FM author Nick and I are approaching near-opposite ends of the greatest journey on earth: parenthood. Nick announced last weekend that his first child is expected to arrive in January. I’m looking forward to his posts on how to earn miles while changing diapers. Meanwhile, my son has just started college and I’m busy earning rewards while paying tuition (see: Double-dipping college rewards).

My son will turn 18 in November. Once he does, he can start signing up for credit cards. He’s been responsibly using his own debit card for a few years now (via a Chase high school checking account) and I think he’s ready for the next step. He understands how important it is to pay his bill in full in order to avoid fees, and he’s interested in earning rewards.

In order to build his credit, over the last few years I’ve added my son to a number of my credit card accounts as an authorized user. I haven’t actually given him the cards to use, I’ve simply ordered the cards and kept them filed away. With some Amex cards, I’ve used them myself when I found good Amex Offers available to them. And, occasionally when he has wanted to buy something online I’ve let him use one of these cards.

How to view under 18 credit info

Many of the tools available for viewing credit scores and reports for free are not available to those under 18. I stepped through some of the options listed in my post “Complete Guide to FREE Credit Scores, Reports, and Monitoring… for credit card bonus hunting,” and the first few I tried did not work. Neither AnnualCreditReport.com, Discover Credit Journey, nor CreditKarma allow under 18 year olds to sign up.

Fortunately, one option worked like a charm: Experian CreditWorks Basic via freecreditscore.com.

| UPDATE: The freecreditscore.com site currently only works for kids with birthdays in the year 2000 or earlier. In other words, at the time I write this, it will work for 17 year olds and some near-17 year olds, but not younger kids. |

First note that Experian is not the company that failed to protect our data. That was Equifax (see: Is the Equifax cure worse than the hack? Here’s what I plan to do…). Hopefully Experian will be more responsible.

Experian CreditWorks Basic is available for free via the website: freecreditscore.com. If you go to that site and aren’t offered a truly free option, try browsing to it via your browser’s private or incognito mode.

The downside to CreditWorks Basic is that they take every opportunity possible to up-sell you to CreditWorks Premium ($4.99 for the first month, then $24.99 per month thereafter). If you can navigate their interface without accidentally upgrading, the basic version is quite useful on its own.

Current Status

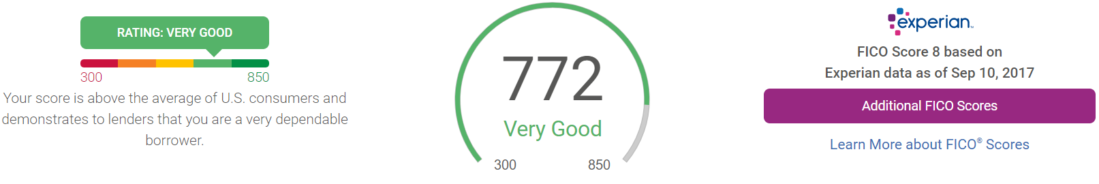

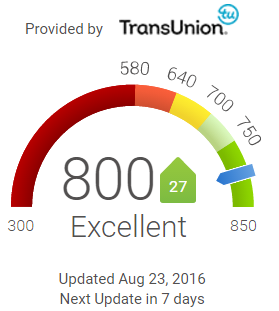

After signing up for Experian CreditWorks Basic, we found that my son already has a nice credit score:

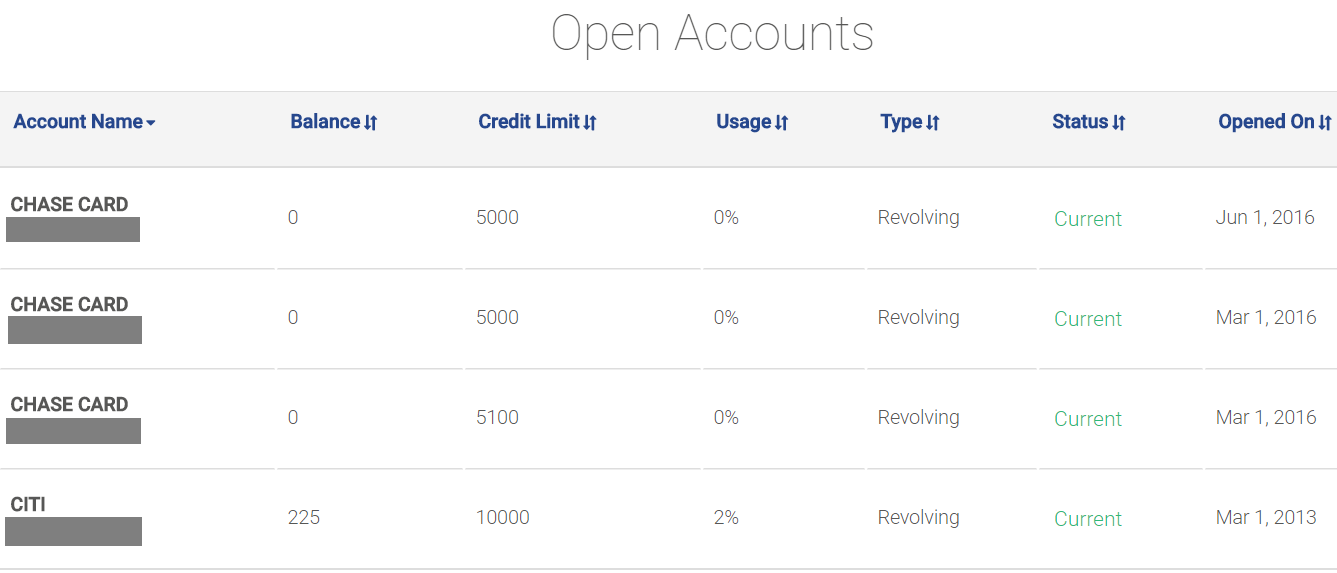

And he has a handful of open accounts (as an authorized user on my and my wife’s accounts):

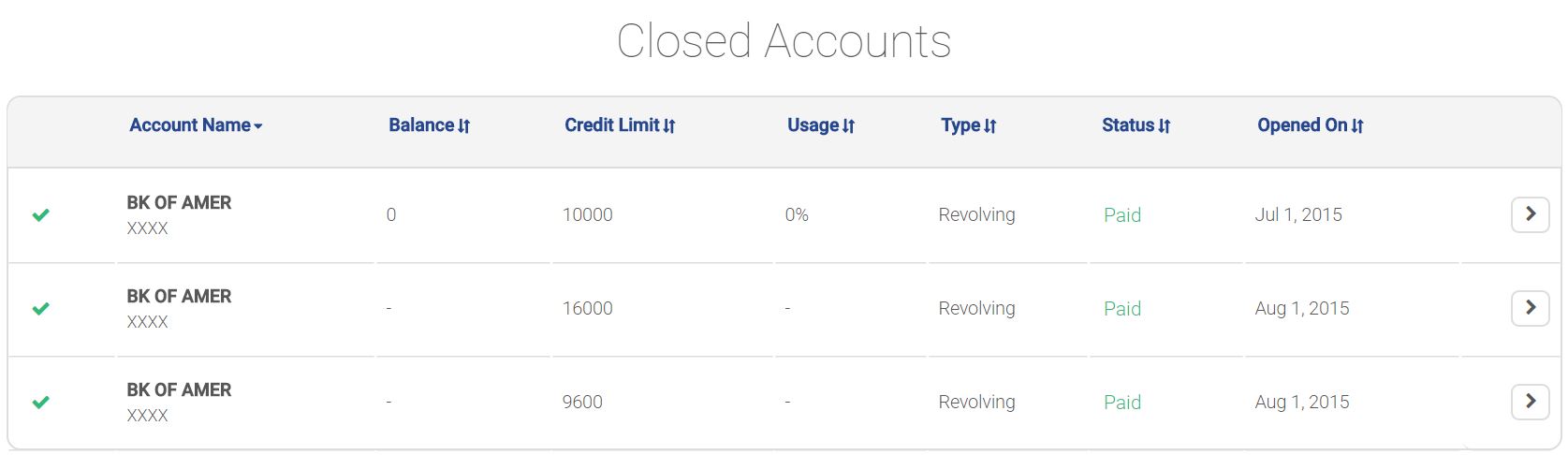

And he has three closed accounts (due to our closing the primary accounts):

Where is Amex and Barclaycard?

The bizarre thing about my son’s Experian credit report is that his American Express cards and Barclays card are not listed. Where did they go? We have added him as an authorized user to one Amex business card, 4 Amex personal cards, and at least one Barclaycard personal card. It makes sense that the Amex business card didn’t get reported as an account. Even primary Amex business card accounts aren’t reported, but the others are strange.

I believe that the Barclaycard account was added before Barclays started requiring social security numbers. Usually the credit bureaus are able to match up names and addresses even without SSNs, but that didn’t seem to happen here.

The missing personal Amex cards are more of a mystery. I’m sure that my son’s SSN was used to obtain them. I simply don’t know why they’re not there. Maybe the Amex cards are listed on his Equifax or TransUnion reports? I don’t know. But I do know that Amex always pulls from Experian when I open new accounts so it would be especially strange if they didn’t report new AU accounts to Experian.

Building credit before 18 with authorized user cards

Adding a child as an authorized user can help establish and build their credit score, but only if you are responsible with the primary account. Also, it helps to have old credit, so it makes sense to add your child as an AU when they are young. And, don’t close the primary accounts. If you don’t want to pay the annual fee on an old account, you can product change to a no-fee card and stick the card in a drawer (note that you may have to put some spend on the no-fee card every 6 months or so in order to keep the account alive).

Different card issuers have different rules about how old an authorized user must be. Doctor of Credit lists the minimum age required for each major card issuer. I’ve also updated this list with information from readers:

- American Express:

15+ years of age13+ (source: Qfcc via comments) - Bank of America: 18+ years of age?; or maybe no restriction (source: BizzyB via comments)

- Barclaycard: No age minimum

- Capital One: Not aware of minimum (somebody that was 15 got added)

- Chase: No age minimum (doesn’t require SSN)

- Citibank: No age minimum (doesn’t require SSN)

- Discover:

No age minimum15+ (source: Justin and Peter via comments) - US Bank: No age minimum

As you can see, most do not have an age minimum, so Nick can add his son as soon as he gets a social security number. Come to think of it, since a few banks do not require SSNs, he may be able to add his son as soon as he and his wife decide upon a name.

Also, note that the Bank of America 18+ requirement must be new since my son had been added to several Bank of America cards in the past.

With most banks, there’s no point in adding your kid as an authorized user (or employee) to your business cards. This is because most business cards aren’t reported as accounts to the personal credit bureaus.

Authorized user backdating

For older kids, you could identify your oldest credit card accounts and add them as authorized users to those accounts. Usually banks report the account open date as the date that you requested the authorized user card, but a few report your original account opening date.

The following card issuers are known to back-date authorized user accounts:

- Capital One (source: MyFICO thread)

- Chase (source: MyFICO thread)

- Bank of America (source: MyFICO thread)

- Synchrony (source: MyFICO thread)

- US Bank (source: GLT via comments)

The following issuers do not back date authorized user accounts:

- American Express, as of March 2015 (Doctor of Credit)

I’ll update the above lists as I get more information. Readers: if you have proof of backdating (or proof against it) for these issuers or others, please let me know!

Next up: Credit card planning

In future posts I’ll discuss my thought process regarding which cards my son should sign up for, how he should prepare for Chase 5/24 rules, how he can meet minimum spend requirements, etc. Stay tuned!

Hi Greg,

quick question. Does the calculation of the average age of accounts in credit score also include the age of closed accounts?

Yes, I believe so. Closed accounts stay on your credit report for a number of years and are included in the average age of accounts until they finally drop off.

Hi Greg, great info! Question on this, does adding as an authorized user use up a 5/24 slot though? Only if with Chase?

The person who’s name is on the AU card is seen as having another new card, so yes it adds to 5/24… sort of. If that person is rejected for a new card due to 5/24 they can call and argue that they’re not responsible for paying the bills on the AU cards.

[…] Building (and viewing) teenage credit […]

[…] Building (and viewing) teenage credit. […]

[…] He’s a responsible kid. I believe he’s ready. In the recent post “Building (and viewing) teenage credit” I described how to build a child’s credit record before they’re 18 and how to […]

Thanks, this is a very interesting article. Question – If I have a cc that is older than my child. If I add him as an AU how do you think the credit reporting companies would treat this?

My guess is that they would show your child as having established credit before he/she was born.

[…] Building (and viewing) teenage credit […]

Thanks to Greg and everyone for the info. Per your suggestion, after failing with Citi and Chase (see comment above), we tried Discover. It was not instant approval, but the approval eventually came after some verification.

Possibly helpful that he was AU with Discover…

I successfully activated AMEX personal cards for my 14 year olds this morning, but no luck with the AMEX business cards (SPG) – ‘must be 18 years or older’

That’s very strange. My under 18 yr old son is on a number of our Amex business cards, including SPG

Thanks to everyone who added info about minimum ages and backdating. I updated the post and linked to your comments.

My son started college last month and just turned 18. My wife and I added him as AU to several

Amex and Chase cards. Win-win, we got small AU add bonuses for each and when he turned 18 and signed up for credit Karma his score was already 768 with almost a 2 year history. Looking forward to advice on which cards of his own to start. He is well aware of points and miles since ALL of his international vacations have been in J. Bali on CX, Japan on JL, Europe on VS!

Us bank backdated when I added my wife. This was in 2012.

When my daughter had a summer job before college we took her to our local Chase and opened a standard new checking account and she happiily received the signup bonus after her first paycheck hit. At sign up we asked if she was pre-approved for any credit cards. She was not. But the banker advised us to check back and after she had the checking account for about a month we checked with the bank and she was pre-approved for a freedom. She got that card and we charged $500 on it for her so she could get another signup cash bonus. She was hooked. Free money! She left for college and used the Freedom for things we intended to pay for anyhow (books mainly) at college and we paid the bill which arrived in paper form to our address. This also allowed us to make sure she was being responsible with the card because of course she allowed us to open the bill in order to pay it. After about six months she applied for a Southwest card and got 60,000 miles. She started telling her friends and got a couple of referral bonuses on Southwest cards. A year later, after a trip on United, she got a United explorer card offer for 70,000 miles and received that. Those cards have gone into a drawer at home after the minimum spend was achieved. I’m amazed at how much credit is extended to kids with a few thousand stated income in summer jobs. In fact in her Junior year she was pre-approved for a CSP with a credit line of $20,000!!! (cough, we reduced that credit line while she was applying) It’s been great to have another mileage stash in addition to my own and we’ve used them to get her back and forth to college several times. At this point she has a lovely credit score after 3 years of managing her credit responsibly. I’ve also timed her applications so that she will be under 5/24 when she graduates and can start from scratch if she wants to take up this obsession.

look forward to more posts to see what you and others have done with these situations.

Thanks so much for this info! I love the idea of starting with Chase banking and going from there to get pre-approved for credit cards.

Note: we did not go with a “high school” or “college” account, just a regular account that has the $300 bonus post after a single direct deposit. I am CPC so we opened a joint account which meant she gains CPC status and has no minimum deposit requirement to keep the account fee free. But even if that was not the case, and a person had to pay the monthly fee it would take 2-3 years before the fees negated that $300 bonus. Surely it could be downgraded to a different type of account or closed before then.

Got it

Was recently approved for boa Amtrak with 4 yo AU. Assuming cards come on, I think it’s safe to say boa still allows. However, Amex was a hard no that had JS to prevent young ones on the front end. To bad Amex no longer backdates…

[…] Building (and viewing) teenage credit by Frequent Miler. Really good post, you can read more about how being added as an authorized user affects your credit here. […]