Note: This offer has expired.

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

The current 100,000 point signup offer for The Enhanced Business Platinum Card from American Express OPEN is set to expire on January 25th. My wife signed up yesterday. We had intended to do the application earlier in the month, but time slipped away. You know how that goes. We realized yesterday that time is running out to eke out the most value possible from the first year of card membership, so we jumped on it.

The Business Platinum card has many great benefits, but I’ll point out four that are of particular interest to us at the moment. Except for the airline fee credits, each of these are unique to the Business Platinum card (i.e. they are not benefits of the consumer Platinum card):

- 50% bonus on points earned for purchases of $5,000 or more.

- 50% rebate on points used to book flights with your preferred airline (or with any airline for business or first class).

- 10 Gogo in-flight Wi-Fi passes per year.

- $200 in airline fee credits per year.

Chances are good that my wife will cancel this card when the annual fee comes due 12 months from now. In the meantime, we want to get as much value from the card as possible. That begins with the signup bonus…

$15K Minimum Spend

To get the full 100,000 point signup bonus, it’s necessary to spend $15,000 in 3 months (new cardholders earn 50K points after $5K spend, plus 50K additional points after $10K more spend in 3 months). That’s a huge spend requirement.

There are many ways to meet that spend requirement (see: Increase credit card spend (and get most of it back). What still works?), but the ideal approach is to avoid purchasing gift cards. Amex’s terms state that prepaid cards (i.e. gift cards) are not qualifying purchases. See: How to avoid Amex Clawbacks.

Also, we would ideally make purchases of $5,000 or more in order to earn 1.5 points per dollar for those purchases. Suppose, for example, we had a very large federal tax bill. In that case, we could pay our taxes by credit card with a 1.87% fee.

Here’s how it could work:

- Pay $14,730 in taxes with the Business Platinum card

- Pay 1.87% in fees = $275.45

We would earn 1.5 points per dollar on the tax payment and 1 point per dollar on the fees (which are usually charged separately):

- Points earned on taxes: 14730 x 1.5 = 22,095

- Points earned on fees: 275

The above payments would be enough to trigger the full 100,000 point signup bonus. So, in total, we would end up with over 122,000 points.

50% Airline Bonus: 122,000 points = up to $2,440 in flights

The Business Platinum card’s 50% Airline Bonus works like this: Use points at 1 cent per point value to book a flight with your preferred airline (or with any airline if you book business or first class). You will then automatically get 50% of the points back. So, a $1,000 flight would cost 100,000 points, but you’d get 50,000 points back.

The downside is that you need to have twice as many points to begin with as you’ll ultimately use, but this is unquestionably a great use of points.

You can read more here: Amex 50% bonus is a (minor) game changer . Here’s why…

10 Gogo Wifi Passes

The Business Platinum card’s Gogo Passes are special because they can be used for international travel. My wife has plans for at least three trips to Europe in 2017, so those passes will come in handy. And, since her first flight will be fairly early in January, it was helpful to get the card now.

Up to $200 $600 in Airline Fee Credits

We may find that the Business Platinum card’s many great perks will make it worth keeping (see: Your Platinum Card arrived. Here’s what to do next…). But, if we decide not to keep it past one year, we can walk away $600 in airline fee credits richer, thanks to signing up in December…

The trick is to earn $200 in credit in December when the card arrives. Then earn $200 in credits in 2017. Then, finally, earn $200 in credits in January 2018. Once the second annual fee comes due, we can cancel the card. If we pay the second annual fee, we’ll have about 30 more days to cancel and get our money back. If we wait longer, we could downgrade to a $95 Green card so as to get the prorated difference back.

OK, great, but how do we make sure we get the card in time?

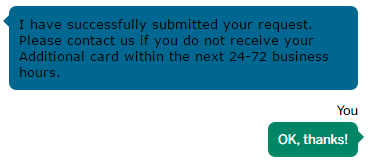

According to Travel With Grant, Amex won’t expedite new business cards for the primary user, but they will expedite employee cards. See: Need to Expedite a New AMEX Card? Add Yourself as an Authorized User / Employee. Weird. So, rather than asking to expedite her new card, my wife simply opened a chat session to request an expedited employee card in my name. Employee Platinum cards would cost $300 each per year, but it’s possible to add employee Green cards for free. And, spend on the Green card would apply to the minimum spend requirement on my wife’s Platinum card. Go Green! Done and done.

The new Green employee card should arrive today or tomorrow. We will then pick a preferred airline and earn $200 in airline fee credits before December 31st. See: Amex airline fee reimbursements. What still works?

Summary

My wife’s single application for The Enhanced Business Platinum Card from American Express OPEN should lead to over $3,000 worth of travel ($2,440 from points + $600 from airline fee credits). Our costs will include $450 for the first year annual fee plus about $300 in processing fees if we use the card to pay taxes (in order to meet minimum spend). We can look at this as earning a 75% discount on up to $3,000 worth of flights. And, this doesn’t even account for the card’s many valuable perks (Gogo Wi-Fi, hotel and car rental elite status, club lounge access, etc.). Not bad. Not bad at all.

Just to clarify, green employee cards get global entry/TSA fee waived??

I’m not sure

Quick update:

1. airline fees paid with the employee Green card DID get reimbursed and counted towards the total $200 (in other words, as expected, you do not get another $200 per employee card).

2. The airline fee paid through Amex Checkout before my wife’s card arrived DID get reimbursed as expected.

applied 12/28, card in hand 12/29, used the card immediately for the 200$ airline credit. The charge is currently ‘pending’.

Does anyone know if it will still be counted in the 2016 credit even if it doesn’t post until say Jan 3? Or would this be counted in the 2017 credit?

Thanks

Yes it will count for the date of the charge (2016), not when it finally shows no longer pending.

[…] off. It might even be possible to still do this if you apply for a card today, assuming you can get a card expedited to you. We’re talking overnight shipping (or two-day) to ensure you can get the card, activate it, and […]

Did that employee card require a SSN?

Yes

[…] $200 statement credits in the first year of card membership. Full details can be found here: Why we rushed to apply for the 100K Business Platinum offer before the end of the year. Also, please see my theory on how it may be possible to earn this year’s airline fee […]

Is anyone having issues buying giftcards from mpx today? All my purchases keep on “failing”.

Greg, when I applied for the Biz Plat, I was not logged in to my AMEX account. Currently, my AMEX login does not show the Biz Plat card. I tried checking out from Newegg via AMEX Checkout, the Biz Plat card isn’t available.

My card did not show up on my account until after I received and registered the card. And even then it did not show up, even after trying to add the card. I had to call for assistance, log out and log back in for the card to finally appear.

On another note – I booked a business class flight looking for the 50% reimbursement. But when I went to “pay” you need to select a card for ID purposes, and only my personal card was showing. When I called Amex I was told that you must select the business card in this step in order to get the 50% rebate, and you need to add the card to your account in Amex Travel. The charge posts as a real charge to United and then several days later the charge is paid off with points applied to the card as payment. I was also told this charge would earn points and count towards my minimum spend requirement. Time will tell!

I applied and was approved for my Business Plat on Sunday 12/18 night and called the next day to have it expedited. Like others, I was told that once it’s approved, it can’t be expedited. The automated machine said I would get the card on 1/2/17, but the first line agent said I would get it by 12/29 at the latest. I asked to speak to customer service for new cards, and that agent told me business cards come in 2-3 business days. I’ve read a few people above say they got it in a couple days without AU trick, but are others getting their cards >1 week after application?

Dave, can you try the amex checkout process I described above? I’d love to get more data points on whether this is works

All: I just found something very interesting!

When my wife’s card was approved she immediately added it to her online account (or maybe she logged into her account when applying — I don’t remember). The point is, the card that she doesn’t yet have appeared in her account right from the get-go. This is interesting because Amex Checkout works without having the card in-hand. We just tested paying an award fee with her card through Delta.com and it worked. The point is that it may be possible to get the $200 reimbursement even if you don’t sign up until the very end of the year. And you don’t have to order an employee card.

Here are the steps:

1. Make sure that your preferred airline offers Amex Checkout as an option. I know Delta does, but I don’t know about others.

2. Make sure that your new Platinum card appears in your online account

3. When logged into your account, go to the Benefits tab and select your preferred airline for the $200 airline incidental fees.

4. Spend $200 with that airline on things that will be reimbursed (e.g. gift cards, award booking fees, etc. See my related post for details). Checkout with Amex Checkout.

5. Report back here whether it appears to have worked (and again once you get the $200 rebate). Let us know if you had to do anything different than I listed here and which airline you chose, and what you bought.

Related post: https://frequentmiler.com/2016/12/14/amex-airline-fee-reimbursements/

I didn’t get the AMEX checkout option when trying to buy gcs at Delta, only credit card options were available.

Alison not seeing Amex checkout there, not on Amex checkouts site as well.

My employee card just arrived today (4 days after asking for expedited delivery). Things must be going slower than usual for the holidays. No sign of the primary card yet. I’ll spend over $200 today on airline incidentals and see if the account gets credited. I’ll report back.

For those who were successful adding an employee card soon after you applied for the platinum, how did you go through the process? I’ve tried several different calls and chats – and AMEX is not able to issue an employee card to me unless I have the primary card at hand to provide them the 4 digit number. Please help. Thank you!

I did not add an employee card and I received my card within 48 hrs.

I don’t understand how an expedited employee Green card helps with earning the $200 airline incidental fee reimbursement before the end of 2016. The Green card does not qualify for that benefit, so why would any airline gift card purchases made with it (it will have a different card number) count towards the $200?

I think that since the charges apply to the account overall, it will still work. I’ll find out soon and will report back.

I just got an email with this offer: spend $10K, get 100K points. So I applied and got instant approval. Hoping to get it right away to still get the $200 travel credit in time. I am thinking that I might get the card on Dec 24 hopefully, do the spend on that day and get the credits 4 days later which is the 28th. I think I still have time!

If you are paying $14k in taxes you are “probably” paying a tax penalty as well. How much is that penalty and did you subtract that from the “rewards”.

There are many reasonable scenarios in which one has a 5 figure tax bills with no penalties.

I pay $15,000 in estimated taxes every quarter – 10K in federal and 5K in state. There’s no penalty for paying estimated quarterly taxes that high.

As others have said, there are many reasons why someone may be paying a lot in taxes, including simply lending uncle sam money that will be paid back later. I am not paying a penalty.