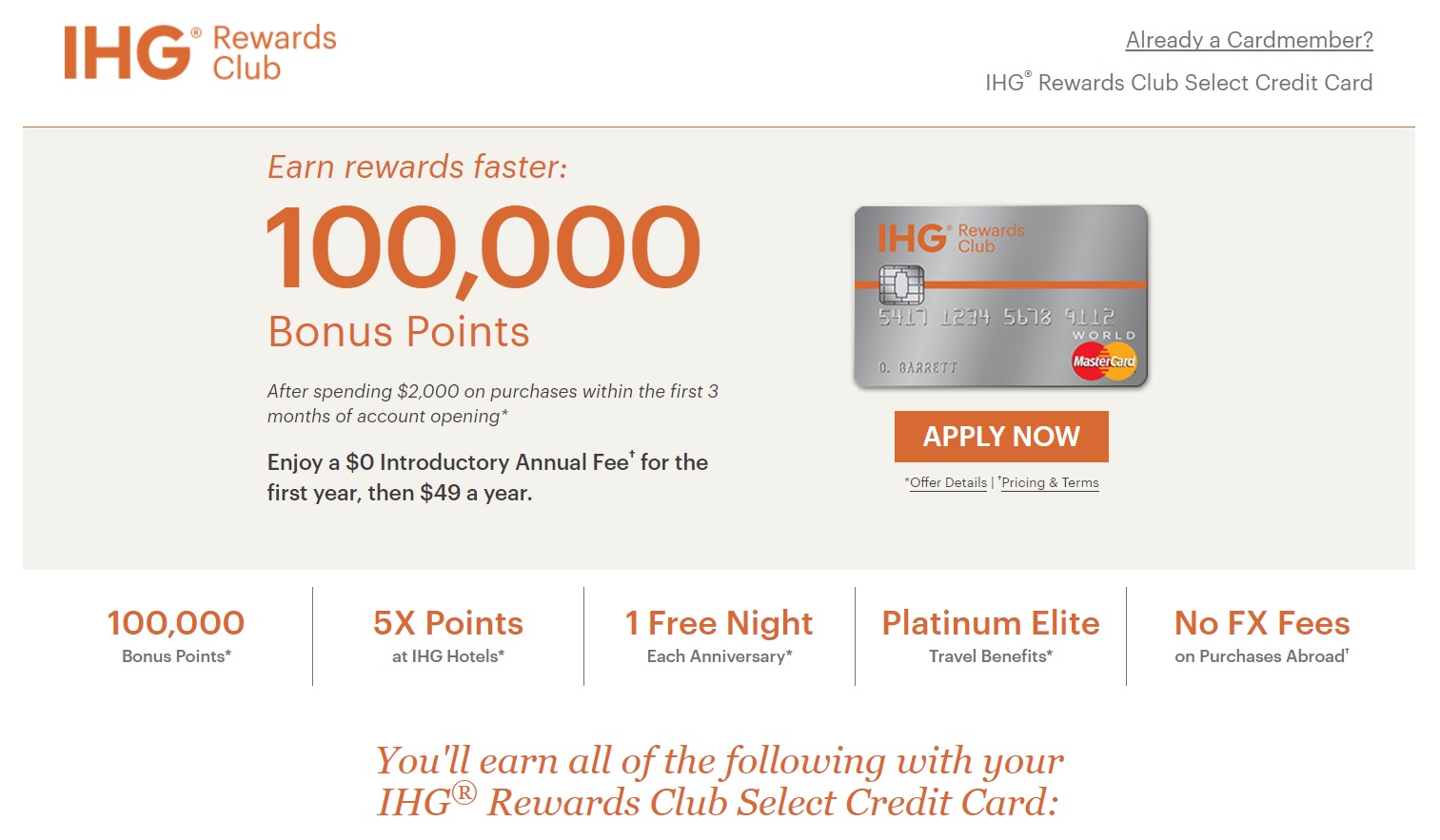

As reported by Doctor of Credit, there is a (targeted) 100,000-point signup bonus offer on the Chase IHG Rewards credit card (plus 5,000 more points for adding an authorized user), and if you have recently applied you may be able to get matched to the higher offer.

Yesterday, we reported the increased 85,000-point offer (total points with bonus and AU). I tried making dummy bookings under different accounts and with different browsers, but hadn’t found a better offer. Doctor of Credit did find a better offer for which some users are targeted. That offer is the one shown above, where you can earn 100,000 points (plus 5K for adding an AU & making a purchase) after spending $2,000 in the first three months. You can click here to see the offer, though the application will error out and then take you to a 60K offer when you click “Apply Now” if you are not targeted (and that’s exactly what happens on my end).

Get matched via secure message

Several Doctor of Credit readers report having gotten matched to this offer by sending a secure message to Chase and asking to be matched. Keep in mind that the 80K offer only had a $1,000 spending requirement and this offer requires you to spend $2,000. Still, 20K for the extra $1,000 spend is well worth it in my book. If you have applied within the past 90 days, you may be able to be matched to this offer by just sending a secure message and asking. The process will work like this:

- You send Chase a secure message saying that you recently applied and you see that there is now a higher offer. Ask if they would match you to this higher offer.

- Chase will write back informing you that you will need to spend $2K and secure message them again and they will manually add the 20K. They will ask you to confirm that this is what you want.

- You will write back and confirm it (don’t forget to say thank you!)

- After spending $2K, you’ll have to send them another secure message to get your points.

That should be it.

Is this guaranteed to work?

Chase isn’t under any obligation to match you to a higher targeted offer, but they have historically been generous about matching offers within 90 days of sign up. I would expect that this will probably work, at least in the short-run if you get a message in to Chase soon enough. It sounds like Chase has been matching people thus far, so I would send a secure message sooner rather than later if you recently applied. It’s well worth a few moments of your time to ask and they may stop granting matches at some point.

Bottom line

The 100K offer is the best I’ve ever seen, and after the bonus for adding an authorized user and making a purchase, you’ll be at 105,000 IHG points. While that won’t quite get you two nights in a top-tier IHG property, it will get you a few nights in many places and could get you up to 21 nights if you chase after IHG Point Breaks for 5K per night. See our previous post for more information on why this card is a keeper year after year. This is as good a bonus as you’re likely to get on this card, so it’s worth seeing if you are targeted (if you haven’t applied) or trying to match to this offer (if you have applied within the past 90 days). Let us know in the comments whether or not you have success with the match.

H/T: Doctor of Credit

![[Reminder: Marriott GCs on 4/23] Daily Getaways 2024: Complete preview of all the deals Daily Getaways 2023](https://frequentmiler.com/wp-content/uploads/2023/06/Daily-Getaways-2023-218x150.jpg)

[…] While the list is mostly populated by Holiday Inn Express and Candlewood Suites properties in the United States, some of them are found in convenient locations along highways and/or may be within your travel plans over the next few months. The Hotel Indigo in Columbus, Indiana makes an appearance as the only of IHG’s boutique-themed hotels on the list. Abroad, there is an Intercontinental in Java, Indonesia and there are four properties in the UK, including one in the London area. As always, the value will really come down to whether or not these hotels fit your travel patterns. I don’t view the PointBreaks list for vacation inspiration but rather where I can save a few bucks on planned stays (due in no small part to the cheap points I’ve purchased). Remember that members are limited in number of reservations at each property (I believe you can make at most two reservations per property at the PointBreaks rate). However, you could theoretically book 20 straight nights with the current targeted signup bonus from the IHG credit card. […]

Girlfriend signed up under the 60k bonus expecting to get a match to the 100k. Sent SM after $1000 in spend and got a denial response. “We know this isn’t the answer you were hoping for.”

Well- that’s disappointing.

Also didn’t get the additional 20K points after SM. Perhaps they did really stop the match across the board.

I called Chase/IHG and they said they will try to honor the 100K points for me (I originally signed up at 60K), but they said they would only do this because I had talked with them a few weeks ago about it. The man said that they no longer honor this upgrade anymore (but I have my doubts about that). So I just have to wait for them to send me confirmation via snail mail.

No go for the additional 20K points after sending secure message. Will only receive 80K points. Disappointed, but that’s the breaks.

[…] are gone, but if you find a hotel you need, these can still be a great value. If you recently matched to the 105K IHG card offer, all the better for […]

My wife & I were both approved for the 80,000 offer despite having opened many more than 5 in 24, so the 5/24 definitely does not apply. I also sent secure messages asking for the 100,000 offer, and they agreed to add the additional 20,000 points after I hit the spend limits. Thanks for the tip.

data point i’ve applied in the last 40 days chase refuesed to match they said because my points had posted the offer would not change

[…] via this link. Also, there as been success applying for the 80k offer ( which is public) and matching to the 100k. My apologies for the […]

[…] Match to 105K-point IHG Offer […]

I’ve had both Hyatt and IHG for 2 years and a couple months. Trying to decide if I should cancel and re-apply for both after a few weeks. I’m currently sitting on 6 Chase personal cards + Ink. I probably have 5 new accts in the past 12 months. I would hate to not get approved as I do value and make use of the annal free night with both.

I sent a secured message per your direction and was approved for the extra 20K points! Thanks for the info.

I just got approved for the 100k offer. Here are the steps I tooked to find it:

1. Logged in to my IHG account

2. Click under My Account

3. Click My Offer Status, and the offer for 100k points poped out

I have the Spire Elite status, so don’t know if the offer will be available to other status. Good Luck!

@mhenner, log into the Chase website, look for the words “Secure Message Center” near the top.

Did DD send his readers over here to comment and ask questions?