Gift of College gift cards are now available nationwide. This is great news for those saving for college or paying off college. Thanks to this new development, it is now possible to use a rewards-earning credit card to pay student loans or to save for college.

In Store Availability

As of November 7th 2016, Gift of College gift cards were expected to be available nationwide at Toys R Us and Babies R Us stores. I visited one of each on November 7th and found a huge supply of these gift cards near the Toys R Us checkout counters. Babies R Us didn’t have the cards and the store manager hadn’t heard of them. My point? Depending on where you shop you may or may not have ready access to these cards.

Fees as low as 1.19%

Each card is loadable up to $500. If you load exactly $500 (which I recommend), then the fee is only 1.19% of the card’s value. Many credit cards today offer significantly better than 1.19% rewards, so it’s easy to come out ahead this way!

Credit accepted?

It’s possible that some stores won’t allow credit card payments for these cards, but I had no trouble at my local Toys R Us. There also didn’t appear to be any limit to how many could be purchased at once.

Gift cards accepted?

It used to be possible to buy gift cards at Toys R Us with gift cards. This was great for those who bought Toys R Us gift cards at a discount. Unfortunately, they have since limited some types of gift card purchases.

When I asked if credit cards were accepted, the cashier I bought the Gift of College gift cards from told me that credit cards were fine, but not Toys R Us gift cards. If I had one on hand I would have tested that theory since it’s rare for store employees to know what works and what doesn’t. Still, my bet is that it won’t work.

Meanwhile, I’m sure that Amex, MasterCard, and Visa gift cards would work fine, but I didn’t test those either.

The online option: Fees as low as 3%

If you don’t have a Toys or Babies R Us store nearby, or you find they’re not stocked with gift cards, another option is to buy Gift of College gift cards online directly from Gift of College. Online, they currently limit each gift card to $200 max. That results in a fee of just under 3%.

In my experience, Gift of College gift cards purchased online code as charitable donations. If you have a credit card that offers a category bonus for charitable donations, then it may be worth paying more in fees in order to earn higher rewards. NOTE: While these purchases are coded by the Visa network as charitable donations, that does not mean that you can claim these as charitable donations on your taxes!

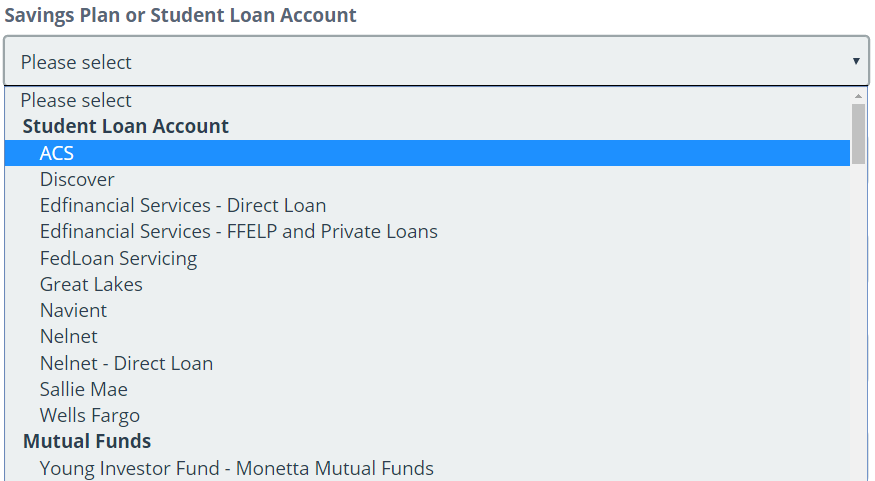

Will this work with your student loan or college savings plan?

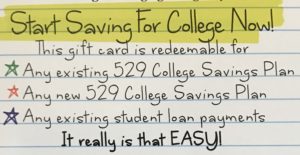

The gift card itself claims that it works with:

The gift card itself claims that it works with:

- Any existing 529 College Savings Plan

- Any new 529 College Savings Plan

- Any existing student loan payments

But, personally, I wouldn’t risk buying these gift cards until I was certain. Fortunately, it’s easy to check whether your loan or 529 plan is supported. Simply create a free Gift of College account and attempt to add your loan or savings plan. If you find your loan or plan and can add it successfully to your account, you should be good to go.

Applying the funds

After buying these gift cards, you can apply the funds to your loan or savings plan as follows:

- Log into your Gift of College account

- Click “Redeem Gift Card“

- Enter the gift card number and 4 digit PIN

How long does it take?

In my experience, it took 7 to 10 days after redeeming Gift of College gift cards for the funds to appear in my son’s account. With my first gift card redemption, funds showed up in my son’s 529 plan 10 days later. On two subsequent redemptions, funds showed up 7 days later.

Gift of College’s FAQ states that funds can take up to 14 days before showing up on plan statements.

Which credit cards are worth using?

- Any new card that requires minimum spend in order to earn a big signup bonus.

- Any card in which you want to earn a big spend bonus.

- Any card that earns better than 1.19% value in rewards, such as:

- Discover It Miles: First year cash back is doubled, making it effectively a 3% cash back card for the first year

- Chase Freedom Unlimited: Earns 1.5 Ultimate Rewards points per dollar. Pair with the Sapphire Reserve to make points more valuable.

- Amex Everyday Preferred which earns a 50% bonus in points each billing cycle in which it is used 30 times or more.

- Citi Double Cash: 2% cash back

- Barclaycard Arrival Plus: 2X miles

- Any card that offers a bonus for charitable spend (when ordering gift cards online) and results in better than 3% rewards:

- US Bank FlexPerks Visa: 3X points for charitable contributions

- US Bank Cash+: Charity is usually an optional 5% cash back category

Please find most of the cards mentioned above on my Best Credit Card Offers page.

![[Update: Fixed] Gift of College limiting loads to $2K per day a gift card and a card](https://frequentmiler.com/wp-content/uploads/2016/11/Gift-of-College-Gift-Card-e1496848035418.jpg)

Really curious how Amex views the direct contribution to a 529 plan option on the GoC webpage (as opposed to buying GoC GCs). I dont want to rock the boat with Amex, but the opportunity to hit minimum spend and fund a 529 is super enticing. Any ideas of Amex will look at this as MSing on a BBP?

I just discovered this and have 2 questions….

Comment Deleted

[…] Gift of College 是一種可以用來儲值到 529 Plan 的儲值卡,也可以用來繳學貸。而對點數里程玩家來說最重要的就是 GoC 的卡可以用信用卡購買,藉此增加信用卡消費金額滿足開卡禮或賺取點數。 自從 ToysRUs 結束營業開始,能夠買到 GoC 卡的地方又大幅減少,現在它們開始跟 Barnes & Noble 我樂觀其成。 有興趣了解 Gift of College 的人可以參考 FrequentMiler 寫的介紹。 […]

[…] of $25-$200. In mid October these cards will be available at all Barnes & Noble stores. Frequent Miler has a good post on why these cards are useful. These still have a purchase fee of $5.95, so they aren’t as useful as the cards that can be […]

[…] of $25-$200. In mid October these cards will be available at all Barnes & Noble stores. Frequent Miler has a good post on why these cards are useful. These still have a purchase fee of $5.95, so they aren’t as useful as the cards that can be […]

[…] You can not pay student loans directly with a credit card. However, we can get around this with the Ultimate hack. Buy Gift of College Giftcards at Toys R Us, Babies R Us (update 3/22/18 no longer available due […]

[…] in another retail store or will offer us fee free gift cards online with a category bonus. Read Frequent Miler’s gift of college post if you need a […]

just recently opened an account with GOC and they limit the online buying to 200$. Was thinking of buying 25 200$ gift cards and applying it my student loan and getting the sign on bonus. Whats everyones opinion on that?

You’d be better off getting $500 cards at Toys R Us — you’ll pay much less in fees. As far as getting a signup bonus, keep in mind that Amex has clawed back signup bonuses from people who have bought large amounts of gift cards. I haven’t heard of that happening with Gift of College cards, but YMMV — it’s something to keep in mind.

subscribed

subscribed

subscribed

Do you know when Bestbuy will sell those cards?

We don’t. It keeps getting pushed back. The minute we find out, we’ll certainly post about it and update this and comment here.

I wonder if my amex spg would clawback this if I buy bunch of this gift card?

You’re probably safe if you stay under maybe $3K per month. I’m just guessing here.

Deposited $500 on 8/27/2017, no fund on 529 plan yet as of 9/10/2017. 10 business days already. This is my first time using this service.

Write to them. They sent an ACH (they said they were testing it) to my state fund (CT) and the state returned it to them saying they were not ready and could not find my account :), they then had to send a check out. all this took about 26 days between my submission and it finally hitting my 529 account

Labor day wasn’t a business day. In my experience, it’s closer to 16-18 calendar days.

Thanks for DP. I will wait another week and see how it goes.

$500 posted on 9/12, excluding holiday in the middle, it has been 11 business days.