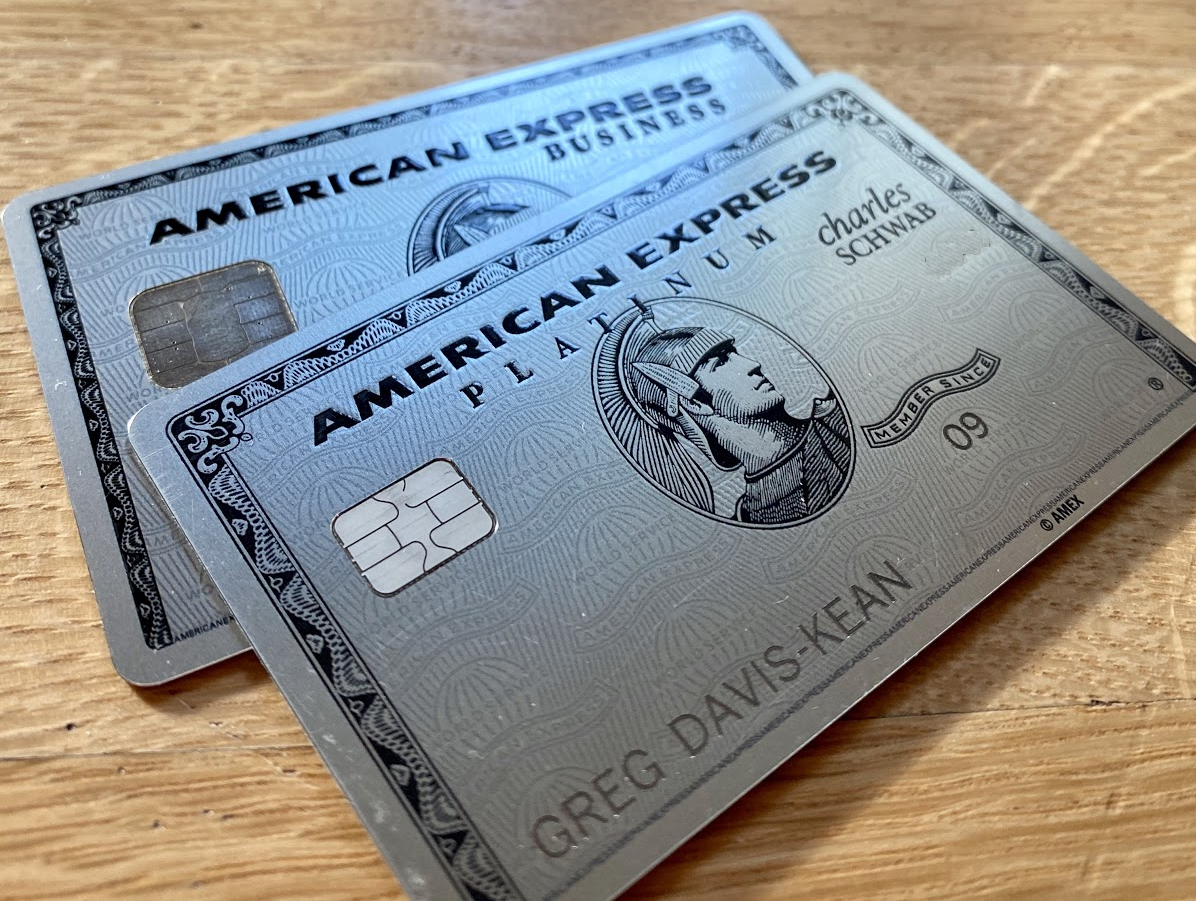

American Express has several varieties of their premium Platinum cards. And, while they’re expensive, they’re loaded with great perks. Which is the best best Amex Platinum card? As long as the 200K offer is around, there’s no question that the Business Platinum card offers the best first year value. But what if you’re looking longer term, then which is best? The answer depends upon which perks you value the most. In fact, Nick and I discussed it on a recent Frequent Miler on the Air podcast and came to completely different conclusions.

Here’s everything you need to know to make the best decision for your own needs…

American Express Platinum Benefits

| Benefit | How to access or enroll | Available to Platinum Authorized users? |

|---|---|---|

| 5X points at amextravel.com: Earn 5X points for prepaid hotel and airline bookings at Amextravel.com | This benefit is automatic. | Yes. Points and bonus points are added to the primary card holder's account. |

| $200 airline fee credit: Amex will automatically reimburse up to $200 per calendar year for airline fees for your selected airline only. Eligible fees include: baggage fees, flight-change fees, in-flight food and beverage purchases, and airport lounge day passes. | Log in and go to Benefit page and click “Select a Qualifying Airline”. For tips on using this benefit, please see: Amex airline fee reimbursements. What still works? | No. Spend on authorized user cards does count, but only $200 per year will be reimbursed altogether. |

| Airport Lounge Access - Centurion Lounges, Airspace Lounges, Escape Lounges: Cardholder is allowed free in Centurion Lounges. In most cases guests will be charged $50 each (details here). Cardholder plus two guests are allowed free in Escape and Airspace Lounges. | No need to enroll. Simply show your Platinum card when visiting a Centurion Lounge. | Yes |

| Airport Lounge Access - Delta Sky Clubs: Cardholder is allowed free when flying Delta same day. Extra charge for guests. Starting Feb 2025: limited to 10 Sky Club visit-days per year (unless cardmember has spent $75K in a calendar year) | No need to enroll. Simply show your Platinum card and same day boarding pass when visiting a Delta Sky Club. | Yes |

| Airport Lounge Access - Plaza Premium Lounges: Cardholder plus one guest are allowed free when flying the same day. | No need to enroll. Simply show your Platinum card and same day boarding pass when visiting a Plaza Premium Lounge. See full list of lounges here. | Yes |

| Airport Lounge Access - Priority Pass Select Lounges: Priority Pass Select member plus two guests are allowed free entrance. Unfortunately, this membership does not include Priority Pass restaurants. | You must sign up for Priority Pass Select. Go to benefit page and click “Enroll in Priority Pass”. You will receive a membership card by mail. Present Priority Pass card and boarding pass at lounge entrance. | Yes. Each authorized user must sign up for Priority Pass Select. |

| Airport Lounge Access - select Lufthansa Lounges | Free access to Lufthansa Business Lounges (with confirmed ticket) or to Senator Lounges (with Business Class ticket) in the satellite building of Terminal 2 at Munich Airport and in Terminal 1, Departure Area B, at Frankfurt Airport. Valid only when flying Lufthansa, SWISS or Austrian Airlines. | Yes |

| Cell Phone Protection: Max $800 per claim, $50 deductible. | No need to enroll. Pay your cell phone bill with your Platinum card. | Yes |

| CLEAR credit: Get up to $189 per year reimbursed for CLEAR subscriptions. | No need to enroll. Pay for CLEAR with your Platinum card. See also: 5 ways to get CLEAR for less. | No. Spend on authorized user cards does count, but only $189 per year will be reimbursed altogether. |

| Global Entry or TSA Pre fee credit: Full reimbursement for signup fee once every 5 years, per card. Note: signup for Global Entry since that includes TSA Pre. | Sign up for Global Entry here. Pay with your Platinum card. Reimbursement should happen automatically. | Yes. Pay with the authorized user card in order to get reimbursed. Terms state “Additional Cards on eligible Consumer and Business accounts are also eligible for the $100 statement credit”. This works with no fee Green and Gold authorized user cards too. |

| Emergency Medical Transportation Assistance | Call the Premium Global Assist Hotline: 1-800-333-Amex (toll free), or 1-715-343-7977 (direct-dial collect) | Yes |

| Hilton HHonors Gold Status: Hilton Gold members receive free breakfast, room upgrades when available, and other perks at Hilton hotels. | Go to benefit page, find the Hilton HHonors Gold benefit, and click “Enroll Now”. | Yes. Authorized users may have to call Amex to enroll. |

| Marriott Gold Status: Marriott Gold members receive a points welcome gift with each stay, room upgrades when available, 2pm late checkout, and other perks (details here). | Go to benefit page, find the Marriott Gold benefit, and click “Enroll in Marriott Gold”. | Yes. Authorized users may have to call Amex to enroll. |

| International Airline Program: Save money when booking premium cabin international flights originating in the US or Canada. | Book your flight on amextravel.com. Make sure to log into your Amex account to see flight discounts. | Yes |

| Fine Hotels & Resorts: Book high-end hotels through Amex Fine Hotels & Resorts and get: room upgrade, daily breakfast for 2, 4pm late checkout, noon check-in, free wifi, and unique property amenity. Also: Earn 5X Membership Rewards for prepaid bookings. | Browse to www.americanexpressfhr.com and log into your Platinum account. | Yes |

| Fiesta Rewards Platinum Status | Use the Spanish language page: http://www.fiestarewards.com/inscripcion and enter code: AMEXPLATINUM | Yes |

| National Car Rental Executive status: Book midsize cars and select any car from the Executive Aisle for no extra charge. | Enroll here. | Yes |

| Hertz Rental Car Privileges: President's Circle Status, discounts, plus four hour grace period for rental car returns. | Details and enrollment form found here. | Yes |

| Cruise Benefits: Pay for your cruise with your Platinum card and receive $100 to $300 per stateroom shipboard credit plus additional amenities unique to each cruise line | Detailed terms can be found here. | Yes |

| Premium Private Jet Program: 20% off plus one time $500 credit towards Wheels Up Connect or 40% off plus one time $2K towards Wheels Up Core memberships. | Sign up here. | Yes |

| ShopRunner: Free shipping at a number of merchants. | Sign up here. | Yes |

| Neiman Marcus In-Circle | Call 1-800-525-3355 to enroll | Yes |

Consumer Platinum Card Benefits

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| $200 in Uber / Uber Eats Credits: Amex will reimburse $15 per month ($35 in December) for Uber charges. You will also get Uber VIP status. | Add your Platinum card number to your Uber account as a payment method. You do not have to pay with the Platinum card in order to get this benefit. Important: when requesting a ride, select Uber Cash for payment in order to use your credits. | No. Authorized user cards do not receive their own $200 in Uber credits or VIP status. |

| $200 Hotel Credit: Get $200 back per calendar year towards prepaid Fine Hotels + Resorts or The Hotel Collection bookings | No need to enroll. Book through Amex Travel and pay with your Platinum card. Hotel Collection bookings require a minimum two-night stay. | No. Spend on Authorized user cards does count, but only $200 per year will be reimbursed altogether. |

| $240 Digital Entertainment Credit: Up to $20 per month rebate for select digital entertainment services (Disney+, The Disney Bundle, ESPN+, Hulu, Peacock, SiriusXM, The New York Times and The Wall Street Journal) | Enroll here. Enroll in any of the listed services and pay with your Platinum card. | No. Spend on Authorized user cards does count, but only $20 per month will be reimbursed altogether. |

| $100 in Saks Fifth Avenue Credits: Up to $50 in credits each year from January through June; and another $50 July through December. | Enroll here. Pay with your consumer Platinum card at Saks Fifth Avenue online or at locations in the US and US Territories. | No. Spend on Authorized user cards does count, but only $50 per 6 months will be reimbursed altogether. |

| Free Walmart+ Subscription: Get back the full cost, including taxes, for a Walmart+ monthly subscription. | No need to enroll. Use your Platinum card to pay for a monthly Walmart+ subscription. | No. You can use an Authorized user card to pay, but you won't get more than one credit per month. |

| $300 Equinox Credit: Get $300 back per year in statement credits for a digital or club membership at Equinox. There is a yearly option for Equinox+ (the app) membership that is $300 annually. | Enroll here. Use your Platinum card to pay for a digital or club membership at Equinox. | No. Spend on Authorized user cards does count, but only $300 will be reimbursed altogether. |

| $300 SoulCycle Rebate: Charge the full price of a SoulCycle at-home bike and get $300 back in statement credits. | Must join Equinox first (see above). | Sort of: Each Platinum account can get $300 back on each of 15 bikes purchased per year. |

| 5X points on flights booked directly with airlines. With business cards you must book through Amex Travel to get 5X. | Automatic benefit | Yes. Points and bonus points are added to the primary card holder's account. |

| Active Military Fee Waiver: Amex will waive consumer card fees (including annual fees) for US active military personnel. | Call the number of the back of your card and tell them you are serving on active duty military and had heard that AMEX offers to handle your account in accordance with the Military Lending Act (MLA) | Yes (primary user must call and can get fees waived for additional cardholders) |

Business Platinum Card Benefits

| Benefit | How to access or enroll | Available to Platinum Employee Cards? |

|---|---|---|

| 1.5X points per dollar: Earn 1.5X on individual purchases of $5000 or more; and on select categories: Construction material & hardware, Electronic goods retailers and software & cloud system providers, and Shipping providers | Automatic | Yes. Points and bonus points are added to the primary card holder's account. |

| $400 in Dell Credits: Up to $200 in credits each year from January through June; and another $200 July through December. | Go to benefit page to enroll. | No. Employee cards do not receive their own Dell credits. |

| $120 in Wireless Credits: Up to $10 per month when you use your card to pay for wireless telephone service. | Go to benefit page to enroll. | No. Employee cards do not receive their own wireless credits. |

| $360 in Indeed Credits: Up to $90 per quarter for purchases with Indeed | Go to benefit page to enroll. | No. Employee cards do not receive their own Indeed credits. |

| $150 Adobe Credits: Up to $150 per year on annual prepaid plans for Creative Cloud for teams and Acrobat Pro DC with e-sign for teams | Go to benefit page to enroll. | No. Employee cards do not receive their own Adobe credits. |

| 35% points rebate on airfare: Pay with points for airfare on your selected airline or for business or first class with any airline and get 35% of your points back. | Book flights through AmexTravel.com and select to pay with points. | No. |

Consumer Card Variations

In addition to the standard Amex Platinum consumer card, there are two currently available co-branded variations. Each one offers a couple of unique features that can be very useful depending on your situation.

The Platinum Card from American Express Exclusively for Morgan Stanley

To get this card you must have a Morgan Stanley account. Fortunately, a low-end Morgan Stanley Access Investing account works fine.

The Morgan Stanley Platinum card adds the following benefits:

- First authorized user free: Add one Platinum authorized user for free. Add up to 3 more for $175.

- Invest with rewards: Liquidate Membership Rewards points for 1 cent each when deposited to your Morgan Stanley brokerage account.

- $500 anniversary spend award: Spend $100K in a cardmember year to get $500. If you spend exactly $100K per year, that amounts to a bonus of half of 1 cent per dollar spent.

- $695 Annual Engagement Bonus: You can qualify for this bonus by opening a Morgan Stanley Platinum CashPlus Account before opening the Platinum card account. Details can be found here: Morgan Stanley Platinum Card Fee Free (how to earn the $695 Annual Engagement Bonus)

American Express Platinum Card for Schwab

The Schwab Platinum card adds the following benefits:

- $100 to $200 statement credit: Receive a $100 Card statement credit if your qualifying Schwab holdings are equal to or greater than $250,000 or receive a $200 Card statement credit if your qualifying Schwab holdings are equal to or greater than $1,000,000, when measured following Card account approval and annually thereafter.

- Invest with Rewards: Liquidate Membership Rewards points for 1.1 cents each when deposited to your eligible Schwab account.

To get this card you must have a Charles Schwab account. Fortunately, even a no-fee checking account is fine. And, incidentally, Schwab has one of the best no-fee debit cards around with no foreign transaction fees and it reimburses ATM fees.

Platinum Card Fee Differences

Each of the consumer Platinum cards charge a $695 annual fee, and you can add up to three Platinum authorized users (AUs) for $175.

The Business Platinum card charges a $695 annual fee, and each Business Platinum employee card costs another $350.

The following table shows the total amount paid depending upon the number of Platinum cards you have with each account.

| Number of Platinum Cards | Consumer Platinum | Morgan Stanley | Business Platinum |

|---|---|---|---|

| 1 (Primary Only) | $695 | $695 | $695 |

| 2 (Primary + 1 AU) | $870 | $695 | $1045 |

| 3 (Primary + 2 AUs) | $870 | $870 | $1395 |

| 4 (Primary + 3 AUs) | $870 | $870 | $1745 |

| 5 (Primary + 4 AUs) | $1,045 | $870 | $2095 |

Note that with consumer Platinum cards you can add authorized user Gold cards for no fee, and with the Business Platinum card you can add employee Business Green cards with no fee. Unfortunately, you need the authorized user Platinum cards get airport lounge benefits. With the exception of Global Entry credits, authorized user cards do not qualify for their own statement credits, but spend on those cards does count towards the primary user’s credits.

Meaningful Differences

Some of the differences between cards show above are hardly worth mentioning. For example, the Morgan Stanley card lets you cash out points at 1 cent per point value. I don’t recommend that unless you really need the cash. You should be able to get far more value for your points.

Here are the differences that I find meaningful:

- Annual Fees for two: If you want or need 2 Platinum cards, the Morgan Stanley Platinum card is the cheapest option since it offers the first authorized user card for free.

- Annual Fees for a family: If you want or need 4 Platinum cards, the consumer cards are much cheaper than the business cards since the former charges just $175 per year for 3 authorized user cards, whereas the Business Platinum card charges $350 per employee Platinum card.

- Annual Fees for five: If you want or need 5 Platinum cards, the Morgan Stanley Platinum card is the cheapest option since it offers the first authorized user card for free and the next three for $175 altogether.

- $200 Uber credit annually (consumer cards only): If you ride Uber regularly or use Uber Eats, this can be almost as good as cash. For others it may be nearly worthless.

- $240 Digital Entertainment credit annually (consumer cards only): If you already subscribe to any of the covered services (such as Disney+ or Hulu), this could be almost as good as cash.

- $400 Dell credit annually (business card only): This is a very specialized benefit, but obviously valuable if you use it.

- $120 Wireless Credits annually (business card only): This will be an easy credit to use for most people, but some won’t like only earning 1x on their phone bills when there’s so many options out there for a category bonus.

- 35% Pay with Points rebate (business card only): This used to be the killer feature of the Business Platinum card when it was a 50% rebate. With a 35% rebate, points are worth about 1.5 cents each. That’s good, but hardly a show stopper.

- Cash out points for 1.1 cents each (Schwab Platinum only): The Schwab Platinum is the only card that lets you cash out points at better than 1 cent per point value.

- $100 to $200 statement credit (Schwab Platinum only): If you already have a lot of money invested with Schwab, or if you can easily move your investments to Schwab, this is a nice perk that effectively lowers the annual fee by $100 or $200 per year.

- $695 Annual Engagement Bonus (Morgan Stanley Platinum only): If you qualify for Morgan Stanley’s annual $695 Engagement Bonus (see this post for details) then the Morgan Stanley Platinum card is essentially fee-free for you and one authorized user!

- Earn Membership Rewards when referring friends: The generic consumer Platinum card and the Business Platinum card offer Membership Rewards points as a bonus (the amount varies from as little as 5,000 points to 30,000 points or more). The Schwab and Morgan Stanley Platinum cards, though, only offer cash rewards (typically $100 per referral). Since I value Membership Rewards points more than 1 cent each, I’d much prefer to earn 10K Membership Rewards or more per referral than $100.

Which Platinum card is best?

It depends. Your first decision point should be consumer vs. business:

- A business Platinum card is best if you highly value the 35% Pay with Points rebate and, the $400 Dell credits and the $120 in wireless credits.

- A consumer Platinum card is best If you highly value the $200 Uber credits, $240 entertainment credits $100 Saks credits, and the ability to earn 5X directly with airlines and/or if you are already paying for services like Walmart+ and Disney+ and can them them rebated.

Which consumer Platinum card is best?

If you decide that a consumer card rather than a business card is right for you (see above), then consider these decision points:

- The Morgan Stanley Platinum card is best if you want to add a Platinum authorized user (since the first AU is free), or if you qualify for the annual $695 Engagement Bonus (which makes the card free for you and one authorized user).

- The Charles Schwab Platinum card is best if you prefer cash back over travel rewards (since it lets you cash out points at 1.1 cents each); or if you have a lot of money invested with Schwab since you’ll get an annual kickback ($100 for $250K invested, or $200 for $1M invested).

- The generic consumer Platinum card is best if you value the ability to earn Membership Rewards points when referring friends.

If you are serving on active duty in the military, then get any or all of the cards since Amex will waive the fees upon request. Call the number of the back of your card and tell them you are serving on active duty military and had heard that AMEX offers to handle your account in accordance with the Servicemembers Civil Relief Act.

Additional details about each of the Platinum cards follows (click the card names for even more information):

| Card Offer and Details |

|---|

150K points ⓘ Friend-Referral 150K points after $15K spend in the first 3 months. Terms apply. (Rates & Fees)$695 Annual Fee Alternate Offer: Targeted online offer of 170K points after $15K spend in the first 3 months See this post for details. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Click here for our complete card review Earning rate: 5X flights and prepaid hotels at AmexTravel.com ✦ 1.5X points per dollar on eligible purchases of $5000 or more (on up to $2 million of those purchases per year) ✦ 1.5x on US construction/hardware stores, US electronic goods, and US shipping ✦ 1X elsewhere ✦ Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Select one qualifying airline and receive up to $200 in statement credits per calendar year for qualifying charges ✦ Up to $400 a year in statement credits for Dell purchases ($200, twice-yearly) ✦ Up to $120 in wireless services credits per year ($10 per month) ✦ $100 Global Entry fee reimbursement.✦ Priority Pass membership (Lounges only) with 2 guests and other airport lounge benefits (Centurion and Delta) ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Gold status. ✦ $189 CLEAR fee reimbursement annually ✦ 35% Airline Bonus: Get 35% points back after you Pay With Points for flights with your selected airline (or premium cabin with any airline). Enrollment required for select benefits See also: Amex Platinum Guide |

100K Points ⓘ Non-Affiliate 100K points after $8K spend in 6 months + 10x on dining for 6 months (on up to $25K in purchases). Terms apply.$695 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 175K after $8k spend (referral only, expired 4/8/24) FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Earning rate: 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $200 a year in statement credits for incidental fees at one qualifying airline per calendar year ✦ $200 prepaid hotel credit per calendar year valid on Fine Hotels & Resorts and The Hotel Collection bookings ✦ Up to $20 per month rebate for Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, SiriusXM, and/or The Wall Street Journal ✦ $15 monthly Uber or Uber Eats credit ($20 in December, use it or lose it each month) ✦ $189 CLEAR fee reimbursement per calendar year ✦ $12.95 (+tax) monthly credit for Walmart+ monthly membership subscription credit when you pay with Platinum card ✦ Up to $100 in credits annually for purchases at Saks Fifth Avenue (up to $50 in credits semi-annually) ✦ Priority Pass membership (Lounges only) with 2 guests and other airport lounge benefits (Centurion and Delta) ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Honors Gold status Enrollement required for some benefits. Terms Apply. (Rates & Fees) See also: Amex Platinum Guide |

80K points ⓘ Non-Affiliate 80kK after $6K spend in first 6 months. Terms apply. (Rates & Fees)$695 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 125K points after 6k spend [Expired 11/8/23] FM Mini Review: In my opinion, this is the best of the consumer Amex Platinum cards when you need two cards thanks to Morgan Stanley offering one free authorized user. Unfortunately you do need to have a Morgan Stanley account to apply. Earning rate: ✦ 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X prepaid hotels booked with American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: $500 after $100K cardmember year spend Noteworthy perks: This card includes all of the great perks that come with the American Express Platinum Card, plus: ✦ 1 Free Authorized User ✦ Redeem points for 1 cent each into your Morgage Stanley account ✦ $695 Annual Engagement Bonus for Platinum CashPlus accounts See also: Amex Platinum Guide |

80K points ⓘ Non-Affiliate 80K after $8K spend in first 6 months. Terms apply. (Rates & Fees)$695 Annual Fee This card is only available to clients that maintain an eligible Schwab brokerage account. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 100K points + 10x when you Shop Small in the US & at restaurants worldwide [Expired 1/20/22] Earning rate: ✦ 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: This card includes all of the great perks that come with the American Express Platinum Card, plus: ✦ Use Membership Rewards® points for deposits by Schwab to your eligible brokerage account. (For example, 10,000 points = $110) ✦ $100 credit with Schwab holdings of $250,000+ or $200 credit with holdings of $1,000,000+ on approval & each year. See also: Amex Platinum Guide |

Are you guys going to post any real articles this week or next? Just wondering, since timmy and Stephen appear to be holding the site together these days. I don’t need cc pimps and would prefer worthwhile information. Enjoy the trip.

Thank you Stephen and Timmy for keeping the site together.

Stephanie, I like CC pimps and I prefer useless information. That’s why I’m an FM reader. I don’t want FM to change a single thing. Sounds like you’re unhappy. Sounds like other blogs would be a better fit for you. But, don’t go away mad . . . just go away. Just curious, are you a Millennial?

so you’re THAT Stephanie

The Business Platinum airfare rebate sets a floor on the value of MR points at 1.53 cpp (provided you have enough airfare eligible for reimbursement), way above the Schwab 1.1 cpp cash-out.

It is most useful for people who don’t have the flexibility to shift travel dates and airports seeking deals or saver award availability. Where all other point booking options yield below the reasonable redemption value of the points.

It’s my favorite AmEx benefit.

Agreed as long as you are very certain you will use the ticket(s) within one year of booking. You can change, but the original booking date starts the clock. Been there a few times.

Add to that the fact that you’ll also earn points on this pseudo-paid ticket. Depending, adding the value of the earned points, I figure a Business Platinum airfare redemption purchase is worth closer to 1.8 cpp.

Not certain if it is still the case but the Morgan Stanley version used to have an annual spending incentive. Spend $100k or more in a year and receive a $500 bonus that year. This is separate and in addition to the reimbursement.

I had never seen the Fiesta Rewards program information anywhere before!? I signed up in English and used the code and it gave me Platinum status right away. Many thanks for the very detailed write up!

I had not heard about this either! Could be interesting. I have seen many Fiesta Americana properties in the past. Now that Hyatt has several properties in many same areas I will stick with Hyatt (Globalist)

On the Morgan Stanley card, the fee reimbursement will get you a 1099 from Morgan Stanley. Mine was $679 taxable for whatever reason. So, not exactly fee-free.

I believe this is avoidable by spending at least $1,000 on the card during the year. Did you not do that? (I’ve had this card for years and have never received a 1099 for it after receiving the reimbursement credit.)

Wasn’t there an article on how to cancel and apply for a new version of the Amex Platinum Card each year, so that you could get the SUBs for each of the four versions? I’m certain it was on this website but I can’t find it. Does anyone know?

I remember reading that. After the first year, you ask for a retention bonus. After the second year, cancel and get a different version. Repeat for each version. By the time you’ve had them all you are eligible for the first bonus again.

Speaking of refer a friend . . . given current referral bonuses and assuming only two referrals a year, the generic and Morgan Stanley cards are essentially even in value. This assumes MS rebate and free first AU — if not, don’t. If someone’s not already at MS, why go through the hassle? Squeeze? Juice? Squeeze? Juice? SUB, then punt. As for the Schwab version, one would have to redeem 900k points per year via Schwab for it to make sense. It, too, SUB then punt.

Any idea when the 150k Platinum Biz offer will end? (I got the personal Gold in April and personal Plat in June). I’m wanting to signup for Platinum Biz, but my spend that I’ll need will be in the fall/winter of this year. I’m worried if I wait until then, the SUB may not be as good. I don’t want to mess with MS on the spend as I heard AMEX is very sensitive to that and don’t want to risk a shutdown

I’m new to the AMEX world so not sure how often they rotate SUBs. I know some of the offers available in the spring/early summer ended on 8/3/22. So not sure if it’s tied into some calendar cycle.

Walmart+ credit (currently not working, but Amex is working on it) is currently $14.18 not $12.95, e.g. the cost of the membership.

I have an Amex Schwab Platinum and a single Platinum AU and have paid no additional annual fee for it since I got it almost two years ago.

I’m surprised that you haven’t been charged for the Schwab Platinum AU. The online documentation for the card is clear that they intend to charge the same as with regular Platinum cards. For example, from my account it says “The annual fee for Additional Platinum Cards is $175 for up to 3 Additional Platinum Cards. The annual fee for the 4th or more Additional Platinum Cards is $175 for each Card.”

With the Schwab version, MR points can be redeemed for 1.1 cents each. Such a redemption seems to require a brokerage account. “Use Membership Rewards® points for deposits by Schwab to your eligible brokerage account.”

On the other hand, you mentioned that a person can qualify for the Schwab version with just a checking account. So, the big question is whether someone who obtains the card via only a checking account can still redeem MR points for 1.1 cents each? Certainly, one can have a token brokerage account if that’s what’s needed. But, the question remains.

I think that you do need a brokerage account

Thanks.

I upgraded my Gold Business to a Platinum Business last weekend. 140,000 points after 10K spend is 3 months and a prorated annual fee of $204.08.

[…] Which is the best Amex Platinum card in 2021? […]

The best plat version is the one you’re still eligible for the SUB. For me that’s only MS and Schwab. But considering how shitty the amex airline credits have become, and many of the covid benefits ended in 2020, I think I’ll wait, get under 5/24, and worry about plat cards later.

Also, if you are a Morgan Stanley Reserve client, they are now requiring $25k minimum daily balance in ‘Bank Deposit’, which earns 0. However, that’s not bad with current interest so low. That $25k saving you $550 amounts to 2.2%. And assuming you make use of the benefits…..

Morgan Stanley engagement bonus info is out of date. Premier Cash is now Cash Plus and much easier to qualify for. Don’t need to be Reserve. Can be done with $5k in Access account and $25k in Cash Plus.

Arg! I thought I had updated that. Thanks for pointing it out. I’ve now updated the post. I had previously written a whole post about this change: https://frequentmiler.com/morgan-stanley-platinum-card-fee-free-how-to-earn-the-550-annual-engagement-bonus/