Membership Rewards points are best used for flights. If you have the Business Platinum card and can find good flight prices, then paying with points is often a great option since that card offers a 35% point rebate for select flights booked with points through Amex Travel. If flight prices aren’t great or you want to book economy on an airline other than your selected airline, then you may do better transferring Membership Rewards points to one of Amex’s best transfer partners so that you can book award flights instead. See the complete list of Amex transfer partners and my picks for the best options here.

Here are the best ways to amass Membership Rewards points quickly…

Credit Card Signup Bonuses

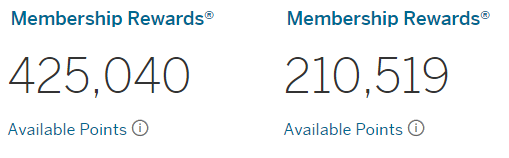

Amex offers a huge assortment of cards that earn Membership Rewards points, and most come with signup bonuses. At the time of this writing, our Best Offers page lists 13 different Membership Rewards cards with a total of 475,000 signup bonus points available through public offers. And targeted offers are often much better.

See: 8 ways to get the best targeted Amex signup bonus offers.

Most Amex offers stipulate that you can’t get the bonus if you’ve ever had that card before. That said, it doesn’t preclude you getting a bonus for a similarly named card. For example, there at least six versions of the high end Platinum card, and it’s possible to get the signup bonus on each and every one. Additionally, targeted offers sometimes do not have that once per lifetime language. In those cases, you can get the bonus even if you’ve had the card before. See: Is Amex increasing exceptions to their Once Per Lifetime Rule? and Targeted personal Platinum offer w/o once in lifetime language.

Signup Bonus Clawbacks

One important detail to watch out for when signing up for Amex cards is that Amex technically does not allow buying gift cards or reloading prepaid cards as a means for meeting minimum spend requirements. Amex signup offers routinely include the following language (underlining is mine):

The following charges do NOT count towards the Threshold Amount: fees or interest charges; balance transfers; cash advances; purchases of travelers checks; purchases or reloading of prepaid cards; or purchases of other cash equivalents.

Since gift cards are prepaid cards, Amex could legitimately withhold a signup bonus if you buy gift cards as a way of meeting a new card’s minimum spend requirements. In fact, Amex has occasionally used this clause as an excuse for clawing back signup bonuses. In practice, gift card purchases usually work out fine, but there is risk. In fact, Amex no longer counts Simon Mall gift card purchases towards minimum spend requirements.

See also: How to avoid Amex Clawbacks.

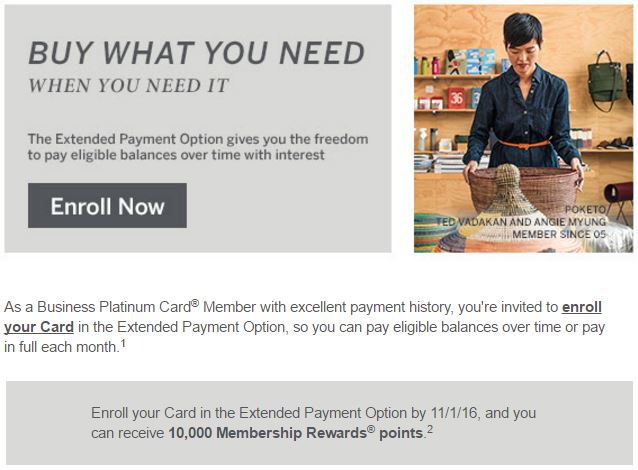

Extended Payment Option

Amex charge cards often offer an easy way to earn additional Membership Rewards points. Once you sign up for a charge card, you will start getting emails and letters inviting you to sign up for the Extended Payment Option. This option essentially turns your charge card into a credit card. Don’t do it. That is, don’t sign up until the offer includes a bonus of 5,000 to 10,000 Membership Rewards points. In my experience, these bonus offers usually appear towards the end of your first year of card membership (as long as you haven’t enrolled already).

Once you get an offer like the one shown above, go ahead and sign up. As long as you keep paying your card’s complete balance each month, there is no downside to enabling this feature.

Upgrade Offers

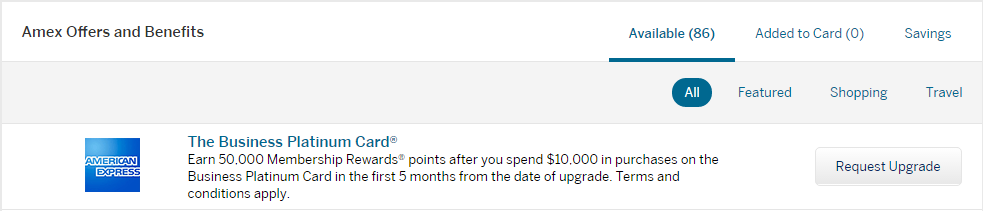

Amex frequently offers bonus points for upgrading from one card to another. For example, we’ve seen 50,000 point offers for upgrading from the Business Gold Rewards card to the Business Platinum card. Even better, these upgrade offers often do not have the once per lifetime language. That is, if you are targeted for an upgrade offer, you may be able to earn the bonus points even if you’ve had the card before. It is best to accept these offers only after you have earned a signup bonus for the higher end card.

Credit Card Referrals

Another way to earn Membership Rewards points is by referring friends and relatives. In some cases referral bonuses are really big. For example, in the past Amex has offered as much as 25,000 points as a referral bonus for the Business Platinum card. If you want to keep your friends, then make sure that the offer they get is as good as the best available public offer (compare to our Best Offers page).

Log into your account and check the section titled “Amex Offers and Benefits” for any special referral offers.

Category Bonuses

The next best way to earn Membership Rewards points is through category bonus spend. If you spend a lot personally or through your business on any of the following categories, you can do very well:

| Spend Category | Best Options |

| US Supermarkets |

EveryDay Preferred 4.5X* (up to $6K per year) EveryDay 2.4X** (up to $6K per year) Premier Rewards Gold 2X |

| US Gas Stations |

Business Gold Rewards 3X*** EveryDay Preferred 3X* Mercedes-Benz Credit Card 3X**** Premier Rewards Gold 2X |

| US Restaurants | Premier Rewards Gold 2X Morgan Stanley Credit Card 2X Mercedes-Benz Credit Card 2X |

| Flights |

Platinum consumer cards 5X Business Platinum (via Amex Travel) 5X Premier Rewards Gold 3X Business Gold Rewards 3X*** Morgan Stanley Credit Card 2X |

| Prepaid Hotels |

Platinum cards (via Amex Travel) 5X |

| Select Car Rental Companies | Morgan Stanley Credit Card 2X |

| Select US Department Stores | Morgan Stanley Credit Card 2X |

| US Shipping | Business Gold Rewards 3X*** |

| US Advertising in select media | Business Gold Rewards 3X*** |

| US Computer related purchases |

Business Gold Rewards 3X*** |

| Everywhere else | Blue Business Plus 2X EveryDay Preferred 1.5X* |

* The Amex EveryDay Preferred card earns a 50% bonus every billing period in which the card was used for 30 or more transactions. Before the 50% bonus, the card has the following bonus categories: 3x points at US supermarkets on up to $6,000 per year in purchases (then 1x); 2x points at US gas stations; 1x points on other purchases. After the 50% bonus, it offers: 4.5x points at US supermarkets on up to $6,000 per year in purchases (then 1.5x); 3x points at US gas stations; 1.5x points on other purchases.

** The Amex EveryDay card earns a 20% bonus every billing period in which the card was used for 20 or more transactions. Before the 20% bonus, the card has the following bonus categories: 2x points at US supermarkets, on up to $6,000 per year in purchases (then 1x). After the 20% bonus, it offers: 2.4x points at US supermarkets, on up to $6,000 per year in purchases (then 1.2x)

*** The Business Gold Rewards card offers 3X points on a single category of your choice, and then 2X on all other available categories from the following list: Airfare purchased directly from airlines; U.S. purchases for advertising in select media; U.S. purchases at gas stations; U.S. purchases for shipping; U.S. computer hardware, software, and cloud computing purchases made directly from select providers.

**** The Mercedes-Benz Credit Card (not to be confused with the Platinum Mercedes-Benz Charge card) offers “2 additional points (for a total of 3 points) on gasoline at gas stations located in the U.S. (superstores, supermarkets and warehouse clubs that sell gasoline are not considered gas stations), for each transaction of $400 or less (Effective May 1 2017, you will get 3X points on the first $15,000 of purchases at US gas stations per calendar year year; purchases made before May 1, 2017 will not be counted toward the 2017 calendar year maximum);”

Amex Offers

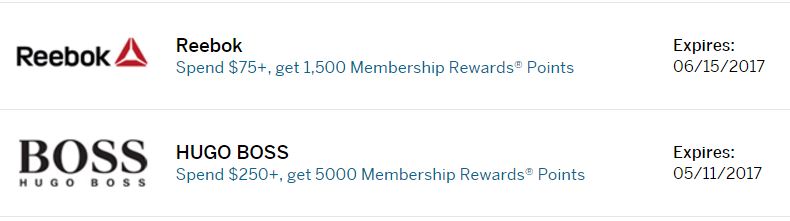

Amex Offers are usually best for saving cash. But, sometimes Amex Offers provide terrific opportunities for point earning instead. One (now expired) example was an offer for Reebok: Spend $75 or more, Get 1,500 Membership Rewards points. And one for Hugo Boss: Spend $250 or more, Get 5,000 points.

Sometimes Amex Offers are longer term and act more like a new category bonus. For example, there were a large number of offers in which you can get an extra Membership Rewards point per dollar spent at selected merchants throughout 2017. See: 2x Membership Rewards (2.5x with Everyday Preferred) at many online merchants.

For general tips and tricks regarding Amex Offers, please see: Complete Guide to Amex Offers.

[…] There are plenty of other Amex cards with great category bonuses for spend within certain categories. For full details please see: Amassing Membership Rewards. […]

[…] also: Top 10 shortcuts to earning SPG points; Amassing Membership Rewards; Amassing Ultimate […]