After writing up a deep dive into the Virgin Atlantic World Elite Mastercard, I decided to maximize spend on the card by spending exactly $2500 per month for 10 months. I also have two Club Carlson cards (one business, one personal) that earn a free night at any US property with $10K annual spend. And I have a Better Balance Rewards card (no longer available to new applicants) from BankAmericard which give me $30 cash back every quarter in which I have a balance and pay it in full each month.

Occasionally I also get offers from banks where they’ll reward me for spending a targeted amount each month. One example is that my wife and I occasionally get targeted by Barclaycard for 15,000 bonus miles after $500+ spend per month after 3 months.

Retention offers (where you call to cancel a card and are offered a bonus to keep it) often require a set amount of spend per month. The best of these are often from Citibank.

Then there’s the American Express Everyday Preferred card that offers a 50% point bonus every time you use your card 30 or more times on purchases in a billing period. I don’t currently have that card, but if/when I get it I’ll definitely want to meet that spend requirement every month.

Each of the above are situations where I’d like to automate credit card spend. The last thing I want to do is to carefully monitor spend on a dozen cards every day. Is there a way I can “set and forget“? Following are a number of options I’ve thought of. Please comment below if you have other suggestions.

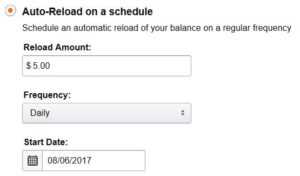

Amazon Auto Reload

Amazon has an option for automatically reloading your gift card balance (Found Here). If you use Amazon regularly enough, your gift card balance may be almost as good as cash to you. Minimum load is $5.

Best used for: Small repeated payments.

Example uses:

- Load $5 every day with your Amex EveryDay Preferred card in order to ensure always using the card 30 times per billing period.

- Load $5 per month with your Better Balance Rewards card to ensure that you have a balance to pay each month.

Automated Direct Bill Payments

Many regular bills can be setup to be paid automatically by credit card. This includes phone, TV services, internet, many utilities, etc.

Best used for: Small bill payments and those that earn category bonuses

Example uses:

- Earn 5X rewards by auto-paying phone, TV, and internet with Chase Ink Cash.

- Pay a small monthly bill (Netflix subscription, for example) with your Better Balance Rewards card to ensure that you have a balance to pay each month.

- Direct all bill payments to your Amex EveryDay Preferred card in order to get closer to 30 purchases per billing period. Some billers may even allow you to setup multiple separate payments.

Automated Indirect Bill Payments (Mortgage, Rent, etc.)

The Plastiq bill pay service lets you use credit cards to pay bills that can’t usually be paid by credit card. They do charge a 2.5% fee, but it can be worth it if you earn high enough rewards from your credit card. Plastiq payments can be setup to repeat weekly, monthly, or yearly.

The Plastiq bill pay service lets you use credit cards to pay bills that can’t usually be paid by credit card. They do charge a 2.5% fee, but it can be worth it if you earn high enough rewards from your credit card. Plastiq payments can be setup to repeat weekly, monthly, or yearly.

Best used for: Spend bonuses where the reward value exceeds Plastiq’s 2.5% fee

Example uses:

- Targeted spend bonus: When you get a targeted spend bonus that requires a set amount of spend for X months, you can use Plastiq to setup payments to repeat for exactly that number of months. If your targeted bonus requires spending $500+ per month for 3 months, for example, you could setup Plastiq to pay $500 of your rent or mortgage each month for 3 months. If your rent or mortgage is much higher than $500, then pay the rest directly by check in order to avoid additional 2.5% fees on the rest of the payment.

- Annual spend bonus: Many cards offer annual bonuses for high spend (see: Big Spend Bonuses). Just as with the example above, you could automate rent or mortgage payments to meet your spending goals. For example, the Delta Reserve credit card offers a total of 30,000 MQMs towards elite status plus 30,000 redeemable miles after $60,000 in annual spend. If you value Delta elite status, it can be well worth Plastiq’s 2.5% fee to pay your $5,000 monthly mortgage this way.

See also: Complete Guide to Plastiq credit card payments.

Kiva Loans

This option isn’t fully automated, but it gets you half way there. Kiva offers the option to auto deposit money by credit card monthly. That’s the automated part. Once the money is loaded, though, you need to lend it. If you want to filter to loans that are likely to be paid back and/or to fund many loans at once, your best bet is to use Kivalens. Full details about filtering to safe loans via Kivalens can be found here: Manufacture Spend (and do good) with Kiva and Kivalens.

Best used for: Any spend where you can float the funds over a number of months and you’re willing to take on a small amount of risk.

Example uses:

- Any repeated spend: I’ll use this technique to spend exactly $2500 per month with my Virgin Atlantic card.

- Small repeated spend: If you have the patience, you could setup 25 separate $1 automated payments with your Everyday Preferred card so as to get close to the 30 per billing period requirement. Kiva loans must be made in $25 increments, so this way you’ll just have to make one Kiva loan each month once you’ve deposited $25.

Other Ideas?

Above I’ve listed the ideas I have for automating spend, but I’m sure readers have other suggestions. Please comment below!

[…] miles for a return visit. I have two Virgin Atlantic credit cards and so I setup a process to automatically spend $2500 on each card every month. Thanks to mileage bonuses granted for high spend, this process […]

Hi Nick,

Yes I tried it several times. I tried to pay my lawn care company, a large established business. I was told via an error message that the company needed to contact Plastiq’s “Business Team” to establish a relationship. My vendor did this and was told he was good to go. They still rejected my payment with the same reply. After several emails back and forth, their Member Services rep said “we are no longer accepting new businesses”. This really surprised me. My vendor was told the same thing. I have been a Plastiq customer for well over a year, over two thousand a month in payments. In our email exchanges they often confused me with the vendor, telling me to set up a business relationship.

Frankly, I think they need some staff training.

This anecdote is exactly why I won’t use Plastiq, regardless of those who use it regularly like yourself. I agree, even if simple incorrect communication and better training is needed, incompetence like this and “no longer accepting new business” to boot, sure make it sound like a one man operation run out of someone’s bedroom.

[…] Automating Spend […]

I was informed today that Plastiq is no longer accepting new business for enrollment. So if your lawn care company or babysitter or handyman etc. is not set up, forget it.

I reached out to a contact at Plastiq to ask about this and was told that there must have been a miscommunication. I’m told that they will let you send a check to a business if you tell them where to send it. Have you tried it a second time?

[…] The main downside to offer 1 is that I’ll have to make sure to spend $1,500 each month to get the full value of the offer. Luckily I know ways to automate spend. […]

I have an automatic $1/month charity contribution through PayPal from my Lufthansa Miles & More card to keep my Lufthansa miles from expiring.

Great idea, thanks.

Thanks, Greg, for another interesting post. Automating spend is something that most of us need to do to simplify our lives already made complicated by this rewarding hobby.

Bank of America better balance rewards play games to not pay out the $30. They are assholes.

I would just warn that while Kiva loans may have a historical repayment rate of 97%, that history is short. These are unsecured loans and if you look back at the history of U.S. banking companies (which spans a much longer time frame) default rates on even secured loans can hit well into double digit percentages during economic downturns.

Everyone always thinks, “nah…I’ll see it coming,” but they don’t. That is why the banks seem to have near death experiences every 10 to 20 years. They get complacent as the years go by with stable loss rates, then…BAM, they get hit with the big one and have to run to the government to save them.

I really recommend not doing Kiva loans or any microloans for that matter. The banks have thousands of trained credit analysts watching for turns and they still fail regularly. An individual with no idea what he is doing, making loans to people on the other side of the globe has virtually no chance of ducking that big wipe out one day when the music stops…and suddenly the 2% cashback or points you got on that loan is going to feel really, really inadequate.

Amex everyday bonus is at 20 purchases per month, not 30

whoops. preferred. missed that.

Although automated Amazon reloads are nice, I don’t want to add $150/month (maybe some do, though). It’s easier for me to set a reminder on my phone then bang out $0.50 reloads in one day. Can understand wanting to automate it though

Thanks for the $0.50 reloads idea.

I’ve been using Plastiq for two rent payments each month (one for me, one for parents) and learned that using VISA cards are coded as “cash advance.” MASTERCARD and AMEX are okay though.

If anyone wants to use VISA for their rent/mortgage payments, they should use something other than Plastiq.

Hope this helps! 😉

I recently got the AmexGold and am trying to meet my 2k spend for 25k points. I am trying to pay my car payment with Amexagold but it doesn’t work. So im guessing I have to sign up for a plastiq account in order to be able to ay with my amex?

Can anyone walk me over this any advice would much be appreciated, thank you in advance!

See our guide to Plastiq bill payments. Unfortunately Amex doesn’t allow car payments, but you can check to see if you have other bills that would work: https://frequentmiler.com/complete-guide-to-plastiq-credit-card-payments/

Thanks, Greg. Your article pushed me to automate payments to my Amazon card and maximize my everyday preferred benefits. I have been kind of a slacker on this issue because I found that 30 charges per month were difficult to keep track of. With your suggestion I was now able to accomplish this with no problem.

Nice to see a reference to the Club Carlson cards. We too have two of the bdns version in the family, and are thinking to do the 10k spend per year on one or both. (a lot more benefit than just a single free night benefit — add the 50K points for the spend, plus 40k for the annual renewal bonus for $60 a/f) But in the back of my mind I’ve been bit hesitant, given the fearsome reports “out there” about US Bank allegedly having all-powerful, unaccountable “RAT” teams determined to sniff out and shut down any and all cards with the slightest whiff of m/s. Thoughts? Have I been unduly a-feared?

Ah, but to your question, wish I had more ideas off hand. (Plastiq’s auto pay doesn’t work real well, alas, if you have a variable rate mortgage and/or heloc — which payment due changes each month, depending on # of days, etc….)

What in the post looks like m/s? These are all legitimate purchases — Amazon balance reload, automated billpay, Kiva loans.

Puzzled by the nasty swipe. Didn’t cast that aspersion….. (though more power to you if you can actually generate THAT much conventional spend on multiple cards w/o m/s….) I’d hazard a guess 98% of your readers are likewise not so fortune-ate.

ps, curious you used to the word “legitimate” — as an apparent swipe against what most of us (and you) do. (m/s)

Apologies. Never mind. I just re-read your original post much more carefully. Thanks for the very interesting tip about the amazon re-load option. Very useful (and yes, more “legitimate” — er, less attention flagging that m/s) , thanks

The Amazon load is even better when you go through the JetBlue link to earn JetBlue miles on Amazon.

The idea of this post is to automate the spend. You’re not giving up any JetBlue miles for the $5 auto-reload, since they don’t give those for Amazon gc purchases anymore. But on the back end, when you’re spending your Amazon gc balance, you can still use the JetBlue link.