| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

There are a number of new Amex Offers out today to get 10% back as a statement credit at Staples, Lowe’s, Dell and Boxed.com. Unlike recent Chase Offers for some of these merchants, the caps are quite good, ranging from $50 back at Staples to $1,500 back at Dell. Interestingly, several of these offers indicate that only business cards are eligible, though the offer showed up on almost all of our personal cards as well. Did Amex make a mistake in how it was targeted? Was it a lazy copy and paste of the terms? Will they later claw it back if synced to non-business cards? Your guess is as good as mine. These are very good offers, but keep in mind that the Staples offer did get clawed back last time around on people who synced it to more than one card. We have added these offers (and more) to our Current Amex Offers database.

The Offers

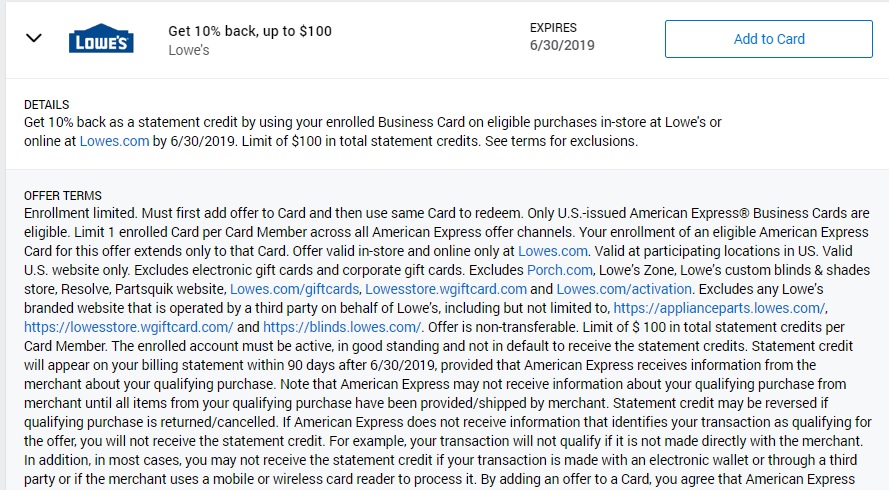

Lowe’s / Lowes.com: Get 10% back up to $100

Expires: 6/30/19

Key Details: Valid in-store or online up to a maximum of $100 in statement credits

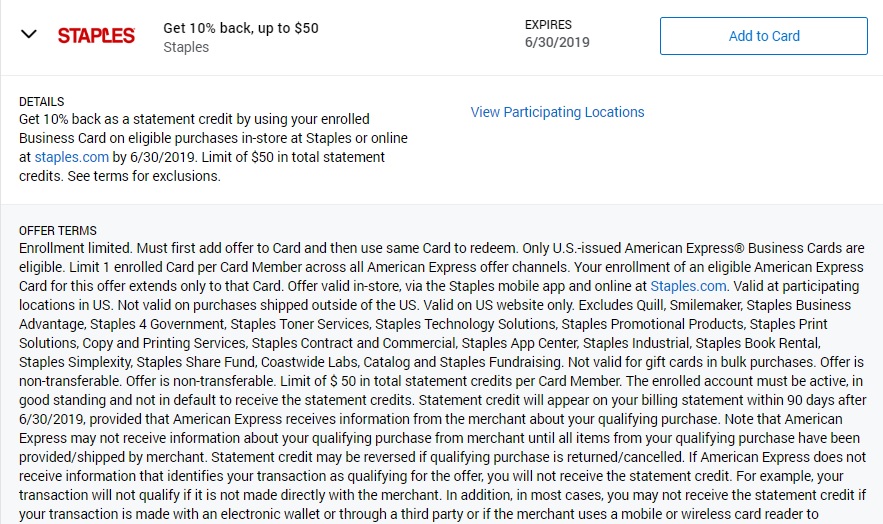

Staples / Staples.com: Get 10% back up to $50

Expires: 6/30/19

Key Details: Valid in-store or online up to a maximum of $50 in statement credits

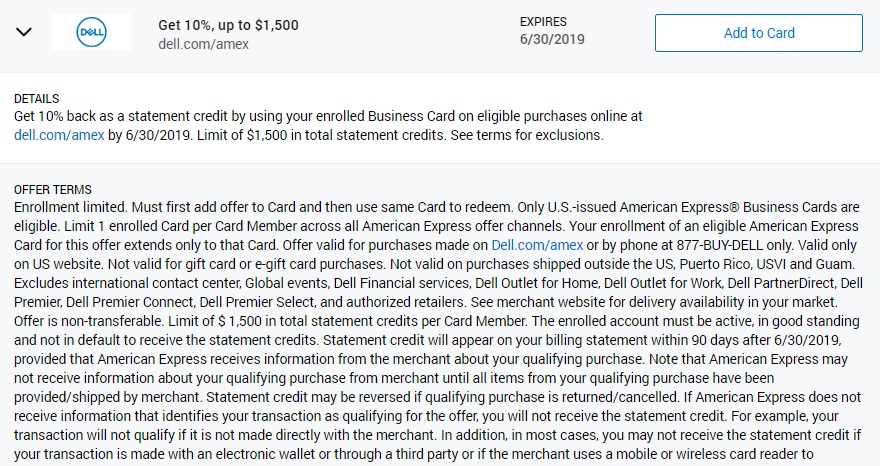

Dell.com: Get 10% back up to $1,500

Expires: 6/30/19

Key Details: This says it is valid for purchases at dell.com/amex, but past offers have been triggered when going directly to Dell.com (or clicking through a shopping portal). Dell Outlet is excluded and I believe that those purchases have not triggered past offers (but if any readers have contrary experiences, let us know in the comments and I will update). This one is valid for up to $1,500 in total statement credits, which means you will get 10% back on up to $15,000 in total purchases.

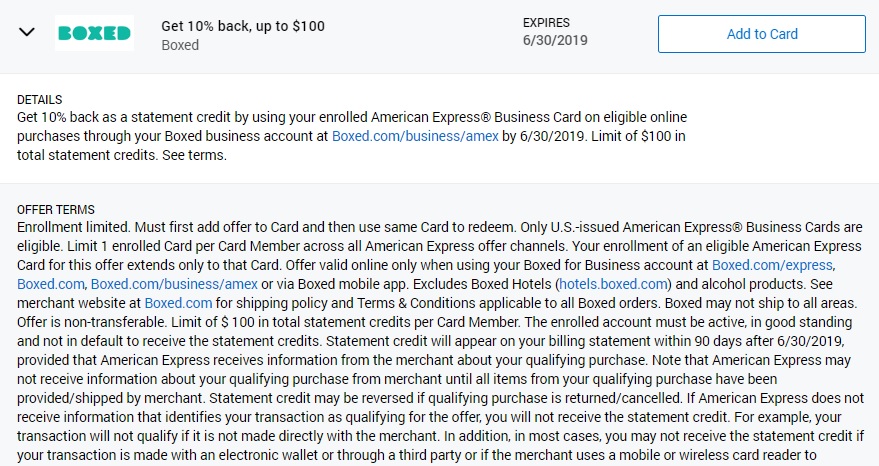

Boxed.com: Get 10% back up to $100

Expires: 6/30/19

Key Details: Limit of $100 in total statement credits.

Bottom line

Overall, these are nice offers with useful caps. They are valid until the end of June, which is positive on the one hand since you’ll have plenty of time to use the offers. On the other hand, it means we are less likely to see similar good offers for these merchants between now and then, which might be a bummer. Whether or not these offers will work on personal cards is anybody’s guess. While I would generally expect offers to work with any card with which they are synced, we did see Amex claw back those Staples offers last year when people synced them to multiple cards, so it’s not impossible to envision them doing the same here and saying that the terms clearly state the offers are valid on business cards. YMMV.

As always, we have added these offers (and more) to our Current Amex Offers database.

![[Live] More easy rewards: Staples fee-free $200 Mastercard gift cards a card with a silver and gold ribbon](https://frequentmiler.com/wp-content/uploads/2019/03/Staples-fee-free-Mastercard-3-19.jpg)

[…] was a Lowe’s Amex Offer earlier this year that offered 10% back in statement credits. While the percentage with this new offer is higher at […]

[…] often possible to pick up BP and Shell gift cards for 10-20% off with Amex Offers, Happy gift card deals, etc., so I’d been hoping that would also stack with GetUpside. […]

[…] the offer and value those points at greater than 1cpp. If possible, load it to a card that has the existing Staples Amex Offer for 10% back to double up on the […]

[…] at the start of the year, a bunch of new Amex Offers appeared at various retailers, one of which was Boxed. That offer is valid until June 30, 2019, so if you’d added that to a card that also has this […]

Does the dell offer work on dell small business website? I have used it many times going to dell.com through a portal without issue but now I’m contemplating going to Dell Small Business website through a portal and wondering if it will triggerthe offer as well

[…] you’d earn 2,510 Ultimate Rewards or $25.10 per card. Alternatively, take advantage of the Staples Amex Offer to save an additional 10%. That offers maximum cashback of $50, so a $500 card would only cost […]

Does this apply to GC purchases? Staples offer says “Not valid for gift cards in bulk purchases” but what is considered bulk purchases?

It’s my understanding that applies to something like if you owned a store and wanted to sell Staples gift cards, so you bought them in bulk from Staples.

If you’re looking to buy gift cards at Staples, those have been known to trigger this credit without issue. The only problem reported was last year when people synced the same offer to multiple cards and Amex clawed back the offer for Staples for those who had synced the offer and used it on multiple cards. Maxing it out on one card with gift card purchases hasn’t been a problem thus far.

Thanks!

Is the dell offer a one-time use thing or is it good on as many purchases as I make

[…] better deal would be to take advantage of the Staples Amex Offer for 10% back. There’s a limit of $50 back, but if both you and a partner have the offer loaded to a card, […]

You may check your account again to see if you get the offer. I didn’t get the offer initially. But I just checked my account yesterday and the offer is there.

[…] week, some great new Amex Offers appeared offering 10% back at Lowe’s, Staples, Boxed and Dell. If you didn’t load them straight away, you might have thought you were out of luck as they […]

Neither my wife nor my accounts have ANY Amex offers on them. ZERO! Could be a message to switch to Citi Prestige!

SAME! Neither me or my husband was had any of those offers. Not a one.

Neither DH or I was targeted for Dell, Staples or Lowe’s. Both of us maxed the last Lowe’s offer with our new appliances.

The big question is whether they sync to multiple cards or disappear once synced to one?

Mine didn’t disappear but you are still limited to the overall cap on all cards in the offer.