Every year around this time people ask about strategies for earning Delta elite status. What are the best ways to earn the final elite qualifying miles needed for the next level of status?

Background

Delta refers to elite members as “Medallion” members, and they offer 4 public levels of status: Silver Medallion, Gold Medallion, Platinum Medallion, and Diamond Medallion. Each level of Medallion status comes with increasing perks (first class upgrades, fee waivers, upgrade certificates, etc.) as you move up the Medallion ladder. A nearly complete list of Medallion status benefits can be found on Detla’s website, here.

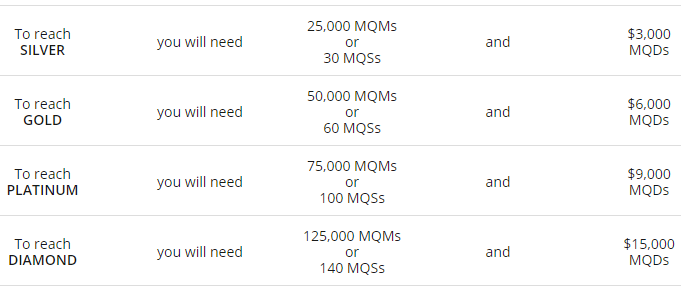

In order to earn elite status, you must earn enough MQMs (Medallion Qualifying Miles) or MQSs (Medallion Qualifying Segments); and MQDs (Medallion Qualifying Dollars). Importantly, you can skirt the MQD requirement by spending $25,000 or more on Delta Amex credit cards within the calendar year. The following chart shows Delta’s current MQM and MQD requirements for each status level:

MQMs are primarily earned through flying, and are usually based on the distance flown. Certain premium fares earn 50% to 100% more (details here). MQMs can also be earned from certain credit card spend, credit card signup offers, or other offers. For example, at the time of this writing, Hilton is offering 250 MQMs for every qualifying 2 night stay for registered members.

Miles vs. MQMs

Most airlines, including Delta, differentiate between redeemable miles and elite qualifying miles. Delta calls the former “Miles” and the latter “MQMs”. Miles are earned based on the price paid for a ticket. MQMs are earned based on miles flown. “Miles” are used to book award flights. “MQMs” are used to reach elite status. Miles never expire (until you do). MQMs must be earned within a calendar year to reach status.

MQM roll-over

If you earn more than 25,000 MQMs in a calendar year and meet the MQD requirements for Silver status, then your extra MQMs beyond those used to reach elite status will roll-over to the next year.

For example, if you earn 49,000 MQMs in year 1 and you meet the MQD requirements for Silver status, you’ll have Silver status for the rest of year 1 and all of year 2, and 24,000 MQMs will roll-over into year 2 — which will make it easy to keep Silver status since you’ll only need 1,000 more MQMs in year 2 to do so. Of course, in year 2, you’ll still have to meet the Silver MQD requirement, or get a MQD waiver from credit card spend.

If you earn 51,000 MQMs in year 1, you’ll have Gold status (assuming you met the MQD requirement), and 2,000 MQMs will roll-over into year 2.

General Strategy

MQD Waiver

Anyone committed to earning Delta elite status year after year should consider carrying either the Delta Platinum American Express card, or the Delta Reserve American Express card. Both offer bonus Miles and MQMs with high spend. Plus, as long as you spend $25,000 or more per calendar year, you’ll earn an MQD waiver. This means that you won’t have to worry about earning MQDs at all. Instead, your status level will be based entirely on earned MQMs.

MQMs Through Spend

The Delta Platinum card offers 10,000 bonus Miles and MQMs after $25,000 in calendar year spend; and another 10,000 bonus Miles and MQMs after $50,000 spend. Similarly, the Delta Reserve card offers 15,000 bonus Miles and MQMs after $30,000 in calendar year spend; and another 15,000 bonus Miles and MQMs after $60,000 spend. Additionally, the MQMs earned through spend on the Reserve card are giftable to others. This makes it possible for high spenders can earn high level Delta elite status through spend alone. For more, see: How to manufacture Delta elite status.

MQMs Through Flights

Since MQMs earned from flights are based on distance flown, and certain fare classes earn bonus MQMs, it is possible to plan your paid trips to maximize MQM earnings. For example, rather than flying the most direct route to your destination, you may be able to find a similarly priced flight that requires a stop at an out-of-the-way airport. While painful, this can significantly increase earned MQMs. Great Circle Mapper is an excellent tool to use to estimate distances of various flight options.

End of Year Strategy

If you are close to earning elite status, the first thing you should do is check on your MQD situation…

1. Check Your MQD Status

Log into your Delta.com account and you should see your current qualifying information on Delta’s home page, like this:

Above is my current status info with Delta. I’ve earned more than enough MQMs for top-tier Diamond status (almost entirely through credit card spend), but not enough MQDs even for Silver status. However, since I spent more than $25,000 on my Delta credit cards, I have an MQD Waiver which made it possible for me to qualify for Diamond status.

If you are not close to $3,000 in MQDs (the amount required for Silver Medallion status) and you can’t get the $25K MQD waiver, then I’d recommend giving up entirely on earning Delta elite status this year.

If you are close to the required MQDs or to a MQD Waiver, and you are close to having the MQMs required for the status level you want, then it may be worth proceeding. If so, make sure you have a plan for reaching the MQD requirement or for spending enough on Delta credit cards to earn an MQD waiver before the end of the year.

2. Consider earning 10K to 40K MQMs through credit card signup bonuses

Update: The signup bonuses listed below have since expired. Please see our Best Offers page for the most updated offers.

Amex is currently offering 70,000 Mile and 10K MQM signup bonuses for their personal and business Delta Platinum cards. Plus, 10K MQM bonuses are standard for their Delta Reserve cards. It is theoretically possible for one person to sign up for all four: 2 personal cards (Platinum and Reserve) and 2 business cards (Platinum and Reserve). Actually, it may be possible to sign up for even more than that if you have multiple businesses, but the exact rules when you go that far are a bit murky.

For a complete analysis of the current Delta Platinum card offer, please see: Should you sign up for the Delta 70K or 50K offers? An in-depth analysis. And, for a review of the Delta Reserve card, please see: An Analysis of the Delta Reserve Credit Card.

Keep in mind that Amex will not give you a signup bonus if you’ve had the exact same card before. However, if you’ve had only the personal Delta Platinum card before, for example, you can still get the bonus for the Delta Reserve card as well as for either or both business cards (Platinum or Reserve).

3. Consider an end of year MQM mileage run

Flights in mid November and December are often pretty cheap as long as you avoid holiday travel. I recommend watching for your closest airports on The Flight Deal or Fare Deal Alert websites. If you use Twitter, then follow both @TheFlightDeal and@FareDealAlert. The goal would be to find cheap, long-distance flights ideally (but not necessarily) to a place that you would be happy to visit.

Another great resource is provided by Rene’s Points. His Mileage Run Deals page focuses specifically on Delta MQM mileage run opportunities.

4. Consider drastically increasing credit card spend

As explained above, high Delta credit card spend can result in an MQD Waiver and in additional MQMs (with the Delta Platinum or Delta Reserve cards). All spend would have to be complete by the end of this year in order to count for this year’s qualifications. Importantly, credit card spend bonuses and Waivers do not roll-over to the next year. So, if you decide to go big with credit card spend, make sure that you’ll reach your spend goals well before January 1.

A few easy ways of increasing spend before the end of the year include:

- Timeshift Spend: With some utilities and other ongoing expenses it may be possible to pre-pay for charges that you know you’ll incur in the future.

- Pay Bills: Obviously if a biller allows Amex credit card payments, that’s a good way to go. If not, consider using a service like Plastiq to pay bills (including things like rent, mortgage, day care, etc.). You will have to pay a fee, but it can be well worth it to reach your spend goals.

- Pay Federal Taxes: Fees start at 1.89% for credit cards. Over-payments, if any, will be refunded after you file your year end taxes. For full details, please see: Top 5 reasons to pay federal taxes with a credit card or gift card.

Miles are NOT MQMs

I covered this at the beginning of the post, but there is so much confusion around this point that it’s worth repeating. “Miles” are used for booking award flights. Your mileage balance has nothing to do with your elite status level. Transferring points from SPG or Membership Rewards to Delta will not affect your elite status level.

Questions?

Have any questions about earning Delta elite status that wasn’t covered in this post? Please comment below.

I’ve been Gold Elite for the past couple of years. I’m going to be about 10000 miles and $1500 short of Platinum Elite status at year’s end. I will be traveling quite a bit in 2018, likely on Delta. I’m wondering if it’s worth taking a quick, long trip to leap into Platinum status.

My guess is that you wouldn’t get $1500 in extra value from Platinum vs Gold but only you could really say. The nice thing about letting your miles roll over is that you’ll more likely hit Platinum naturally in 2018 and that will last thru all of 2019 and Jan 2020

I have recently earned 15,000 MQM’s through the Delta Reserve card (Nov 17) and have 90 days to gift or apply to my account. If I wait the 90 Days, will these MQM’s count as 2018 MQM’s?

(It makes a difference because I am currently at 45,000 and would prefer to roll over 20,000 and go into the new year as Silver than roll over 10,000 miles and go in as Gold)

No, it doesn’t matter when you apply the MQMs. They’ll count as having been earned in 2017 either way. I know this because I’ve tried it before. One option is to trade with a friend that you trust. They must have the Reserve card too. It works like this. You gift your 15K MQMs to them for 2017, then when they earn 15K MQMs in 2018, they gift them to you.

If I buy (and pay for)2 tickets, do I get the MQDs for each ticket? I am $656 and 1309 miles short of silver status and we are planning a trip to Miami or the Dominican Republic. One ticket alone will not get me the $656 (they don’t include fees) but paying for both tickets puts me way over.

No, you only earn MQDs for the one ticket/seat that you fly. Could you buy a more expensive ticket (e.g. comfort plus or first class)?

Hi, I was gold medallion in 2016, with plenty of MQD’s to qualify for 2017, but ended 2016 with 24,600 MQM’s. I got a notice that I needed to send in 200 bucks or I would have zero status in 2017. I had been told that you can only drop one status level from the previous year. Was that a policy that changed?

Delta doesn’t officially offer soft landings (dropping a person just one elite level). Sometimes they proactively do so, but you can’t count on it. In your case, you have a tough decision. If you pay the $200, you’ll get Silver status apparently, but Silver isn’t worth a lot. I’m not sure what I’d do in your situation to be honest.

I spent $27k on my Delta platinum card by 12/20 but the 10k MQMs haven’t posted yet… should I call Delta or Amex?

They will post once your statement closes. If it closes after year end it might take a few days longer than normal.

Hello Greg,

I just received the Platinum Amex with bonus MQM’s. I didn’t realize the rules on the calendar year etc. Will my MQM bonus post right at year end and then disappear in January? Any chance they would allow me to roll them into 2017?

Thanks for the help!

The MQMs from the signup offer are different than the ones from spending $25K. I think (but don’t know for sure) that the MQMs from the signup offer will post for the year in which they are earned. So if you put off spending on the new Platinum card until Jan 1 there’s a good chance that the MQMs will count for 2017.

Greg,

Could you give me some advice?

I am 8 miles short of gold status for 2017. I have been gold or platinum for the past 15 years.

I have the Platinum Delta card and spent $60k to get 30k in MMQ miles + 20k in travel.

The gold desk said there are no waivers for being close to 50k. She suggested purchasing the miles which would cost $500 for 1000 miles.

Any thoughts on how to get the additional 8 miles without purchasing them? It is too late for me to take a mileage run.

Thanks and Happy New Year!

Wow, that’s terrible that you’re that close! Here are two ideas:

1) Go back through the trips you’ve taken in the past year and see if any were re-routed to a more direct route, or had a segment cancelled on you. If so, call Delta and ask for “original routing credit”.

2) Call about your Platinum card and ask if you’ll get a bonus for upgrading to the Reserve card. You may be offered 5K or 10K MQMs. You can always downgrade later and they’ll give you a prorated refund on the annual fee.

It says that I need 1-2 k to get the waiver. Is there a way to know the exact $? It can be 1001 or 1999… Big difference

Do you mean that you need that much spend on the credit card? If so, call Amex to ask for the exact amount.

Hi,

Do you have advice for me? I’m over the MQMs needed for Gold status next year. Regarding MQD’s, I’m a long ways away from the card-spend waiver, but only $33 away on MQDs. I have a flight scheduled but I bought it with award miles. If I buy trip extras like wifi or a seat upgrade, will this count toward my MQDs for that trip, even though it was an award trip? I’m also traveling with my dog and paying $100 to carry him with me, but not sure if that would count either. I’m having trouble finding information on what spending counts toward MQDs and what doesn’t. But I’m SO CLOSE it feels ridiculous not to get the bump.

Pet fees do not count. I asked Rene of Renespoints.com and he said:

A paid upgrade should work fine even from an award ticket. See:

First Class, Delta Comfort+ and Preferred Seats purchases and paid Premium class upgrades, made through a Delta channel (including delta.com, Fly Delta mobile app, Delta Reservations, Delta kiosks, and select Delta airport locations) are included in MQDs

http://www.delta.com/content/www/en_US/skymiles/medallion-program/medallion-qualification-dollars.html

Interesting. The website and the app are both not allowing me from purchasing an upgrade. Do you happen to know if a purchase of internet and mileage boost would count??

No those won’t count. Read the fine print from the link shown above. It says:

All other ancillary purchases or fees including but not limited to checked baggage fees, Priority Boarding, Delta Sky Club® memberships, Wi-Fi passes, in-flight food and beverage purchases, in-flight entertainment, unaccompanied minor fees, pet travel fees, Mileage Booster™ or mileage purchases, ticket change fees, Direct Ticketing Charge (DTC), same-day confirmed or standby fees, Administrative Service Charge (ASC), and External Reissue Charge (ERC), do not count toward earning MQDs.

What a shame. i guess I’ll have to call i and see if they’ll let me purchase an upgrade through an agent.

I am short 1200 MQMS for silver but just hit 25000 with my Delta Amex platinum which is supposed to give me 10000 MQMs mileage boost. My billing closes on 12/16. Will the 10000 MQMs be credited for 2016 do I can keep my silver for next year?

Yes, any MQMs earned from 2016 spend will post to your 2016 MQM total (this would be true even if your statement closed in January). Just make sure you don’t count the annual fee as part of your $25K spend.

Hi, do you know how long it takes after you apply for an amex credit card for the MQMs to post? I’m wondering on 12/2/16 if I’d get the MQMs in time to apply to my status qualification in 2016.

In my case, MQMs posted a few days after I met the minimum spend requirements. So, yes, if you apply now and meet the spend right away, you’ll be good to go for 2016

Greg – i’m in a similar spot, 5K short of diamond, just got an amex delta card and met requirements on spending. My closing date for the card for my first full bill is Jan 3 of ’17 but i did the spend in ’16.

Are you saying you got credit for meeting a new card spend min in ’16 before your Amex statement closing date?

I think that’s my scenario and would give me some comfort it’s going to work same as you… thanks

Yes, I can’t promise that it always works that way, but that’s what happened for me: the MQMs posted after I met the spending, but well before my statement closing date.

I just got off the phone with Amex trying to upgrade to Reserve to get the miles for this year. They said it takes 6 – 8 weeks for the miles to be posted, so if I signed up for the card now, and made a purchase right away, the miles likely wouldn’t count for 2016. (I need 8k to get to Diamond). Does that sound correct to you?

Dan D, No that doesn’t sound right to me. I think that the miles would post right away. That said, I can’t promise!

Thanks for this, very helpful! One question: by end of year I will have the $25K spend, but will not have the MQMs. Knowing that my 75K MQMs will roll over, I’m wondering if my MQD waiver will roll over as well? That way I will only have to get 50K MQMs to receive Diamond?

I’d love to know if this is the case, or if I will have to start my MQD waiver over from scratch next year.

Thanks again!

I’m confused by your question. You send that you have a MQD waiver, but not the MQMs, but you think that 75K MQMs will roll over? How can that be?

My question is basically, if I don’t have enough MQMs but I have an MQD Waiver, will the waiver roll over into the next year? Or is it just MQMs that roll over? Hope that makes sense!

No, the waiver won’t roll over

Hi Greg,

Great site. Right now, I’m about 30,000 MQMs short of Diamond on Delta and am a full-time traveler for a consulting company. I hate the idea of not being Diamond and I have found a way to get there the last 5 years, even though I do mostly east coast travel. I’m embarraed to admit I paid like $k last year for the final 10000MQMs I have maxed out the Amex Platinum Reserve for all 30,000 MQMs.

I’m interested in how I can get 22000+ MQMs in one reasonably priced trip. I’m willing to take a long haul holiday trip (Australia, Brazil ?) – either as mileage run or take the family. I saw a good message board past to connect LAX to EZE on Aeromexico (delta partner) that was fairly cheap ($1200) for good MQM yield, but I can’t recreate even after a couple calls to Delta. I live in Detroit and would really appreciate any advice that you have.

Thanks,

Tim

Tim,

I don’t do butt-in-seat mileage runs anymore, so I’m not aware of the latest and greatest options. Your best bet is to ask Rene, who runs the Delta mileage run deals site: http://renespoints.boardingarea.com/category/mileage-run-deals

I am clear for Gold with both MQD and Card Spend (same category). I am currently short on MQM by 5,400 with at least one NYC-ATL RT planned (but that won’t get me there). Is there are accelerator option for MQM or should I just look for a cheap RT to the West Coast?

No accelerator. Delta usually offers to let you buy MQMs at the end of the year, but prices are crazy high for that.

My recommendations is to either:

1) Look for a cheap RT; or

2) Sign up for the Delta Platinum Amex in order to get 10K MQMs after meeting spend requirements.

It used to be that the spend requirement was waived if you lived outside the US. Is that still the case?

I believe that’s still true.