As we reported earlier today, Bank of America launched a new card this morning: the Bank of America Premium Rewards card. Greg even wrote a Bank of America Premium Rewards Card Complete Guide. I’m sure he will soon have more analysis and thoughts about this new offering, but in the meantime, I got digging through the terms of the Preferred Rewards program and found myself wondering: Can you earn 4.59% back on everyday spend with this new card? In short, I doubt it – but I’m also not convinced that it’s impossible. Here’s why.

Preferred Rewards

As noted in today’s Quick Deal and our Complete Guide, the signup bonus makes this card attractive from the get-go, but the long-term prospects for keeping this card rely on your relationship with Bank of America. This card really becomes interesting if you qualify for Bank of America’s Preferred Rewards program.

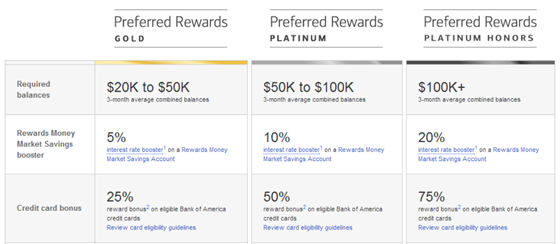

The Preferred Rewards program has 3 tiers based on the total amount of money you have on deposit or invested with Bank of America / Merrill Lynch. There are three tiers, but only the top tier is pertinent to this post: Platinum Honors. This tier requires you to have $100,000 on deposit/invested with BOA/Merrill Lynch. In fact, it requires that you maintain an average daily balance of $100K or more for 3 calendar months in order to enroll in Platinum Honors Preferred Rewards. Once you meet that requirement, you’ll earn 75% more points with a number of Bank of America cards, including the Premium Rewards credit card. Your earnings with the Premium Rewards card would look like this:

- 2X on travel & dining + 75% bonus = 3.5 points per dollar back on travel & dining

- 1.5X on everything else + 75% bonus = 2.625 points per dollar back on everything else

Considering the fact that those points can be deposited into your eligible BOA/Merrill Lynch bank account at 1 cent each, this card effectively earns 3.5% cash back on travel & dining and 2.625% cash back on everything else if you qualify for Platinum Honors Preferred Rewards. While the return on travel & dining is good but not amazing, the return on everyday spend is unmatched. Sure, there are cards with rotating categories or limited-time bonuses that are higher — but for long-term uncapped earnings, that can’t be beat. Or can it get even better?

Qualifying for Platinum Honors status

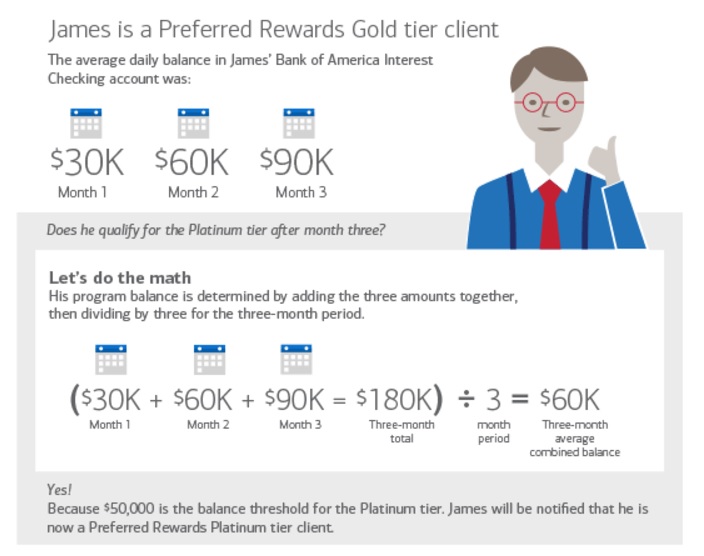

I decided to dig into the terms of Preferred Rewards a bit to see how it worked. I started out curious about how one qualifies for Platinum Honors status and how long that status would last. The answer to that turned out to be relatively easy. Bank of America publishes qualification guidelines here. Your eligibility for Preferred Rewards is determined by your three-month average combined balance. The key in understanding that is this blurb from that linked page:

Your Preferred Rewards program balance is calculated based on your combined average daily balance for a three calendar month period that you — as the primary or co-owner on the account — keep in your eligible Bank of America® banking and/or Merrill Edge® and Merrill Lynch® investment accounts. It is not a current total of your account balances.

So the key then is that you must maintain an average daily combined balance of $100K or more for 3 calendar months (and the accounts must be yours or you must be a co-owner; business accounts do not count). If you deposited $100K today, your average daily balance for September would not be $100K. You would have to leave the money there in October, November, and December. Then, presumably on or around January 1st, you would become eligible to enroll in Platinum Rewards.

If you initially qualify for a lower tier, the terms state that they will re-evaluate your status at the beginning of each month to see if you qualify to move up in tier. But what about the reverse — what if you earn Platinum Honors status in January and then your account balances drop below the $100K threshold? The terms don’t leave it ambiguous (bold is mine):

What happens if your balances drop?

Even if your eligible balances drop below the requirements for your tier (Gold, Platinum or Platinum Honors), you’ll maintain your Preferred Rewards status for 12 months following enrollment. If you no longer meet the balance requirements after 12 months, you’ll have a three-month grace period to increase your balances. After that, if you still don’t meet the balance requirements, you’ll be moved to a lower tier or lose your Preferred Rewards benefits.

In other words, once you get Platinum Honors status, you keep it for 15 months regardless of your ongoing balance. If you want to keep it beyond that, you’ll need to be sure you have at least $100K in combined balances for the final 3 calendar months of that period (or the final 3 calendar months of year to sort of “automatically renew”.

A look at the terms of the Platinum Honors 75% bonus

My next stop was a look at the terms for how the 75% bonus works. I assumed that someone with Platinum Honors Preferred Rewards status simply earns 75% more points as shown above with the Premium Rewards card. And with that card, it does indeed work that way. But it seems that Preferred Rewards are not applied uniformly to every type of card…..

From the bottom of the Preferred Rewards benefits page, point #2 (bold mine for emphasis):

Certain credit cards are eligible to receive the Preferred Rewards bonus. View a complete list of ineligible cards. Enrolled clients with eligible cards will receive the Preferred Rewards bonus based on Preferred Rewards tier and type of card. For example, the BankAmericard Cash Rewards™ credit card awards the Preferred Rewards bonus when you redeem cash rewards into a Bank of America® checking or savings account or an eligible Cash Management Account® with Merrill Lynch® or Merrill Edge®. That means a $100 cash rewards redemption becomes $125, $150 or $175, based on your tier when you redeem. All other eligible card types receive the Preferred Rewards bonus with each purchase. That means a purchase that earns 100 base points will actually earn 125, 150, or 175 points, based on your tier when the purchase posts to your account. The Preferred Rewards bonus will replace the 10% customer bonus you may receive with certain cards. Other terms and conditions apply. If you have an eligible card, please refer to your card’s Program Rules for details about how you will receive the Preferred Rewards bonus. Program Rules are mailed upon account opening and are accessible through the rewards redemption site via Online Banking or by calling the number on the back of your card.

To rephrase that:

- The BankAmericard Cash Rewards card earns the 75% when you redeem the cash rewards

- All other cards earn the bonus with each purchase

That’s interesting for a number of reasons. First, it means that if you open a BankAmericard Cash Rewards card, you can stretch the signup bonus with Preferred Rewards. The current signup bonus on that card is $150 on $500 spend. If you earned that today, but redeemed it in January when you reach Platinum Honors status, you could redeem that $150 for 75% more — or $262.50. In terms of bonus-to-spend ratio, that’s a monster. Of course, it’s still barely more than half the signup bonus on the Premium Rewards card. But what if…..

You can transfer points between some types of Bank of America accounts

There is not yet a complete set of program rules for the rewards that the Premium Rewards credit card will offer (the application page and associated terms state that complete program rules will be sent with your new card). Looking at the program rules for cards like the Cash Rewards or Travel Rewards cards, we see a clause in each that states something to this effect:

- Unless specifically authorized by us, Cash

Rewards cannot be transferred between

any credit card accounts issued by us.

or

- Unless specifically authorized by us,

Points and Rewards may not be combined:

• With other discounts, special rates,

promotions or other reward programs

offered by us

That’s interesting because it says that points and rewards may not be combined “with other reward programs offered by us”. How do they define “other” rewards programs versus the same reward programs? Will the cash rewards and Premium Rewards programs be separate? After all, both programs earn points-per-dollar that are redeemable for 1 cent each. And we know that Bank of America does authorize some transfers — after all, it is possible to transfer points between some Bank of America rewards cards. This was something I didn’t know. I actually stopped my research on this fairly early on until Greg told me that you can indeed transfer points between some accounts….

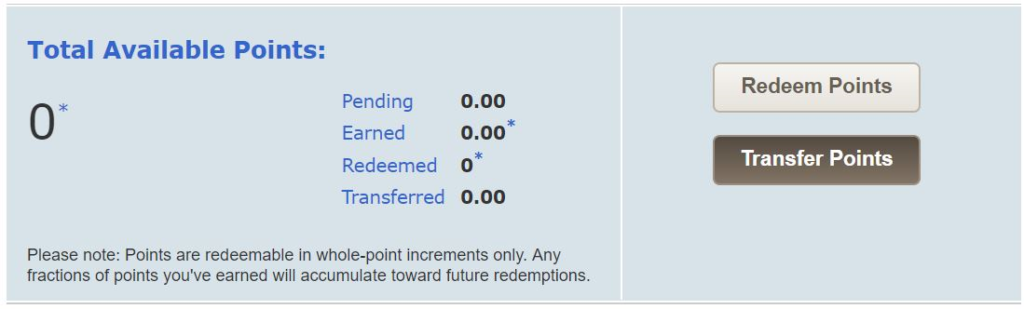

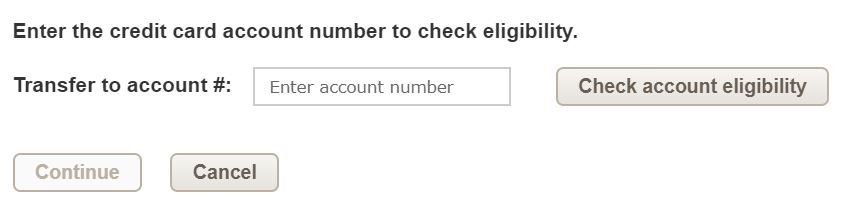

In the name of science, Greg tried to transfer 0 points from a Travel Rewards card to a Better Balance card. After clicking “transfer points”, this is what he got:

After entering the Better Balance rewards card number, he got an error that stated, “There was a problem processing your request. Points cannot be transferred into this account”. So you definitely can not transfer points from the Travel Rewards card to a Better Balance card. Why does this all matter?

If you can transfer from Premium Rewards to Cash Rewards, you could earn the 75% bonus twice

Remember from above that the Cash Rewards card earns a 75% bonus on the redemption of cash rewards, whereas all other cards earn the bonus with each purchase. If it were possible to earn points at 2.625 points per dollar and then transfer those points to your Cash Rewards card, you could then redeem those points at a 75% bonus — an effective rate of 2.626 + 75% = 4.59X. In other words, if you made a $100 purchase with your Premium Rewards card and then transferred to your Cash Rewards card before redeeming, you would earn $4.59 as follows:

- Use Premium Rewards card to make a $100 item, earn 1.5X (150 points) + 75% bonus = 262.5 points

- Transfer points from Premium Rewards to Cash Rewards

- Redeem 262.5 points from your Cash Rewards card account and earn a 75% bonus = 459.37 points

- That’s a final rate of return of 4.59% or $4.59 on every $100

Is this likely to be possible?

As I stated at the outset, I don’t imagine it is very likely that you will be able to transfer points in this way. However, Bank of America has created the feature to transfer points and the Cash Rewards and Premium Rewards cards both earn rewards points that are redeemable for 1 cent each in the form of a statement credit / cash deposit. It’s not altogether impossible that this would work if you had Platinum Honors status and both credit card accounts.

Are you going to try this and be the data point you hope to see?

Honestly, I’m probably not going to test this. I am somewhat intrigued by the possibility of earning Platinum Honors status for 15 months by parking $100K in cash & investments at BOA for three months and this possibility does make it somewhat more intriguing. However, my main focus at this point continues to be miles & points. That said, I’ve certainly considered the benefits of a more cashback-centric approach. I can’t rule it out, but I certainly won’t move that kind of money to BOA expecting this to work. If we do go after Platinum Honors status, it will be to earn 2.625% back on everything…..though that sure wouldn’t stop me from trying this. I look forward to finding out, whether through my experience or someone else’s — because at this point, we just don’t know what might be possible with the new Bank of America Premium Rewards card.

I am BOA Preferred Rewards Platinum Honors (75% bonus tier) and I recently received this card and also completed the $3k spending requirement to get the 50,000 point bonus.

Just so others are aware, the 50,000 sign-up bonus is NOT eligible for the 25%/50%/75% bonus multiplier, although your individual purchases are. This was a bummer because I thought that the $500 cash sign-up incentive would really be worth $875 ($500 x 1.75) when deposited to a linked BOA account, but it’s really only worth $500. Still a decent card though.

Didn’t work for me. Funny thing about the mobile wallet comments and carrying around 2 phones is people actually think all of these alt-coin cryptocurrencies are going to become the payment system of the future…we can’t even get mobile pay many places.

Not having to pay a 3% jack goes a long way to convincing a vendor to update their POS.

Has anyone confirmed yet if transferring the earned points to other accounts actually get the 4.59% return? Thanks in advance.

[…] Can you earn 4.59% back on everyday spend with the new BOA Premium Rewards card? […]

Don’t forget the opportunity cost of the $100k that you are parking in their bank.

I can’t stand dealing with Bank of America. (Or US BANK… why is it the Patriotic name sounding banks are a pain in the ass to deal with?)

As a side note, I called to cancel an Amex Plat today and the retention rep straight out lied to me:

– your points will vaporize at midnight (i have several other amex cards linked to MR)

– you can’t cancel online

I told her

– I cant believe you are straight up lying to me

– ok leave it, I will figure something out, don’t cancel

I should have said

– cancel the card, don’t cancel my points

or

– i’ll think about HUCA

She benefitted from me not cancelling with her. She was a smart one.

This card earns point, just like old Travel Rewards. Both point worth 1c each (yes, even old travel reward point worth 1c even if not redeem for travel, this Premium Rewards just make it easier to redeem for 1c).

Since this is point, don’t expect it can be transferred to cash reward system (just like old travel rewards can’t transfer into cash reward system and get extra 0.75%). How ever, i would expect point in old travel reward can be transfer into premium reward.

Tough part is, and everyone forgets this, is just how strong a card US Bank Altitude Reserve is when using a Samsung phone or for travel purchase. That is a 4.5% rebate toward travel, and 3% if used as cash. yes, it falls down for most online purchases where a card like this still has the edge, but I am happy taking 2X MR points…..

I swear it has to be one of the greatest cards ever, but it is like every blogger already forgot about it. (Which, I don’t mind at all as it may last!)

Nick, why does that not get more press in the hacker media?

I gave the Altitude a lot of coverage when it first came out. Since then, I’ve been disappointed in how rarely I can use Apple Pay for things where I don’t already get 3X or more with other cards.

Yes, to some extent Samsung Pay is a silver bullet for in-person spend, but personally far more of my spend is online. And I’m not ready to abandon the Apple ecosystem nor am I ready to carry another phone.

And, of course, there was a lot of press about US Bank shutting down accounts of people who bought a couple gift cards. If that wasn’t the case, I’d be all over it.

If the question is why I don’t think it gets more press in the hacker media, the answer is because it doesn’t offer a better reward on travel than the CSR and the 3X Samsung Pay (or other mobile wallet) wasn’t hacker-friendly at launch. Those are two separate points:

Travel: CSR beats it

Both the Altitude Reserve and the CSR offer 3X on travel. Both cards allow you to redeem that as a statement credit at 1cpp (making it 3% if you take cash back). Both cards offer 1.5cpp if you’re booking travel through their travel portal. But US Bank’s flight search is notoriously difficult (I haven’t used it myself, I’m going off of what I’ve read about it from multiple sources). The Chase travel portal, while far from perfect, seems to be generally better-regarded. And then Chase additionally gives you the ability to transfer to partners. While 20K Hyatt points (transferred from Chase) per night got me an awesome stay at the Park Hyatt Mallorca recently (where I was able to stack a suite upgrade award since I was using Hyatt points to stay in a suite that was going for around $1800 a night during my stay), I can’t do that with Altitude Reserve points. The “standard” room was going for around $500 a night I believe (I’d have to check back in my screenshots), meaning that it would have cost me 50,000 points per night with Altitude Reserve points — and I wouldn’t have been able to attach my suite upgrade or get free breakfast since Hyatt doesn’t honor elite benefits on third party bookings (or at least, I shouldn’t have been able to — perhaps I’d get lucky, but I was much happier not to rely on that). The same can be said about premium-cabin flights via Chase transfer partners — while you might be able to get a business or first class flight for 60K or 70K or 100K, you would often need a lot more US Bank points (or Chase points if using them for 1.5cpp) for the same flight. While I have used the 1.5cpp through Chase more often than I anticipated, there’s no doubt that the transfer partners make 3X Chase points a lot more valuable to me than 3X US Bank points. Unless there is a great part of the US Bank booking engine that I’m missing or you’re earning tons of 3X with Samsung pay and want to keep accumulating points together, I can’t see most people benefiting more from 3X with US Bank than 3X with Chase. I think Chase wins the travel purchases hands-down. And let me add on that: With a Chase Ink Business Preferred, you can earn 3X travel and transfer to partners for a lot less of an annual fee, albeit sacrificing the ability for 1.5cpp (but gaining a much more valuable signup bonus and a couple of other 3X categories).

Mobile wallet: Could be huge…

As for mobile wallet purchases, I said in the beginning that the Altitude Reserve could be a stone cold assassin if 3X mobile wallet worked as well as it sounded. I think there are two key things to mention in response to your question. The answer to why it doesn’t get more press is because of the early reports of shutdowns for very light gift card purchases. That probably turned a lot of the blogging/travel hacking community off from it right away. That may have been strategic on US Bank’s end. I imagine if people are going wild on buying GCs with it now, they’re not screaming about it for fear of encouraging a wave of shutdowns.

However, the second part of my response to you is that I think it *is* a terrific card for everyday spend if you’ve gotten Samsung Pay to work and you can effectively get 3X nearly everywhere and you just use it as a daily card to earn 3X on all of your regular stuff. If you’ve gotten that to work, and resisted the temptation to buy enough gift cards to get you shut down, I say carry on.

And of course, the Blue Business Plus made a big splash with 2X everywhere for $50K in spend. While you could certainly argue that 3X Altitude Reserve points are more valuable than 2X Membership Rewards points, I think many people in the travel hacking community would choose 2X MR over 3X US bank at least in terms of not needing a special phone or watch to get the points.

I think the US Bank card is fantastic if you’ve got Samsung Pay specifically because of how much more widely Samsung Pay can be used than Android/Apple Pay because of the LoopPay integration. And it doesn’t require 100K in the bank to get a high rate of return. If there hadn’t been the early shutdowns, and if everyone were willing to use Samsung Pay, I think you’d hear it talked about more. I think US Bank was ahead of the curve on mobile payments and as people become more accustomed to using them, maybe you’ll see a resurgence in popularity of that card.

Just my $0.02 since you asked 🙂

Great replies. Greg did an excellent job on the math when it launched; with that said, I too was disappointed on the gift card angle, but it is such a strong card on everyday spend; I literally get 3x nearly everywhere I am in person, and US Bank is kind of stuck on folks like me until they devalue.

The debate of 3X US bank points to 2X UR or MR is always a tough one, but with samsung pay, and can even easily switch cards if I decide to go 2x. 🙂

I guess it is worth mentioning from time to time when you are doing these kind of cards. Lots, and lots of folks use Samsung phones……

Wouldn’t that be your 2.5 or 3 cents?

Thank you Nick for sharing this idea.

Although I think it’s highly unlikely that this will work, the post reminds me of the good days when MS was more fun and easier. Reading FM everyday back then was my favorite pastime. This is a classic Frequent Miler.

Thanks, Vic. That’s an awesome compliment 🙂

I still would use Chase reserve for travel and restaurant even if I have this card. 3x Chase point is worth a lot more than 3.5% cash back if redeeming for premium class international flights.

I agree. But for DH who hates to carry around more than a couple credit cards, this should help his confusion of which card to use and when. It will replace his Travel Rewards card and then he won’t need to carry around his CSR (which I was planning on canceling anyway; I’m keeping mine though).

If this works, we don’t even need to use the new card to test. Just use the BoA Travel Rewards + BoA Cash Rewards. I’m interested to see data points about this, but I’m afraid BoA isn’t stupid 🙁

I agree with you physixfan. I don’t think it’ll be that easy

Let me be clear: I think this is unlikely. But unlikely things sometimes happen.

However, in response…

Like the Travel Rewards–>Better Balance transfer, I would expect Travel Rewards–>Cash Rewards would fail. The reason I expect it would fail is because to me those are clearly different rewards programs. They are both points, but Travel Rewards are not worth 1c each in terms of cash. I understand that they’re worth 1c towards travel – but if you go to cash them in, they don’t have the same value as Cash points do, so I would expect they are coded in the computer system as something different.

However, the points from the new Premium Rewards card are worth the same amount as the points from the Cash Rewards card — 1c each towards a “cash” redemption. I think that makes it more likely that you could transfer the points between the two programs as they are each “cash” points with identical cash value per point,

Of course, the Premium card’s points can also be used for travel redemptions through the travel portal, so it’s entirely possible that they are not coded as equal animals in the BOA system. But I think it’s more likely that points would move between Premium Rewards and Cash Rewards than between other two-card combinations. Again, I say “more likely than other card combinations” — I’m not saying “more likely than not this will work”. In fact, I’m saying that this probably won’t work — but if I had Platinum Honors status, I’d sure be curious.

Travel Rewards–>Cash Rewards won’t work. I get same error as the Travel Rewards–>Better Balance transfer.

Travel Reward and the old Fidelity points used to get along swimmingly… Stranger things can happen!

This card is like an IQ test for those us us that have a Platinum level qualifying balance at BofA/Merrill. Only a moron would not apply, especially considering the 500.00 sign up Cash bonus. I have had the older Travel Rewards card and have been getting 2.625 percent on everyday spend for years. Now, since Bof A adds 3.5 percent Cash rebate on all travel and restaurant, the blended CASH BACK rate goes to about 3 percent.

I spend hours on Frequent Miler and it’s really a great place and I kind of enjoy it as a time suck but, for Platinum level, this is the best offer I have seen, at least for my purposes.

I will keep 1 of my 2 sapphire reserve cards for the lounges and rental car insurance etc, but I am wondering where, in reality I will ever use it.

If a person does the math on this new card and IF AND ONLY IF that person qualifies for Platinum level rewards without changing their banking relationships or maintaining a balance that they would not ordinarily maintain, this card is can not be beat as a Cash Back card, especially counting that the New B of A card has an effective annual fee of zero.

The good news is that if this does work, it might last a while. I suspect that the barrier to Platinum Rewards status might be sufficiently high to keep the n-size of partakers low enough for this to not make it onto BofAs radar for adverse action.

Thanks for this idea, Nick.

A few stocks, that I’ve used the last few years for the Fidelity mileage bonus, are en route to a Merrill Edge brokerage acct for the $250 sign-up bonus. I only need to leave them there for 3 months to get the bonus. 🙂

If they continue to hold their value, I should qualify for Platinum Rewards. I haven’t applied for either cash rewards B of A cards. Maybe I’ll give it a whirl and be a guinea pig for this one.

It looks like it makes sense to hold off on the premium card until Platinum Rewards is in place in 3 months since I wouldn’t earn the 75% bonus on spend until then. Maybe I’ll get the Cash Rewards card first and let those rewards sit around until Platinum status kicks in. Does that sound like a reasonable strategy?

BOA won’t be that stupid. I just tried it won’t work.