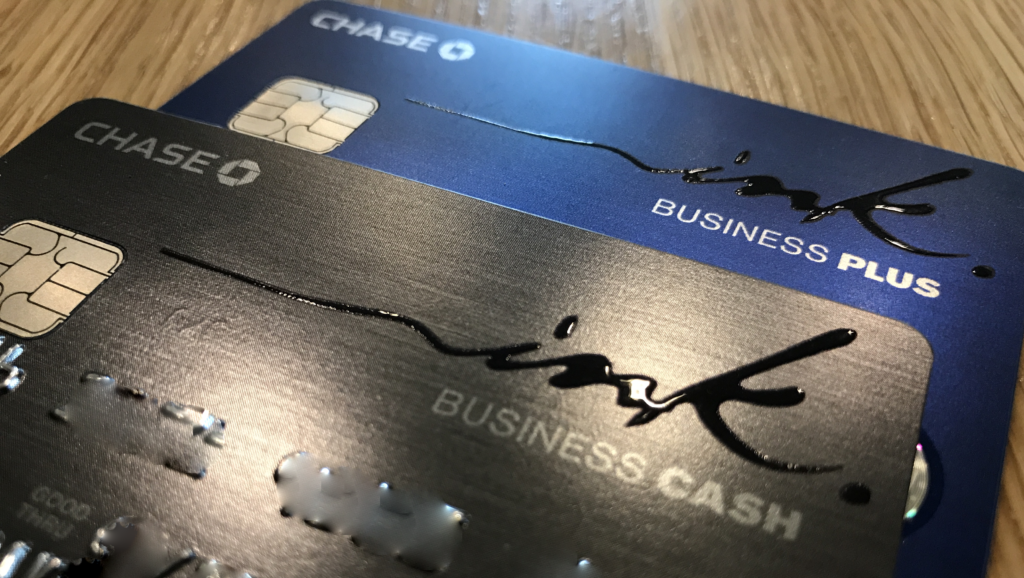

To celebrate Memorial Day, here’s a quick and easy post (easy to write and, hopefully easy to read). If you have the Ink Business Preferred or Ink Plus card and no longer want to pay the $95 annual fee, you can change to the no-fee Ink Cash card simply by sending Chase a secure message online.

UPDATE: CHASE NO LONGER ALLOWS PRODUCT CHANGES VIA SECURE MESSAGE

Full details about the Ink Cash Business Card can be found here. The short version is that the card has no annual fee, and it offers great 5X Ultimate Rewards category bonuses (office supply purchases, phone, TV, and internet), up to $25K spend per year. Remember that you can get better value from those points by freely moving the points to a premium card account such as the Sapphire Reserve, Sapphire Preferred, Ink Business Preferred, or Ink Plus.

My wife recently received a her Ink Plus credit card bill with the latest $95 annual fee, so we decided to switch to the Ink Cash in order to get the annual fee removed. She could have called, but she preferred that I do it for her, so I made the change online. I logged onto her account (with her permission, of course) and sent secure messages, as follows:

On my wife’s behalf, I wrote:

I would like to product change my Ink card ending in XXXX to an Ink Cash card in order to save on the annual fee. Please make that change if possible. Thank you.

Less than two hours later, Chase wrote:

Hello,

I am writing in response to requesting to switch your INKPLUS Visa Signature Business.

Let me share that you can convert to the to INK CASH Visa Signature Business with no annual fee. Please review the following information before we process your request.

Earn 1 point for every $1 spent on purchases. You earn an additional… [truncated]

I responded:

Yes, I agree to the terms. Please make the product change.

And, three hours later, Chase wrote:

We appreciate your confirmation email about changing your account.

I’ve changed your account to a INK Cash Visa Signature as you requested.

Here’s what you need to know: … [truncated]

That was it. Soon enough, the Ink Plus $95 annual fee was reversed, and we received the new Ink Cash card in the mail. Done.

[…] to Chase from their website asking to downgrade my card (thanks to Greg at Frequent Miler for instructions on how to do this online). After some back and forth with legalese forms, I was allowed to change to the Ink Cash card. So […]

DP – Just tried thru SM (copy/pasted your message) and they advised to call in. My wife is so anti-calling, she’s going to love that she gets to do this 😉

Oh yeah, Chase stopped allowing this: https://frequentmiler.com/2018/02/22/chase-stopped-allowing-product-changes-via-secure-message/

I’ve updated the post. Thanks for the reminder.

@MH

This….

https://www.flyertalk.com/forum/chase-ultimate-rewards/1854146-chase-survey-regarding-possible-changes-when-combining-points-3.html

I started that thread! :))

Is it possible to product change from the chase ink preferred to the chase ink cash? Thanks

Should be, yes. Send a secure message and ask.

Did you happen to read any recent datapoint about the conversion?

I sent a SM and asked for a fee refund. The secure message said the $95 annual fee could only be refunded within 30 days of the original posting date. But the rep also stated that I could get a prorated refund (it has been over 90 days since the fee posted). I was skeptical because various online DPs have stated that Chase has limited this to 40 days.

I called in and downgrade (Ink Preferred to Ink Business Unlimited). The rep confirmed I would get a pro-rated AF refund.

Fingers crossed.

FWIW I have a Chase Sapphire Reserve and also am an AU for the Chase Ink Cash.

I just got the Explorer & Marriott Business cards (long delay before approval; in fact it’s been a week and while the cards show up online I still have not received them). I think I’m still below 5/24 if these two won’t add to the count and thanks to Chase not having 1/lifetime I think I can still get the $500 signon bonus for another Chase Ink Business Unlimited in the future.

It may be better to try to PC near or during the renewal. And probably better luck over the phone.

Thanks MH. The annual fee just came due thus the impetus for downgrading. Hoping a phone call can get it done.

I’ve tried twice now to product change via secure message. Once before I read this post, and once after. Both times I have received the same response (below):

“Hello,

I’m writing in response to your inquiry about switching

your card.

I have reviewed your account again and see that

the option to switch your current Ink Plus card to a Ink

cash is not available. I regret any inconvenience this may

cause.

You may choose to apply for a new Ink Cash card. New

applications are available online at our secure website.

Please visit our website for the most current offers and

terms available:

https://creditcards.chase.com

We appreciate your business and thank you for being a

Chase customer.”

I don’t know why I am getting this response. Has anyone recently attempted to PC their Ink Plus to Ink Cash? Were you successful?

Jason, do you have a Visa or MasterCard Ink Plus? The Ink Plus was originally a MasterCard and then later a Visa card. If you have a MasterCard, it makes sense to me that they wouldn’t allow a product change to an Ink Cash Visa. Can you confirm?

Hi Greg,

Thanks for the reply. I have an Ink Plus Visa. Chase is giving me mixed messages via SM. First they said it wasn’t possible. Then they said it could be done only in branch. Being that this is my wife’s card I’m trying to avoid having her go. I’ll give it one more try via SM.

Has she had the card more than a year? If not, that might be the problem. Sometimes they’re more restrictive w/ cards if you haven’t had it 12 months.

Yes, she’s had the card for a few years now. I’m hoping the agent(s) is/are just misinformed.

Well, I got shot down yet again:

“Hello,

Thank you for contacting Chase to convert your account.

At this time, I’m unable to change your account to a

different product. As an alternative, you may apply for a

new Ink cash product. New applications are available

online at our secure website. Please visit our website for

the most current offers and terms available:

http://www.creditcards.chase.com

When selecting the credit card that best meets

your needs, please remember that our policy no longer

allows for customers to have more than one credit card in

the same product. Applications for a card product you

already have may not be eligible for approval.

We appreciate your business and thank you for choosing

Chase.”

She doesn’t already have an Ink Cash card, so that’s not an issue. Looks like we’ll try our luck over the phone or in branch.

Has anyone had any recent success?

FYI I product changed from my Ink Preferred card to the Ink Cash card 5 months after opening the Ink Pref account. I transferred my 80K points to my CSR before the change. I just checked and Chase just issued a pro-rated refund of the annual fee for the Ink Pref and I still kept the points.

Sweet. That’s good to know. Thanks.

So, it appears I signed up for the wrong card – got the Ink Business Preferred, not the Ink Cash (I really wanted the 5x points on office supplies). My question – I just hit the bonus point threshold (in 30 days) for the offer on the Business Preferred. If I try to change the card online to the Ink Cash, will I lose the bonus points now? If so, how long do I wait before changing and be able to hold on to the bonus points?

I don’t know for certain what would happen, but I’d recommend waiting until your signup bonus points post before product changing. Another option, if you are under 5/24, is to sign up new for the Ink Cash in order to get another 30,000 points. You can merge points together into your Ink Cash account and then cancel the Preferred card when the annual fee comes due next year.

A 5/24 question in reply. If I do what you suggest (apply for the Ink Cash and then cancel the Ink Preferred), will cancellation of the Preferred card offset the additional card (i.e., Cash) in Chase’s 5/24 calculation? Or does 5/24 only work in addition (not subtraction) mode?

Closing a card does not subtract from your 5/24 count. That said, the jury is out about whether or not Chase business cards count at all towards 5/24. If they do, I’m willing to bet it is only for open cards. So, I think this approach won’t hurt you, but I can’t give you a 100% guarantee.

[…] Switch to Ink Cash online […]

I just fell out of 5/24 a couple of weeks ago. Since Kates and Serve/Bluebird have gone away I have no time nor interest in trying to convert $300 VGCs into money orders, so I am never at the $25,000 cap. Would a good strategy be to downgrade to Ink Cash and then open up a Ink Preferred, or should I go for CSR even though the bonus is at 50k? And should I wait for the annual fee to post (mine is in July) or do it before the AF posts? Thanks.

I don’t think it matters whether you downgrade now or when the annual fee hits.

As to whether to get the CSR or Ink Preferred, it depends on your goals. If all you care about is the signup bonus, then the business card is better. If you want a good travel card that offers 3X for travel & dining and a few other travel perks, CSR is better.

[…] post earlier this week about product changing to the Ink Cash card online generated a surprising number of questions via comments and social media. Clearly, many details […]

Thanks for the info. The annual fee on my Ink Bold was coming due and I was really hesitant about calling to do a product change. With two secure messages, I was able to change to the “Chase Ink Cash 5-2-1” as they are calling it. No AF and still 5X on Cable, Phone, Internet and Office Supply up to 25K. I don’t MS so I’m not going to hit anywhere near that and we still have Sapphire Premier. It was summer shape up of the CC’s today and I finally got approved for a Sapphire Reserve as well so might try to change Sapphire Premier to a Freedom card in the near future.

1 – Call and ask. But what’s the rush? Wait until your AF posts and see what they might give you.

2 – Yes

One reason to rush is if you want 5X categories right away. As you said, it can’t hurt to call (or secure message) and ask.

Same unanswered question as above. I have a Ink Preferred card I received in a December of 2016 with a 75K point balance.

1- can I product change this early ?

2- can I first transfer my ink preferred points to my CSR without worries ?

1) I don’t know, but if you find out please let us know.

2) Yes

I copied and pasted your product change request. Chase ok’ed it and I got the Ink Cash. I transferred my points to my CSR first.

Sweet. Thanks for letting me know!

@MH

Debbie is my cousin, but thanks for asking!