Update: Citi is now denying claims based on a missed connection (like the one outlined in this post) unless your leg arrived more than 3 hours late. See: The Fine Print: Fighting Citi Prestige’s ‘Trip Delay’ Shenanigans for a more detailed update.

Greg has recently written several posts on travel insurance offered by various premium credit cards (See: Travel Insurance Showdown: Reserve vs Prestige vs Platinum). Many cards offer what sounds like generous protection benefits on the surface, but the key question boils down to this: Will they really hold up their end of the bargain? This summer, I had a chance to test Citi’s limits — both in terms of payout and time — and I was impressed with the outcome.

The Delay

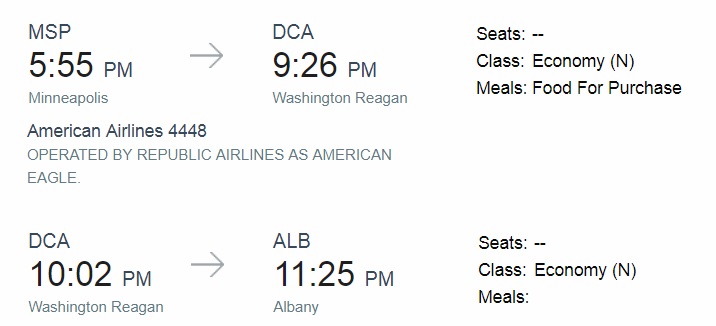

On my way back home from FTU Minneapolis, I had a tight connection in Washington, DC.

As you can see, there were only 36 minutes between my scheduled arrival and takeoff — meaning that my DCA-ALB flight would be boarding more or less as soon as I got in. Luckily, I was seated up near the front of the aircraft and my gates were scheduled to be nearby each other. Less fortunate was the weather around which we had to navigate in Wisconsin.

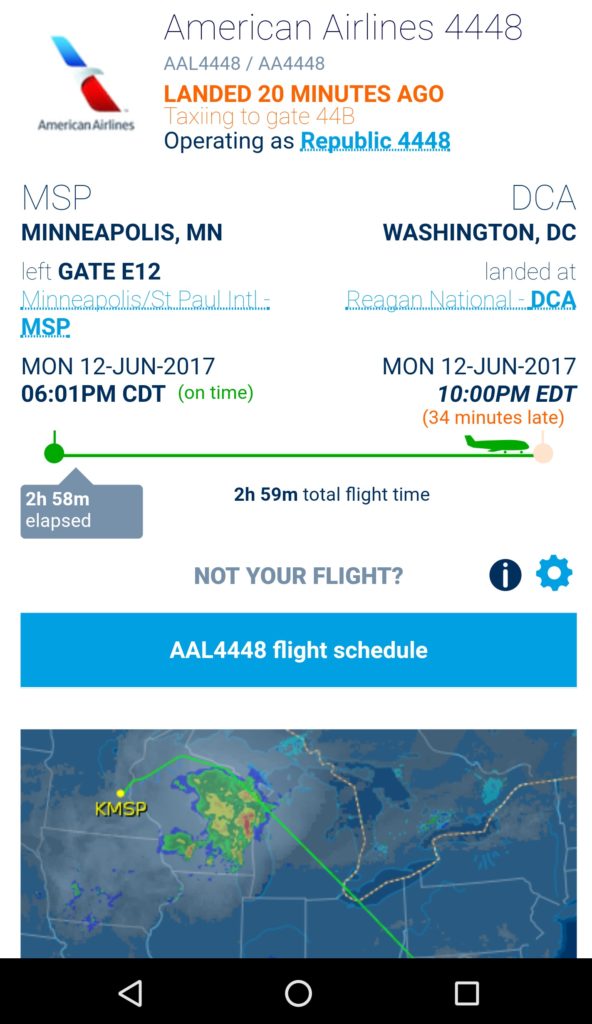

As you can see, we landed at 10:00pm. Actually, we landed a few minutes sooner — but we sat on the tarmac for more than 15 minutes waiting for a gate to open. By the time we got off the plane, my connection to Albany was gone. I knew there wasn’t another flight until around 8am the next morning, resulting in an overnight layover. While that certainly wasn’t convenient, I was simultaneously glad to get a chance to try out my Citi Prestige trip delay protection benefit since I had paid for this ticket with my Prestige card.

The benefit

As we’ve previously outlined, the gist of Citi Prestige Trip Delay protection is this: if you pay for at least part of your ticket on your Prestige card and are delayed for 3 hours or more, Citi will cover your expenses for things like food, lodging, and transportation up to $500 per person (including your family and those traveling with you provided you paid for their tickets with your Prestige card). You are required to submit your claim within 60 days of the delay, and the form (which can be downloaded and filled out after logging in here) asks you to submit any documentation that supports your claim. Once you fill out the form, you can simply email it to the Citi claims administrator (the form also lists a mailing address and fax number if you prefer). You can find the full guide to benefits here.

Five hundred dollars per person has always sounded impossibly generous to me — would Citi really pay out $500? While I had read some delay protection success stories, I hadn’t read one that fully tested the limits. I didn’t set out with that intention in mind, but it soon became apparent that I might have to do so.

Hotels were expensive

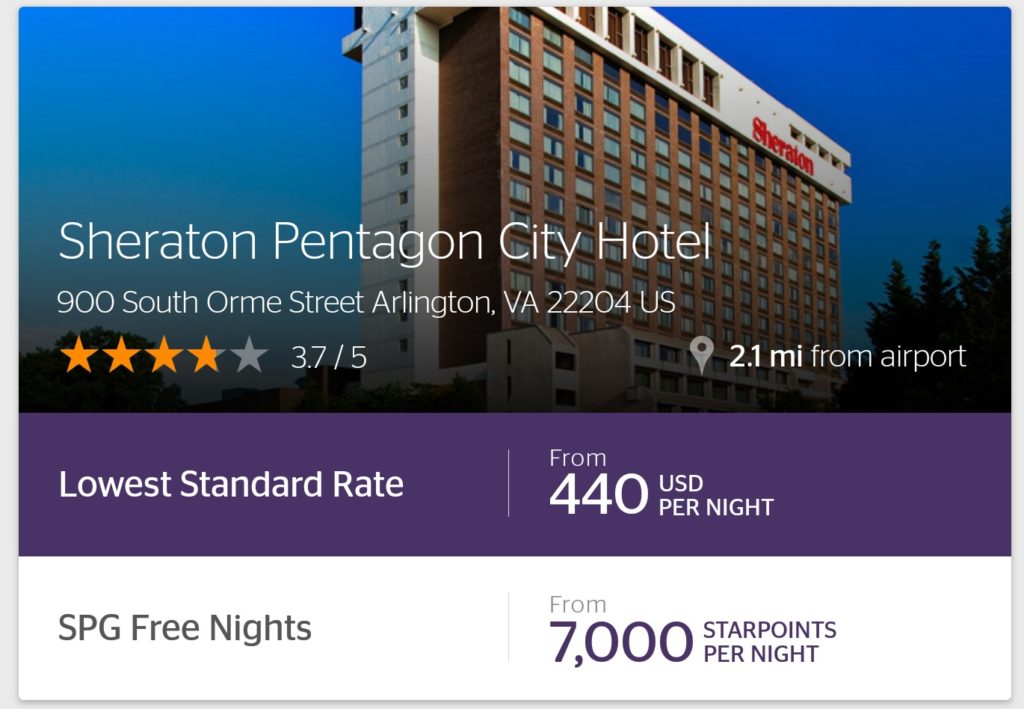

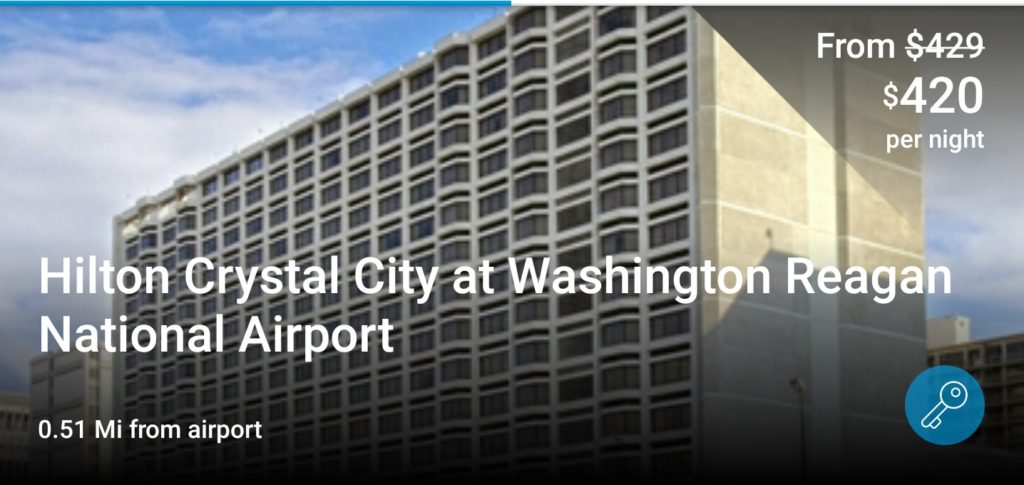

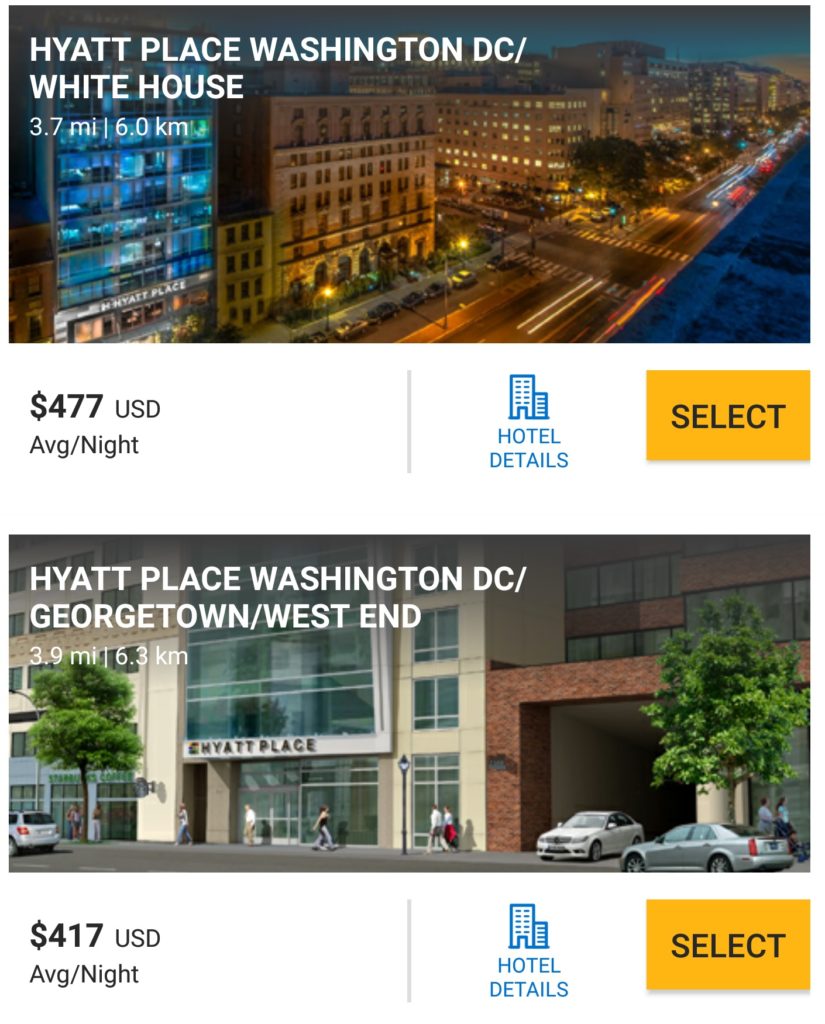

Even though I knew I had missed my flight, I ran to the gate just in case (it was basically across the hall). Sure enough, it was gone. I went back to the gate where we had landed and got on line with others in my same situation. Nobody was happy. At this hour, many had missed connections and would be stuck in DC for the night. What’s more, the airline wasn’t offering rooms; since the delay had been a result of weather, the gate agents were telling people that there was nothing they could do to help and that all of the hotels with which they partner were full. Understandably, that wasn’t going over well. As I soon found out, even if they had wanted to provide rooms, there simply weren’t many left to be had. Hotel after hotel was totally booked. The ones that were available in the area were exorbitantly expensive and were surely giving people sticker shock if they were looking on their phones:

What’s more, availability seemed to come and go — one moment, it showed a room available, the next nothing. I thought for sure I’d find something more reasonably priced with a few minutes of effort, but I first wanted to get documentation of my delay from the airline.

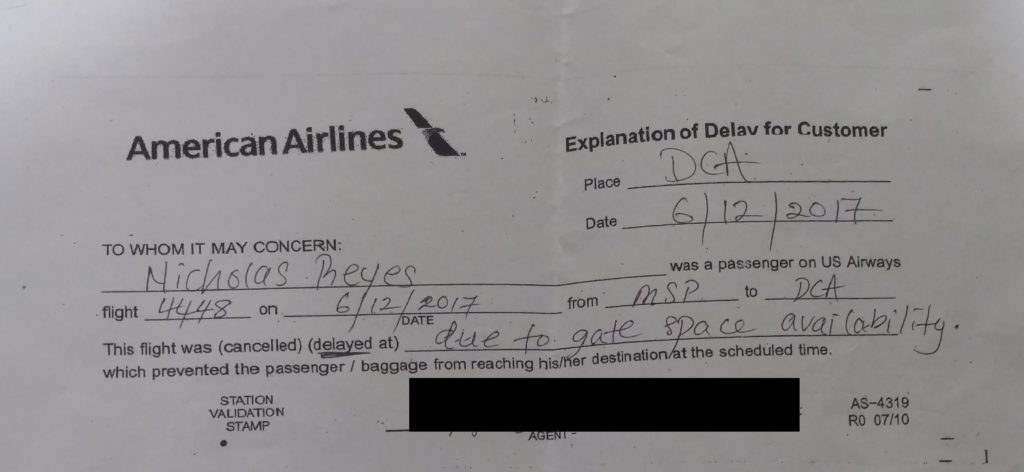

A military excuse

I went back to my landing gate for a military excuse. I knew that my Citi Prestige card should theoretically protect me and cover my costs, but I had read in other write-ups that one piece of documentation I might need would be proof from the airline that I had been delayed. I wanted to cover all of my bases on this one, so I went to the agent to ask for a military excuse — which is just the term that every gate agent seems to recognize for a document that shows you were delayed due to no fault of your own. Mine looked like this:

I thought it was odd that they marked by delay as being due to gate space availability rather than weather, though both had delayed my arrival. To be on the safe side, I had also taken the screen shot shown above of the weather in Wisconsin and our delayed arrival from Flightaware.com. I figured more documentation beats less.

A little kindness never hurts

When it was my turn to see a gate agent, I was certainly less angry than other travelers. After all, I knew I wasn’t going to sleep in the airport and that Citi would probably reimburse me for a reasonably-priced hotel. Since I didn’t expect to pay for my room in the end, it was easy for me to be the one guy who didn’t want to crucify anyone. I smiled and let her know that I understood it wasn’t her fault and I just needed the documentation for the delay. She seemed appreciative of my attitude and stepped away for a moment, making a couple of phone calls. She came back with a piece of paper and handed it to me. On it, she had written the name of a Comfort Inn somewhere in the vicinity and she had written $175 and the phone number. She pointed and said quietly, “they are holding a room for you at that rate, but you should call them right now to book it because it’s their last room available.” I was surprised, but it was a good reminder that you catch more flies with honey than vinegar — sometimes even when you have a right to be angry (such as if you missed your connection because the airline didn’t have gate space), a pleasant response may be more likely to get you what you want..

However, I knew there were people around who were facing a choice between sleeping in the airport and spending enough money to actually buy a new mattress but only getting to spend a few hours on one instead. Someone needed that $175 room more badly than I did, so I politely told the gate agent that my credit card should cover my expenses and she should give that room to someone else who needed it. I think she was a combination of surprised and confused when I said no thanks — but hopefully it made someone else’s night a little bit easier.

Shopping around

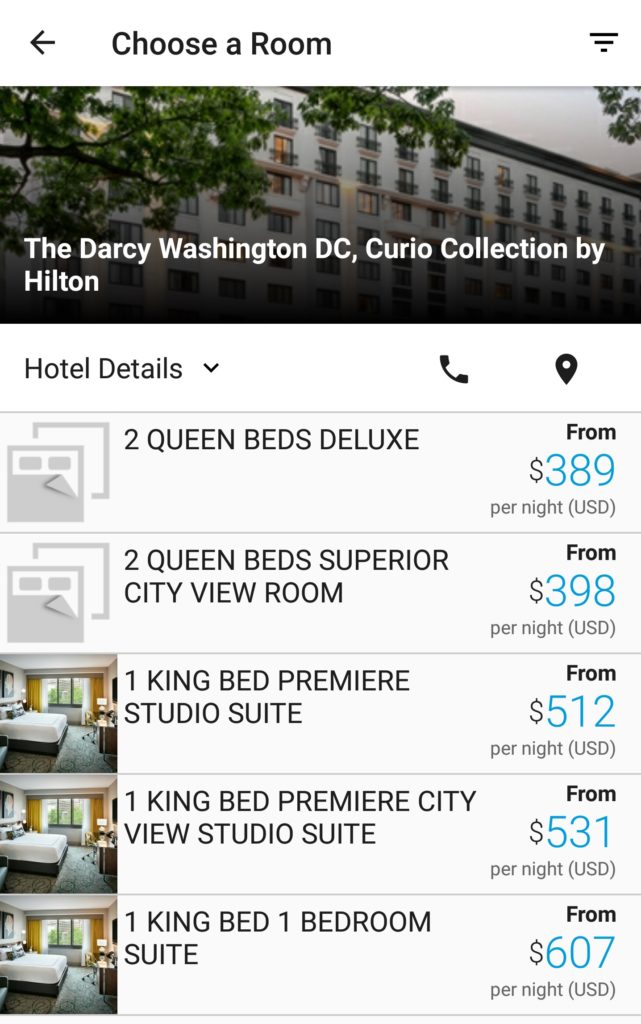

While I expected Citi to pay out, I wasn’t necessarily looking to test the limits of their generosity. After all, I had only paid about $362 for my ticket. Would they really agree to pay out more for my trip delay claim than I had spent on the ticket in the first place? I didn’t want to get stuck with a $500 loss, so I sat down at baggage claim and shopped around. Hotel after hotel told me that they were fully committed for the evening. I tried pulling the Globalist card at the full-service Hyatts to no avail. There simply weren’t many rooms available. The Sheraton and Hilton near the airport disappeared soon after I started shopping and I quickly regretted not booking one of them from the get-go as it didn’t seem I was going to do much better. In the end, I settled on The Darcy — a Curio Collection by Hilton hotel. It was only about 10 minutes from the airport, and while it was still very expensive for the night, it looked a hair more reasonable than the other options and I knew that Hilton was offering bonus points for Diamond members (they are doing so again this quarter).

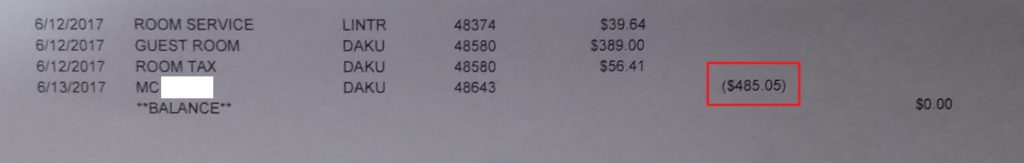

The cheapest room came to $389 before tax or about $445 all-in. I hadn’t eaten dinner and needed to get to and from the hotel, so at that point I realized this would likely end up maxing out the Citi Prestige trip delay benefit. Sure enough, my bill after getting tomato soup and grilled cheese came to $485.05.

The Uber/taxi rides came out to about $15 each way, meaning I exceeded $500 in expenses. The Darcy itself was nice. I’d certainly consider going back if the price were a bit more reasonable.

Filing my claim

For no good reason, I dragged my feet on filing my claim. It became one of those things you keep putting off until tomorrow knowing that you have more time. I have no doubt this is why Citi is gives you sixty days to file your claim — since you know you can wait, you inevitably wait too long. In my case, it popped into my head just before the deadline and I submitted my claim on Day #59 after the delay. I received an instant auto-response:

Thank you for your recent submission and/or inquiry. We appreciate the opportunity to service your request provided through your Citibank N.A. issued card.

You can expect to hear back from us within 14 days after we receive all requested information.

Note that you only have to submit the initial claim within 60 days. After that, I believe you have up to 180 days to provide all of the necessary documentation for Citi to pay out your claim. While the auto-response email promised a response within 14 days, I had hoped it would be faster. In the end, they stuck pretty close to the timeline. Twelve days later, I received this message with the subject line, “Important information regarding your Citi Card Benefits Request XXXXX“:

Thank you for your recent claim request. We appreciate the opportunity to service your claim request for the Trip Delay Protection program provided through your Citibank N.A. issued card.

In order to substantiate your claim request, please provide the following information for review.

Itinerary

Additional Information NeededPlease provide a copy of the original trip itinerary received at the time of booking. Thank you

The documents can be submitted via email (mybenefits@

cardbenefitscommunications.com ), fax or mail. You can expect to hear back from us within two weeks after we receive all requested information. If you have any questions, please call the Citi card benefits service center toll-free at 1-866-918-4670. Our representatives are available 24 hours a day.

Sincerely,

Citi Card Benefits Administration

Ooops — I guess I had left out a critical detail — my initial itinerary, showing that I didn’t have an overnight layover after all. I immediately forwarded them my email purchase confirmation. This time, I expected to wait a full two weeks to hear back.

Two weeks came and went

Two weeks came and went without any email from Citi. At this point, I was starting to worry that I had simply blown $500 on a night of lodging and they weren’t going to pay out on the benefit. I was prepping to call or write when I first logged into my Prestige account. There, I saw that just two days after I submitted my itinerary, I had received the $500 reimbursement.

Moral of the story: don’t count on an email confirming that your claim was approved. If you choose to receive a statement credit, keep an eye on your account. If you choose to receive a check, keep your eye on the mail.

What documentation did I submit?

For clarity, here is the documentation I submitted:

- Original itinerary (paid for with my Prestige card)

- “Military excuse” from AA

- Screen shot from Flightaware.com showing the delayed arrival

- Photo of my folio from The Darcy

- Copy of my Prestige statement showing the purchase of the airfare (as I had purchased direct, the confirmation number showed on my card statement)

- Copy of my Prestige statement showing the payment of the charges for the room and Uber/Lyft rides.

While I initially forgot step one, I was able to later send it later and have my claim approved in full within two days of receiving all of my documentation. That’s great. Note that since the benefit is capped at $500, I only asked for $500 and I received it.

And I grabbed a nice chunk of points

On top of getting reimbursed in full for my expenses exactly as I’d expected based on the benefit terms, I was lucky enough to pick up some points. As I mentioned, Hilton was and still is offering bonus points for everyone and even more for Diamond members. I knew this, but I almost forgot to register for the promotion. Luckily, it popped into my mind as I was getting out of my ride from the airport. I literally registered for the promotion as I walked through the door to check in. I was glad I did, because this stay earned me a nice little chunk of Hilton points:

Bottom line

Citi Prestige trip delay protection worked out exactly as I would have hoped — I got my full $500 even as a solo traveler on a ticket that cost significantly less than my expenses on the delay. While not lightning fast, the process was simple and painless. The Citi Prestige had already become my go-to card for booking paid airfare based on how generous this benefit sounded. Now that I know it also works that way in practice, it would be hard to convince me to book airfare with another card. This benefit saved me more than $200 (including the cost of the next best alternative plus taxes and transportation). Combined with the annual $250 airfare credit, that’s more than $450 in total value. As I was grandfathered in to a $350 annual fee from an old CitiGold account, I feel like I’m ahead of the game this year on the Prestige — not even counting the two 4th Night Free hotel bookings I’ve made and my Priority Pass lounge visits.

[…] One area where Chase is really leading the way is in travel protections for tips booked with premium and ultra-premium credit cards. While things like trip delay and cancellation insurance or rental car CDW may not be useful on the vast majority of trips, it is certainly useful to have those protections when you need them. Our own Stephen Pepper wrote about his experience utilizing the Chase CDW when his rental car got caught in a hail storm in Australia (See: My experience using Chase Sapphire Reserve rental car insurance). I haven’t yet had a claim with Chase for trip delay, but I was glad to have had coverage on what was surely either an expensive or uncomfortable night in DC for many travelers who had to choose between ridiculous hotel rates or sleeping at the airport (See: My $500 trip delay claim with Citi Prestige). […]

Hey Nick,

Did it happen to you that both outgoing flight and returning flight were delayed for more than the threshold time? In that case, would CITI consider the two flights as separate trip?

Thank you

Henry

Hey friends, I wonder if we can stay in a hotel if we are delayed in home airport with citi trip delay? I know Chase put specifically in the term that you have to be away from home 100 miles to be able to claim. But there is nothing like that in Citi’s term.

I tried using the benefit on a lounge day pass and food outside of the lounge. They covered the food, but rejected the lounge day pass. This was not a good experience.

[…] use the 4th night free benefit often, I have used it a handful of times. I also had one big trip delay reimbursement that paid out $500 for my expenses on an overnight delay. Citi hasn’t been covering missed […]

[…] if I only use the 4th night free every other year, I’ll be ahead for a while thanks to one trip delay reimbursement (which would no longer be paid out thanks to the way Citi now defines trip delays). If I decided […]

[…] has written about how he was reimbursed $500 for a trip delay when he used his Citi Prestige card. Here’s how it works: if you pay for at least part of your […]

This article sorely needs updating. This information is NOT current per my interactions with TWG

You should update this post as DEAD, it seems that Citi Trip delay reimbursement no longer covers connections. Look at the thread from above with official letter from the Citi.

Look at this thread, it seems Citi is making is official that missed connections are not part of the trip delay protection. And Virginia Surety Company (The Warranty Group) legal department backs it up.

https://www.flyertalk.com/forum/citi-thankyou-rewards/1662492-citi-trip-delay-reimbursement-prestige-chairman-hhonors-aadvantage-24.html

Official letters from both Citi and The Warranty Group are included. I wonder if there is a better credit card there for this type of protection.

@ V

Yeah I think that is a fair point – the overnight stays are where you can really rack up some serious expenses due to taxis, hotels, etc.

@HoKo, I agree it’s pros and cons. For me, the pros are not enough to outweigh the cons in the long run. If I have 5 situations and 1 is denied by Citi, that probably wipes out any benefits I got from 3x or such. I’ve also decided for myself personally that I don’t much care about a delay that’s not essentially overnight (so 6 hours is fine for me). If it’s a daytime flight that is delayed 5h30m what expenses would I realistically incur that I would really need reimbursement for?

Yes, there’s a chance that I’m delayed on the last flight out and then rebooked on the first flight out the next day, but usually that is not <6 hours. Anyway, just my thinking. I'd rather have 1x fewer points and fewer times I can use coverage that I can count on when I really need it than something that can't always be relied upon (as I and other people here have experienced).

@V — just thought I’d chime in to let you know that CSR applies to >6 hours delay OR overnight stay, so even if the oddball event did happen where an overnight equated to <6 hours, you'd still be covered. Here's the language as stated:

"Provides reimbursement for expenses such as meals and lodging if your common carrier (airline, bus, cruise ship, train) travel is delayed more than 6 hours or requires an overnight stay"

As I mentioned before, in my experience having filed claims with Amex, Chase and Citi– Citi goes out of their way to deny claims. Chase and Amex do not. I put all my flights on Chase now.

Prestige gives 3x for air travel. I only have the regular Chase Sapphire. So I’m stuck with citi

and it’s a tradeoff since the prestige card triggers at 3 hours as opposed to 6 hours from CSR

@HoKo and @Rich, I have the CSR so the 3x is not an issue– but at the same time for the points and 3 vs 6 hours, what good is any of it if you’re stuck holding the bag when they deny your claim? 3 hours is meaningless and I’d be willing to forgo 1x for protection that works (or about $10 in points on a $750-1000 in airfare).

I do this now with Amex, even though Amex is 5x on airfare with the Platinum card, but it has no travel protection. Giving up 2x points is worth it for me to have this protection. In the Citi case, it’s a crapshoot whether the protection comes through, so in my mind it’s effectively like not having protection at all.

I disagree. Citi has covered me both times I needed the trip delay coverage to kick in. And just to be clear I think it is bogus that they won’t cover us for missed connections. I am not a Citi fanboy blindly defending them – I’m just explaining my positive experiences.

Oh and by the way, one of those trips was a delay of around 5 hours. So I dunno why you are asserting that 3 hours vs 6 hours is meaningless…obviously it’s very meaningful for anyone that experiences a delay of between 3 and 6 hours. So this is an example of where (1) Citi came through and delivered on their benefits and (2) I wouldn’t have had a single penny covered by CSR due to 6 hour threshold.

So as I said in my previous post: pros and cons.

I filed a claim. Even mentioned your article. They keep insisting that the initial flight must have been delayed for 3+ hours. They don’t care about missed connections. Claim denied.

rich — According to Citi’s benefits guide:

“If a Covered Traveler’s Trip on a Common Carrier is delayed for at least 3 hours, we may reimburse you for expenses incurred because of the delay. You are covered for up to $500 per Covered Traveler, per Trip.”

Missed connections aren’t the unit of measure, it’s the number of hours delayed. If you miss a connection and still make it on the next flight to your final destination with fewer than 3 hours delayed, you won’t get a claim approved. However, if you miss a connection and that leads you to get to your final destination >3 hours after originally scheduled, then you should have a claim. The airline should be able to provide you with some documentation as to the rationale for the delay for insurance purposes– be it weather, mechanical issues, etc.

If you were delayed in total by more than 3 hours and you get pushback, HUCA. The language very specifically states if a TRIP is delayed at least three hours, not a FLIGHT. And their definition of trip is actually quite broad (any pre-paid travel on common carriers from start to end — it even covers one ways). Though I’m not certain how they’d handle multiple ticket itineraries with fewer than 3 hours scheduled between them.

Just called again. they seem pretty sure. they only count the first leg of the itinerary. If the first flight is not delayed for more than 3 hrs, they don’t care if you miss the connection.

gotta say xiamen airlines is pretty crappy. one of their on ground staff thought she was hot stuff, all full of herself. didn’t want to pay for my cab to the craphole hotel.

Nick, citi must know you have a website so they gave you preferential treatment lol.

Ok seems pretty clear they aren’t gonna pay you on this. I’ve heard them state the same policy so I do not think this is a HUCA situation.

I think someone needs to take them to SCC/arbitration and see how things play out.

I just ran into the same issue. The claim specialists and adjusters now seem to only recognize a >3 hours delay on flights, but not missed connections, which doesn’t seem to comply to their TOC though…

It seems there were many DPs showing citi was trying to decline claim for the trip with initial flight delayed less than 3 hours.

https://www.flyertalk.com/forum/citi-thankyou-rewards/1662492-citi-trip-delay-reimbursement-prestige-chairman-hhonors-aadvantage-22.html

Just had exactly the same experience. Flight delayed 2 hours, missed my connection, whole trip was delayed 24 hours. Citi denied my claim. I spent an hour just now talking to 5 different people, and all say same thing. What’s the recourse here?

Thank you sir. Weird that the airline didn’t pay for your hotel. I’ve had this happen in the US and hotel was always paid for. Something for me to research. My airline paid for hotel but I had to share a room. In order to preserve my organs in my body I elected to pay more and get my own room