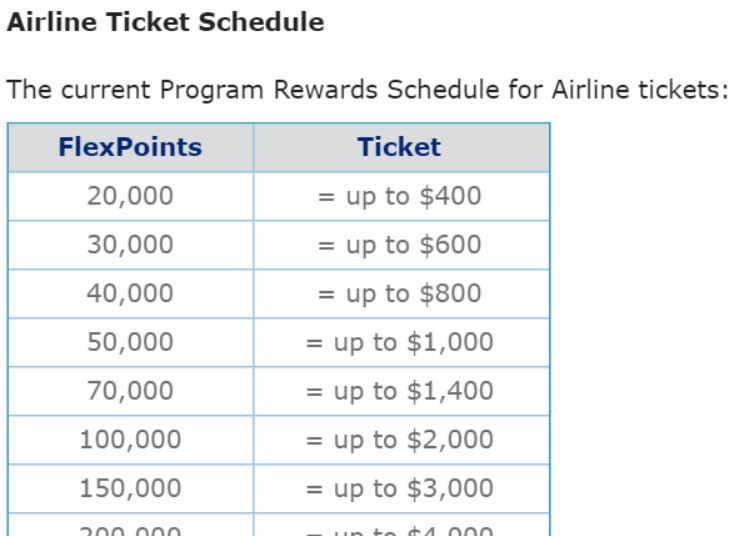

Currently, FlexPerks points are worth up to 2 cents each for airfare, up to 1.5 cents each for hotels, and up to 1.25 cents each for car rentals. The best use of these points has been to try to snag flights at the top of each price band in the Flexperks award chart. For example, ideal flight prices were $390 to $400, $590 to $600, etc:

However, a Reddit user reports learning from a US Bank insider that things will change on December 31. According to his source, FlexPerks points will be worth 1.5 cents each towards travel. He wrote:

From my insider friend at US Bank, some changes are coming to flexpoints, to be announced in July:

*Beginning Dec. 31, it will be easier to understand redemption of FlexPoints. Each FlexPoint will be valued at at 1.5 cents when redeeming for car rentals, airline tickets, hotel rooms and travel packages. Redemptions made prior to Dec. 31 will continue to use the current tiered rate schedule.

Effective Jan. 1, 2018, all earning tiers will be removed for all FlexPerks products. There will no longer be a cap for points earned at the 1:1 rate, regardless of the amount spent. Additionally, the definition of “charitable organizations” will expand to over 1,000 entities. The accelerated earn rate for charitable organizations will be 2X on all FlexPerks product with the exception of FlexPerks Reserve, which will continue to earn at 3X.*

While this is little more than a rumor at this point, I find it completely believable. It makes sense for US Bank to change their FlexPerks program to match the Altitude Reserve. Already they allow FlexPerks points to be moved to Altitude accounts. Once this change takes place, I imagine they’ll freely allow the points to move back and forth. Or, maybe they’ll automatically pool the points as they do today when people have multiple FlexPerks cards.

Obviously, if you are good at getting nearly 2 cents per point value, the upcoming change is bad for you. If you’re in that camp, you may be able to bank those 2 cents per point rewards with techniques similar to those that Miles per Day suggested for the Merrill+ card.

I expect though that most people will be happy with this change. It will no longer be a waste to use Flexpoints for $200 flights, for example. And, using points to pay for hotels and car rentals won’t be a terrible idea (I still prefer paying with points for flights, but that’s another discussion). In other words, Flexpoints will change from being a good backup program to one that people can count on for good value everyday travel rewards.

Changing to 2X charity, but there’s a 3X or even 4.5X possibility…

I’ve reported before that the Flexperks Visa card will no longer offer 3X for charitable contributions beginning January 1, 2018. These two changes together mean that travel rewards for charitable donations will go from today’s max of 6 cents per dollar, to a fixed 3 cents per dollar. Ouch. For those of us who like to contribute to Kiva loans, this will hurt.

Interestingly, the Reddit post says that the FlexPerks Reserve card will continue to earn 3X. What the heck is the FlexPerks Reserve? Doctor of Credit reports that US Bank has a couple of premium version of the FlexPerks card: U.S. Bank FlexPerks Reserve American Express Card, and FlexPerks Reserve Visa Signature Card. Unfortunately, these are intended only for their Private Wealth customers. But, those who can get them can continue to earn 3X for charity in addition to a 50% relationship bonus for Private Client Reserve customers! Together, this means earning up to 4.5 points per dollar. With points worth 1.5 cents each towards travel, you could get 6.75 cents per dollar value.

[…] HT: Reddit via Frequent Miler […]

[…] Greg wrote about the rumored changes to the FlexPerks program in his post, “FlexPerks to ditch its backup status“. In a nutshell, it was rumored that beginning December 31, 2017 FlexPerks would be worth 1.5 […]

Also, be careful using this technique with other airlines, planning to cancel within 24 hours. Some may agree to hold the funds for future use; others may insist on refunding to the original form of payment (which, if you used FP to buy the tickets, means US Bank gets the refund and you are out of luck).

I’ve also redeemed FP for Southwest flights. It can work well if you’re familiar with Southwest’s policies. But you need to be careful. In addition to the gotchas mentioned above,t here’s another one: If you combine travel credits with new money, the entire ticket price inherits the expiration date of the oldest travel credit. Here’s an example:

Say that you get a FP ticket for $399 on WN on January 1, 2017. So far, so good.

Now you use $349 of the funds for a trip on February 2, 2017. Still good.

Now, on December 1, 2017, you use the remaining $50 of the funds, plus $450 in new money, to purchase a $500 fare for travel on December 25, 2017. You now have $500 that expires on January 1, 2018, because all funds used for a reservation inherit the oldest expiration date. This is OK if you actually travel as scheduled, but if you need to push your trip into 2018, you have lost the entire $500.

In that case, it might be better to forfeit the remaining $50 from FP, and use $500 in new money to buy the ticket. That way the funds would not expire until December 1, 2018.

In addition, when booking with FP (or Citi, or Chase), it’s probably best to use only your first and last names. If you use your middle name, your booking may look like “Jones Jerrymiddle” (with no space between first and middle names) in Southwest’s reservation system. Since your Rapid Rewards account is in the name “JonesJerry”, names will not match, and you won’t be able to reuse funds online. (I actually ran into this with a Citi TYP redemption. I was able to reuse the funds by calling Res, but it was much less convenient than using them online.)

Finally, when I redeemed FP for WN travel, even using just my first and last names, I could not change or cancel the booking online. Again, Res was able to do it for me. (Normally not too big a hassle, but when there’s a storm, with resulting hours-long hold times, it can become a nightmare.)

Great tips, thanks!

Greg,

This is a clear cut devaluation of the program, reducing the maximum benefit from 2 cpp to 1.5 cpp. Yes, 1.5 cpp also now operates as a floor, but honestly it’s already pretty darn easy to get at least that much value routinely.

I’m not sure why you’re trumpeting this as an improvement that makes the program better.

I don’t think I’m trumpeting anything. I agree that it is a devaluation for those who gamed it or those who used it as a backup program (e.g. only use points when you get high value). The new program will be less top-end valuable, but more widely usable. It’s a trade-off. I’d bet anything that the average cardholder will get more value and more satisfaction from the new program than from the old. But, yes, those who try to maximize everything will lose out

More used, maybe. More “usable,” not at all. And way less valuable. 1.5 cpp was already insanely easy to achieve. Now that’s the max benefit.

There may be those out there who would never have redeemed at 1.5 cpp (knowing that meant leaving value on the table) who will now do so, making the program more used. But still much less valuable.

And the fact that people will use the program more because of being forced into a fixed (lower) redemption rate (rather than saving points for future higher redemptions) is not a good thing.

Not to mention the lower earning rates as well…

“There may be those out there who would never have redeemed at 1.5 cpp (knowing that meant leaving value on the table) who will now do so, making the program more used. But still much less valuable.”

But more profitable to the bank – which is their objective.

There is a clever technique for obtaining almost all the value from FlexPoints, a technique described by MMS roughly a year ago. It only works for folks who often fly Southwest, and it goes like this:

1. Assuming you have 20K FPs, find a SWA fllght sometime in the future that costs just under $400 as Wanna Get Away. It does not need to be a route you will ever use, but it should be at least several days in the future.

2. Use FPs to book that flight. Accept no substitutes…you “have” to take that particular flight.

3. Later you can cancel the booking, being sure to select the option of using the funds for a future flight.

Now, you’ve got almost a year to use the $395 on future SWA flight(s).

It looks as if the new redemption scheme will eliminate the need for these shenanigans.

Thank you. This is a perfect solution for me.

That said, this requires use within a year. Greg mentions : cancel flights to a “bank” which you can then use for other cheaper flights “similar to those that Miles per Day suggested for the Merrill+ card.”

Does the FP program allow you to return the funds to your bank account?

No, you can’t withdraw to your bank account. I just meant that you could bank the funds with a particular airline to be used later (often with a 1 year expiry)

This technique is not limited to SW. I’ve used it on JetBlue, cancelling my flight for future credit. The key is to cancel within the first 24 hours after booking so as to avoid fees. I imagine the same technique works with most airlines.

(Another option is to purchase a fare that does not incur cancellation fees, which gives you the ability to make the switch even after 24 hours).

This has been an effective way to use FP and maximize value via SW tickets.

BUT, a few very important details to know about before you start cashing out in quantity via this method before December 31:

– The Southwest credit can ONLY be used for the named person of the original ticket you booked using FP. IOW, if you book a FP award for Jane Doe, and then cancel the ticket, you can re-book *only* Jane Doe using those particular funds. You can’t use that credit for John Smith.

– You have one year from the original booking date (not the original travel dates!) to use the credited funds. Even if you book and cancel again, the original date stands.

– You have to keep track of the confirmation numbers of cancelled itineraries in order to use the funds.

– You can use only a maximum of two travel credits towards any other purchased itinerary. They can use a portion of a credit if it exceeds the value of the new ticket.

Great tips, thanks!

No worries, something else is just right around the corner.

These changes have been confirmed in a number of forums.

For me, the 5-6% on charity was the big draw of the card. With the decrease to 3%, I’ll simpify my life by using my points, cancelling the card, and putting the spend elsewhere.

[…] FlexPerks to ditch its backup status. – Pretty big devaluation coming for US Bank FlexPerks points redeemed for airfare. But the changes will make it easier to redeem for lower priced flights. […]

Any word if the $25 travel credit per reservation will continue? If it will, it’s an opportunity to stack up credits on low cost flights. Something that isn’t possible under the existing rules.

I haven’t heard but that would be great!

Thanks for sharing. I find that FlexPerks are one of the most underrated bank points out there given the 2% redemption value and the ability to earn 2x on grocery shopping (hello Visa GCs!). The changes, while they hurt, will make redeeming the points a better option for fares that aren’t near the top of the range. I wonder if 20K points will still be the minimum redemption amount?

I assume that there’s no minimum but we’ll see

Thanks for posting this information. Related question: when purchasing a flight using FlexPoints, does the charge show up on your statement in dollars with a second item crediting the charge for using their points (which is how Amex MR flight purchases are done), or does the purchase never even show up on your statement (which is how Citi TYP flight purchases are done)? Haven’t used my FlexPoints yet, but wondering vix-a-vis business travel expense tracking.

The purchase is made with points from the get go like with Citi

It usually doesn’t matter if you find a flight for $390 or $590 because they usually can’t, especially for flights that don’t start in the US. This spring we tried to fly from Spain to Brazil and found what should have been 20,000 point flights. There computer system doesn’t even recognise Sao Paulo as a city. When I called the first agent told me it was probably blacklisted as it is too dangerous. The second agent found the exact same flight I was looking at but for 60,000 points. At least now I will be able to use my points and cancel this worthless card.

Isn’t there a rule about FlexPerks points expiring 5 years after they were earned? If so, is that still going to be the case or will points no longer expire with these changes?

I don’t know.

My points show expiring. I already lost a couple hundred because I forgot about it. I thought transferring pts between accounts would extend them another 5 yrs, according to a rep from a while ago. But I just tried that and they are still expiring on the new account.

So the SW ticket and then cancel is a way to bank them for another year.