Hilton has rolled out their new single-H Hilton Honors program. In addition to dropping the old double-H (the old program was called “HHonors”), the new program has ditched the hotel category system, introduced a new points & money scheme in which you pick how many points you want to apply to any award, and will soon allow members to freely share points with each other (via “pooling points”).

When I last wrote about the new program (see: My take on the new World of Hilton Honors), I noted that the new category-free approach and the new points and money scheme meant that opportunities for getting outsized value from your points would become rare. Now, the results are in. Was I right?

A Chinese website has collected data for all of the Hilton hotels worldwide, for a period of 150 days, and has setup a page for viewing the results: http://www.yeekapp.com/ruanwen/pointsValueEvaluation. There isn’t much information there to help interpret the information. Luckily, US Credit Card Guide has published a summary. And, even better (for many of my readers), it is posted in English. See: Big Data: How Did The Hilton Point System Change?

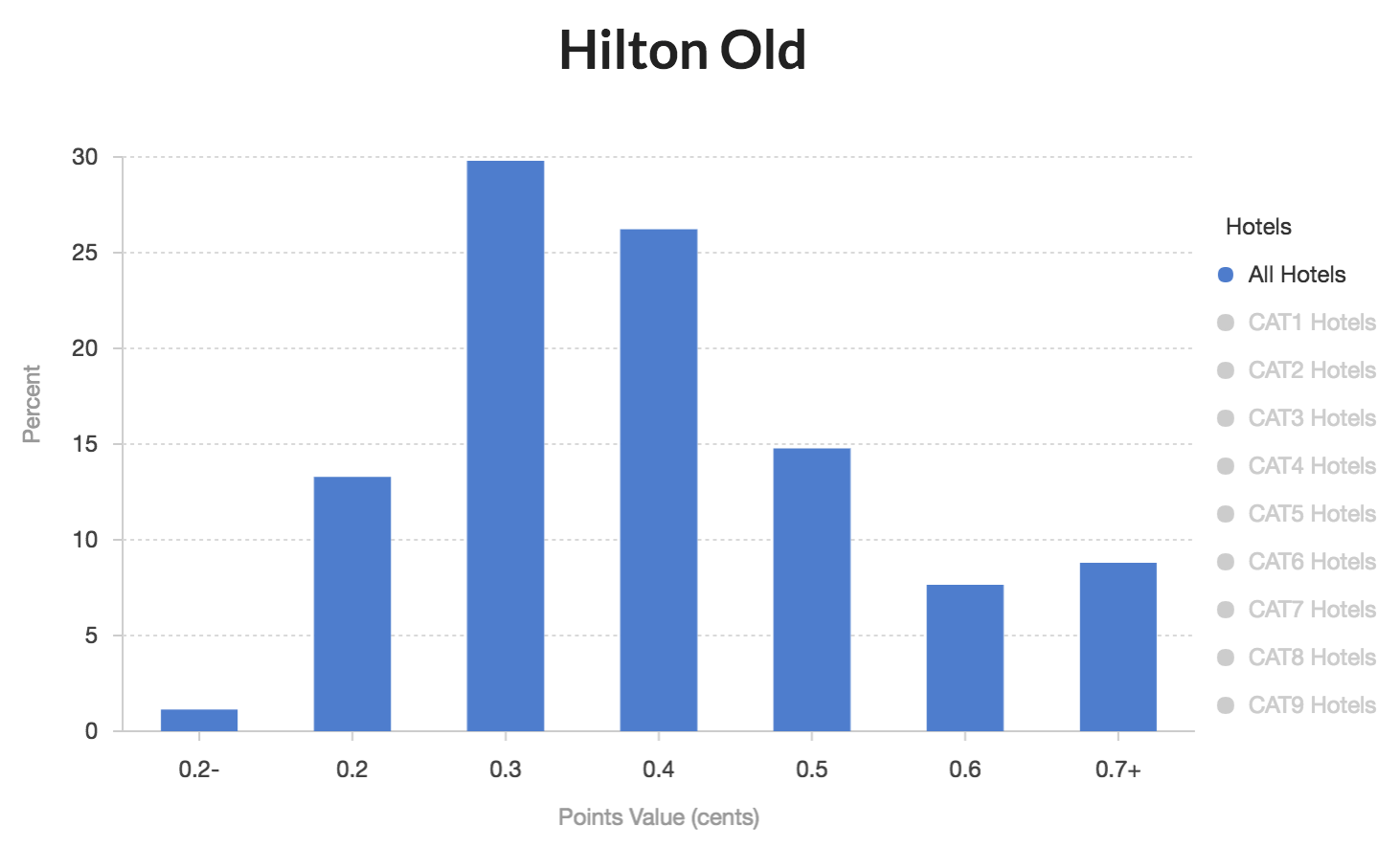

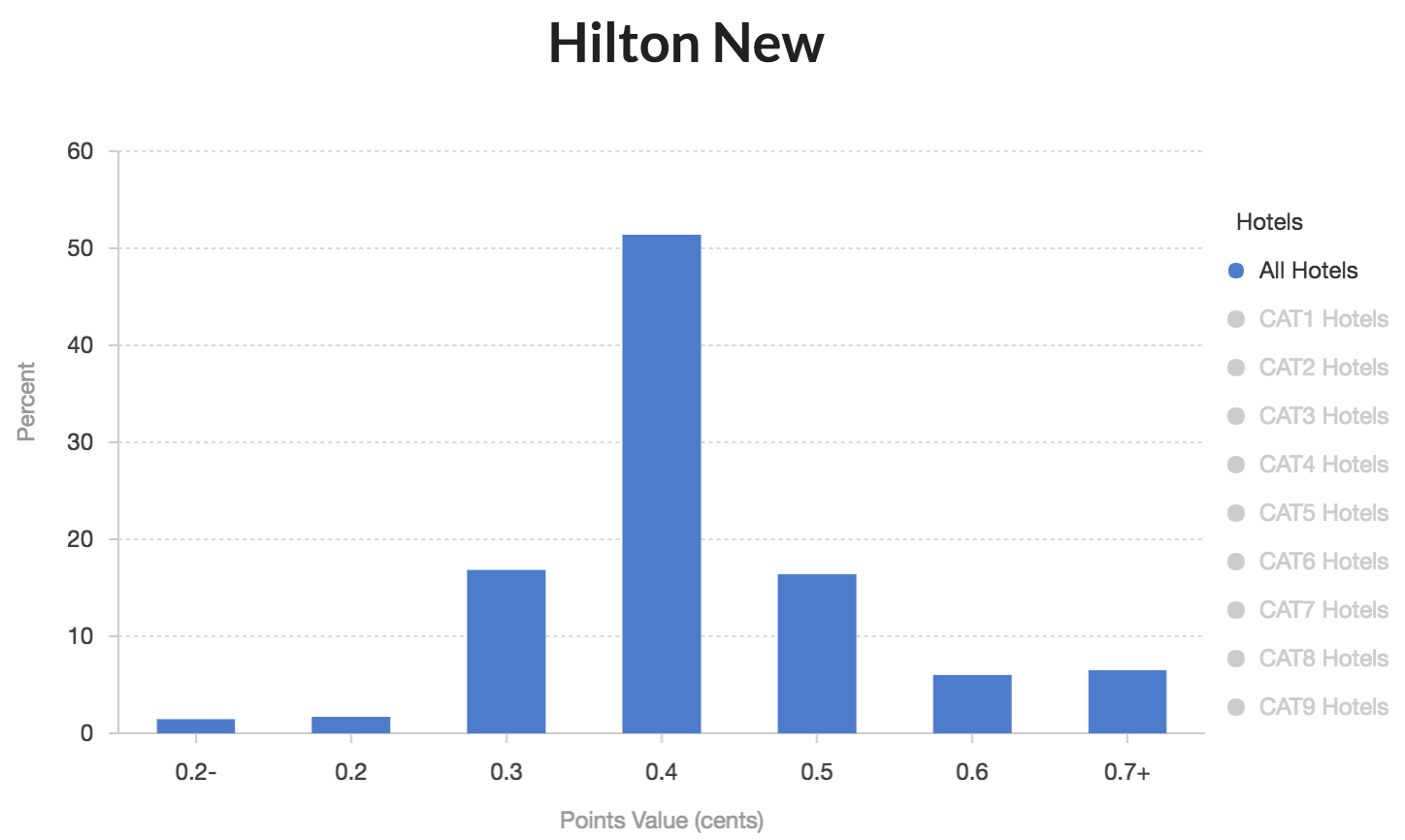

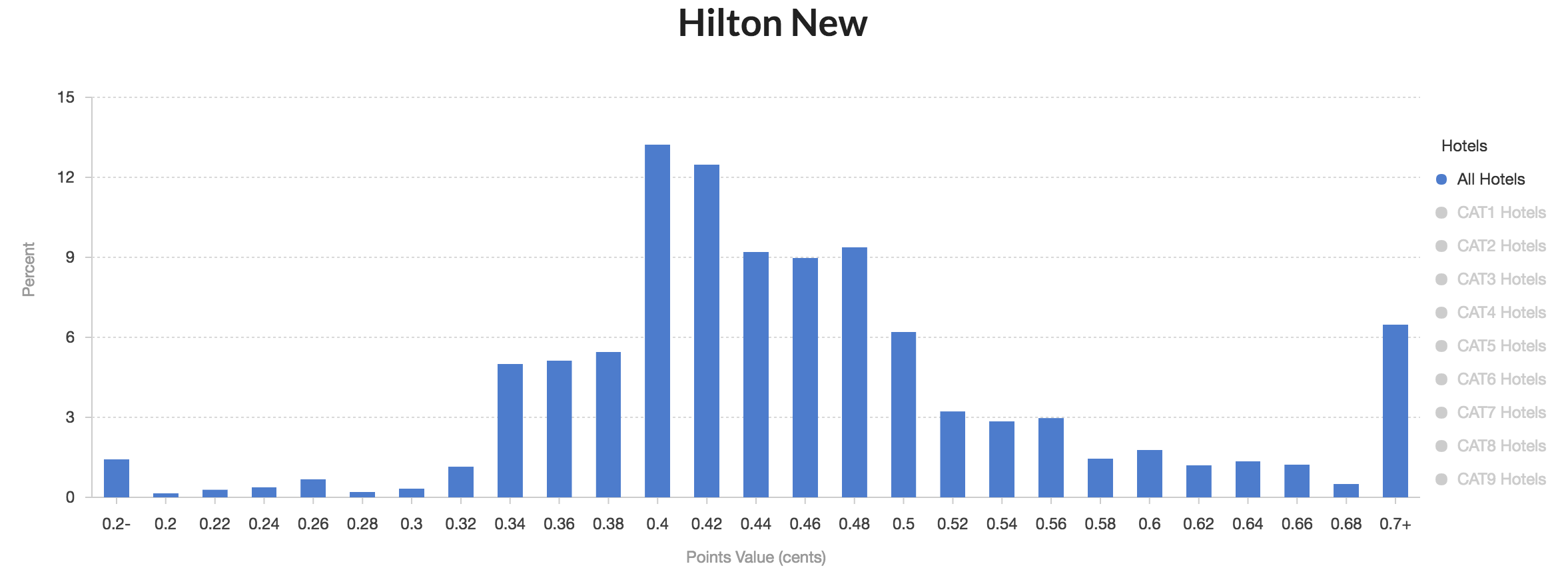

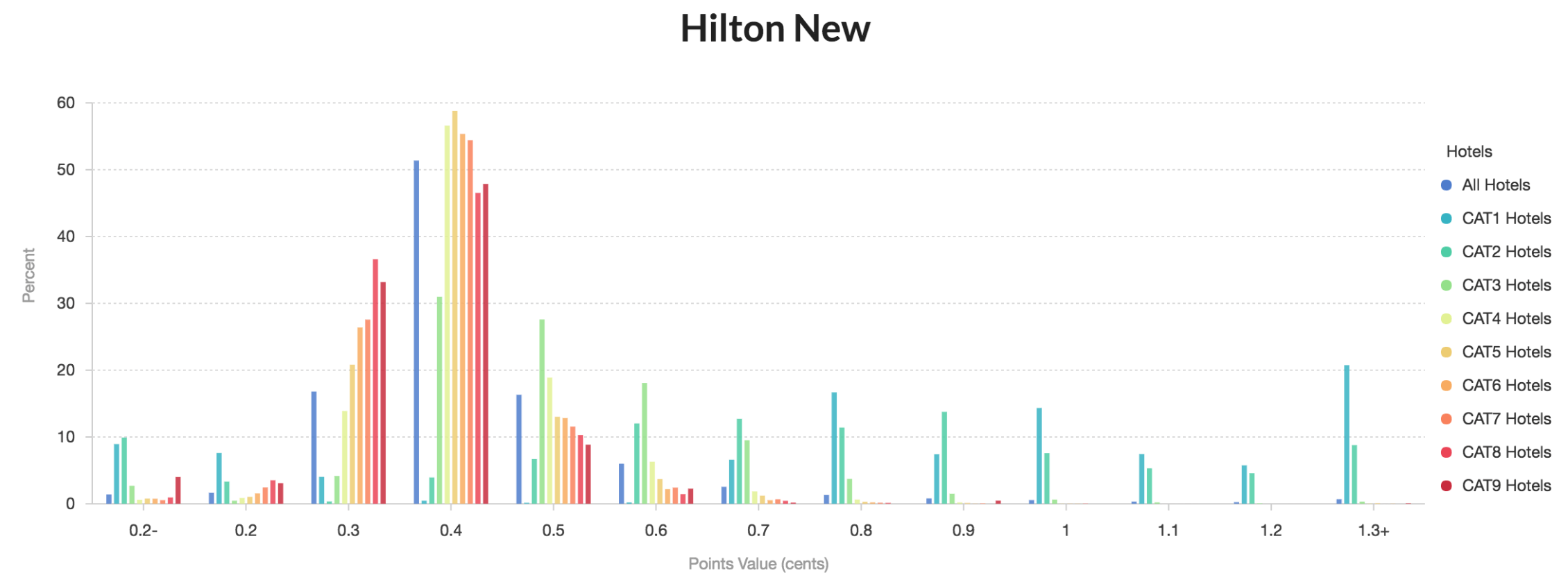

US Credit Card Guide shows the distribution of per point values in the new and old Hilton programs. The following charts (published with permission from US Credit Card Guide) compare the hotel’s best available rate to the point price for a standard room…

Old vs. New Points Awards

In the old program, there was a wide distribution of point values. The most common point values were around .3, but a large percentage of observations showed much higher values:

In the new program, point values are heavily clustered around .4. As you can see below, my prediction was clearly correct. Hilton point values are now much more predictable, but also much less likely to offer outsized value. UPDATE: I was wrong! Please see: New Hilton Honors is better for many. Maybe that wasn’t a middle finger after all…

Maybe its just me, but when I look at this chart I see Hilton giving us the middle finger:

I asked US Credit Card Guide to drill down on the above chart to get more detail. As you can see below, point values cluster most heavily between .4 and .42, but values from .44 to .48 are also very likely. US Credit Card Guide reported to me that the median value in the data is .44. That’s a bit better than Hotel Hustle’s current observed median value of .42. (Hotel Hustle’s data at this point is probably a mix of the old and new system). This suggests that, on average, people may get slightly better value from their Hilton points today, but it will be much harder to find outsized value opportunities.

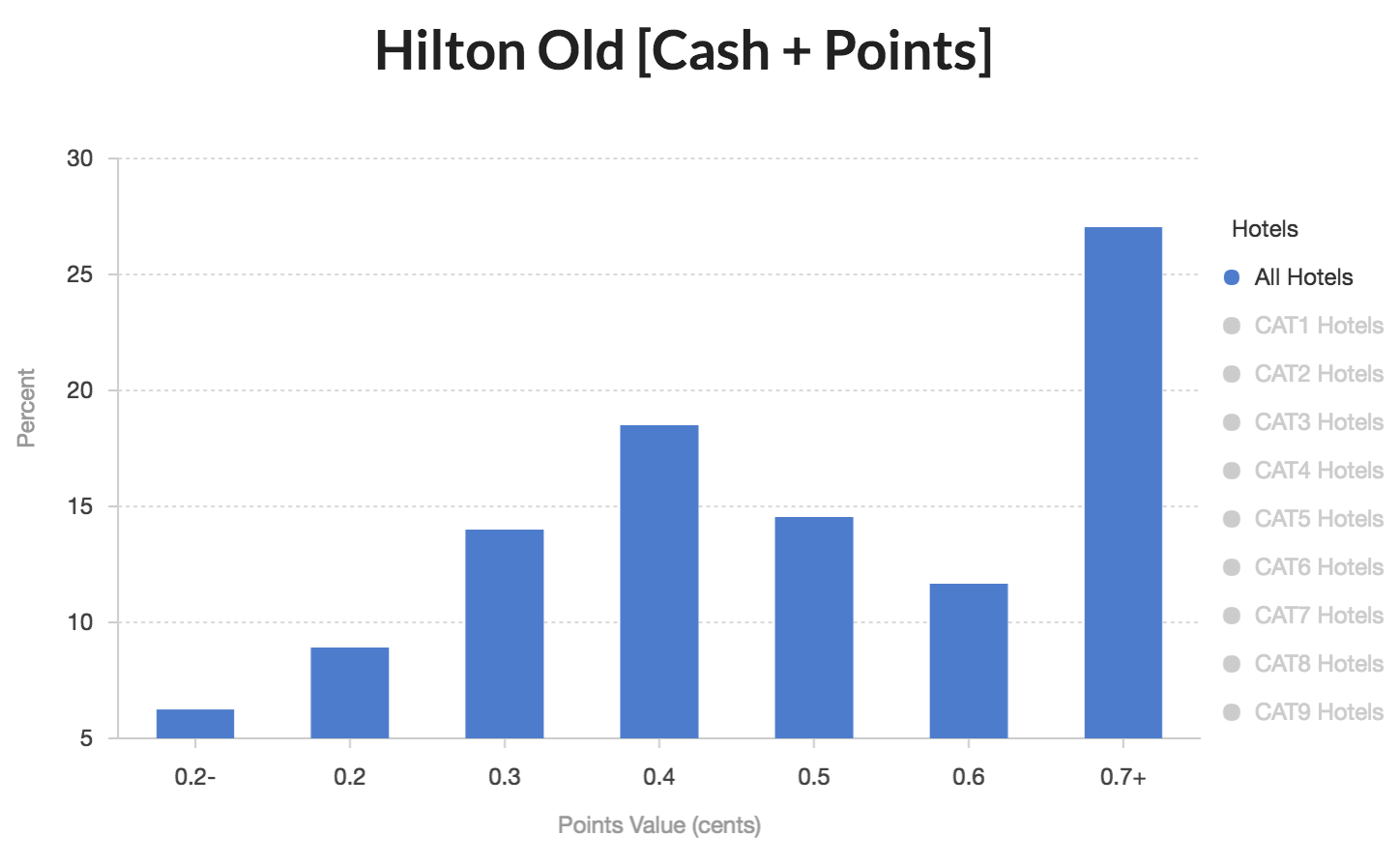

How about Cash + Points?

The Cash + Points results are even more striking. In the old system, Cash + Points bookings were most likely to offer .7 cents per point or better value:

In the new system, Cash + Points leads to the exact same values as points-only awards. There’s that middle finger again:

Outsized Value Anywhere?

US Credit Card Guide displayed the results broken down by hotel category. Even though Hilton doesn’t explicitly price awards by category anymore, they have promised not to increase award rates during the changeover to the new system. As you can see below, outsized value is still possible, but primarily only with Category 1 and Category 2 hotels. So if you’re happy staying at the hotels that Hilton itself deems least worthy (I jest… sort of), you can still do very well.

Important Nuances

The point valuations displayed above do not account for the following:

- Hotel Taxes. Hotel Taxes are applied only to the cash portion of a stay. Result: Points are more valuable than shown above.

- Discount Rates. If you qualify for special rates: AAA, senior, government, etc., you’ll often find prices that are better than the “Best Available Rate”. In fact, just being a Hilton Honors member gives you slightly better rates when logged in. Since the charts here compare to “Best Available Rate” and it is usually possible to find better rates, the point values are inflated. Result: Point prices are less valuable than shown above.

- Resort Fees. Resort fees are not applied to points-only awards, but they appear to be applied in-full to any booking that includes even $1 in cash. Result: At resorts, points are more valuable than shown above, but only when you pay in-full with points. See this Travel Codex post for more details: Resort Fees Plague Hilton’s New Points & Money Awards.

- Point Earnings. Hilton Honors members earn points only on the cash portion of a stay. And, between regular point earnings and Hilton’s frequent promotions, paid stays can be quite rewarding. The good news is that the new Cash + Points system treats the cash portion like a regular stay so you will earn points on that portion. Result: Points are less valuable than shown above (since you usually won’t earn points when using points).

Booking Stays

It looks like I need to create a Hilton MakeUpYourMinder spreadsheet! In the meantime, I’d use these general guidelines to help decide whether to pay with points, cash, or both:

- Does the hotel charge a large resort fee? If so, pay entirely with points if possible. If you don’t have enough points for the entire stay, book as many nights as possible entirely with points so that you can avoid the resort fees on those nights.

- Does the hotel pass along very high taxes? (you can see the tax charges if you go through most of the steps for booking a cash rate). If so, pay as much as possible with points. Any amount paid with cash will be charged taxes proportionally so it is fine to book Cash + Points if you don’t have enough points.

- Is Hilton running a valuable promo that only works for cash stays? You can find current promos here. If a promo offers a fixed reward for a cash stay, you should be able to book a Cash + Points stay and pay the minimum required in cash (this is a change from the old system). If the promo offers rewards based on amount paid, it may be worth paying entirely in cash.

[…] that the median redemption value for Hilton Honors points is around .44 cents per point, we can convert these earnings to expected rebate percentages. For example, 3X Hilton points at […]

[…] on March 1st moved Hilton Honors ever-closer to a fully revenue-based program. While that initially looked pretty rough, it turns out that the changes might be a net positive to many (most?) members. While I remain a […]

The Chinese site you linked is actually pretty helpful if you let Chrome translate it for you. There’s a pretty good feature to search the major chains for any given stay in a city and it will show you price, award cost, and value per point.

Thanks. I’ll have to check it out more!

[…] Hilton Honors results are in. Is that Hilton’s middle finger? […]

[…] very few higher value redemptions. I’ve long valued their points at 0.4 cents apiece. Now you’ll rarely get more value than that. […]

In the accurate numbers department . . . while I CANNOT COMMENT on Hilton’s new “Points & Cash” concept, I can tell you that I have booked two hotel stays for this Fall with domestic (U.S.) Hilton properties — a three-night stay at a Conrad hotel, and a overnight stay one from their Curio portfolio — using ALL POINTS. The value-per-point I received at the Conrad was 1.027¢/point, while the Curio stay comes to 1.036¢/point.

@farnorthtrader – the cash & points rates might have gotten better on average, which is useful for casual members who don’t really look at the point value and just book a “free night” regardless.

But points fans look for pockets of value, like p&c rates used to be. And that pocket of value has been eliminated. The average is of limited interest…

Making the program more revenue oriented makes it easier for casual members and tougher for value oriented members!

Yes, as I noted, the cash and points program has become next to useless for those hotels that offered it under the old program. I simply wanted to point out that the graph really didn’t show what it purported to show, that cash and points showed a value of 0.7 cents plus in about 27% of hotels under the old program. In fact, if only, say, 20% of hotels offered points and cash, then that 27% really only represents 5.4% of all hotels that offered 0.7 cents or more in value for a cash and points redemption. That would mean that this opportunity was actually devalued at 1 in 20 hotels, not the 1 in 4 that the graph made it look like. There is no question that for the hotels that offered the very best in points and cash values, this is a very large devaluation, likely between a 20% and 60% reduction in value, however, that was a very small percentage of the total hotels. Just eyeballing the graphs, I would say that this devalued points and cash in roughly 55-60% of the cases where there used to be cash and points (including all cases where a savvy points hound would use their points), however, just anecdotally, I would say that there was only an opportunity to use points and cash in this way in maybe 10 to 20% of bookings, so the devaluation is on 10 to 20% of a savvy bookers reservations and more like 5.5 to 12% of a typical bookers reservations.

If my numbers are correct and the savvy booker loses an average of 40% value on 20% of their bookings that are cash and points (and nothing on their all points bookings), this is about an 8% devaluation, even for a savvy booker. My historical average for Hilton points is 1.22 cents per point, so this likely devalues my Hilton points by about a tenth of a cent to about 1.12 cents. I still think that I will be able to average at least a cent a piece in the new program (as long as I continue to mostly use hotels outside the US), which is just fine with me.

[…] For example, I presented this with max value 30 percent: […]

Another useful chart would be to plot a histogram of the valuation change (old vs new) for individual properties. (Could ignore category or create separate charts for each category.) These charts show absolute valuation, but the absolute value tells one story (is there outsize value anywhere) and change tells a different story (is the new program more rewarding or less).

I find it just a little bit misleading to have all of these charts on different scales. For example, graphically, it looks like from the first two charts that there is a huge drop off in point values in excess of 0.7 cents and 0.6 cents, but in reality, they were about 8% and 7.5% in the old program and 7.5 and 6.5% in the new program, virtually no change. Almost all of the additional values that went into the middle finger came from the point values in the 0.2 and 0.3 cent values, which dropped from 13 and 30% to 2 and 17%, so using full point redemptions, it appears that the points have, on average, become more valuable without much loss of the high end redemptions.

On the other hand, the cash and points has, as predicted, become very nearly useless for those properties that used to offer cash and points, however, this analysis does not take into account that most properties did not offer points and cash before, so the “old” points and cash pretty much has to have been a much smaller sample. If they included the hotels that did not offer points and cash before at a 0 value, I think you would have a barbell effect, with at least as many offering 0 value as offering 0.7 cents+ and I think that would be a fairer comparison to the new program.

I think you’re right. I’m going to try to get accurate numbers (as opposed to eyeballing the chart) and write an update.

Hmmm, just signed up for HIlton Rewards for our upcoming trip to Puerto Rico. I have not heard much great things about their rewards program. However, I did pay for two nights with my chase UR points, which is probably a better value. However, you must pay for taxes with your points on Chase UR.

I agree points and cash are worse. But for 100% point bookings, it looks like about 30% were/are in the 0.5 or better under both the old and new systems. Primarily, it was the 0.3 and less in the old that moved into the 0.4 bucket in the new. This is an improvement.

Yes, you may be right. I’m working on an update

This analysis neglects AAA and AARP rates. It’s very cheap to join AARP.

Right. I meant to include discounted rates in the bottom portion of the post. They lead to lower point values (and that was true before as well). I’ll update.

Awesome analysis. Thanks.

We’ll just use up our massive pile of HH at airport hotels and such like we’ve been doing. Really don’t stay there anymore anyway. Just means any idea of staying at some Tahiti hotel or whatever just needs to be gone from my mind. That’s fine.

hilarious – great post