Update: Originally published a couple of years ago and updated today, these credit card duos remain great 1-2 punches with a few updates.

In the past I’ve analyzed the heck out of cards to come up with the best credit card combinations based on earning rates, annual fees, redemption value, etc. Today, I’ll take a more casual look at my favorite credit card duos. I like cards that have great perks and earn great category bonuses. And I prefer cards that earn transferable points (points that can be transferred to airline and hotel programs). A big plus is when those points can alternatively be used for better than 1 cent per point value to purchase travel. Together, that means that I like Amex Membership Rewards, Chase Ultimate Rewards, and Citi ThankYou Rewards (see this post for a comparison of the three programs).

In each of the below cases, I believe that credit cards are better in pairs. With the right cards (and credit card duos), you can maximize point earnings and get the best value from your points. So, without further ado, here are my favorite credit card duos…

Membership Rewards Credit Card Duo: Amex Enhanced Business Platinum + Amex EveryDay Preferred

Great redemption value; Lounge Access, Elite Status, Up to 5X airfare, 4.5X grocery, 3X gas, and 1.5X everywhere else.

Everyday Preferred ($95 annual fee): 3x points at US supermarkets on up to $6,000 per year in purchases (then 1x); 2x points at US gas stations; 1x points on other purchases. Earn 50% more points: Use your Card 30 or more times per billing period to get 50% more points: 4.5X grocery (1.5X after $6K spend), 3X gas, 1.5X everywhere else.

Business Platinum ($695 annual fee): 5X flights and hotels booked through Amex Travel. $100 Global Entry fee reimbursement. Great airport lounge benefits (including Centurion Lounges, Delta SkyClub, Priority Pass). Rental car elite status. Marriott Gold elite status. Hilton Gold elite status. 35% Pay with Points rebate for selected airline, and for business or first class with any airline. For complete details regarding Business Platinum card benefits, please see: Your Platinum Card arrived. Here’s what to do next…

Why this is a great credit card duo: This combination delivers fantastic benefits, huge earnings on spend, and terrific value when redeeming points. Membership Rewards points are best redeemed by transferring to an airline program for premium class international awards, or for the Amex Business Platinum 35% rebate when you pay for flights with points.

On the other hand: This combo has a very high combined annual fee. The EveryDay Preferred incurs foreign transaction fees. Can be a big hassle to ensure 30 EveryDay Preferred purchases per month. The $200 in airline fee reimbursements are not as easily earned as the the Sapphire Reserve card’s travel reimbursements, though note that the Business Platinum card also carries up to $400 in statement credits for Dell purchases each year ($200 from January to June and $200 from July to December). And the Business Platinum 35% point rebate is limited to your selected airline when buying economy class tickets.

Update 8/4/20: Should we re-think this two card combo? Another great Amex wallet could be the Amex Gold Card and Blue Business Plus. That would give 4x grocery (on up to $25K spend per year, then 1x) and 4x restaurants on the Amex Gold and 2x everywhere else (on up to $50K per year in purchases on the Blue Business Plus, then 1x) for a combined annual fee of $250. Add in the Gold card’s other perks and $100 airline incidental credit and that may be the better Amex combo for those who don’t need the perks of a Platinum card.

Ultimate Rewards Credit Card Duo: Chase Sapphire Reserve + Freedom Unlimited

Excellent point redemption value; lounge access; 3X travel & dining, 1.5X everywhere else.

Chase Sapphire Reserve ($550 annual fee – $300 in annual travel credits): 3X travel & dining. Points worth 1.5 cents each towards travel. Primary auto rental collision damage waiver. Priority Pass Select lounge access. $100 Global Entry fee credit.

Chase Freedom Unlimited (No annual fee): 1.5X everywhere. Transfer points to your Sapphire Reserve card for better point redemption value.

Why this is a great credit card duo: With points worth 1.5 cents each towards travel booked through the Ultimate Rewards portal, you’ll earn at least 2.25 cents in travel per dollar spent with your Freedom Unlimited card, and 4.5 cents in travel per dollar spent on travel & dining with your Sapphire Reserve card. And while 1.5 cents per point is good value, you can often get much better value by transferring points to high value partners such as Hyatt, United, etc. For more details, please see: Chase Sapphire Reserve Complete Guide.

On the other hand: The Freedom Unlimited card does charge foreign exchange fees, so you’ll want to use your Sapphire Reserve card when traveling outside of the US. Also, the Sapphire Reserve card’s lounge benefits are limited to Priority Pass lounges and restaurants. That severely limits domestic lounge options when compared to the Amex duo, above.

ThankYou Rewards Credit Card Duo: Citi ThankYou Premier + Double Cash

Very good point redemption value; 3X gas, grocery, restaurants, flights, hotels, & travel agencies; 2X everywhere else

Citi ThankYou Premier ($95 annual fee): 3X gas, grocery, restaurants, flights, hotels, & travel agencies

Citi Double Cash (no annual fee): 2X everywhere (Note that this card actually earns 2% cash back – 1% when you purchase and 1% when you pay the bill – but you can convert the cash back rewards to ThankYou points if you send the rewards to a ThankYou Premier or Prestige card.

Why this is a great credit card duo: Low combined annual fee of just $95. Free authorized user cards.

On the other hand: The Double Cash card charges foreign transaction fees, so use the Premier card when traveling. Citi ThankYou has fewer and mostly less valuable transfer partners than Amex or Chase – though there are a few great Citi sweet spots, most notably using Turkish Miles & Smiles miles ot book United flights. No lounge access benefits with this combination (but you could swap in the Citi Prestige card for the Premier in order to get lounge access).

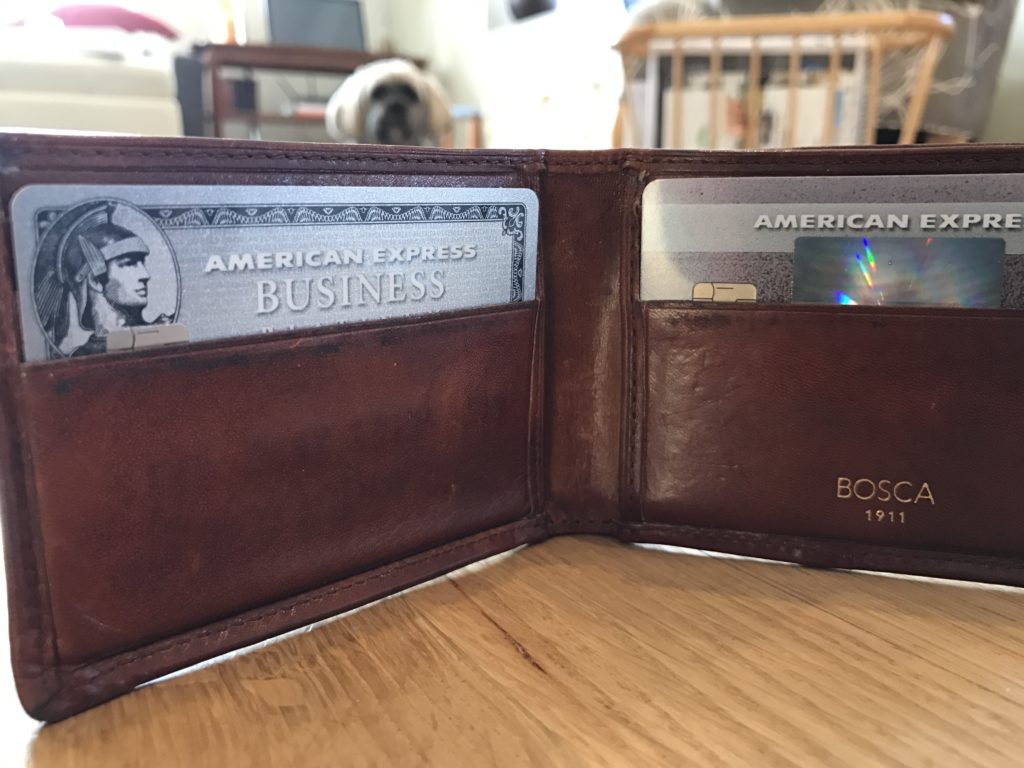

Photo Bomb

What happens when my dog gets curious about my credit card photo shoot? A photo bomb, of course…

Where is the Bank of America combo? 5.25 Gas, 3.5 Club Stores and Groceries, 3.5 Travel, AND 2.625 all other. Premium Rewards and Cash Rewards cards. Need $100k on deposit or invested.

Those are great options. This post focuses only on transferable points programs.

[…] might make sense to get a premium card for the benefits and another card on which to spend (See: Super credit card duos. What’s in your wallet? for some great pairs). One of my favorite benefits of premium cards are hotel booking programs, […]

[…] our wallets, but what”s on our phones. Of course, for those of us still carrying the old-fashioned wallet around, we need to fill it with the right stuff. This week, we bring you more of how to get the […]

Cash earned at 1.5% on Capital One Quicksilver or 3% at restaurants on Capital One Premier Dining card may be redeemed for 2% on travel purchases when transferred to Venture.

That doesn’t sound right. Can you explain what you mean? The Venture card earns 2X points for spend, but then each point is worth 1 cent each

Oops! Allow me to clarify! What I mean is that cash earned on No Hassle Cash Rewards Cards (Quicksilver, Journey, Premier Dining Rewards) can be transferred to Venture or Venture One at $1 = 1 mile. I must have been dozing when I wrote the previous post.

LOL. Thanks for the clarification

[…] Reserve plus Freedom Unlimited duo, but I’ve already dragged this post on too long. See Super Credit Card Duos for […]

Would def add chase ink bold/plus/cash/premier into the chase combo just for the category bonus.

[…] Super credit card duos. What’s in your wallet? […]

One other thing to keep in mind are the various other benefits and insurance included when deciding what cards to put spend on.

I find generally Citi to be weakest as they try everything to deny a valid claim, and have narrower definitions for their coverages (for example, no extended warranty on an Apple certified refurbished laptop because it’s “pre-owned”, yet Chase and Amex do cover that situation).

With Amex careful about putting travel spend as they have no trip interruption/cancellation insurance. Otherwise pretty good with extended warranty etc.

Chase is best of all in my experience, easy and customer friendly when it comes to coming through on their promised benefits, from purchase protection to travel to extended warranty.

Yep, very good points.

You should give one of those nice wallets to Nick for doing a great job

straight out of the gate.

– You have at least four of them. 🙂

Hahaha! Thanks, skizzy. I appreciate it :-).

Greg does have some nice-looking wallets there….but I’m afraid I’m a bit more on this end of the spectrum:

https://www.amazon.com/Blocking-Premium-Genuine-Leather-Bifold/dp/B01BZCKXZ8/ref=sr_1_3?ie=UTF8&qid=1489543167&sr=8-3&keywords=wallet+many+credit+cards

LOL. Yes you’re right, he’s doing a fantastic job.

If you are an authorized user on an amex biz platinum card, but have never had one yourself as primary cardholder and have never received sign up bonus, are you eligible?

Yes, you are eligible in that case.

can any card be converted into ATT card (like an AA card perhaps)?

I think so, but I’m not sure

I started the process to convert my Legacy AA AMEX to Costco. Halfway through the process I learn’t converting AMEX to MC will deny me getting a bonus for another 24 months because the account numbers will change. So I canceled the conversion so hat I can get the next AA bonus in April/ May 2017.

Best way is to convert an TY card into ATT card and Citi is Pretty good about converting to any card. By being in the TY family this will not count against the “closed or opened in the last 24 month” language.

These are the 2 things to keep in mind:

1. Covert within the same family (TY to TY or AA to AA)

2. Convert within the same processor ( MC to MC or Visa to Visa)

Thanks Kumar. That approach sounds like the theory I previously wrote about: https://frequentmiler.com/2016/08/15/citis-new-speed-limit/

I never got confirmation from readers that the theory was correct, though. Do you have evidence that it really works?

You are spot on, with your theory on that blog greg.

I can confirm this as I have talked to 3 representatives before I cancelled my request to convert my AA AMEX to Costco Visa.

They told I’ll be ineligible to get a new AA bonus 24 months after the conversion.

Another interesting thing would be, how chase would see a new MC while calculating 5/24. All in all that grey area is not worth a try, I tnink

On the other hand, I converted my TY Premier to preferred after 12 months in April 2016 and I’m due for the bonus next month. It didn’t affect it at all. I checked with the agent about my eligibility to receive bonus in April 2017 during the same call as well

Thanks!

Kumar is probably leading you in the right direction on this. I converted an AA card to AT&T, but I did get a new account number. I did it about 14 months ago I believe and haven’t tried to open a new TY card in that time — so I can’t confirm that it precluded me from getting another TY bonus, but I believe Kumar is right.

Love the dog

When would it make sense to carry multiple combos? Initially, I would think that it’s overkill and poor value bc you’re paying multiple high card fees for the premium, plus the lower card in some cases. And the premium cards overlap so much. However, maybe with high spend, if you can utilize the various categories and bonuses, it makes sense? Do you carry all of these, and if so at what point is it worthwhile to keep them all?

imo, if you want to speculate get em all. If you lose a little on one u make it up with the other. this is about winning the war, not individual battles…takes a long time to learn.

It can make sense when the incremental value of the additional cards outweighs the extra annual fees. I think that most people would do better to stick primarily with one family of transferable points (e.g. Amex Membership Rewards, or Chase Ultimate Rewards, or even SPG). Earn points in other programs primarily through credit card signup bonuses and then cancel or downgrade to no-fee cards after the first year is up.

Cute photo bomb.

Quick question.

Isn’t it possible to transfer your freedom points to the reserve and reap the same redemption value per point?

Yes, exactly. That’s why the Freedom cards pair so well with the Sapphire Reserve.