that this whole thing is a one-off witch hunt. I don’t think they’re likely to enforce these things in general. Specifically:

1) Buying gift cards has always counted towards minimum spend in the past despite the terms & conditions indicating otherwise. My bet is that it will continue to count (unless Amex has a reason to review your account)

2) I think that we can continue to get signup bonuses on different variants of Platinum cards as long as we haven’t had that exact variation before. For example, if you’ve had the Platinum Mercedes card before, you should still be able to get the signup bonus for the Schwab Platinum card.

Again, these are just my best guesses. Going forward:

1) Regardless of my guesses, it make sense to meet spend requirements with purchases that don’t violate the offer terms.

2) I plan to continue to sign up for Platinum variants until I fail to get a bonus or receive enough evidence from others’ experiences that suggest that Amex has started treated all of the variants as one product.

There are a couple of scattered reports of folks who did NOT signup for the 100k offer who have had similar issues (freezes and/or clawbacks). There is one on FT recently and a couple on Reddit back some weeks ago. I sort of take those datapoints with a grain of salt given the small number so far but I would be less confident than you seem to be about this not expanding. My take is that higher bonus offers will likely draw more scrutiny going forward. I personally will be cautious about singing up for bonus offers that require high levels of spend that I cannot meet organically.

Also Amex appears to have backed off the different flavors of Plat are one product there are several reports (one very well documented report on FT with CFPB responses) where points have been restored after they were clawedback for this reason.

Mine were clawed back – all legit spend with no refunds besides the $200 airline credits. I opened a case as they stated they were clawed back due to refunds.

100k points were credited back about a week later – I had to call a couple times as the case took longer than I was told but all ended well.

mine were clawed back citing “closed too early” was that the reason for you? i did not do MS

Same thing, they said that I closed mine card before yearly payment

Here is a thought. For people who were given the reason of purchasing cash equivalents. Did they still give points for the spend but remove the 100k?

Yes they only removed 100k not the MR earned on spend.

Mine were clawed back 3 days before Amex changed their annual fee policy to no longer pro rate the annual fee. I was able to cancel and receive $375 back. The reason was because I had the MB and Ameriprise previously. When I received the letter it mentioned nothing about the previous cards but gave other BS reasons.

My wife also applied for this card. We transferred her 103k points from her account and then cancelled. She received $337.50 back of her annual fee.

I still have mine. I used some venmo and had an open Ameriprise card when I applied. I continue to put some spend on it. I’m nervous every time I log into my Amex account.