Our current Top 10+ Credit Card Offers page contains a list of all best public welcome offers (that we know of), sorted from top to bottom by an unbiased estimate of first year value. Currently, the top 10 includes four Delta cards each offering intro bonuses of 60,000 or 70,000 miles. The Ink Business Preferred 80K offer has kept its top spot and the Sapphire Preferred 55K offer has held on to its long-time top 10 standing. Also in the top 10 are: CNB Crystal Visa Infinite Credit Card (70K), Amex Business Platinum card (up to 75K since expired — see the current offer on our Best Offers page), Business Gold Rewards card (50K since expired — see the current offer on our Best Offers page), and the Southwest Rapid Rewards Premier Business card (60K). Those Top 10 offers add up to 650,000 points and miles on the table for intro bonuses.

It has come to my attention recently that many readers didn’t know that our Top 10+ Credit Card Offers page goes far beyond the Top 10. There’s a reason for the plus in the page’s name. At the time of this writing, the next 10 offers add up to another 620,000 points and miles thanks mostly to cards from Chase, Citibank, and Amex. But, for those who already have all of the great cards from those issuers, there’s also the 60K Avianca card and the 50K Merrill+ card.

There are two easy ways to see beyond the Top 10 entries…

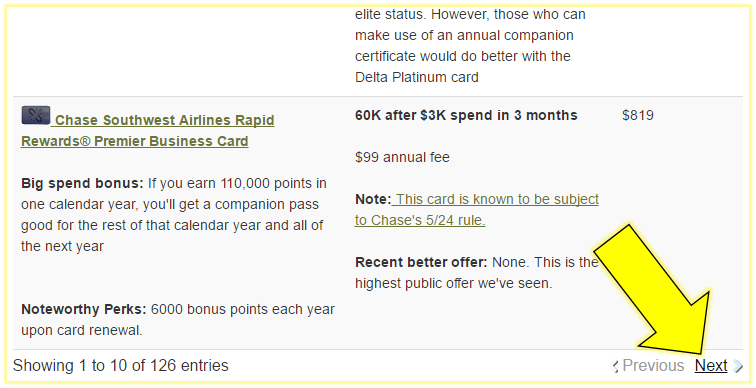

Page Next

At the bottom of the list of offers, you’ll find a link titled “Next”. This will take you to the next 10 entries.

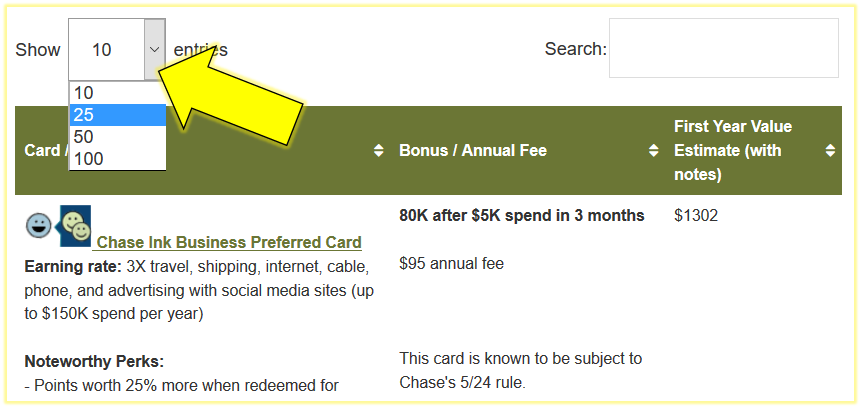

Show Entries

Another option is to change the number of items shown at once. For example, select “25” to turn this into a Top 25 list:

How we calculate Estimated First Year Value

At a very high level, we estimate first year value by adding up the value of the welcome offer plus statement credits (if any) and subtracting out costs such as the first year annual fee. With points and miles, we use Reasonable Redemption Values (RRVs) to estimate their value. Full details of how we calculate Estimate First Year Value can be found here: Credit card welcome offer estimation details.

Estimated first year values do not include the value of most standard credit card perks (4th Night Free, free checked bags, companion ticket, etc.) because we don’t know if those perks will be used or how much they’ll be used. So, this list should be used, at best, as a guide to those cards that offer the best first year value. If you’re looking for cards with the best ongoing value, see:

And, if you know which cards you want and simply want to find the best public offers for those cards, see:

Greg is different than some of the other bloggers, giving lots of in depth information, even if he doesn’t gain directly. I find I can trust him to find the best info possible.

[…] 1.2 million miles available through Top 20 offers […]

[…] you read Greg’s post this morning about view our best 10+ credit card offers, you might have noticed a number of Amex cards in our Top 10+. One of my favorite things about my […]

I have gained so much knowledge from this, and other blogs I follow. I have applied that knowledge over the past 3 years to take some amazing trips that I could have only dreamed about previously. I have been enriched with other ways of viewing the world and thus, became a more conscious and (dare I say it?) insightful person.

I sign up for credit cards anyway. It is my pleasure to use the links from the blogs I read as a way of saying thank you for the knowledge I have gained. I have zero problems with bloggers making a living out of their efforts.

CNB Crystal 70K expired back in March.

Quick, sign up for all my CreditCard links. Hurry!!

Most of the cards currently shown in the top 20 are not affiliate links. That’s the beauty of an unbiased sorting of cards. It is not influenced by whether or not I make money with those cards.

Exactly SumOfAll. Mile Nerd list all the way.