Do you remember our informed newbie, Ben? First, we helped him form a credit card plan. Next, he successfully signed up for three cards at once. Intentionally, all three were business cards that do not report to personal credit bureaus. This way, Ben can sign up for lots of cards without exceeding Chase’s 5/24 limits. I now have Ben’s initial results. Not surprisingly, his credit score was barely effected. The surprise was the number of points that showed up on his first statement…

As a reminder, on June 20th Ben signed up for each of the following offers:

- Chase Ink Business Preferred: 80K after $5K in 3 months

- Chase Ink Cash: 30K after $3K in 3 months

- Amex Delta Gold Business: 60K after $4K in 4 months + $50 credit after Delta purchase in 4 months (this offer has since expired)

Credit Impact

We expected Ben’s credit report to show only two new inquiries since the Chase business card inquiries should be combined into one. And we expected no new accounts to show on his report since Chase and Amex business cards aren’t reported to the personal credit bureaus. In other words, the applications and new accounts should have had very little impact at all on his credit report and score. Early results have confirmed our expectations…

Here, for example, was his prior Experian score and summary:

And, here’s his new one:

You can see above that Ben’s FICO score dropped 6 points due to the 2 inquiries. That’s not bad at all. Plus, based on prior experience, I’m sure that his score will fully recover in the next 60 days or so unless he applies for more cards in the meantime.

You can also see above that there are no new accounts on his credit report. He had a total of 9 accounts before and has 9 now. That again is because the business cards he signed up for were not reported to the credit bureaus.

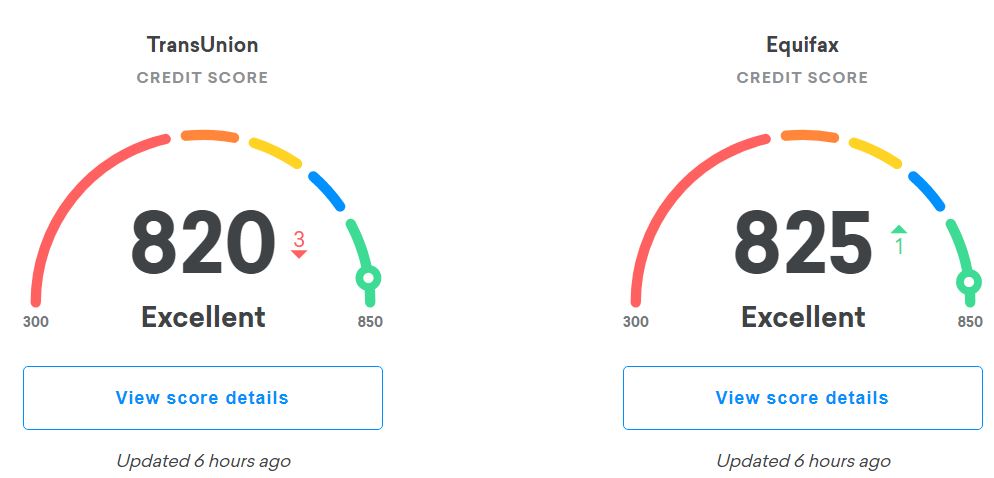

Here also is a look at his TransUnion and Equifax scores as reported by Credit Karma. His TransUnion score fell 3 points and his Equifax score increased by 1:

Progress Towards Minimum Spend Requirements

Ben lives in a retirement village where he is billed about $5K monthly for his rent and other services. In one fell swoop, he knocked out the $5K minimum spend requirement for the Ink Business Preferred card by paying this bill via the Plastiq bill pay service.

Ben has put all other credit card charges on his Delta card (about $800 so far). He plans to knock out the Ink Cash $3K spend requirement plus about $2K of the Delta $4K requirement with next month’s rent & services payment via Plastiq (he’ll have to make two separate payments). Since the Delta spend requirement allows 4 months (vs. 3 months with the other cards), he has plenty of time to tackle the rest later.

Ben’s 3X Surprise

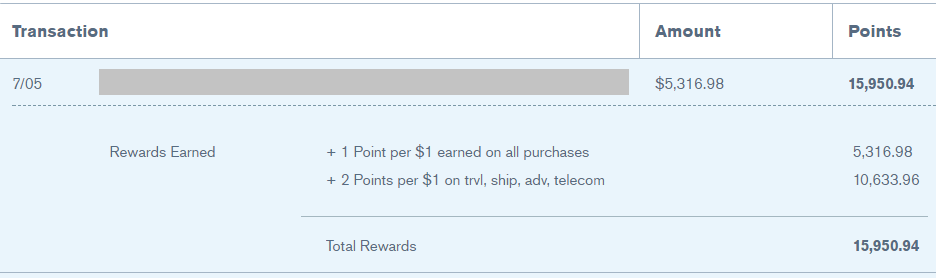

Ben’s Ink Business Preferred statement showed more Ultimate Rewards points than he expected. He expected to earn just over 5,000 points from spend, plus 80,000 bonus points from the signup offer. Instead, he found over 96,000 points!

His Plastiq payment had counted for 3X!

This surprised me and Ben! Plastiq rent payments used to result in 3X rewards with this card, presumably because they were coded as travel. But, as we reported previously, it seemed that Plastiq 3X opportunities died in May.

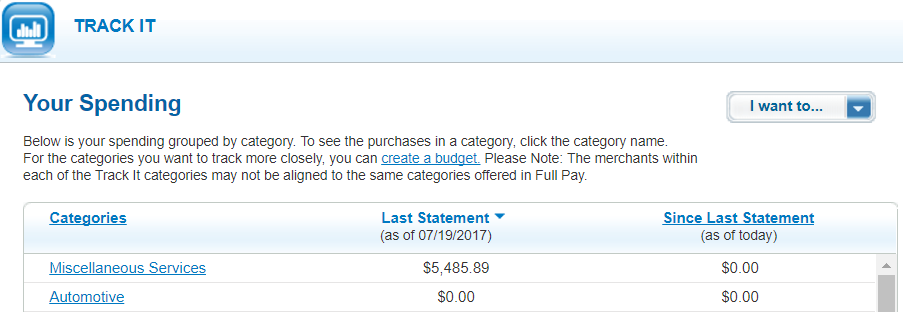

I asked Ben to look at Chase’s Blueprint feature to see how the expense was coded. It showed up as Miscellaneous Services. That’s weird.

So then I asked him how the recipient was setup within his Plastiq account. First, he set it up as a payment to a business:

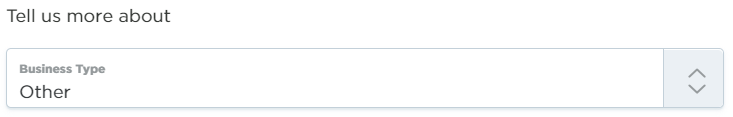

Then, when asked to categorize the business, he had picked “Other“. He explains that his bill includes things other than rent, so he didn’t pick the Rent or Mortgage option.

Then, when asked to categorize the business, he had picked “Other“. He explains that his bill includes things other than rent, so he didn’t pick the Rent or Mortgage option.

It is a complete mystery to me as to why Ben’s bill payment via Plastiq resulted in 3X rewards. It doesn’t seem to fit in any of the Ink Business Preferred card’s 3X categories (travel, shipping, internet, cable, phone, or advertising with social media sites). Regardless, I’m happy for him!

Note that I have no idea if this result is reproducible. If you have the Ink Business Preferred card, it may be worth setting up a payee in the business… other category to see what happens. If you try it, please let us know the results!

[…] the past year, since learning that the Chase Ink Business Plus earned 3X for Plastiq payments, I’ve been using that card exclusively and extensively to pay all sorts of bills via the […]

[…] This is a nice addition if you do business and need to pay invoices via ACH or wire. Plastiq gives a number of examples like paying for advertising with Facebook or buying wholesale goods from factories overseas. Being able to pay for those things easily via Plastiq could be very attractive for anyone with a small business and certainly for resellers who are sourcing wholesale overseas, especially if you pay with a card that outpaces the fee (keep in mind that Plastiq fees could potentially be a write-off for businesses). For example, Greg noted a few months ago that newbie Ben had been receiving 3x on all Plastiq payments. […]

I just opened a new Chase ink business preferred card. I an about to spend $7k in replacing windows and doors of my business. The contractor said I could pay with my credit card directly to the factory, but now he says that the factory only accept payments from him. My contractor doesn’t accept credit cards. If I pay him via plastiq, am I getting the initial $80k bonus? Do I also get 3x? Do I have any other alternatives to make my payment? Thanks

Yes if you pay him via Plastiq the payment will count towards your minimum spend requirement and you should earn 3X. I think that’s a good way to go since 3X Ultimate Rewards are worth quite a bit more than Plastiq’s 2.5% fee.

Will paying any random contractor via Plastiq/Ink Business Preferred trigger a 3X on Plastiq?

We don’t know why, but all Plastiq payments have been coding at 3x on the Ink Business Preferred. In short: yes, I believe it would.

Can Plastiq be set up on auto bill pay

You can set it up to automatically pay a fixed amount each month, but there’s no option for it to automatically pay however much is billed.

Good to know! Thanks

Wonder if this works for the old Ink Plus.

Back when I was meeting my wife’s ink preferred signup spend bonus in April and May I can personally confirm that gyft purchases got 3x points. Since I have an ink plus we use that for gyft now.

Why didn’t you just buy the gift cards with the credit card, instead of paying the 2.5% fee with Plastiq?

He didn’t use Plastiq for that – he’s confirming the bonus he got when using his Ink Business Preferred on Gyft. You couldn’t use Plastiq for that even if you wanted — Plastiq can be used to pay bills normally paid with a check…you couldn’t use it to pay for stuff like gift cards.

Does the Chase Ink Preferred code as 3x on CardCash like the Chase Ink Plus (5x on Cardcash). Having trouble finding answers to this one.

I doubt it would earn 3X since it offers different bonus categories than the Ink Plus / Ink Cash. I haven’t seen any reports of people trying it though.

confirmed it earns 3x on cardcash. I just had my fiance get the ink biz preferred. Will try paypal digital gifts, gyft, etc when i get the chance. Also paying my rent with it on Plastiq in the next few days, we’ll see if that gets 3x.

Great! Thanks for letting us know!

I am still getting 3x on Ink Preferred paying my Utilities (both electric and water) with Plastiq. Not nearly as lucrative as Ben’s 5k monthly, but I’ll take it!

Which plastiq category are you using for these?

Utilities

Hi, Did you choose “Utilities” as the Category or did Plastiq automatically assign the category?

Thank you!

Is it just Mortgage you are not going to be able to use Visa to pay with on Plastiq?

Yes, just mortgage

This is indeed still alive in some cases. My mortgage is currently held by a small, regional bank in the northeast, and I my payment last week through plastiq coded at 3x on my Ink Preferred. Also 3x on my car note, I guess counts as travel?

I think some people have stumbled upon a category other than travel that is being coded here. I say that because I haven’t heard any data points of the Sapphire Reserve 3X still working with Plastiq. Makes me think that some things are being treated as shipping, internet, cable, phone, or advertising with social media sites.

Yes, it is. I just tested all Plastiq categories, and for Visa most were coded as GOVERNMENT SERVICES-NOT ELSEWHERE CLASSIFIED, the other 2 coded as insurance, and as a CHARITABLE AND SOCIAL SERVICE ORGANIZATIONS

For MC most were coded as a utilities – gas, sanitary, water, and 2 were coded as misc. government services. These too still give 3x with ATTAM.

This may be a downer but how is rent a business expense? Doesn’t Chase TOC frown on this?

Almost every business has rent expense. If he does anything income producing for his business from his home, his business has rent expense. Now how much of the house’s space/rent/utilities should be allocated to the business is between him and his tax accountant, but from the bank’s perspective it is none of their business.

I know he probably doesn’t want to disclose the name of the payee, but I suspect maybe the name of the retirement village that bills him sounds like it is in one of the bonus categories? Like maybe it sounds like or is run by a company that is also in the extended stay hotel business or something? Is that something you could check with him and report back just whether that could be it?

I thought that too until I saw the name. It just sounds like someone’s last name. I tried Googling it to see if that name was used for other stuff like internet advertising, travel, etc., but couldn’t find anything.