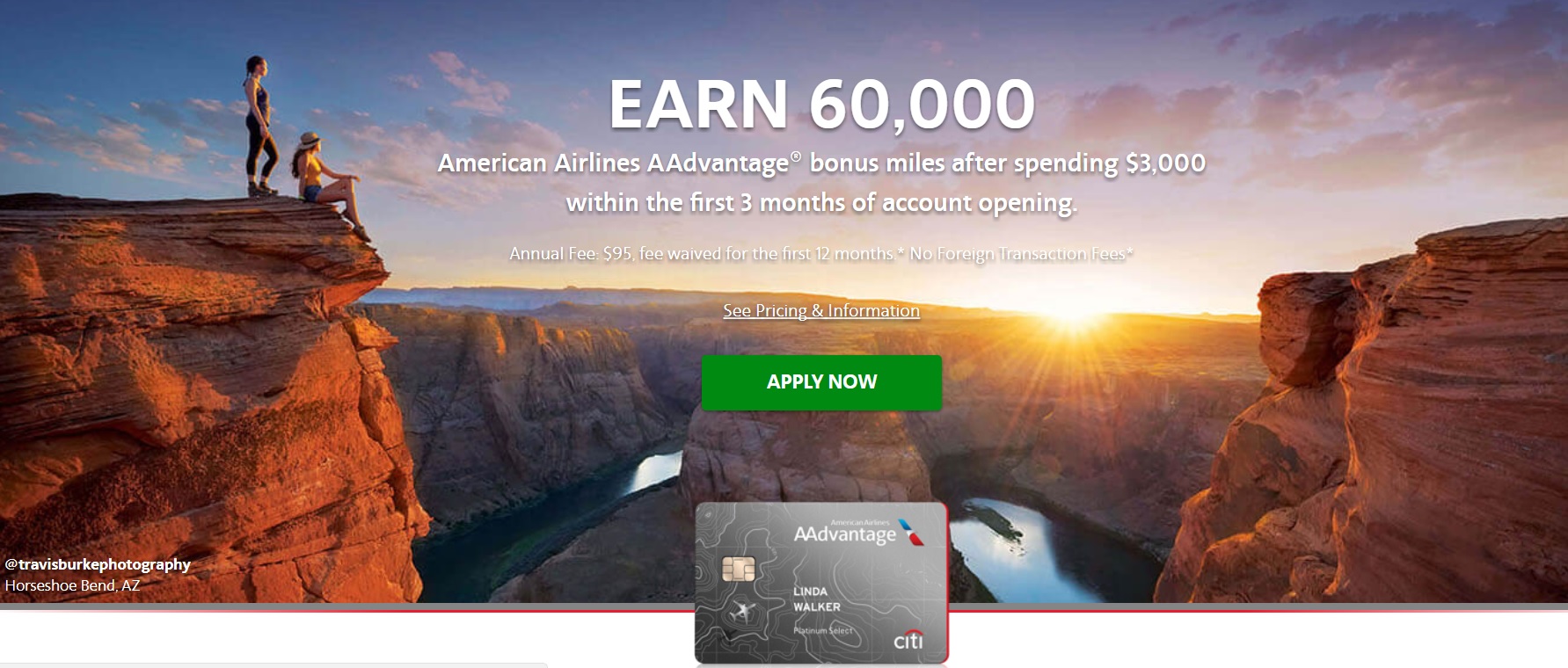

The signup bonuses on both the Citi AAdvantage Platinum Select World Elite Mastercard and the Citibusiness AAdvantage Platinum Select World Mastercard have again increased to 60,000 American Airlines AAdvantage miles for $3,000 spend in the first 3 months on each card. Both of these offers can be found on our Best Offers page.

Citi AAdvantage Platinum Select World Elite Mastercard

The Offer

- 60,000 AAdvantage miles for spending $3,000 within the first 3 months of account opening

Card Benefits

- 2x on American Airlines purchases

- 1x everywhere else

- Preferred boarding on domestic flights

- First checked bag free for you and up to four traveling companions on the same reservation

- No foreign transactions fees

- 10% of your redeemed miles rebated every year up to a max of 10,000 miles per year

- $95 annual fee is waived the first year

Quick thoughts

This offer beats the previous best offer of 50,000 miles and is a strong value considering the waived annual fee in year one. If you do not hold one of the Barclaycard Aviator cards (which also offer the annual 10% rebate on redeemed miles) and you redeem at least 100,000 miles per year, the annual mileage rebate could easily offset the fee. Note that the mileage rebates do not stack — you will receive a maximum of 10,000 miles per year rebated even if you hold both an Aviator and Citi AAdvantage Platinum Select card. While this card is not the most rewarding for everyday spend, the sign up bonus and annual mileage rebate make it worthy of consideration.

Citibusiness AAdvantage Platinum Select World Mastercard

The Offer

- 60,000 AAdvantage miles for spending $3,000 within the first 3 months of account opening

Card Details

- 2x on American Airlines purchases

- 2x at telecommunications merchants, car rental merchants, and gas stations

- 1x everywhere else

- Preferred boarding on domestic flights

- First checked bag free for you and up to four traveling companions on the same reservation

- No foreign transactions fees

- $95 annual fee is waived the first year

Quick Thoughts

While this card does not come with the 10% annual mileage rebate, a distinct advantage is that this card does not count against Chase 5/24 status as it is a business card that typically does not appear on your personal credit report. The bonus categories are nice if you have no other cards with bonuses at those types of merchants, though there are other cards with greater return on those purchases.

Final word

Both of these offers are a great way to rack up some American AAdvantage miles. While availability on AA flights can be difficult to find, word is that it might be slated to improve in the near future. Whether or not it does, I usually prefer to use American Airlines miles with partners, where you can enjoy some good values on some great airlines if your travels bring you outside the US. You can find links to these offers on our Best Offers page.

[…] 60K offers return on Citi AA cards […]

I applied for and was approved for the Citi Business Platinum Select Card (PSC) on Oct. 2017

I closed the Citi Business PSC on Oct. 2014. It had been 36 months since I closed it.

I opened the Citi Persoanl PSC on Jan. 2017.

I called Citi twice and both of the representatives told me I am not qualified for getting the sign up bonus because it has been less than 24 month since I opened the Citi Personal PSC. I thought personal and business cards are two different groups. Now I would like to close the Citi Business account to reset the 24 month cycle as soon as possible . Is that a bad idea to close the Business account so soon?

[…] 60K offers return on Citi AA cards […]

[…] 60K offers return on Citi AA cards […]

Does Citi match? I just got the AA business card on a 50k offer. Can I ask them

To match the 60k offer?

They sometimes do. It’s definitely worth sending them a message.

Update: sent PM and they matched it ASAP. Sweet, thanks.

Just now saw a huge banner at ORD Terminal 3 for 60k. Aviator card, though, I think.

Yes, the Aviator card has been at a 60K offer on first purchase for a while now. That’s an awesome offer. You’ll also find that on our Best Offers page.

I have this card already and I’m thinking of applying for another one. I got it in 2011 when it was a Visa but Citi changed it to MC less than 24 months ago. Since I got a new card number, does that mean I’m not eligible for the bonus if I apply for this offer? I haven’t opened or closed any AA cards in the past 24 months otherwise.

Well, that stinks. The truth is I don’t know for sure….but if you got a new card number, I think it’s possible Citi’s computer system will record that as a new account. It’s hard to know without trying.

The good news is that these two cards are independent. The application page from the Citibusiness card says:

“CARD OFFER

This card is not available if the business already has a CitiBusiness® / AAdvantage® Platinum Select® World Mastercard® account. Bonus miles and any additional special offer not available if you have had any CitiBusiness® / AAdvantage® account opened or closed in the past 24 months.”

And from the Citi personal card says:

“OFFER AVAILABILITY

60,000 American Airlines AAdvantage® bonus miles can be earned by new Citi® / AAdvantage® Platinum Select® card cardmembers approved through this offer. American Airlines AAdvantage® bonus miles are not available if you have had any Citi® / AAdvantage® card (other than a CitiBusiness® / AAdvantage® card) opened or closed in the past 24 months. / AAdvantage® account opened or closed in the past 24 months.”

Note where it says “other than a Citibusiness AAdvantage card”. Assuming you’re talking about a product conversion on the personal card, I’d think that you would still be eligible for the Citibusiness one for sure. You could certainly try to make the argument on the personal one as well, but I’m inclined to think that you might have to fight that one out with Citi. If you do apply, please let us know what happens.

I can’t get to the application for the AA business from the best offer page. The link doesn’t appear to be active.

It’s there somewhere. You just might have to click around a bit and choose “show more results” to find what you’re looking for.

no the credit card link is not on best offers page. Only link to application tips.

That is correct. Keep clicking through from there.